Bitcoin has been consolidating this week. It is very positive that past resistance levels now seem to act as support

Issue 53

December 29, 2023

Bitcoin – Holding the new range

Contents

Introduction

By The Moralis Research Team

Dear amazing Ivan on Tech & Moralis community,

Thank you for letting me serve you this TA dish over these years.

Despite the success we’ve had, nailing the major moves of the market these years, or perhaps because of the success, I’m making some changes. Success is a dangerous spot. That’s the place you must fight complacency and instead renew up your game further.

In 2024 I will change the format of my content reports. Hence this is the last Friday TA report to this group. (And I’m typing it on a Thursday.)

Happy New Year and CONGRATS to everyone who’s been with us during these cycles.

I hope to see you all on other channels.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

TA Report - Thursday 28th of December, 2023 17:00 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds. I don’t give advice to buy or sell specific assets. The education and software tools are timeless and generic for any asset. Rather than relying on subjective market opinions, I apply the principles of technical analysis formulated in 1930s on historical charts. Anyone can apply the same process and get the same result. Technical Analysis does not predict the future. It is a tool to find setups for controlled risk/reward. Larsson Line does not predict the future. It is a mathematical formula for trend expression. My objective with this report is to help you reflect on your own analysis, not to replace it.

Disclosure: I hold Bitcoin and Ethereum exposure through company ownership and in my personal capacity, as ETP price tracker certificates through my bank.

Trend Analysis

Bitcoin (BTC)

Holding the new range

Ethereum (ETH) and Altcoins

No follow-through in ETH/BTC seen yet.

Bitcoin (DOMINANCE)

The trend line broke

Bitcoin

Bitcoin - Holding the new range

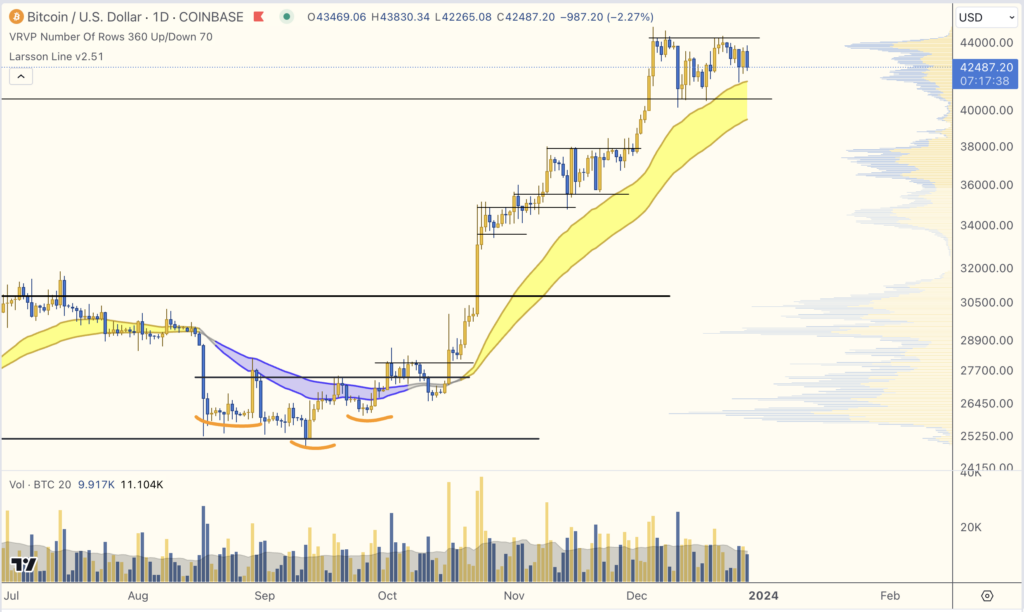

The analysis from last week turned out useful. Last Friday I wrote:

“… we can see that BTC/USD is now building a new range between $40,600 and $44,300 approx.

There has been significant volume changing hands at the high of this range (see volume profile).

A breakout from this range would be the next sign to look for. This could also be the resistance point for a retracement”

That is exactly what we have seen this week, and it’s still the case.

The next short term clue is the breakout direction from this range.

Web3 Wallet: Start Guide

Metamask Wallet

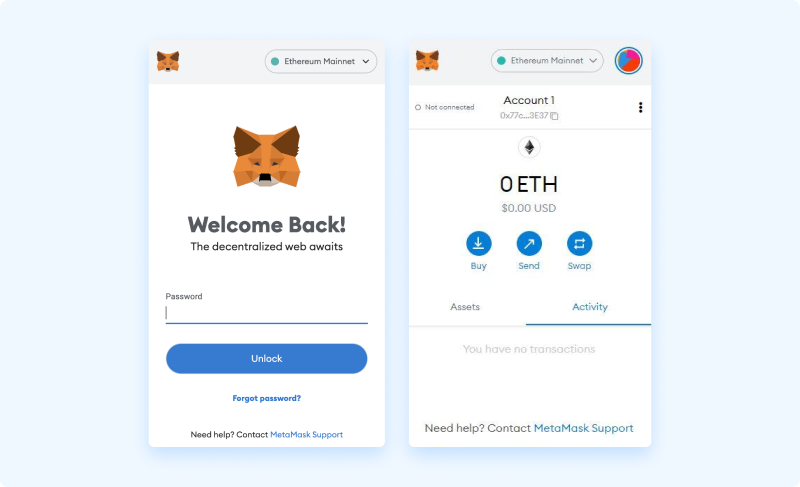

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

The first step to getting started with Metamask is to install either the browser extension wallet or the mobile version for iOS or Android.

(in the upcoming steps we will cover the browser extension version, but the steps are similar if using a mobile option)

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

After selecting the [Get Started] button we are asked if we would like to import and existing wallet, or create a new one. We select the [Create a Wallet] option here.

STEP 4 Opt out of Data collection

On the next page, selecting the [No Thanks] button will opt us out of usage data collection (optional, either choice is fine here):

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Now that we have a good understanding of the purpose and security practices surrounding seed phrases. Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed:

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

People Also Read

The future of blockchain is certainly multichain as we see more and more projects like coinbase launch their own layer

Bitcoin NFTs are all the rage lately. What are they, and how do they work? In this issue, we answer