As the conversation about clean and sustainable energy becomes ever more present, the use cases for blockchain in the energy sector are becoming more compelling than ever. As major energy providers across the globe transition from cheap, unsustainable, coal-based energy production, the increasing demands for efficient cryptocurrency mining present an interesting intersection between the two industries.

Blockchain technology – which is often seen as being nearly synonymous with the advent of Bitcoin – is a revolutionary process of mathematically verifying data and transactions, with increased security and transparency. This technology, although predominantly used in decentralized finance and fintech at the moment, has use cases that spread far and wide across the world, encompassing virtually all global industries.

Consequently, the energy sector is no different. Blockchain technology has the chance to revolutionize the energy industry as we know it, allowing individuals to pay for only the energy they need, offer prosumers a more profitable passive income, along with tools for monitoring and reducing carbon emissions and wasted energy resources.

In this article, we’ll explore how blockchain technology is being implemented in the different areas of the energy sector, and how changes in how we produce electricity will affect cryptocurrency mining in the future. We’ll also take a look at some of the existing projects that currently utilize blockchain in the energy sector.

Blockchain technology potentially holds the keys to drastically altering and improving the energy sector. However, understanding the blockchain is essential to realizing its potential applications and use cases. This is why Ivan on Tech Academy offers a wide variety of blockchain courses – and you can enroll today!

How Can We Use Blockchain In The Energy Sector?

Blockchain can be used in the home to monitor things such as gas and electricity expenditure via smart meters installed in the home. These smart meters can then provide real-time information to make energy bills simple and painless by providing an immutable account of energy usage at home.

This can extend much further; combined with the use of oracles, smart contracts, and artificial intelligence, blockchain technologies could be used to automate household appliances, turning them on-and-off and diagnosing any faults as they occur. In the future, we could see appliances such as smart-refrigerators that automatically order your milk to be delivered before you run out!

Blockchain has the potential to optimize efficiency in energy consumption in the home, the workplace, and in transport and supply chain management. Thanks in part to internet-of-things (IoT) devices, electric vehicles connected to the internet can feed real-time data on traffic conditions, diversions, and an array of data points that could save time and money for commuters, businesses, and consumers. Node operators that are incentivized by cryptocurrency can provide data relating to travel and logistical issues and reach consensus on the blockchain to provide a trustless network of reliable data sources.

Petroleum is a natural liquid underneath the Earth’s surface that’s refined into fuel for transportation, heating, and electricity generation. It’s also used to make the plastic and synthetic materials used for every-day items. Petroleum is one of the most valuable traded commodities, passing through a process of refiners, tankers, jobbers, governments, and regulatory bodies before reaching the consumer level. The introduction of blockchain in the energy sector, particularly in conjunction with petroleum, is being considered by the industry as a way to maximize efficiency and privacy security with the use of private permissioned blockchains, and immutable accounting that will lower costs and increase the speed of trade.

Wholesale Energy Distribution

By connecting end-users directly with power grids on the blockchain, energy can be traded without retailers or middle-men. Not only does this save money for the consumer and the supplier, but it also means that users can purchase a specific amount of energy at a certain price, giving flexibility over energy consumption that is easy to track while facilitating good value energy when it is available.

Connecting consumers directly to the grid will drastically improve efficiency in billing and could reduce costs by around 40%. Blockchain company Grid+ offers wholesale energy distribution that aims to replace many of the inefficiencies in consumer electricity markets. Grid+ allows electricity to be purchased at wholesale prices in some jurisdictions, pushing the industry towards a lower-cost and more equitable energy market through the use of blockchain-based services and cryptocurrency.

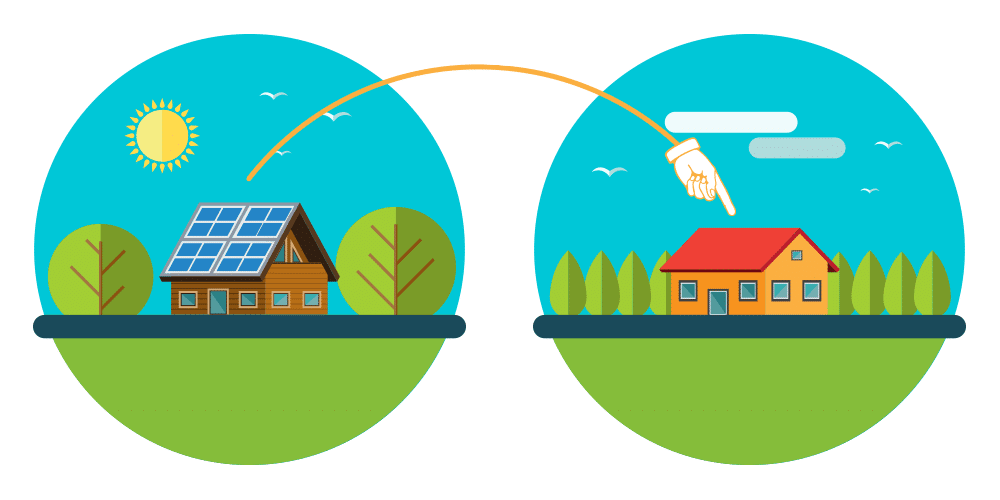

Peer-Peer Energy Trading

According to a 2018 Blockchain In Energy Report published by Wood Mackenzie, 59% of blockchain-based energy projects are in the process of building peer-to-peer energy markets.

Peer-to-peer energy markets are a network of prosumer and consumer individuals, who can buy and sell energy between each other, without the need for a third-party energy retailer or wholesaler. This can provide an opportunity to make a lucrative passive income for people involved in wind and solar energy, which is becoming somewhat of a cottage industry, facilitating several home-built cryptocurrency mining farms.

Energy prosumers can digitalize the energy they’ve created, and trade or purchase within ‘energy clubs’. Blockchain technology offers symbiotic secure account management with the tokenization of energy units, making inventory and accounting faster and easier with increased security.

Australian start-up Power Ledger is a blockchain-based operating system designed for trading renewable energy and environmental commodities. Power Ledger is reinventing energy markets by creating a platform for renewable energy to be traded as and when it is needed, reducing waste, emissions, and helping to create a more sustainable future with the use of blockchain in the energy sector.

The platform has connected several peer-to-peer communities to create ‘Microgrids’, a second-layer energy distribution resource built on top of the national grid, but created to be self-sustainable.

Electricity Data Management

Blockchain technology offers a transparent immutable ledger of all energy data including market prices, excess costs, trade prices, and usage. As the subject of clean and renewable energy becomes increasingly debated, the logistics of electricity data management are being more widely explored.

The Chilean National Energy Commission (CNE) announced in April 2018 the governmental department will be using the Ethereum blockchain to record and track data about energy usage, allowing all transactions to be public and viewable to all citizens.

VeChain partnered with Shanghai Gas in 2018 – which powers 90% of the energy in Shanghai. The partnership has allowed for a more efficient asset management system such as IoT tanker tracking information during deliveries. After a successful pilot, it was confirmed that the partnership will be expanding from March 31st this year.

An additional advantage of blockchain in the energy sector is proof-of-origin, ensuring provenance tracking with renewable energy solutions. Companies and consumers can view on the blockchain where and how an energy unit was produced, and therefore can be more mindful of the choice of their energy consumption.

Challenges

Despite the aforementioned advantages, the legalities of peer-to-peer energy trading are somewhat murky at present. Because this is an emerging industry, it is still largely unregulated. The legal logistics of scaling blockchain energy solutions present a hurdle for greater adoption throughout the industry.

The energy industry is extremely complex and nuanced. Having evolved through decades of technological innovation, much of the current energy system is embedded in its current infrastructure both from a physical, technical, and regulatory point of view.

Having global conglomerates and major energy providers agree on updating business models in sync with one another could be a challenge. The cost of removing old systems and replacing them with blockchain solutions will likely come with substantial initial development costs which could put many businesses off during times of economic uncertainty and market volatility.

If all of this seems interesting to you, we highly recommend that you enroll in Ivan on Tech Academy. Joining the Academy is the best way to supercharge your blockchain education. What’s more, you can get 20% off if you enroll in Ivan on Tech Academy using the promo code BLOG20.

Bitcoin Mining Energy

A common criticism of blockchain in the energy industry is that of the Bitcoin mining energy required. Bitcoin was the first decentralized cryptographically-secure digital currency powered by blockchain technology. The mining nodes in the network use the Proof-of-Work (PoW) consensus mining algorithm. In short, each node competes with the others within the network to complete a mathematical equation in order to validate a transaction.

The mathematical equations are of such substantial difficulty, they essentially require supercomputers to guess the correct answer, as this proves a quicker way of solving the equation rather than trying to calculate the entire process. A huge amount of computational power is required before an equation can be solved, with the difficulty level being adjusted depending on the amount of hash power, or nodes in the network, as per the Bitcoin whitepaper.

Part of the transaction data is used by the nodes to complete the equation, and some of the transaction data of the previously verified transaction is also required. This ensures that each transaction is cryptographically entwined with the previous transaction.

Machines are often running all day and night, with miners incentivized by a reward in Bitcoin for each transaction verified. These transactions are placed into a block; once the block is full it becomes appended to the blockchain.

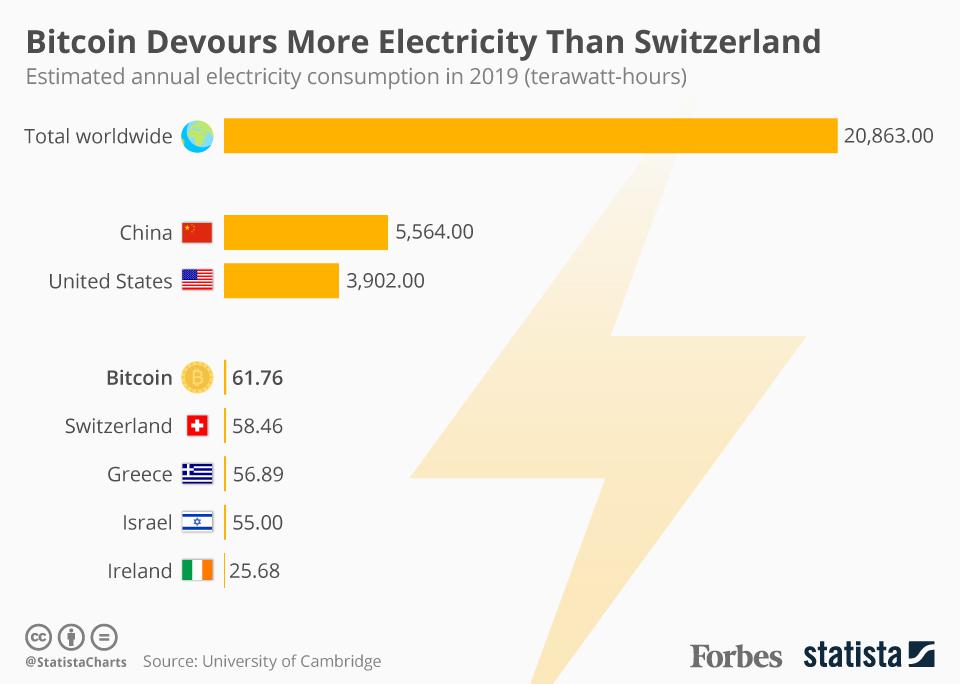

No discussion about blockchain in the energy sector can, therefore, be complete without a mention of the substantial energy required for Bitcoin mining.

Excess Energy

A great deal of Bitcoin mining is performed using cheap, coal-powered electricity, but as the cryptocurrency industry continues to grow, so too does the demand for clean, sustainable energy that can be harnessed to carry out proof-of-work computations that require an increasing amount of energy as the blockchain networks expand.

It makes sense that the complex and fragmented energy industry could be made more efficient, sustainable, and cost-effective by the use of distributed ledger technology. This is becoming a reality as many different crypto projects have come to prominence to simplify and optimize the shifting landscape in clean energy and replace some of the outdated, redundant infrastructures with forward-thinking ideas and technologies.

There have been many complaints over the years about the amount of energy consumed when mining Bitcoin, however, Coinshare’s 2019 report on the global mining ecosystem indicates that 73% of Bitcoin mining rigs are operating using renewable energy. This is broken down into various energy sources, with hydroelectric power coming up top, and the most popular countries utilizing the technology being China and Canada.

Bitcoin Mining Alternatives

Another way of mining Bitcoin with environmental consciousness is through the use of excess and waste energy and gasses produced by oil mining rigs and fossil fuel excavation. Excess gas and wasted energy sources from oil mining rigs and such would normally be sent through a pipe and sold off to the market at a loss price, or alternatively, the gas may be transmuted to liquid form before being auctioned or transported to market. Instead, companies are realizing they can use this excess energy and convert it into electricity to power mining rigs, offering a far better return on investment than pipeline infrastructure.

The process is relatively simple, with no need for building any new or specially designed extensions. The everyday shipping container, used across hundreds of energy plant sites, are being used to house Bitcoin mining rigs that can be easily stored and scaled. Instead of piping out excess gas, companies are beginning to realize the financial and environmental advantages of using their waste energy to mine cryptocurrency.

Marty Bent, a crypto podcaster, explained in an interview how the introduction of mining rigs using excess energy can help reduce Co2 emissions, stating “a small V-8 50-kilowatt hash generator reduces carbon emissions by up to 10,000 tonnes/year when deployed on vented gas sources”.

Marty Bent

Questions have arisen over the profitability margins between crypto mining rigs or selling the excess energy back to mainstream power grids, for prosumers creating their own solar or wind energy. It appears that Bitcoin mining offers a more financially fruitful option than the legacy energy companies. An energy distribution company in Canada, Black Pearl Resources, is using Bitcoin mining rigs to reduce operational costs and pass on these savings to consumers.

Summary

The energy industry is a complex matrix of transactions, energy sources, stakeholders, retailers, utility companies, and consumers, each wanting the best deal for themselves, their partners, and sometimes the environment.

Reducing costs whilst simultaneously improving efficiency and transparency seems like an enormous task, but by using blockchain in the energy sector, the industry could become more stable, forward-thinking, and environmentally friendly.

By implementing blockchain-based solutions, both consumers and shareholders have complete transparency and access to real-time data that is secure and reliable. In the future, we could see certificates for environmentally-conscious use of energy tokenized on the blockchain in the form of NFTs (non-fungible tokens).

The use of blockchain in the energy sector is projected to grow from $200 million in 2018 to an estimated $3 billion by 2025. Not only does this bring value and utility to the cryptocurrency space, but it could also have a drastic impact on the way we generate, store, and consume energy.

Nevertheless, the energy sector is just one of the many different sectors using blockchain technology to supercharge the implementation of radical new techniques. Ivan on Tech Academy offers dozens of courses with deep-dives on blockchain technology. Enroll to learn about the potential of blockchain technology, and join the blockchain revolution!