DAOs or Decentralized Autonomous Organizations happen to be one of the most innovative blockchain-based concepts. DAO is also known as DAC or decentralized autonomous corporation. The core philosophy is to create an organization that’s free from centralized control.

As the name suggests, DAOs have three core features:

- Decentralization: Not governed by one single, centralized entity.

- Autonomous: The DAO can automatically execute operations on its own without any intervention.

- Organization: The DAO is governed by its own predetermined rules, like an organization.

Since 2019, the support for DAOs has been increasing rapidly due to attention from the non-crypto world. An excellent example of this is the UK-based Nexus Mutual, which is the first decentralized mutual insurance incorporated as a cooperative and driven by a DAO. As such, decentralized autonomous organizations have made a pretty outstanding comeback since the disaster of 2016. However, we get into all that, let’s clear up some basics first.

What is DAO crypto? DAO vs Traditional Organizations

So, what are the differences between traditional organizations and decentralized autonomous organizations? To understand this, let’s look at what we mean by an organization and how it works. The idea is to fulfill specific goals by getting a bunch of people to do their jobs.

Now, the next question to ask here is, how do we get people to do their jobs? In traditional companies, we have contracted individuals legally bound to fulfill their duties for the organization. These contracts are either overseen by the firm’s legal team or a third-party lawyer/organization. When things go wrong, the contract can decide who will get punished in the court of law.

This system has a lot of inherent flaws. Oftentimes, ex-employees who are wrongfully terminated cannot properly sue the company because of the obvious power and intimidation factor.

How can the DAO help here?

DAOs work using smart contacts, which are automated, self-executing contracts binding two individuals to each other. In a decentralized environment, people interact with each other via an open-source protocol. They are responsible for overall network upkeep and are rewarded with the native tokens for successfully finishing various tasks.

So, what does this mean?

Individual behavior isn’t enforced upon by a legal contract. Instead, economic incentivization automatically makes individual nodes act in the best interest of the network. Unlike traditional companies with a complicated top-down structure with several layers of management, the DAO’s governance is much more refined and ruled by a predefined code.

Plus, once deployed, the DAO can grow by itself without depending on its creator(s).

How do Decentralized Autonomous Organizations operate?

Step 1: Putting down the rules

The first step in building the DAO is to establish and define the rules that will govern the entire ecosystem. These rules are written in and stored in a smart contract. There are two things that you must keep in mind about smart contracts:

- They are open and transparent. Everything chronicled inside a smart contract is visible for everyone to see.

- Smart contracts are immutable. Once recorded, no one can change the content defined inside them.

Step 2: The Funding

The next stage is the funding phase. This is very important for the following reasons:

- Decentralization is critical for the success of DAOs. During the funding phase, it will have the opportunity to distribute its tokens as far and wide as possible.

- Secondly, by acquiring these tokens, the users get several rights and privileges within the environment. One of these privileges happens to be the right to vote on certain matters.

Step 3: Becoming Autonomous

Following deployment, the DAO becomes completely autonomous, aka, free from external control. Everyone who holds the DAO’s native tokens owns a stake within the network. As such, they get voting powers in the ecosystem that’s directly proportional to their stake. The approval percentage required to reach a majority may vary from proposal to proposal.

Now, this system of majority voting has both its advantages and disadvantages.

The most significant advantage is that the interests of the majority dictate all the decision-making and funding. On the flip side, this also makes decision-making a prolonged and drawn-out process.

Imagine someone discovers a fatal vulnerability on the DAO’s attack surface. Instead of fixing it immediately with an emergency hard fork, you will have to wait for the majority to vote on fixing it. This can be a big time waster since you would ideally want to fix up these bugs faster than the speed of bad.

What is DAO crypto use case?

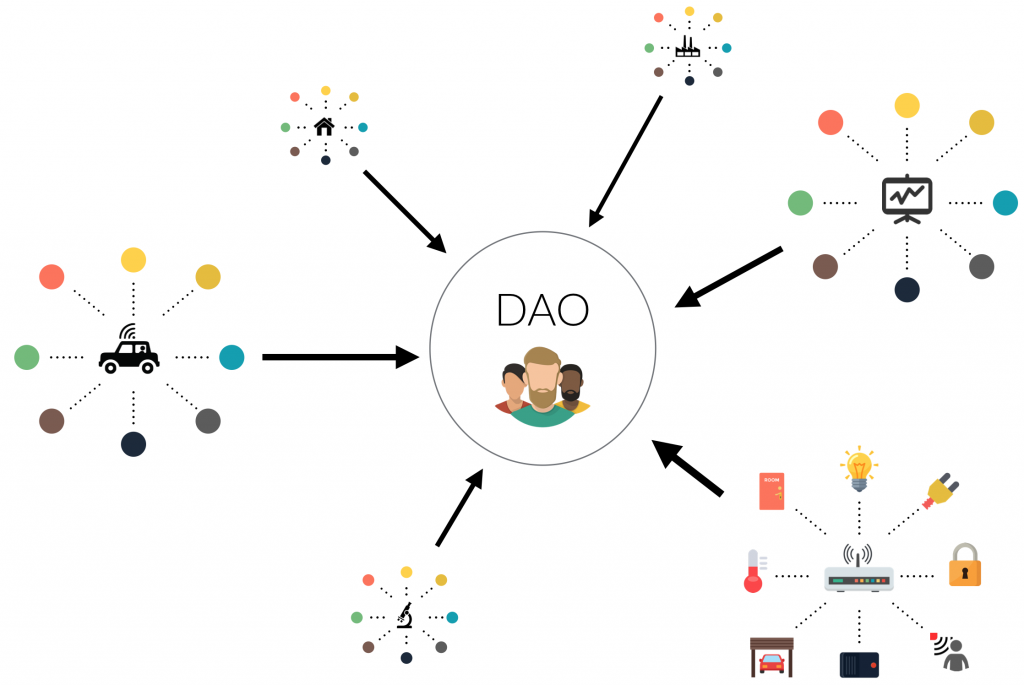

DAOs have a variety of use cases. The complexity of the use case itself is dependent solely on the number of stakeholders and processes involved. Before we go any further, let’s illustrate how DAO works with a simple example.

Think of how Bitcoin works.

While, Satoshi Nakamoto designed the protocol, he is not responsible for the daily operations. The protocol runs by itself.

While it’s a very primitive version of DAO, it still gives you a great idea of what this technology can potentially do. Some examples of complex DAO use cases include – token governance, decentralized venture funds, or social media platforms.

What is DAO crypto hack?

Before we go any further, let’s take the time to address the elephant in the room. For many people, the DAO happens to be equivalent to a “four-letter” word in the crypto space. Let’s talk about the infamous DAO hack which split up the Ethereum community in two. Henceforth, we will refer to this particular DAO as “The DAO.”

“The DAO” was launched in late April 2016 after a month-long crowdsale and raised more than $150 million in funds. This, at that time, was the largest crowdfunding fundraising campaign of all time.

So, what was the purpose behind The DAO’s creation?

- It was supposed to be an open-source, decentralized venture capital fund.

- The developers believed that it was going to remove human error and manipulation from investor funds.

- Due process and decision-making will be placed in the hands of an automatic system.

- Investors from all over the world could send money to The DAO contract anonymously.

- The investor’s voting rights were directly proportional to the size of the DAO token holdings.

- The DAO offered unprecedented flexibility, control, and complete transparency.

The DAO functionalities

So, how could the investors fund promising projects using the funds locked up inside the DAO? Let’s find out.

- The DAO has certain well-known figures in the Ethereum world as its project curators. These guys were responsible to get projects whitelisted.

- Following that, DAO token holders can vote for a project that they feel should get some financial backing from the contract. If a project got more than 20% approval, they were greenlit to receive the funds.

Now, was The DAO designed to be the be-all-and-all of decentralized venture funding? Well… no.

If you weren’t happy with the way The DAO was running, you could opt-out of the contract and make a “Child DAO” of your own. In fact, you and many other investors could start your own Child DAO and start funding proposals.

However, this is when things took a significant turn for the worse.

The DAO Attack: Ethereum vs Ethereum Classic

Henceforth, a hacker known as the DAO hacker, exploited a bug in the DAO’s contract and made off with about $50 million worth of Ether. The immediate aftereffects of the attack were devastating. Ethereum crashed from $20 to $13. To reverse the effects of the hack, the community decided to go through a fork.

For the uninitiated, a fork is a split in the blockchain’s protocol to create a “new chain” and an “old chain.” This fork can either be soft or hard.

- Soft fork: The new chain is backward compatible with the old chain.

- Hard fork: The new chain is an entirely different protocol from the old chain.

A soft fork wasn’t a possibility due to certain restrictions in the protocol. This is why the developers opted for a hard fork. However, what this unfortunately meant was that the new protocol and the old protocol was no longer interoperable with each other. This pretty much split up Ethereum into two – Ethereum (new) and Ethereum Classic (old).

Working examples of Decentralized Autonomous Organizations

Now that we have familiarized ourselves with DAOs, let’s now look at some working examples of DAO.

#1 Dash

Dash is one of the most well-known projects in the crypto space. Initially founded in 2010 by Evan Duffield, Dash happens to be a fork of the original Bitcoin protocol that emphasizes both scalability and privacy. Duffield forked from Bitcoin in January 2014 to create XCoin, which eventually became Dash.

The Dash network consists of normal nodes and masternodes. Masternodes are like full nodes in the Bitcoin network; however, to run one of these nodes, you will have to:

- Stake 1000 DASH in the ecosystem.

- A server or VPS that runs Linux. VPS stands for virtual private server. Services like Vultr and DigitalOcean are well-suited for this.

- A dedicated IP address, which you should automatically get with your server/VPS

Dash Masternodes are responsible for the two most critical functions of the ecosystem – InstantSend (for scalability) and PrivateSend (for privacy).

Funding the ecosystem

Alright, so why did we bother telling you about Masternodes in an article about decentralized autonomous organizations? Well, it will help you understand how the block reward distribution works within the network. Speaking of the distribution this is how it works:

- 45% to the miners

- 45% to the Masternodes

- 10% goes towards funding further network improvements <- DAO governance.

The last 10% is what we will be focusing on as we go further.

DASH Decentralized Autonomous Organizations

10% of the rewards are locked up in a decentralized treasury and used to fund the ecosystem’s growth and advancement. Several proposals for improvement are submitted to Dash, and the community itself votes on the best solutions.

Due to this voting mechanism, the native DASH token is often referred to as a governance coin since DASH holders can freely vote on these proposals.

This is a welcome change from projects like Bitcoin and Ethereum that utilize off-chain governance, which is dominated by the core developers. Often, this lack of alignment can be problematic because of the following reasons:

- The project’s direction and decision-making are governed by the “few” decision as opposed to that of the “majority.”

- This also leads to the centralization of the protocol. Not only does this go against the spirit of decentralization (obviously), but there is also the danger of the project being overtaken by a large corporation/company.

By leveraging on-chain governance via a decentralized treasury, Dash completely flips this equation around. The proposal system funds the project development team. As such, they must perform the way the community wants them to. If they don’t, the masternodes can simply defund the team and fund another proposal.

#2 DigixDAO

While the DigixDAO was recently dissolved following a community-wide vote, it’s still worthy of closer inspection. The main aim of this project is to allow them to build around DGX on the DigixDAO platform. > 50 projects have been submitted to the DigixDAO platform of which the following are extremely noteworthy:

- NeutralG: A $4 million project that addressed liquidity issues within DGX

- BullionIX: The platform creates gold-backed non-fungible tokens (NFT). Users are free to mint these NFT tokens with their DGX.

- SeSocio.com: A leading crowd investment company that added the DGX token to enable thousands of people in unstable Latin American economies to access tokenized gold.

Along with these three, the DigixDAO funded projects like marketing, on-ramp off-ramp projects, community management, exchange integration, and uniswap liquidity.

So, what is a DAO dissolution? Well, let’s take a brief look at how DigixDAO handled theirs to get a better idea.

- All the staked DigixDAO (DGD) tokens were unstaked at the start of the next Digix quarter.

- The ETH tokens locked up in the DAO moved to the DigixDAO Refund Contract.

- To avail refunds, DGD holders had to do two transactions via MyEtherWallet.

What is a DAO? Conclusion

As a concept, the DAO had been around since 2013, when EOS co-founder Dan Larimer first came up with the term. Since then, the DAOs have faced several missteps, most notably with the 2016 DAO hack. However, it seems like we have several exciting projects out there working on their own version of DAO. Are they going to replace and disrupt organizations as we know them? Well, no. But, they still have several exciting use cases that should be looked into and studied.

Well, now that you know what is a DAO, do you want to learn more such interesting innovations from the crypto space? If yes, then checkout our comprehensive blockchain courses at Ivan on Tech Academy.