E-stablecoin is the first stablecoin to potentially eliminate the failure point of centralization by using thermodynamics and information theory. In the future, E-stablecoin may also assist in distributing electricity to remote locations that aren’t connected to an electrical grid system. More importantly, the token could ultimately help combat climate change by enabling the transmission of renewable energy to places that need it the most.

Researchers at the federally funded Lawrence Livermore National Laboratory developed the E-stablecoin concept as a physics-based cryptocurrency that links blockchain technologies and electrical energy and could transmit electricity in the form of information. Their new E-stablecoin will allow electricity to transfer between users worldwide without wires or a grid-based transmission system.

These goals seem lofty, but the researchers believe they are reachable. This article will cover their fascinating discovery. But first, let’s put everything into context by looking more closely at stablecoins and cryptocurrencies in general.

Two Categories of Cryptocurrencies

There are two broad categories of cryptocurrencies: Those backed by a conventional asset and those that are not. Another way to describe them is collateralized vs. non-collateralized.

Collateralized Cryptocurrencies

DGX is an example of collateralized crypto. Gold backs it. To be more specific, users can exchange each DGX token for one gram of gold. So, DGX stores enough gold to cover each crypto token it issues. However, physical assets require storage vaults, which require space and infrastructure.

One problem with this type of crypto is that the backing assets are at risk of theft or loss. Furthermore, asset-backed cryptos use a degree of centralization that many in the cryptocurrency community find unacceptable.

A single entity (or a few) acts as custodians of the backing assets. Therefore trust requirements span from the crypto to the assets backing it to the custodians who control the backing assets. Another problematic question is, do the backing assets exist in the amount advertised? In sum, it’s far from a trustless design.

Tether and Venezuela

Take Tether, for example. It issued the USDT token that supposedly had U.S. dollars backing it. But later, the New York Attorney General had to investigate it due to allegations of missing funds.

At the nation-state level, Venezuela issued its crypto called Petro in 2018. The country’s natural resources, such as oil, gasoline, diamonds, and gold, back Petro. However, later investigations cast doubt on the legitimacy of the backing assets.

The other problem with nation-state cryptos is the country’s native fiat currency. As we’ve all seen, any country with a central bank has the habit of inflating its money supply with excessive printing whenever they want to spend what they don’t have. Such monetary policies lead to unacceptable inflation levels, which in turn affects the value of the cryptocurrency.

On the other hand, non-collateralized cryptocurrencies sidestep many of the issues that asset-backed cryptos face.

Non-Collateralized Cryptocurrencies

Bitcoin is one example of a non-collateralized cryptocurrency. It does not claim to have conventional assets backing it. Thus it doesn’t suffer some of the problems associated with asset-backed cryptos. However, these non-collateralized cryptocurrencies like Bitcoin instead rely on an unproven hypothesis that can be a contentious issue depending on who you talk to.

EVH

The “Emergent Value Hypothesis” (EVH) suggests that an asset that starts devoid of any intrinsic value can attain stability as it amasses brand awareness, adopters, and growing popularity. Further, many uncollateralized cryptos adhere to this hypothesis that an asset can maintain its value if a sufficient number of people believe it holds value.

Thus far, EVH-based cryptos continue to experience extreme price volatility. Even though some experts argue price volatility is only temporary in the price discovery period. Nonetheless, such instability limits their utility, and it remains to be seen if EVH-based cryptocurrencies will ever stabilize in price. Since collateralized and non-collateralized cryptos both suffer from potential pitfalls, developers started creating stablecoins.

Bear and Bull markets tend to go in two-year cycles, and there’s no telling how long this one will last. So, make sure to check out our article on how to invest during a crypto bear market. Furthermore, understanding crypto crashes is vital for investors to better prepare for the next time it happens.

The Purpose of Stablecoins

Developers design stablecoins to maintain a stable price. The goal is to combine many of the advantages of cryptos (like a censorship-resistant ledger) with a stable currency. These coins can thus provide significant utility in the blockchain ecosystem, particularly in decentralized finance (DeFi), where complicated layers of transactions only exacerbate risks. Further, stable cryptocurrencies help empower longer-term planning regarding smart contracts on the blockchain.

So, developers build stablecoins to have minimal volatility. They’re like a peaceful island amidst the choppy waters of crypto volatility. More importantly, these tokens help instill confidence and usability and encourage more blockchain transactions and long-term planning.

After all, no active crypto trader wants to go through the rigamarole of divesting their cryptocurrency back into fiat each time they want to pull out of their asset of choice. It’s much simpler and more efficient to stay on a crypto exchange and swap for a stablecoin before reinvesting.

But there are pros and cons to using them. So let’s look at three classes of stablecoins before investigating this new class of stablecoin called E-stablecoins.

Three Classes of Stablecoins

The classes of stablecoins we’ll look at are:

1. Fiat-collateralized

2. Crypto-collateralized

3. Non-collateralized

Fiat or Other Asset-Collateralized Stablecoins

Fiat-collateralized stablecoins are the easiest to understand. These tokens are hard-pegged to a fiat currency (or another asset like gold). Fiat is held in reserve to directly exchange with the coins at a fixed rate to maintain this peg.

This type of crypto is stable as long as the backing fiat currency is stable and the asset custodians are trustworthy. One advantage of fiat-collateralized stablecoins is that price shocks in other cryptos do not impact their price. Moreover, this class does not rely on EVH. The disadvantage, however, is the required centralization at various levels.

Cryptocurrency-Collateralized Stablecoins

The second class of stablecoins is crypto-collateralized stablecoins. These stablecoins hold other cryptocurrencies as collateral to set the stablecoin’s price.

MakerDAO’s Dai token, for example, is created as an overcollateralized loan. The collateral is typically held in ETH (or Pooled ETH). Further, by adjusting the loan’s interest rate, the Dai in circulation can maintain a soft peg to the U.S. dollar. However, this soft peg is more vulnerable than a hard one. If ETH’s price drops suddenly, MakerDAO could liquidate a user’s collateral. Further, if ETH’s price drops radically, it could cause the peg to fail. Therefore, crypto-collateralized stablecoins still indirectly rely on EVH.

Non-Collateralized Stablecoins

The third class of stablecoins behaves as their name implies. They don’t hold collateral. Instead, they use price oracles to monitor the trading prices of the stablecoin. This oracle’s info goes into a smart contract, which acts like an automated central bank. It mints new tokens as the trading price increases and buys back tokens as the price drops. The goal is to maintain stability through continual adjustments to the stablecoin supply. Non-collateralized stablecoins also rely on EVH.

Solana is a competitor blockchain to Ethereum and uses the Rust programming language. Learn about Rust & Solana here. Like Solana, NEAR is also looking to address some of Ethereum’s alleged shortcomings. Please read our latest article on the Moralis Academy blog about Solana vs. NEAR to learn more.

What Is the Ideal Stablecoin?

Each type of stablecoin listed above has pros and cons. Non-collateralized stablecoins and cryptocurrency-collateralized stablecoins rely on EVH. Fiat-collateralized stablecoins, on the other hand, do not. Thus they suffer little risk of collapse as long as their backing asset is stable. Their main downside is centralization due to their asset custodians.

So, the ideal stablecoin needs two fundamental properties operating simultaneously:

1. A physical asset

Stablecoins benefit by having a physical asset that has a stable value and intrinsic utility to back them.

2. Decentralization

All the working parts of the stablecoin system operate in a decentralized manner.

In sum, the problem with stablecoins is the tradeoff between decentralization and collateralization. This tradeoff stems from the belief that tangible assets cannot be managed in a decentralized fashion as intangible assets can.

When we pull out of this Bear market, blockchain gaming and NFTs will likely lead the way. So, now is an excellent time to get a jump on the competition and start learning about NFT coding. While we’re on the topic of gaming, you can learn how to build a Unity NFT on the Moralis.io blog.

Enter the E-stablecoin

The researchers at the Livermore Lab are challenging conventional wisdom by proposing a new class of stablecoin that can be decentralized and collateralized by a physical asset with intrinsic utility—in this case, electricity. For E-stablecoins, the developers employ information theory and statistical mechanics to achieve a coin with both properties of decentralization and collateralization.

These scientists reveal they can use electricity to collateralize a stablecoin so that each token can get exchanged for one kilowatt per hour (kWh) of electricity without involving any centralized authorities. It combines the advantages of fiat-backed and non-collateralized stablecoins.

The researchers envision a future blockchain rooted in real-life assets through thermodynamic reversibility. In this particular use case, the asset is electricity. Their research paper claims that by utilizing this statistical mechanics and information theory formula, they can transfer electricity between anonymous users of a decentralized network without having to interface with utility companies or power plants.

The E-stablecoin Concept

This new concept is a move forward toward implementing responsible cryptocurrencies beyond the digital world to tie them to the physical world in tangible ways. It seems novel to use advancements in thermodynamics to transmit energy as information.

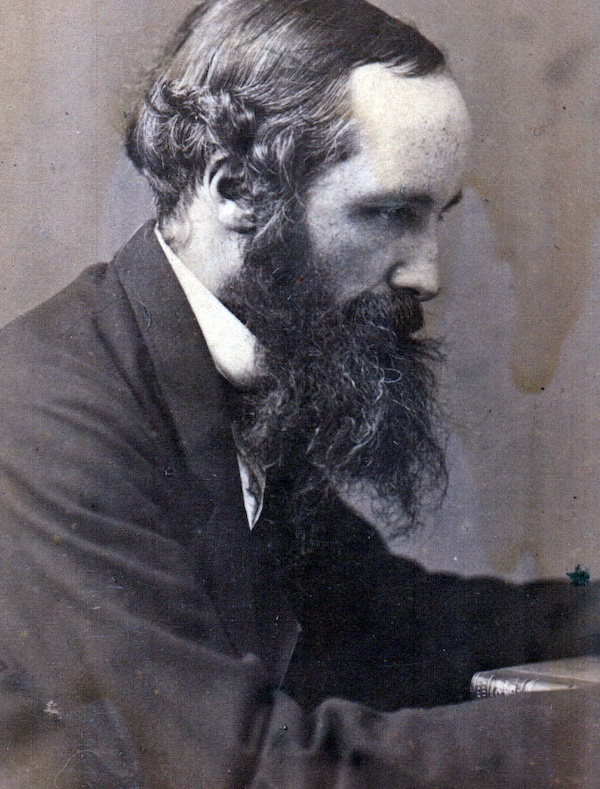

However, the idea behind E-stablecoins dates back to the “Maxwell’s Demon” thought experiment postulated in 1867 by James Clerk Maxwell. This experiment ultimately drew a deep connection between information and energy. And Lawrence Livermore’s researchers drew upon this idea and detailed how the relationship between energy and information allows for a crypto token to be backed by and convertible into one kWh of electricity.

While it requires one kWh of electricity to mint an E-stablecoin token, users could later destroy the token to extract one kWh of usable electricity. Hence, one E-stablecoin is pegged to the price of one kWh of electricity in a stable and trustless system.

Summary

The E-stablecoin researcher’s work at the Livermore Labs solves stability problems inherent to cryptocurrencies. Furthermore, it claims to be the first fully decentralized stablecoin collateralized by a physical asset secured by statistical mechanics’ laws.

It’s democratic because anyone can mint an E-stablecoin token with one kWh of electricity input. They can then transact with the E-stablecoin token like any other crypto or return it into usable electricity. Additionally, a user can accomplish all of this without power companies, electrical transmission lines, or third-party authorities. It is a trustless system all the way.

This concept is still in the proposal form, and the researchers have not yet implemented it because it will require further technological advances over the coming years. But it certainly sounds promising and will open the doors to other physical assets with utility. This article won’t delve into the profound subjects of statistical mechanics, information theory, and thermodynamics. But if you’re interested, you can read the E-stablecoin research paper in its entirety.

Now is your chance to create your own bleeding-edge technology like the E-stablecoin. Enroll at Moralis Academy today and learn how to code for the blockchain!