On-chain analysis is one of the most interesting emerging fields in crypto. Moreover, while there are many firms offering blockchain data analysis today, there are a few things that make Dune Analytics unique.

First off, Dune Analytics’s data is open and community-driven. But what separates Dune Analytics from the rest of the other on-chain analytics platforms is its focus on decentralized finance (DeFi).

If you’ve ever used on-chain analytics, then you’re familiar with having to wait for the company to choose which projects they will prepare data for. With Dune Analytics, however, you can build your own data sets. You can do this by running simple or complex queries of on-chain data through the Dune editor. This not only means more freedom of choice but also faster, and more up-to-date information than what the “closed” platforms can offer.

What is On-chain Analysis?

On-chain analysis helps users enhance their trading strategies. If you’ve studied stocks in the traditional markets then you already know about Technical analysis (TA). TA studies price action and is still the most popular form of analysis—even in crypto. However, with the vast amount of data available on the blockchain, a new type of analysis is emerging. And that is on-chain analysis.

So, by leveraging information found on the public blockchain, on-chain analytics firms aim to help their users to better predict future market moves. On-chain analysts can scrutinize blockchain data such as transaction details and smart contract info to gain insights into the market. So, while TA tracks price movements, on-chain analytics provides a more in-depth view.

Those who want to learn more about on-chain analysis should be sure to check out the courses available on Ivan on Tech Academy. Ivan on Tech Academy is one of the most popular platforms for blockchain education, and has over 20,000 students already enrolled. What are you waiting for?

About Dune Analytics

Fredrik Haga and Mats Olsen originally founded Dune Analytics in Oslo, Norway back in 2018. Between them, the pair has backgrounds in statistics, startup analytics, and machine learning. The world of data seemed a practical pursuit based on their background experience so that’s why they started Dune.

Dune Analytics released its free version in 2019. Since that release, Dune has grown exponentially with users from all around the world joining in to leverage the on-chain analytics it provides. There are reams of data accumulating every day from the blockchain. And it’s collecting in pools just waiting for the harvesting. However, “getting it right” is trickier than one might imagine. The founders not only had to spend the time to get it right but they also had go to through multiple iterations to get the data decoded into the best format.

Dune’s strengths are in its open data source. Analysts, traders, and enthusiastic, number crunching, data nerds make up the community. They create and openly share their queries which can then be forked and remixed in a multitude of ways by others. That’s why Dune has been described as the “Github for on-chain analysis.” The secret sauce is the collaborative effort that is built-in to the Dune Analytics platform.

The Hive Mind

Platforms like Wikipedia and Github have already successfully found a way to tap into the “hive mind” of collective human consciousness. This creates a megadose version of the “two heads are better than one” scenario. One or two employees performing on-chain analysis in a closed setting can never compete with the hive mind of thousands of enthusiasts mixing, matching, and experimenting with different queries and data sets.

So, instead of dealing with the status quo, siloed sets of dashboards, the queries on Dune Analytics are open source. Thus, by opening it up, the founders have created a revolutionary way for their community to harvest and remix blockchain data.

Decentralized Data

It’s not much of a stretch to say that Dune Analytics is fast becoming the default platform for Ethereum data seekers. That’s because it’s a far cry from the un-auditable, closed-source dashboards that require trust in a central authority—which describes how most on-chain analytics firms operate. At most places, you’ll find yourself stuck using the data dashboards that the company and its employees provide. You can petition to have new queries added but that takes time and they may or may not decide to listen to your request.

Also, depending upon the central authority doing the data crunching requires a lot of trust. It’s very hard to audit these firms for accuracy. You just have to take their word for it.

But Dune is different. It allows anyone to conduct on-chain analysis from smart-contract data. They’ve already constructed the infrastructure so all you have to do is just sign up and you can hit the ground running. And it’s not like you have to dig into low-level Ethereum Virtual Machine code. The data starts in raw table form but evolves into visual charts.

And unlike with closed systems, you don’t have to wait for anyone. With Dune, you can access data the same day a new project launches! You can perform your on-chain analysis without hoping company employees will eventually get around to it.

For example, the on-chain analytics firm, IntoTheBlock, has been promising data on DeFi protocols, and we’re looking forward to it. But if you don’t want to wait, you can dig into DeFi data today on Dune’s platform.

Dune has moved far and beyond the blind trust requirements involved with centralized authority where one can only hope that they are accurately verifying their on-chain analytics. Trustlessness is pure DeFi. That’s what it’s all about.

DeFi is just one of the many emerging fields in the crypto sector. If you want to learn more about crypto basics, blockchain and Bitcoin, or even decentralized finance itself, Ivan on Tech Academy is your go-to site. Additionally, you can get a whopping 20% off right now, if you use the BLOG20 promo code.

The Community Aspect and Dune’s Ease of Use

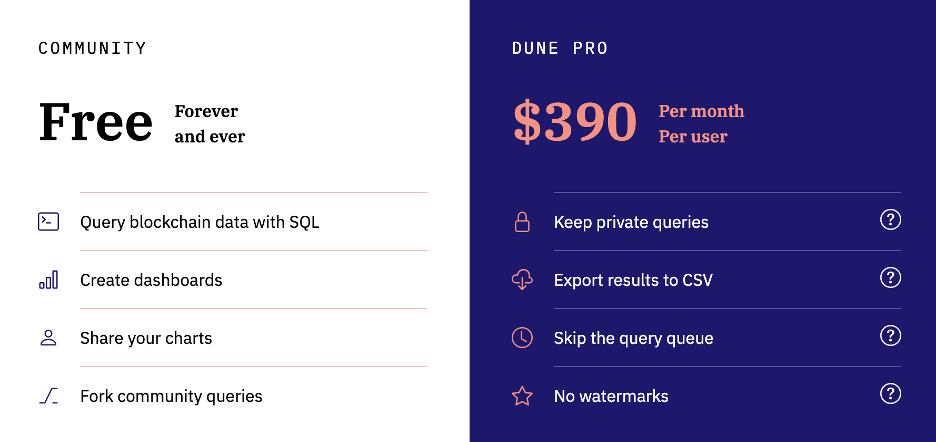

The community version of Dune allows users to conduct any kind of on-chain analysis. Dune converts the raw blockchain data into a readable format, and queries can be completed with SQL. Dune gives its users access to datasets and they can create their charts and dashboards. Users can then share what they’re working on. And working with Dune provides one with good education and powerful insights into how on-chain analytics systems work in general.

With Dune you can explore the dashboards and queries of others in the community. It’s kinda like sharing dashboards on Google Analytics. And by researching the work of others, you can find inspiration to come up with even more queries to find deeper insights.

Dune works on the freemium model. Basic features are free to use and the promise is they will always be free. Direct access to the data, however, requires upgrading to the paid version which isn’t cheap. Prices rapidly jump to $390 a month for the pro users looking to keep their queries private.

The goal is to lower the bar for those interested in on-chain analytics to provide them with a way to gain aggregated insights for Ethereum. But the potential is there to explore other blockchains in the future.

Ease of use and data sharing has helped propel Dune to become the default platform for DIY crypto natives interested in on-chain analytics. Again, one of the best parts is that users can verify the data themselves.

3 Steps to Using Dune Analytics

- Start with a question

Like, what is Uniswap’s trading volume?

- Write a Query in SQL

You can either look at SQL documentation to learn how to write a query. Or just look at what the community has already created and copy and paste their code. This is a good way to start until you learn to write your own.

- Create Visualizations

Your dashboard will display the visual graphs.

Afterward, you can even embed the <iframe> code from your dashboard into your blog posts to share your insights and analysis with your followers.

Another thing that can help you on your journey is to understand the smart contract architecture of the protocol you’re interested in before you start querying it. This is more advanced but if you’re serious it might be worth pursuing the info.

Tips for Running Queries

At present you can query from:

- Decoded Smart Contract Data

Dune decodes smart contract data into readable tables.

- Abstractions / Table Views

Table views make blockchain data easy to work with. So a good way to perform on-chain analysis is to use the pre-prepared views or abstraction tables that Dune provides.

- Raw Ethereum Data

This data is composed of blocks, logs, transactions, receipts, and traces. It is a bit over the top and often unnecessary, but it is available for those who want to dig deep.

- Centralized Exchange (CEX) Data

This is for the user who wants more than just token volume data.

Understanding Dune’s Infrastructure

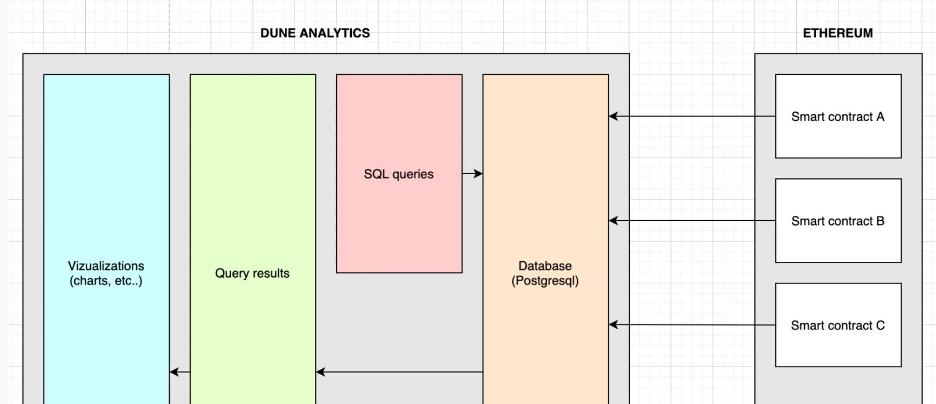

If you’ll notice the graph, on the right side are the Ethereum smart contracts. On the left side, we have the infrastructure layout. Dune stores everything on a Postgres database on Google Cloud.

So, after you’ve signed up for a free account, you can access your dashboard then click the “Create” button and choose “Query.” And again, the first thing that happens is the transfer of a copy of the smart contract data from Ethereum to the Dune Analytics database.

This is never a one-off task. That’s because the blockchain is constantly changing as new data is added. So, Dune Analytics must reindex as the new data comes in.

You will then use the SQL language to query the database. Just so you know, you are not querying the Ethereum blockchain directly. You will only query the database on Dune. That means there will be slight delays from the time the actual data on the blockchain gets reindexed on Dune’s database. Remember, it’s in a constant state of reindexing.

What You Can Do with Dune Analytics Data?

There are numerous ways to massage data and even torture it. As you get more experienced, you’ll learn which kinds of data sets and combinations are most useful for developing your insights.

Some Example Charts on Dune Analytics

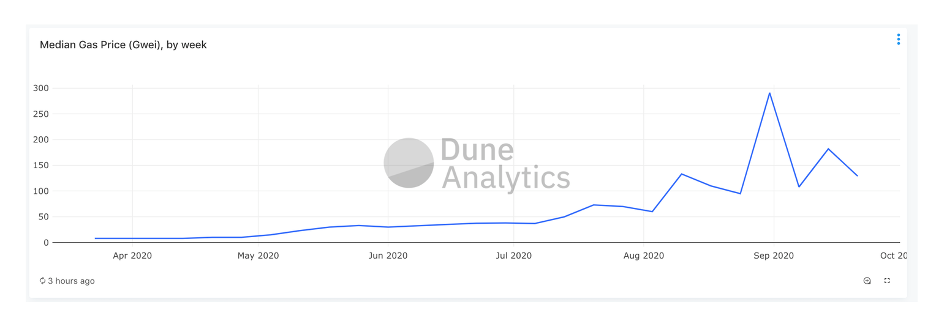

This chart was created from raw data in the Dune Analytics database. In it, you can see the median gas price in Gwei. It is still going up which is not good news for Yield Farmers in the DeFi space or any other active traders on the Ethereum blockchain. The good news is there is a large demand for ETH.

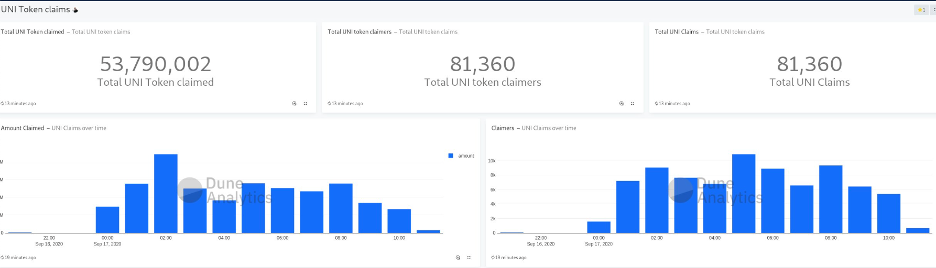

In keeping up with the times and the surge in DeFi, Dune has added UNI to its data mix. Uniswap only recently released this token. And here is an example of a dashboard for DeFi users that monitors UNI claims.

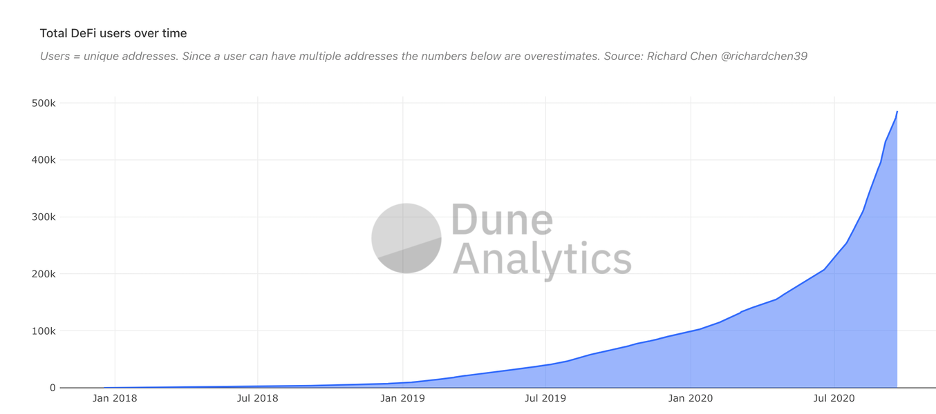

Here’s another on the total DeFi users over time.

These were created on Dune Analytics. They may seem a bit obtuse at first hopefully they have piqued your interest enough to dig in and get your hands dirty. That’s the best way to learn.

The Future of Dune Analytics

The two founders Fredrik and Mats have executed an amazing amount of output in a short time for a two-man team. And now that they’ve raised $2 million in a new seed round comprised of multiple crypto investors, they can afford to hire more people to help.

Dragonfly Capital lead the seed round and angel investors included Stani Kulechov, founder of Aave, Calvin Liu of Compound, and Matteo Leibowitz of Uniswap. Andre Cronje of yearn.finance even granted them a no-strings-attached donation asking for no stake in return. He simply wanted to help support and has been quoted as saying that “Dune has been a lifesaver.”

That’s high praise and a vote of confidence from some big players attesting to the venture’s prospects. Not to mention that the $2 million investment dropped without Dune ever pitching a token to elicit investor interest.

On the negative side, Dune has had issues with “function overloading.” This can occur when smart contract developers specify two functions with different parameters whilst carrying the same name. In these situations, Dune only carries one of the implementations in their database but they are working on a fix.

But with this new round of investment, the founders will be able to work towards a better future by continuing to fix any issues, whilst making the UX easier for community interaction and help lower the bar of entry for its non-technical users.

Conclusion

To summarize, Dune Analytics is building a real-time platform for on-chain analysis. It’s making the data open and remixable. This will result in more up-to-date info being culled faster than the competition can with their closed systems.

With access to raw data, you can create your own data sets and identify trends early on. This works with DeFi or any protocol you’re interested in culling data from on the Ethereum blockchain.

This is the Information Age and information is power. And Dune Analytics is offering the keys to unlocking a large portion of it. If you want to learn DeFi and receive the best blockchain education anywhere, enroll in Ivan on Tech Academy today!

Author: Mindfrac