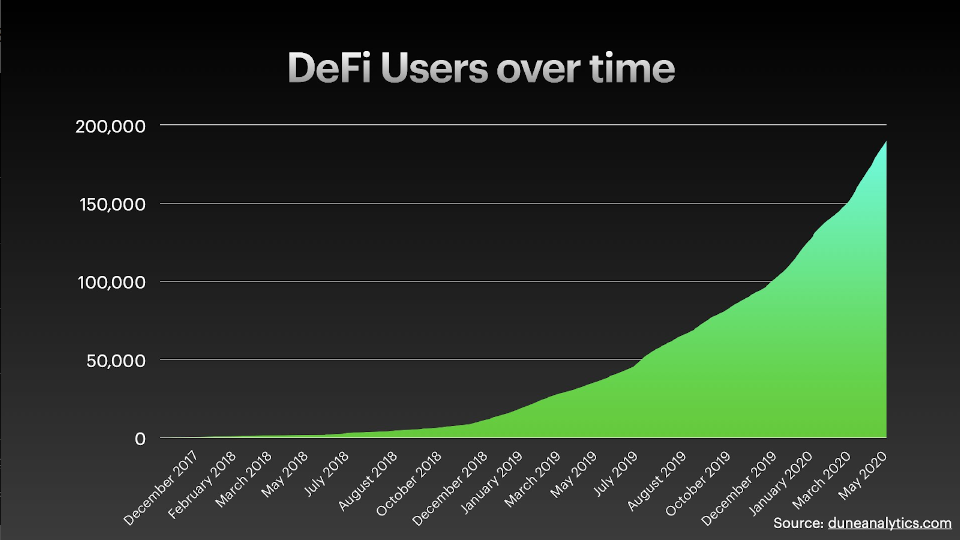

There is no shortage of innovative DeFi projects in 2020. Far from it, this year appears to be the one where the DeFi sector could be ready for the limelight. However, what DeFi projects are really setting themselves apart – and is it possible to develop socially innovative DeFi solutions? This article explains everything there is to know about decentralized finance and DeFi innovation!

DeFi Innovation

Those keeping an eye on either the field of finance of blockchain technology will have heard about DeFi. DeFi, short for Decentralized Finance, is a technology that promises to change the existing financial ecosystem. If this sounds dramatic, it is because it is.

The recent flurry of DeFi innovation has been a long time coming. Relying mainly on the Ethereum network and blockchain-driven smart contracts, the DeFi ecosystem began growing in the shadow of the Bitcoin boom and cryptocurrency craze. Nevertheless, DeFi innovation never got as much attention as the glitzy world of crypto. Until now, that is.

In as simple terms as possible, DeFi innovation aims to replace existing financial services with more accessible ones. At the same time, however, DeFi innovation seeks to make financial services dramatically more efficient, secure, and reliable.

This is done through using decentralized technologies, and primarily blockchain technology. Moreover, one should stress that exploring blockchain technology is already becoming the norm in the business world.

Countless billion-dollar companies are either actively exploring blockchain possibilities or already deploying the technology. Nevertheless, a large part of the existing finance sector does not face the same tough competition as other sectors.

Specifically, this is largely due to the significant barriers to entry and lack of choice in the world of financial services. Most of us are arguably unhappy, or at least unenthusiastic, about our current bank. However, few actually act on this and change their bank provider, as most banks are more or less the same.

DeFi innovation is looking to upend this. In fact, DeFi aims to replace banks altogether with decentralized solutions that connect customers directly, in an open, easy-to-access manner. Additionally, these DeFi innovations will be open to everyone – which is why some call DeFi “open finance”.

What are the Advantages of DeFi?

Anyone close to the DeFi field understands why there is so much buzz about this latest sector. However, anyone unfamiliar with the subject could struggle to understand why it is so revolutionary and innovative. Let’s, therefore, take a look at some of the core advantages of DeFi.

Some would say three main aspects constitute the most significant advantages of DeFi technology. Although there are naturally many more, these three offer a fundamental view of DeFi’s unique selling point to adopters. They are:

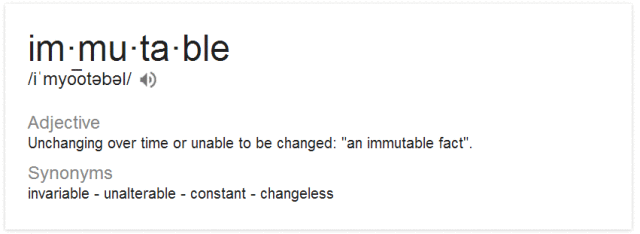

- Immutability

- Programmability

- Interoperability

These terms can sound challenging to wrap one’s head around, but they are actually quite intuitive. Moreover, they are at the core of understanding the advantages of DeFi innovation.

Starting with immutability, this refers to the fact that information in a true DeFi system is immutable. This means that no one can neither alter nor tamper with the data, or information, held in a DeFi system.

This is made possible through leveraging distributed ledger technology (DLT) such as a blockchain. The decentralized nature of such a system means that no single actor holds the data. Subsequently, one actor can’t alter the data, increasing both security and the ability to audit data.

Programmability, on the other hand, relates to the functionality of a DeFi system. DeFi solutions rely on “smart contracts”, which users can program to automatically execute when a specific condition is met. This increases trust, as no party can alter a deal.

Finally, the interoperability of DeFi systems comes from the Ethereum network underpinning the majority of DeFi solutions. This common software stack and Ethereum’s composability means that both decentralized applications (dApps) and DeFi protocols can be integrated with each other. As such, it represents a genuinely interoperable system.

Innovative Definition

Proponents of the DeFi field and blockchain technology, in general, would readily argue that all DeFi solutions are, by their very nature, innovative. Just looking at the Oxford Languages innovative definition, one finds it is something “featuring new methods; advanced and original”.

Taken at face value, one could suggest that this means each and every DeFi solution is, to some extent, an innovation. While this is certainly true, and the revolutionizing effects of blockchain technology can easily be seen across sectors, not all DeFi projects are created equal.

Instead, some DeFi projects consist of “more” innovative DeFi solutions than others. For example, merely porting an existing finance function to a DeFi setting can admittedly be a great way to make it more resilient. Decentralized infrastructure is always preferable to centralized infrastructure, purely from a reliance perspective.

However, the advent of innovative DeFi projects provide opportunities to rethink the rules. Modern technologies offer greater freedom in designing new solutions that are superior to the existing ones in numerous ways, with the right vision and technical know-how.

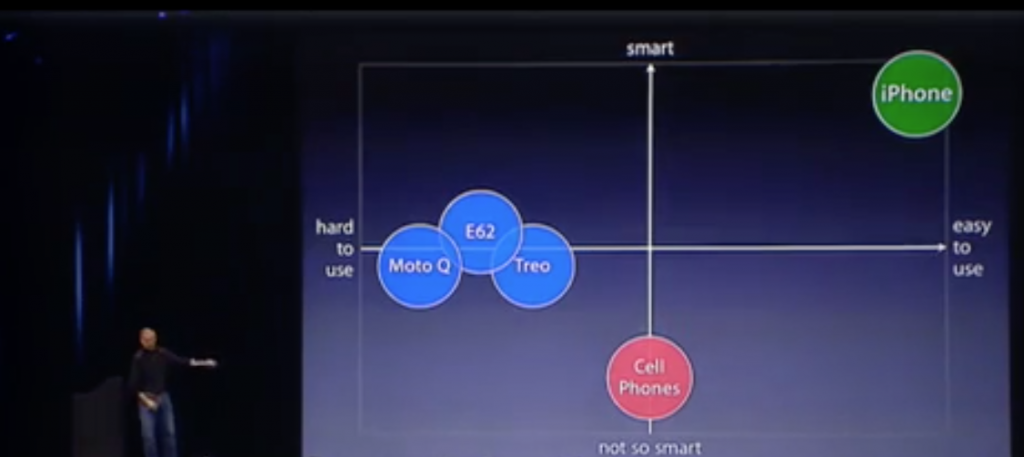

During the introduction of the original iPhone, Steve Jobs spoke about the iPhone as being a “leapfrog product”. He said that it was both smarter than the existing smartphones and easier to use than existing “dumbphones” by a considerable margin, and the iPhone was subsequently able to leapfrog both product categories.

The iPhone is a classic “leapfrog product”

A truly innovative DeFi product is one that leapfrogs legacy financial services, in being both better and easier to use. Consequently, those looking to build a revolutionary DeFi solution should strive for one, which is the innovative definition of a leapfrog product.

As such, the innovative definition certainly applies to DeFi in general. Nevertheless, it can be worth taking a closer look at some, especially innovative, aspects of the DeFi field.

Innovative DeFi Applications

The list of innovative DeFi applications can be made quite long. If one takes a bird’s eye view of the entire DeFi ecosystem, it is clear that it is rapidly increasing its functionality. At the time of writing, there is already an abundance of DeFi applications for services typically done by traditional financial service providers.

For example, there are already DeFi solutions that do everything from lending and borrowing to insurance, to various trading protocols, to decentralized exchanges and platforms for decentralized collateral.

Furthermore, stablecoins are increasingly making the advantages of DeFi and digital currencies accessible to those skeptical of crypto. Stablecoins are, essentially, digital currencies such as cryptocurrencies, but without the considerable volatility of cryptocurrencies.

Types of Stablecoins

Instead, stablecoins are pegged to the value of either a fiat currency, a cryptocurrency, an asset, or a basket of these things. This lower volatility means that there is less risk for investors that the value of a transaction or price will change before the smart contract executes.

Consequently, the DeFi space is becoming more attractive to large companies and investors as these types of solutions appear. Although the rising maturity of the DeFi field is attractive to users, it is also important to consider the introduction of more innovative DeFi applications.

There has never been a greater number of innovative DeFi applications on the market than today. For example, there are DeFi lending protocols, such as Compound, insurance solutions such as Nexus Mutual, predictions markets such as Augur, decentralized leverage trading options such as dYdX, and synthetic asset alternatives, including UMA.

All of these products constitute far more complex, innovative DeFi applications than merely providing cheap and fast international remittance transfers. As such, it has never been more obvious that the DeFi field is ripe with innovation.

Socially Innovative DeFi

Another whole subset of DeFi solutions is that of socially innovative DeFi projects. However, in order to fully understand the advent of socially innovative DeFi projects, one must first understand what constitutes social innovation.

Societal innovations are ones that improve society as a whole. This can relate to a broad range of various subjects. For example, it can stem from enhancing things such as healthcare, community development, people’s working conditions, education, or even happiness.

Put simply, socially innovative DeFi needs to be projects that truly improve society and people’s roles within it. A DeFi solution that speeds up payments is nice and will certainly make payments more efficient, but it is arguable whether it can be said to be a socially innovative DeFi project.

Instead, a project that qualifies as socially innovative needs to be a true game-changer; a paradigm shift. Let us imagine a DeFi dApp which grants microfinance loans to those living in third-world countries.

Although microfinance is far from a new concept, it still relies on existing financial infrastructure such as banks. Microfinance loans have been wildly successful in the Indian subcontinent during the past two decades. However, a prerequisite for this success was proximity to existing banks, which could grant the microfinance loans.

The Indian Subcontinent

Subsaharan Africa, on the other hand, does not have preexisting bank infrastructure in the same way. This is partly why microfinance loans are yet to make a real breakthrough in many third world countries. True, the loans themselves are oftentimes successful in lifting people out of poverty. However, many lack access to banks that can grant the loans to begin with.

Nevertheless, a DeFi dApp solution that truly grants openly available microfinance loans to those without access to traditional finance infrastructure would be a truly socially innovative DeFi product.

Paradigm DeFi

Another socially innovative DeFi undertaking is the Paradigm DeFi project. Paradigm is a crypto asset investment firm but is now branching out into the broader DeFi sector. Naturally, this is due to the growing allure of decentralized finance.

In fact, even billion-dollar legacy companies and banks develop their own DeFi solutions to stay competitive in a changing financial landscape. As such, it should not come as a surprise when a crypto actor such as Paradigm decides also to create a DeFi project.

Moreover, the Paradigm DeFi undertaking could also add significant benefits to those looking to utilize DeFi dApps. First and foremost, the Paradigm DeFi project revolves around offering a lending protocol with set interest rates.

This Paradigm DeFi protocol is known as the ”Yield Protocol”, and comes from Paradigm’s Dan Robinson together with Allan Niemberg. The Yield Protocol whitepaper describes the project as offering a comprehensive ”on-chain lending with interest rate discovery” solution.

The basis of this Paradigm DeFi is something known as ”yTokens”. These yTokens act similar to zero-coupon bonds, and the yTokens will settle on a specific future date in relation to the price of a certain asset. In practice, users can either buy or sell these yTokens and effectively lend or borrow the asset in question for a set period.

Users are able to effectively create yTokens as they deposit some form of an asset as collateral. This means that anyone buying this asset’s yTokens is similar to lending the asset in question. All in all, the Paradigm DeFi solution is yet another that takes a novel DeFi approach to solve existing problems.

DeFi Innovation Summary

As such, there is no denying that innovative DeFi solutions are all around. Nevertheless, one needs to differentiate between ordinary forms of innovation, and the revolutionary types of true DeFi innovation (such as socially innovative DeFi) that hold the potential to change our financial services ecosystem for good.

Additionally, those looking to learn more about the wonderful world of DeFi – or even help build it – are in luck. Ivan on Tech Academy, the go-to place to learn blockchain, is offering a wide range of courses on both blockchain and DeFi.

For example, some of the blockchain courses include a beginners course on DeFi, going through all the DeFi fundamentals – unlike this article, which only scratches the surface. For those done with that or already familiar with DeFi, there is also an advanced DeFi course that covers everything from DeFi hedge funds to flash loan programming and yield hacking.

Join over 20,000 existing Ivan on Tech Academy alumni and learn more about DeFi innovation! Perhaps you are the next real-world success story to graduate out of Ivan on Tech Academy, and who will land a top job working with blockchain? Let’s find out!