Does the COVID-19 coronavirus pandemic affect cryptocurrency in any way? In this age of information, it can sometimes be difficult to determine what is true and what is not. The rise of “fake news”, coupled with extreme economic uncertainty is distorting our perception of reality and changing the fabric of our lives. Throughout mainstream media, there is an abundance of misinformation and misrepresentation of facts, with much of the conversation in the news falling short of any substantial discussion.

What we do know, however, is that a deadly virus has spread across the planet, already killed an estimated 1.16 million people and bringing the global economy to a standstill. The long-term implications of the COVID-19 pandemic are chilling, but the damage to society and the global economy are not openly discussed as governments and central banks quietly try to print their way out of economic disaster.

Though people are free to socialize now, businesses have closed down, and several countries are facing record unemployment. Many businesses are running at a loss and will not be able to trade much longer without further stimulus, which will likely lead to further unemployment, business closure, and bankruptcy.

However, this is not reflected in the stock market. Throughout this year the stock market has skyrocketed, despite a drastic drop in global productivity. By the end of 2020, it is estimated that global GDP will have dropped by 7.5%.

In this article, we’re going to take a look at the economic situation pre-pandemic, and compare it to the situation we find ourselves in today. We’ll also discuss the reaction from the cryptocurrency markets to the pandemic and what this means for the future of global finance. Moreover, we will also look at some of COVID-19’s impact on crypto.

US Stock Markets

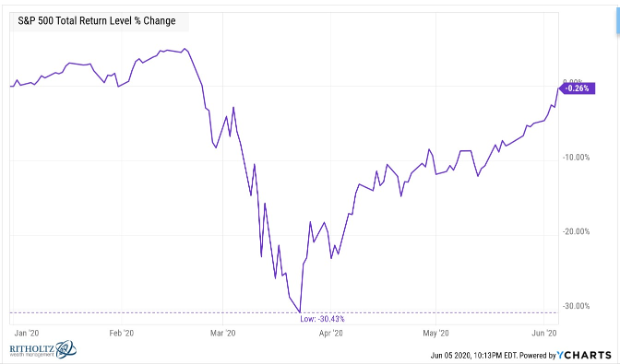

No article about the economy is complete without looking at the US stock market. A Forbes article written at the beginning of this year, explains how 2019 surpassed all expectations and proved to be a historic year for the stock market with the S&P 500 rising by 29%, the Nasdaq by 35%, and the Dow Jones Index by 22%, some of the biggest gains seen in years.

Yet, economists had been calling for a correction the year before, expecting a stock market crash sometime in 2019. When it didn’t happen, the end of the year was filled with warnings from economists anticipating a large stock market correction for 2020.

There have been several reports over the years about the manipulation of the stock markets, however, in recent months it is becoming more apparent to the public that the numbers of the American stock markets are not reflecting the economic turbulence in society.

A record number of businesses have been forced to close due to the adverse impacts of the pandemic. Unemployment has never been higher in America, statistically showing rates worse than 100 years ago during the Great Depression.

If you want an even more comprehensive overview of the history of money, check out the Ivan on Tech Academy course on that! Ivan on Tech Academy offers countless cryptocurrency and blockchain courses. Be the next person to boost your blockchain and programming skills through the Academy!

COVID-19 Stimulus in the US

Yet, the US stock market, and indeed the world’s, has ‘bounced back’ within months of a record sharp fall in March, showing new all-time-highs. Stimulus packages were handed out 6 months ago, a large majority of which has gone into inflating the stock market share prices, and a small portion being handed out to the American people. Also, many of the people who received a stimulus cheque that found themselves with some money left over would naively turn to the stock market to invest their wealth.

The second round of stimulus packages has been on the cards and talked about for a couple of months. However, endless talks and reports later, the government has still yet to agree on the amount and how it should be spent.

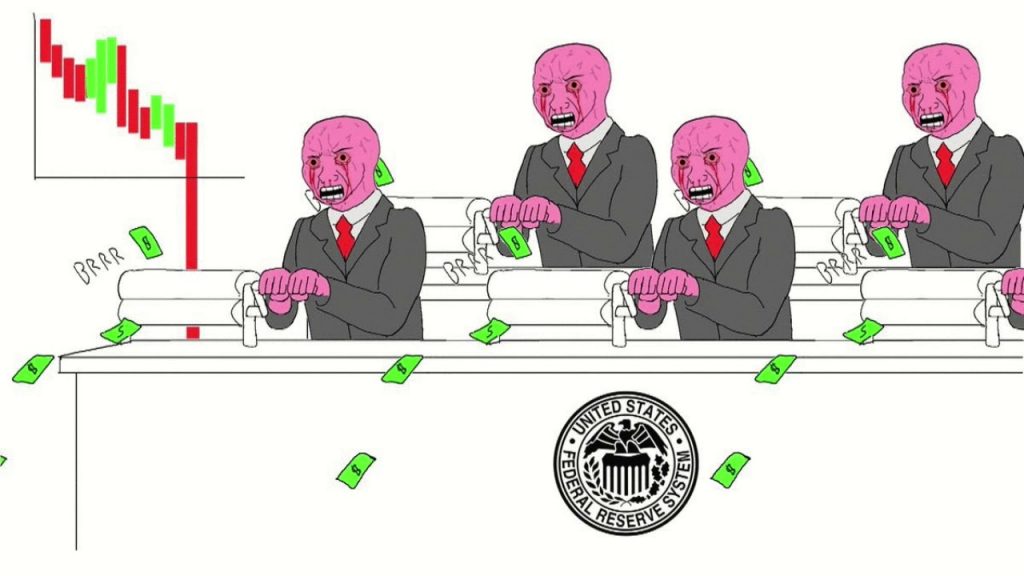

QE – Money Printer Goes Brrr

The measurement used to calculate how much a country is in debt is by using the debt to GDP ratio. GDP or, gross domestic product, can be understood as the amount of money a nation is producing through sales of goods and services and exports. This is then calculated as a percentage compared to the amount of debt the nation has. The pandemic has resulted in an unprecedented amount of QE – quantitative easing, or ‘money printer goes brrr’. Little do the citizens realize, the fiat currency they’re saving is being devalued with every new note brought into circulation. Since the start of the pandemic, central bank debt has grown by 10% of global GDP.

Whilst the debt to GDP ratio of America is alarming, it comes in 12th on the global scale of nations’ debt to GDP, behind Japan in the top spot with 234%, Greece at 181%, and Sudan at 176%. Other countries such as Venezuela, Lebanon, Italy, Barbados, and Portugal all have a larger debt to GDP ratio than America, whose debt ratio sits at 109% as of August 2020. However, it’s worth bearing in mind this figure may significantly rise if or when another stimulus bill is passed.

Race for CBDCs

In July, Thailand rolled out a pilot scheme for its launch of its CBDC, the Digital Baht. If you’re unsure of the differences between central bank digital currencies and other currencies, click

here!

This October, China proposed a lottery airdrop of their new Digital Yuan in Shenzhen city, as a trial before a national roll-out. Users had to download an app on their smartphone and sign up using a form. Three days after the lottery, the winners had 6 days to spend their winnings before any remaining Yuan was removed. This shows the freedom of governmental activity and control with CBDCs, but also the correlation between COVID-19 and cryptocurrency adoption.

Whilst the pandemic appears to have spurred on the development of CBDCs, during talks at the recent IMF conference, the chairman of the FED did not appear to have any plans or sense of urgency for creating a digital dollar, leaving some economists concerned that the United States will fall behind in the decentralized finance and blockchain industries.

IMF – Global Monetary Renegotiation

The International Monetary Fund (IMF) called for a new “Bretton Woods” style moment earlier this month, with financiers from across the globe coming together to discuss the urgent need for a worldwide economic overhaul.

This unprecedented turn of events is comparable to the Bretton Woods agreement Conference that took place after the second world war. Once the dust had settled after years of conflict, 730 delegates from all 44 allied nations met at the Mount Washington Hotel, Bretton Woods, New Hampshire. World leaders came together to agree on a new global economic paradigm that would change financial and monetary policy to help restore the economies of nations ravaged by war.

In the recent announcement by the IMF, much of the focus of the debate was around digital currencies and in particular, central bank digital currencies (CBDCs). The effect of COVID-19 on the global economy has expedited the need for new and efficient monetary policy and economic infrastructure.

The IMF and the International Bank for Reconstruction and Development (IBRD), established a framework for international financial relations in what is now commonly referred to, as the Bretton Woods system.

The Bretton Woods system saw the price of gold become the basis for the US dollar, while other currencies would become pegged to the dollar. This system was overturned by President Nixon in the 1970s when it was announced that gold could no longer be exchanged for USD and subsequently, the US dollar became unpegged from gold.

This is the type of moment that the IMF is calling for, and CBDCs appear to be at the forefront of the conversation. Countries suffering from economic downturn as a result of the pandemic are pushing towards CBDCs, which is a bullish indicator for blockchain technology adoption and innovation.

The Crypto Market During COVID-19

After the long bearish period throughout 2018, the cryptocurrency market appeared to be making a trend reversal throughout mid-2019 up until the news of the pandemic caused a colossal dump in March this year.

The crypto market has often shown correlation to the traditional stock market, so it comes as no surprise that markets across the world hit the floor as the global economy came to a standstill during a period of complete uncertainty.

However, the confidence in cryptocurrency was apparent by the speed at which the market recovered. The already over-inflated stock market was slower to recover during the pandemic, with only a handful of major tech companies holding up the markets. Despite this, tech company stock skyrocketed throughout 2020, pushing the S&P 500 to new all-time-highs, contrary to productivity grinding to a halt globally, and central banks and governments printing money out of thin air, further increasing the national debt.

How Has Crypto Performed During The Pandemic?

Cryptocurrency has been the best performing asset class this year, outperforming gold, stocks, and commodities. The recovery in the crypto market was astonishing, and now we could be on the road to new all-time-highs as early as this year.

The change in sentiment around cryptocurrency has several major factors. One factor is that now, compared to the ICO bubble of 2017, the crypto market is full of fully functioning products that provide real value to users.

Secondly, there is a “wall of money” coming into the crypto space, as publicly traded companies, payments processors, banks, and other institutional investors rush to invest in crypto to offer the latest digital financial instruments and cryptocurrency services.

Bitcoin appears to be decoupling from both gold, and the stock market, and with record amounts of USDT entering circulation, it looks like many investors are turning to cryptocurrency, in particular Bitcoin, as a hedge against inflation. Markets have been rocked by COVID-19 and cryptocurrency appears to be coming into favour faster than ever before.

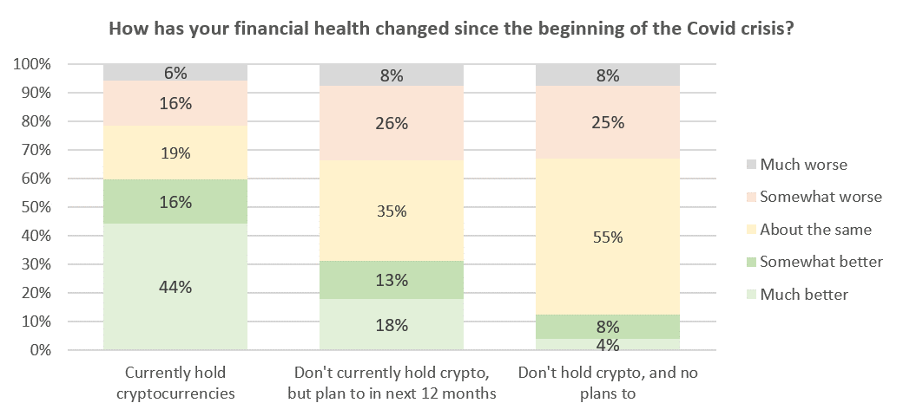

Why People Are Choosing Crypto Now

There is a creeping sense of urgency for people to move their finances on to the blockchain, with a rapid decline in the use of cash – although supply has increased – not only for ease and convenience but now for health reasons. Cash is now considered by many to be ‘dirty’ and is being accepted in fewer and fewer places, predominantly due to the virus.

Just a decade ago, commercial banks made up 96% of the global banking and payments industry, the other 4% being the payment merchant giants such as Visa, Mastercard, etc.

Fast forward 10 years to now, and not only has the percentage of commercial banks reduced to 72%, (down from 81% at the start of 2020) the introduction of Fintech companies are beginning to make themselves known, accounting for 11% of the payment and banking services. Chinese fintech firm Ant Group and payment giant PayPal’s combined market value has increased to $900 billion. After announcing crypto extension options from 2021, both Bitcoin and PayPal’s stock price rose by 5% last week.

Since the beginning of the pandemic, Brazil’s leading digital lending service Nubank has seen the number of registered accounts rise by 50%, American-based peer-to-peer payments firm, Venmo, has grown by 50% year-on-year during this quarter.

Research firm Forrester found that one out of five American adults used digital payments for the first time in April this year – suggesting the economic lockdown was a catalyst for digital financial adoption. Another survey, this time global, conducted by consulting firm, Bain & Company, found that 95% of consumers plan to use digital banking services in the post-pandemic future.

It’s So Easy!

In parts of the world with struggling economies, more people than ever are not only choosing to hold crypto as a hedge against their hyper-inflating currency but also to create businesses allowing others to be a part of the crypto revolution too. Businesses in Africa are using cryptocurrencies in their everyday transactions, receiving Bitcoin and other cryptos for goods and services, and paying their suppliers with cryptocurrency too.

The use and adoption of crypto and blockchain technology are growing exponentially in the African regions because all you need is a smartphone and an internet connection to participate. Albeit some of these nations don’t have constant or super-fast, fiber-optic broadband comparative to the western world, but the financial tools, and services available by simply downloading an app with an electronic wallet offer immense freedom and opportunities for growth, both on an individual and socio-economic level.

COVID-19 has halted a tremendous amount of international trade, with countries taking precautionary measures by closing borders and restricting exports to a bare minimum. Different nations have handled the situation in different ways, however, the IMF has reported nearly 120 new export restrictions in 2020 – over 100 more than in 2019.

Restrictions such as these, are counter to the philosophy of global trade and suggest that we’re moving toward a form of separatism or protectionism. However, these are reminders as to why we have Bitcoin and other cryptocurrencies, and the dream of Satoshi Nakomoto to have a secure, transparent, global peer-to-peer electronic cash system. Bitcoin is borderless and used internationally, crypto doesn’t discriminate.

COVID-19 and Cryptocurrency Conclusion

One thing for sure is that the future is uncertain. However, surveys and reports are showing a clear trend of people adapting to an increasingly online lifestyle, including how they chose to allocate their finances.

It is difficult to measure any exact effects or direct impacts of COVID-19 and cryptocurrency, nevertheless, the adoption of Bitcoin and blockchain technology until the past 12 months has been gradual, but 2020 has shown an exponential increase in user adoption and trading volumes.

Coronavirus has pushed people in the right direction of personal financial freedom, the population has never been so close, yet so many can neither see nor feel this. With an increasing number of institutional investors and public companies choosing to hold a percentage of their assets in Bitcoin, global payment giants adopting cryptocurrency facilities and partnerships, and hundreds of new decentralized financial applications becoming available, it is only a matter of time before cryptocurrency use becomes mainstream.

COVID-19 has enlightened some, who have reassessed their personal priorities and circumstances. In addition, the economic implications and the governing responses to the crisis have also been an eye-opener in terms of monetary policies and currency value.

Throughout the pandemic thus far, Bitcoin has proved itself as the best-performing asset for the protection of wealth and hedge against inflation, surpassing gold and other deflationary materials. The more people realize this and get involved, the higher the value of Bitcoin and the stronger the network will be. If you would like to see a clear breakdown of Bitcoin vs gold vs stocks, click here!

What’s more, if you want to supercharge your blockchain education, the answer is Ivan on Tech Academy. The Academy has over 20,000 students who have already enrolled, and consistently produces real-life success stories. Additionally, right now you can get up to 20% off when enrolling in Ivan on Tech Academy, if you use the exclusive promo code BLOG20 when joining!