Traditional, government-issued fiat currencies have been present for more than 100 years in their contemporary form. On the other hand, crypto is barely a decade old since Bitcoin (BTC), the first cryptocurrency, was launched in 2009. However, crypto managed to gain worldwide popularity thanks to its innovative technology and numerous utilities. Unlike fiat currency, whose sole purpose is facilitating payments, crypto offers more possibilities to users. The crypto vs fiat question compares two dramatically different classes of financial assets. Fiat currency is a firmly established, globally accepted financial instrument. However, digital currencies are yet to achieve the widespread acceptance and institutional adoption that fiat currency already has.

In this article, we’ll explore the differences between crypto vs fiat currency to find out how traditional and digital currencies work. Also, we’ll look at the traditional financial system and the innovative concept of blockchain-powered digital currencies.

Learn the basics of the crypto market with our Crypto for Beginners course at Moralis Academy.

What is Fiat Currency and How Does it Work?

Fiat currencies are all traditional currencies issued by governments through national central banks. The etymology of the word fiat comes from the Latin expression let it be done, which was used by medieval rulers for executive orders. The medieval use of fiat in such cases dates back to the 17th century. However, the expression fiat currency came later, in the 19th century, to signify official, state-issued currency. The expression gained prominence among financial experts in the early 20th century when discussing government currencies.

The word fiat didn’t have any significance during the rest of the 20th century, and it wasn’t in use until Bitcoin launched in 2009. With the launch of digital currencies and their rising popularity, the expression “fiat currency” became popular again. People needed a way to make a distinction between traditional and digital currencies.

Any government-issued and approved currency that uses the traditional financial system is fiat. For example, the US dollar and the Euro are fiat currencies. The US central bank is the Federal Reserve System, also called the Fed. The Fed works closely with the US government to ensure the stability of the US dollar as a government-issued currency. While the US dollar is an example of an internationally accepted fiat currency (as the global reserve currency), most of these currencies are limited to their native countries. However, anyone can exchange fiat currencies at exchange offices or a bank branch for another fiat currency. Usually, exchanges offer users the ability to exchange their local currency for a few leading global or regional fiat currencies.

The Fiat Monetary System

The fiat monetary system gives value to fiat currency and ensures people in specific regions accept it as the official currency. If we look at the United Kingdom, the country has its national fiat currency, GBP. Merchants, businesses, banks, and individuals in all corners of the country accept GBP as the official currency and use it to conduct transactions. The UK government gives legitimacy to GBP as a currency, while the central bank is responsible for issuing the currency.

Banks are a crucial part of the fiat monetary system because they are official financial institutions that handle fiat transactions. Employees receive salaries in their bank accounts. Companies conduct business transactions by transferring money between bank accounts. Paying for a product in person or online sends money to a company’s bank account. Also, you need a bank account to pay for products and services with a payment card.

Fiat currency depends on state authority, central bank currency issuance, and the local and global banking system. These pillars give fiat currency a degree of stability and ensure the global acceptance of traditional money. One of the critical characteristics of the fiat monetary system is that centralized institutions control the whole system. Users can’t do anything but accept the rules governments and banks impose if they want to use fiat currency.

JavaScript is a crucial Web2 programming language and is the basis for various popular Web3 languages. Learn JavaScript Programming at Mortalis Academy.

What is Cryptocurrency and How Does it Work?

Cryptocurrency is dramatically different from fiat currency. Cryptocurrencies are innovative, virtual financial assets that don’t exist physically. You can’t hold crypto in the form of notes or bills. Instead, cryptocurrencies use blockchain technology to facilitate transactions and host virtual “coins” on a decentralized digital network. The idea behind Bitcoin, the first crypto, was to introduce a decentralized, peer-to-peer, digital cash network. Most of the first cryptocurrencies were purely digital cash projects. However, developers soon realized there’s much more to crypto than virtual cash. Cryptocurrencies today are highly versatile digital assets that people can use as digital money and programmable virtual currencies.

Many cryptocurrencies provide programmers with the framework for launching decentralized applications (dapps). There are more than 20,000 active crypto projects on the market, far more than all of the fiat currencies in the world. These projects mostly use decentralized blockchain networks, which don’t depend on governments or banks. Users can store cryptocurrencies in specially designed crypto wallets, which come in the form of digital apps and hardware devices.

The main idea is to provide users with decentralized assets which don’t infringe on privacy and give complete ownership to users. There are no banks, no hierarchy, and no bureaucracy involved.

Learn how to invest during a crypto bear market at Moralis Academy.

Blockchain Technology: The Moving Force Behind Crypto

Blockchain networks are the key technological solutions behind cryptocurrencies. Almost every crypto project uses a blockchain to conduct transactions, and there are different types of blockchains. Some cryptocurrencies, like Bitcoin, use a Proof-of-Work (PoW) consensus mechanism, which requires crypto miners to validate transactions. Others, like Cardano (ADA) or Solana (SOL), use a Proof-of-Stake (PoS) structure where users stake the project’s native coins through network nodes, which process traffic.

There are numerous additional blockchain models and structures. However, the critical characteristic of every blockchain is that it uses rigorous cryptographic algorithms to validate and process each transfer. Once the network approves a transaction, it’s added to the following data block of the blockchain, and it’s immutable. No one can change it except if someone hacks more than 51% of the network, but that’s highly unlikely.

Most popular blockchains are public blockchains and use a fully decentralized network architecture with numerous network nodes. The nodes are autonomous, and anyone who meets specific network requirements can start running a blockchain node. No one can shut down a whole blockchain because if a node goes down, the network just keeps running.

Blockchain networks utilize the internet to create autonomous, decentralized infrastructures for transferring money and data between users across the globe.

Check our Blockchain and Bitcoin 101 course to learn the essentials of blockchain technology.

Crypto vs Fiat: The Key Differences

Now that we’ve gone through the basics of cryptocurrencies and fiat currency, let’s move on to the critical differences between crypto vs fiat.

Decentralization and Centralization

Fiat currencies operate in a heavily centralized, hierarchical manner and depend on governments and central banks. These institutions can manipulate the value of a local fiat currency and introduce regulations to artificially maintain its value at a certain level. Furthermore, banks, the critical fiat financial institutions, are centralized, privately controlled systems. The bank decides how and when you can access your money. If the bank goes broke, you can lose all of your funds. Additionally, hackers can steal your sensitive data if they breach a bank’s security system.

Most cryptocurrencies are fully decentralized and run on blockchains with thousands of independent network nodes. There’s no central authority on a blockchain, and many crypto projects use decentralized community governance models.

Check our blockchain guides and our crypto terminology article to dive into the innovative solutions of blockchain technology.

Different Technology and Speed

Technology is one of the most significant differences when comparing crypto vs fiat. Traditional currencies use the centralized banking system to conduct electronic transactions. A bank account transaction can take hours or sometimes even multiple business days. When you use a bank card, the network approves the transaction within a few seconds. However, the funds take up to 48 hours to arrive in the destination bank account. A business transaction between two companies can take even longer because it may require contracts and other paperwork. All of these transactions use slow, centralized electronic banking systems.

Cryptocurrencies use blockchains to distribute transaction approval among numerous nodes and facilitate a multitude of transfers simultaneously. Some of the most scalable blockchains, like Solana, Avalanche, Polygon, and others, can process tens of thousands of transactions per second. Also, they can achieve transaction finality in a matter of seconds. When you send a crypto transaction on a fast blockchain, the funds arrive almost instantly at their destination.

Learn how to build a dapp in three steps with Moralis.

Custody and Ownership

You can store fiat currency in your wallet, home, or in a bank account. Someone can steal your wallet or break into your home and take all your money. That’s why people keep most of their savings in bank accounts. However, the money in your bank account isn’t really yours. The bank controls that money, and you need to abide by the rules of the bank to get access to your cash. Due to daily withdrawal limits, you can’t even withdraw all of your money at once. Additionally, banks sometimes require explanations regarding the source of your incoming transactions. If law enforcement agencies ask them, most banks will freeze your assets.

With crypto, you can take custody of your assets personally by storing your cryptocurrency in a non-custodial digital or hardware wallet. Cryptocurrencies use private keys, a type of password that gives you access to the crypto in a particular blockchain address. Crypto wallets don’t require users to provide personal information as banks do. All you need is to keep your private keys safely stored on your device, and you can manage your crypto as you wish. Digital currencies give users full ownership over their funds for the first time in history. No intermediary or custodian holds your funds when you store them in a non-custodial wallet.

Learn all about the trending Starbucks Odyssey NFT program at Moralis Academy.

Utility

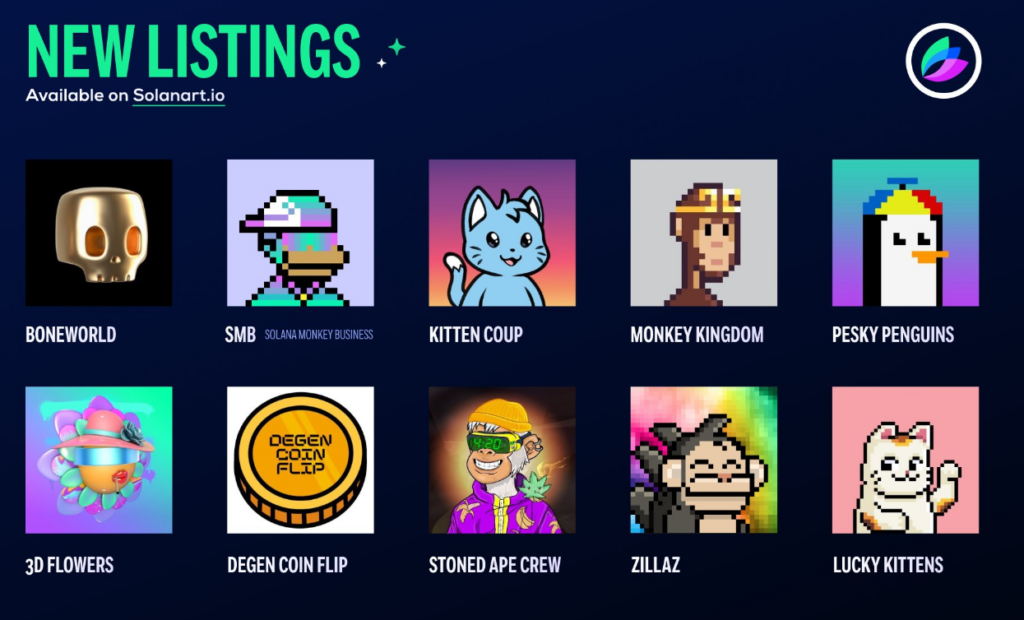

The only thing you can do with fiat currency is use it as a financial instrument to conduct payments. Cryptocurrencies are also financial instruments with which you can pay for services and products at businesses that accept crypto. However, crypto has further utility. Many digital currencies focus on providing developers with a framework for launching dapps. Blockchains like Avalanche, Solana, Ethereum, and other networks give programmers the tool to launch decentralized exchanges, NFTs, digital marketplaces, DeFi protocols, and more.

Volatility

Cryptocurrencies are highly volatile assets. The price of a fiat currency usually changes a few percent within a year. Digital currencies have constant price fluctuations of at least a few percent. It’s normal for Bitcoin to jump or fall in value a few percent within a day. Altcoins with lower market capitalizations are prone to even more-dramatic price swings. Because of this volatility, crypto is a very high-risk investment but also provides opportunities for high profitability.

Inflation and Supply

One critical difference between crypto vs fiat is how each asset class handles inflation and supply. Fiat currencies don’t have a finite amount of bills. The Fed can print more US dollar bills in coordination with the US government whenever it decides to do so. Furthermore, that’s exactly what the Fed does annually when the need arises. By doing so, the annual inflation rate of the US dollar is constantly increasing. The USD inflation rate grew from 3.2% in 2011 to 8.3% in 2022.

Cryptocurrencies are much more scarce because most reputable digital currency projects have a finite amount of coins. Bitcoin, for example, has a hard cap of 21 million coins, and there won’t be any new BTC on the market. As BTC’s popularity and market adoption increase, so does its value, making it a more scarce asset. Nonetheless, several crypto projects exists which can increase their token supplies at any time.

Solana is one of the top blockchains for launching NFTs. Learn about the top Solana NFT marketplaces at Moralis Academy.

Adoption Level

Fiat currencies have a full adoption rate on a global scale. There isn’t a country or region in the world that doesn’t accept some type of fiat currency. Thanks to the worldwide banking system, local financial systems are interconnected and allow users to exchange currencies. Crypto has a long way to go before being close to reaching the global adoption level of fiat currency. Data shows that only around 300 million of the world’s eight billion people hold some crypto. However, the adoption rate of cryptocurrencies is growing annually, and millions of new users are joining the crypto market.

Transcending National Borders

Fiat currencies are confined to national borders except for global currencies like USD, EUR, and a few others. To facilitate a fiat transaction from one country to another, users usually need to convert currencies before sending them. Also, bank conversion rates are often quite unfavorable and incur high fees. Cross-border bank transactions also require considerable paperwork. Fiat currency transfer services like Western Union incur even higher costs.

Digital currencies successfully transcend national borders. Users can send crypto to anyone worldwide with an internet connection and a crypto wallet. A crypto user from the US can send a crypto transaction in a matter of seconds to another user in Europe. There’s no paperwork or bureaucracy involved. Crypto only changes blockchain addresses and doesn’t have to do anything with geographical borders.

Crypto vs Fiat: What is the Difference? – Summary

Crypto and fiat currency are very different, although they are both financial assets, and people can use them to pay for products and services. Crypto is much more than digital cash, especially when looking at vibrant dapp-development ecosystems and DeFi projects. However, fiat currency is much more widely accepted than crypto, and digital currencies are yet to achieve widespread adoption. In terms of technology and utility, crypto offers much more possibilities than fiat currency.