Ray Dalio is the founder of Bridgewater Associates, a global macro investment firm that is currently the world’s largest hedge fund earning a whopping $49 billion for its investors. A best-selling author, Mr. Dalio, regularly shares his knowledge through articles and videos. I will be focusing primarily on his latest piece, The Big Cycles Over The Last 500 Years, and the role Bitcoin could play should his projections prove to be accurate.

Ray Dalio’s theories about market cycles are too involved to cover in one post, so I have focused solely on the portions that I believe are most relevant to Bitcoin. Namely, the long-term money and debt cycle, the rise and fall of empires and reserve currencies, populism, and their interconnection to one another. Could we soon see the death of the dollar?

Market Cycles of the Past

We’ve all heard the adage, “Those who do not learn from history are doomed to repeat it.” For Ray Dalio, this played out before his eyes when President Nixon announced that the U.S. dollar could no longer be exchanged for gold on August 15, 1971. The dollar instantly dropped like an anchor.

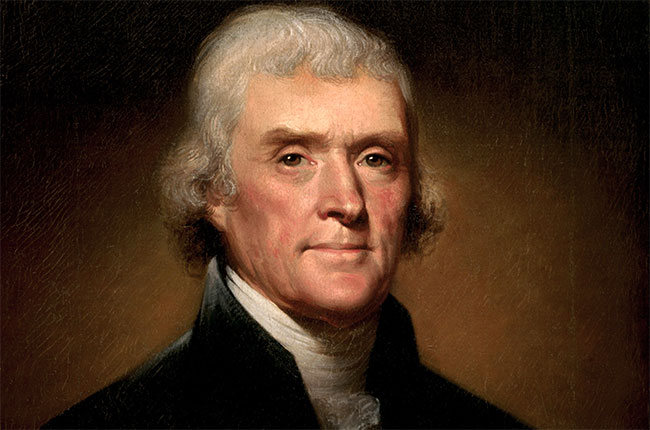

Ray Dalio

Upon hearing the news, Dalio showed up to work fully expecting a blood bath with rampaging bears thrashing and mauling their way across Wall Street’s length and breadth. What he found, however, was something entirely different. What he found was that stock prices shot up by 4%.

How could this be?

Dalio had to find answers to this paradox because watching the stock prices rise is not what he expected, and if he hoped to survive (much less thrive) as a global investor, he knew he would have to come to understand such market phenomena. Ultimately, this event pushed him towards a lifelong path of hard study and exploration to uncover the mysteries of market cycles. Otherwise, like the average person on the street, he would continuously be blind-sided by them.

We, as human beings, see patterns quite naturally. Sometimes, we even create designs that don’t exist because our drive to understand things is so innate. But how can we recognize a legitimate pattern—much less decipher its meaning—if we’ve never encountered it before? Dalio didn’t see this market shock coming because it had never happened in his lifetime. Now, getting caught unawares by big market moves might be tolerable for the average person, but for one who planned on profitably trading other people’s money, he would have to do better.

By figuring out how market cycles had played out in the past, Dalio believed he could determine with a degree of certainty which section of the cycle was confronting him at a given moment in time. That was the goal. And after all, the names and characters of history may change, but human nature doesn’t change that much. Thus, it stands to reason that the same forces (albeit with different technologies) will continue to drive market cycles as they always have.

How Money and Credits Work

First off, let’s briefly summarize Dalio’s treatise on how the economic machine works and what he means by debt eats equity.

Let’s say you own a house, but you put it up as collateral when you took on some debt. In most jurisdictions, the creditor gets paid first. So, if you can’t earn enough to pay back your mortgage, you might have to sell your house to make the payments or turn it over to your creditor. So, debt eats equity means that debts have to be paid above all else.

Now, apply this simplistic example to governments. Like the rest of us, they have to repay their debts. Unlike us, however, they can print money—and they can print ad infinitum. As individuals, we can print money too, but that’s called counterfeiting, and if we tried it, we’d be put in jail.

However, back to Dalio: “Unlike what most people intuitively think, there isn’t a fixed amount of money and credit in existence. Money and credit can easily be created by governments.”

And (initially at least), people like easy money and easy credit. It gives them, their companies, and their governments increased spending power. But as we in the crypto community regularly talk about, this kind of spending creates a lot of debt that will someday be repaid.

A Short History of Money

Before we delve into the long-term debt cycle, let’s look at money. The societies that first created it used different items, and whether they started with trinkets, baubles, or an enemy chieftain’s skull on a pike, money eventually evolved into things that had an intrinsic value like gold, silver, copper, and nickel. As Dalio calls it, “hard money.”

These were the day’s preferred monies of the day because they had intrinsic value and could be downsized and coined to fit into pockets or gunny sacks. And this money was trustless. Meaning, you didn’t need to hire a lawyer to enforce a contract or a promise to deliver goods and services. There was no trust component involved because gold was gold, and when you got paid, you got paid. Alles geht gut.

Ultimately, gold (and to an extent silver) became the safe medium of exchange and store of value of that time. Later, paper notes came into existence and, along with them, the “linked system.” These notes, while not actual money, were “claims on money.” And the masses began to trust the institutions behind these claims on cash to the extent that paper notes began to be seen as actual money. Thus, the value of the paper notes became linked to the value of hard money.

Enter the Banksters

Dalio doesn’t touch on the conspiracy theories that surround the period in history that was to usher in the powerful banking families. Still, most of us in the crypto space have been privy to various tales about how they manipulated kingdoms, financed both sides of wars to profiteer off its misery, formed secret societies, and by some accounts, even enthroned Satan himself. I’ll leave it to your imagination to decide which of these tales are true, but suffice it to say, money could now be leveraged and manipulated by the powerful few who controlled the lion’s share of it.

It is important to note that when this linked system first started there were equal numbers of paper claims on hard money as there was hard money stored to back up the claims. It wasn’t until some super genius discovered that the paper claims could be loaned out and paid back with interest that things began to change, and with it, it was a new era of profiteering from credit and debt.

The Long-Term Money and Debt Cycle

Essentially, holders of the aforementioned paper claims could lend them to banks for an interest payment. Bankers could then lend the paper notes to others for an even higher interest rate. And everyone liked it. Boy, did they like it! Banks liked profiting off the interest, borrowers liked increasing their purchasing power, and society liked the rising levels of production and asset prices. With everyone so happy, lots of lending and borrowing commenced.

Regardless of how happy everyone was in this initial stage of this debt cycle, there are no utopias in this world, and when debt started to eat up earnings and assets, it felt like a greedy dinner guest was gobbling up the food before anyone else could get served. Nonetheless, things continued, and private banks were joined by central banks and they began to control the economy by adjusting the costs and availability of money and credit.

When the economy got too hot, central banks slowed it down by making money and credit more expensive and thus less available. If the economy became stagnant, central banks could stimulate it by making money cheap and plentiful, thus encouraging people to borrow, invest, and spend.

However, central banks can lose their ability to stimulate the economy when debt levels are too high, interest rates can’t be lowered any further, and the creation of money and credit inflates financial asset prices more than it increases real economic activity.

Dalio puts it this way, “Think of the central bank as having a bottle of stimulant that they can inject into the economy as needed with the amount of stimulant in the bottle being limited.”

Looking at The Long Term Debt Cycle

So how does a long-term debt cycle play out? They last between 50 to 100 years and Dalio contends, “They start when debts are low so central banks have a lot of stimulant in the bottle, and they end when debts are high and central banks don’t have much stimulant left in the bottle.”

Another way to look at is if we as individuals lose our income and debt begins eating all our equity, we might have to sell our house or other assets to pay the debt. Or we might have to seek protection in bankruptcy court. Neither is pleasant, but when governments can’t pay their debt obligations, something more complex and far-reaching occurs. As Dalio puts it, “Without exception, they print money and buy up debt.”

Mr. Dalio takes a deep dive into the intricacies of how central banks do this and I encourage you to read his articles to learn more. For now, it’s enough to paraphrase him in saying that by printing money and buying debt the banks “bid up the prices of financial assets (which also widens the wealth gap). And by buying financial assets (mostly bonds) they hold interest rates down, which stimulates borrowing and buying and encourages those holding these bonds to sell them and encourages the borrowing of money at low-interest rates to invest it in higher-returning assets, which leads to central banks printing more money and buying more bonds. That is what happened in 2008 and has happened for most of the time since until just recently. This approach of printing money to buy debt (called debt monetization) is vastly more politically palatable as a way of getting money and shifting wealth than imposing taxes, which leads taxed people to get angry.”

The Current Currency Situation

Let’s take another look at the phases of a nation’s long-term debt cycle with the three types of monetary systems being employed over the past 1,000 years:

1) Hard Money (metal coins).

2) Paper Money (claims on hard money) and

3) Fiat Money (the dollar today).

Phase 1: No or Low Debt and Hard Money

As we’ve seen, this phase starts with hard money and no or low debt levels which provides banks plenty of opportunities to create debt.

Phase 2: Claims on Hard Money

This phase begins the linked system where notes (paper money) is backed up by hard money.

Phase 3: Increased Debt.

During this period, the lenders begin exchanging paper notes for interest. Those holding the debt assets get repaid on time and with interest.

Phase 4: High Debt

This phase moves to high debt burdens with little capabilities to create buying power and smaller chances of lenders getting repaid with good returns.

Phase 5: Fiat Currency

When claims on hard money become too restrictive, central banks typically shift to a fiat system. In such systems there is no hard money involved. The central banks just print paper money at will. This is how they avoid default or having their hard money liquidated.

As mentioned, the last time this happened was in 1971 when President Nixon, dogged by excessive spending from his predecessor’s “Great Society” social program coupled with the expense of the Vietnam War, loosed the dollar from its golden chains.

US President Richard Nixon

Inevitable Debt Restructuring?

So, in this phase central banks working hand-in-hand with the commercial banks create more money and debt assets and liabilities in relation to the number of goods and services produced. That buys them some time to extend the debt cycle until those holding the debt try to turn them in for goods and services. The next inevitable phase is…

Phase 6: Debt Restructuring, Defaults, and Devaluations

When there is more paper money and debt than hard money to back it up, there will come a day of reckoning when demands for that hard money will become greater than the bank can provide. In these scenarios, private banks must default (where depositors lose their hard assets) or get a bailout from the government. Central bankers on the other hand can devalue their claims and pay back a lesser amount than originally agreed. The only recourse at this junction is to do a debt restructuring or a devaluation because at the end of a long-term debt cycle there is no more stimulus left to inject to extend the debt cycle.

And as Dalio puts it: “When these debt restructurings and currency devaluations are big, they lead to breakdowns and possible destructions of the monetary system.”

Phase 7: Destruction / Reconstruction and The Flight Back To Hard Money

The stories from those who’ve lived through these periods of financial collapse are scary. Thankfully these destruction periods are relatively short, but even so, we do know that nobody, no matter how financially savvy, comes through these volatile periods completely unscathed.

Could The US Dollar Collapse?

Author James Rickards has postulated that a likely scenario of a collapsing dollar would unfold with a few weeks of food riots and unmitigated chaos until the IMF finishes issuing debit cards using the SDR as the international form of currency. Not everyone agrees that the IMF will impose the new currency, but if/when it happens, whatever monies you had in your bank account before won’t have the same spending power as the new currency being issued.

In days of old when a new king came to power he minted new coins. Now this was not only done for the narcissistic purpose of putting his handsome face or favorite insignia on the coins, because when the populace turned in their old coins they noticed the new ones were always a bit lighter. That’s because bits had been shaved off as a hidden tax. So, be assured, if the dollar sinks into destruction, the replacement currency you receive in return will be, oh let’s just say, a bit lighter.

Modern Money Printing

So, when over-printing and selling of debt assets (bonds) devolves to the point where people pull a run on the banks and take flight from both the currency and debt assets, governments will, by necessity, be forced to return to some form of hard currency. In the past this has been gold, certain blue-chip stocks, or different foreign currencies.

Again, while the restructuring phase can be over with quickly, it can have long-lasting, negative consequences—one of them being the loss of reserve currency status.

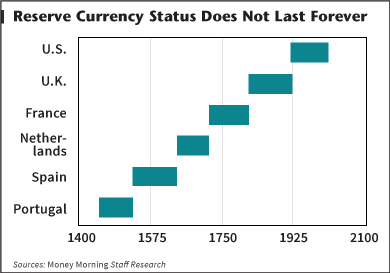

Reserve Currencies and the Rise and Fall of Empires

Holding the privileged position of being the world’s reserve currency is huge. Although Dalio comments on pre-1800s China, he mainly focuses on the last three empires to have held that coveted spot.

The Dutch empire and the Dutch guilder moved to prominence in the 1600s. The British Empire and the British pound were their successors in the 1800s, and the United States rose to superpower status along with the U.S. dollar becoming the world’s reserve currency during and after World War II.

Presently we see China as the next possible ascendant to the throne.

Dalio sees the rise and declines of empires as happening in three phases: The Ascent Phase, The Top Phase, and The Decline Phase. And he measures a country’s wealth and power based on the following factors: Education, Competitiveness, Technology, Economic Output, Share of World Trade, Military Strength, Financial Center Strength and Reserve Currency Status.

Now, there are numerous advantages to being the world’s reserve currency but for our purposes here, the one to remember is that it grants the country phenomenal borrowing and purchasing power. But because of this, it also affords the empire the opportunity to sow the seeds of its own destruction because it can borrow much more than it could if it weren’t the world’s reserve currency.

As we’ve already seen, too much debt that can’t be paid pushes the central bank to print more money which debases the currency further which ultimately leads the country down the doom-ridden path whereby its currency is no longer seen as a good place to store wealth.

The Rise of Populism

Still, over-borrowing can continue for quite some time but when the richest countries get into debt by borrowing from the poorest, it is an early warning sign that a wealth shift is afoot. The British borrowed loads of money from its poorer colonies during World War II and the Dutch did the same centuries before. At present, we see the United States engaging in similar behavior.

Dalio compares the periods of 1929-32 and 2008-09 as both being times of serious debt and economic crises in which gaps in wealth and values led to social and political conflicts.

In each period, interest rates hit 0% neutering the central bank’s power to use interest-rate cuts to stimulate the economy.

And in both cases central banks reacted the same way by printing money. This money was used to buy financial assets which caused financial asset prices to rise and the wealth gap to widen. And on both occasions, we saw increases in political polarization and populism.

That’s because when wealth and values gaps get oversized it creates economic stress and increases the probability of greater conflicts between the rich and the poor, as Dalio says, “at first gradually and then increasingly intense.”

That combination can lead to political extremism—populism of both the left (socialists and communists) and fascists on the right. The political left in the 1930s then as now, were calling for greater wealth redistribution while the fascists, being proponents of state-run capitalism were against such redistribution schemes.

Wealth Gaps and Social Division

Whatever poison you pick, increasing wealth gaps inevitably leads to higher taxes and rife divisions between the rich and the poor. Rich people didn’t get rich by being stupid with their money, so as soon as they see their assets about to be plundered or segments of society turning dangerously against them, they will attempt to move themselves and their hard assets to other countries as safe havens.

This of course leads to what Dalio calls “a classic, self-reinforcing hollowing-out process in the places that money is leaving.” Less rich people around to tax leaves the tax base further diluted which leads to more taxes, more tensions, and even more rich people catching the next train out of town. Such disruptive forces undermine productivity even further causing more conflict and hostility as the ever-shrinking economic pie continues to be diminished.

Governments will want to stop this flight of hard capital and assets, of course, and in the past the state has been known to outlaw the ownership of gold or transactions in foreign currencies.

US President Donald Trump

Flash forward to the present time with President Trump as the obvious populist on the right with Bernie Sanders (before he dropped out of the race) being the populist trying to dethrone him from the left. And even though the liberals have chosen to go with a traditional Democrat in Joe Biden this time around, how well he fares in the election might signal a more radical shift towards a new populist candidate in the next go-around.

The End of U.S. Hegemony and Bitcoin

Although in the U.S. we’ve seen skirmishes between groups like the Proud Boys on the right vs. Antifa on the left, we haven’t yet seen an escalation to levels like pre-Nazi Germany where left-right factions routinely slugged it out on the streets. But if economic conditions worsen and populist rivals become ever more hostile and autocratic in their drive for power, we could see tensions worsen.

So, you’re probably thinking, “this is an interesting study but what does all this have to do with Bitcoin?”

I’m very glad you asked. If Dalio is correct (as I believe he is) and as long as I’ve done a decent job encapsulating his theories without misrepresentation, then I (along with many others) think we’re poised for a large wealth transfer from fiat to Bitcoin. Some of you figured this out a long time ago and such a prediction isn’t all that controversial or profound to you—although to traditional investors it certainly is.

The U.S. dollar has been the world’s reserve currency since the 1940s—some 80 years now. We’ve been in the fiat currency stage since 1971 which is 49 years. The resulting market shocks have already started to occur with ever-increasing intensity like harbingers of worse things to come. The 2008 crisis with its glorious carnage of defaults and debt restructuring schemes left nerves rattled and confidence shaken. Now, with this Covid-19 pandemic, the Fed is printing money even more rabidly and the U.S. appears to be edging ever closer to the end of its long-term debt cycle.

Growing Monetary Instability

All it would take is another market shock like the oil-producing nations to move away from the petrodollar or an outbreak of a pandemic worse than Covid-19 and the U.S. could be pushed into the final stages of currency destruction. And if things did go too far, could the U.S. dollar survive as the world’s reserve currency?

China is knocking on the door and the structural problems of their economy notwithstanding, they are poised to become a competitive power to the U.S. as Dalio points out, “If trends continue, China will be stronger than the United States in most of the important ways that an empire becomes dominant. Conflict is increasing fast,” and “those who are most successful typically have their ways of being more successful copied by emerging competitors, which also contributes to the leading power becoming less competitive.” Really? U.S. technology and innovation being copied? Tell Noah about the flood.

And since Dalio names education as one of the important measurements for a country to retain its reserve currency status, it is worthy to note that harsh critics of the American public education system lament the way their kids are indoctrinated with unearned doses of self-esteem and participation trophies while Chinese kids are knuckling down and doing the hard work when it comes to mastering math and science.

Of course, the U.S. has its share of exceptional students, but the Chinese routinely blow Amarican kids away en masse when it comes to testing scores in math and science. They are learning skills that will propel them to success in the modern, technological world. Sadly, the same can’t be said for the mass of public school kids in America.

Rising Unemployment Paints A Dire Picture

And what about the productivity factor that Dalio mentions? Governmental reactions to the Covid-19 pandemic have had some unintentional (though some would say intentional) consequences. Now that states are finally opening up, many businesses can’t get their employees back. With unemployment checks paying more than what many employees used to make while working, they are in effect being incentivized to stay at home. It’s all fun and games now, but what happens when the unemployment fund runs out and there are no jobs left to go back to? Trillions of dollars are being printed to essentially subsidize unproductivity on a massive scale.

So whether Covid-19 was released on purpose by the Chinese government to quell the unrest in Hong Kong by quarantining the dissidents, or if it manifested as the result of some vaccination research gone awry, or if it was the result of some modern-day neanderthal eating a rabid bat, or if it was transmitted to humans via an intermediary host, the fact that a pandemic could bring the world’s strongest economies to their knees means it will likely happen again. Especially when those in power can do economic harm either naively through good intentions or purposefully with bad ones.

And what happens if Covid-19 mutates into something far worse or a new strain comes along? Something more lethal like the Spanish Flu in 1918 that left 50 million carcasses in its wake. Perhaps an earlier, economically stronger America could have withstood such terrible market shocks, but nowadays it’s not so certain. Even with the pre-Covid economic expansion that followed the Trump election, Americans seemed to be dining on the bloated corpse of a bygone era of past achievement being artificially propped up by easy money and credit.

Those Who Become Richer Tend to Work Less Hard

And as Dalio says regarding reserve currency empires in their descent stage, “Those who become richer naturally tend to work less hard, engage in more leisurely and less productive activities, and at the extreme, become decadent and unproductive. That is especially true as generations change from those who had to be strong and work hard to achieve success to those who inherited wealth—these younger generations tend to be less strong/battle-hardened, which makes them more vulnerable to challenges.”

All the indicators are there that the U.S. is in the final stages of the money and long-term debt cycle. It seems only a matter of time before institutional and individual investors alike begin to take flight to hard money assets. The U.S. dollar used to be seen as a safe haven in times of economic troubles. But what happens when people finally lose their faith in fiat? What happens when the government and their bedfellows in the central bank finally crash the U.S. dollar? Where will people flee to then?

In a way the U.S. dollar deserves to crash. One of the founding fathers, Thomas Jefferson sounded the alarm bells long ago but the people didn’t want to listen.

US President Thomas Jefferson

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…. I believe that banking institutions are more dangerous to our liberties than standing armies…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

What Happens If The US Dollar Crashes?

Historically, when the people lose faith in their currency they move to precious metals, some blue-chip stocks, or other currencies. But when the U.S. dollar crashes, what other currency will be worth owning? It seems obvious that the haven of choice will be between precious metals and Bitcoin. Again, nothing profound there. But since real estate can be taxed up the wazoo, these two seem to be the likely candidates. The problem with silver and gold, however, is that they can and will be confiscated by the state should such a meltdown happen.

So, what about Bitcoin? It’s been maligned by the mainstream for years and people who dismiss it as a Ponzi scheme or fake money are still mewling the same buzzwords they’ve heard others say without digging into it themselves. But when the masses are finally shocked out of their comfort zone with fiat, those with a brain will come to appreciate the majestic qualities of math and protocol and a world where honesty is incentivized.

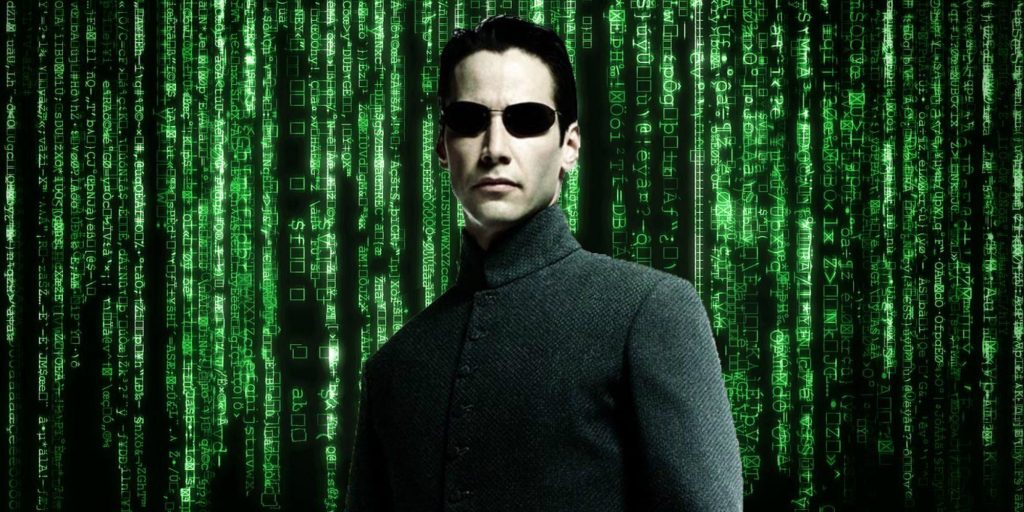

As the old banking system kicks and coughs in its final death throes, it seems as if the new age of crypto waits patiently in the wings whispering the last words of Neo in The Matrix: “I’m going to show them a world without you.”