If today’s candle closes like this, Bitcoin once again flips previous resistance into new support! Fantastic! Very positive! Again!

Issue 12

December 30, 2022

Moralis Research 2022 Recap

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. It’s the end of the year and time to reflect on what’s been learnt from all the trials and tribulations we’ve experienced in the industry throughout 2022.

As the majority of digital assets have decreased in value this year there’ve been key events contributing to this along the way. The downfall of Terra Luna and the algorithmic stablecoin USTC was the first significant project to fail. It caught many thousands of retail participants but it was the big boys who had placed fund money, customer money or borrowed money into the seemingly irresistible 17% APR ‘available’ on Anchor that caused the first domino of many.

Three Arrows Capital was then the first fund to fail, with their high profile exposure to Terra and USTC. They were once a brand name venture capital fund desired by many projects to assist with launching their projects. They turned out to be totally overleveraged and had been making increasingly risky bets.

Then came the collapse of CeFi with Celsius, BlockFi and Voyager all going into bankruptcy. They’d been offering high APR on both volatile assets and stablecoins with claims of a buoyant borrowing and lending market. These rates proved to be unsustainable and the risks unquantifiable. Loans were meant to be overcollateralized but this wasn’t always the case when lending to other large players and corners were cut.

Some CeFi were also engaging in activities away from their core lending business and began taking risks in nascent DeFi or mining enterprises. Hacks happened, losses came and balance sheets dwindled. The highest profile was of course when the death spiral happened on Luna/USTC. But there were many other smaller losses which also left holes in balance sheets.

Billions disappeared and billions defaulted on loans.

The spiral down continued in the overall market. Everytime a large player went, confidence in the market dwindled. Then came SBF and FTX with their narrative of a ‘knight in shining armor’ declaring they had billions of capital on the sidelines ready to make acquisitions.

This turned out to be the biggest farce of them all. With the billions set aside some of it had been customer deposits, rather than actual profits. Or tokens which they had created being used in deals, or as liquidity to borrow against. The closely affiliated VC, Alameda Research was a key part in this too. They’d been given unlimited credit to play with and had access to data on users’ positions and liquidation points on FTX. This meant an extremely unfair trading environment.

So what are the stand out lessons? To be extremely careful when delegating responsibility of your funds to any centralized exchange or CeFi provider. The prevalence of greed, which anybody can experience at any time, was rampant throughout the industry and even the so called trusted brands clearly weren’t immune to excessive risk taking and engaging in unfair practices.

The other is to be extremely careful with leverage and the resulting spirals which can happen especially when collateral is correlated. Much of this year has been the unwinding of excessive leverage by the large players. But this can happen to anybody, at any level.

It’s time to get back to basics throughout 2023. Anybody who sticks around now will then have the lessons of the past to form their wisdom of the future. A lot of the newcomers who came during the bull market have now disappeared again. But we’ve got to do our best to get them back once they understand the true potential of crypto and primarily decentralization.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

December 30th, 2022 | 13:00 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information, I will adjust my opinion accordingly. Technical analysis of historical data is not a prediction of the future. It is a tool that can aid in finding setups for favorable risk-reward and points of invalidation.

FOR GENERAL INFORMATION PURPOSES ONLY, NOT FINANCIAL ADVICE.

All information presented in this report references an opinion of the author and is for general information purposes only. You must not construe any information presented as legal, tax, investment, financial, or other advice. Nothing presented constitutes a solicitation, recommendation, endorsement, or offer to buy or sell financial instruments. I am not a licensed financial advisor or registered investment advisor. For financial or investment advice, seek a duly licensed professional in your jurisdiction, who can take your specific situation into account. Past performance does not indicate future results. You are always at risk of losing all invested funds.

Disclosure: I hold Bitcoin and Ethereum exposure, both through company ownership and in my personal capacity, as ETP price tracker certificates in ISK through my bank.

Trend Analysis

Bitcoin (BTC)

2022 in Review

Ethereum (ETH)

2022 in Review

Binance (BNB)

Trend down first half of 2022. Stabilized 2nd half of the year.

Cardano (ADA)

Trend down 2022.

Solana (SOL)

Trend down 2022.

XRP

Trend down first half of 2022. Stabilized 2nd half of the year.

Polygon Matic

Trend down first half of 2022. Stabilized 2nd half of the year.

Bitcoin (DOMINANCE)

Trend up first half of 2022. Stabilized 2nd half of the year.

Bitcoin

(BTC) 2022 in Review

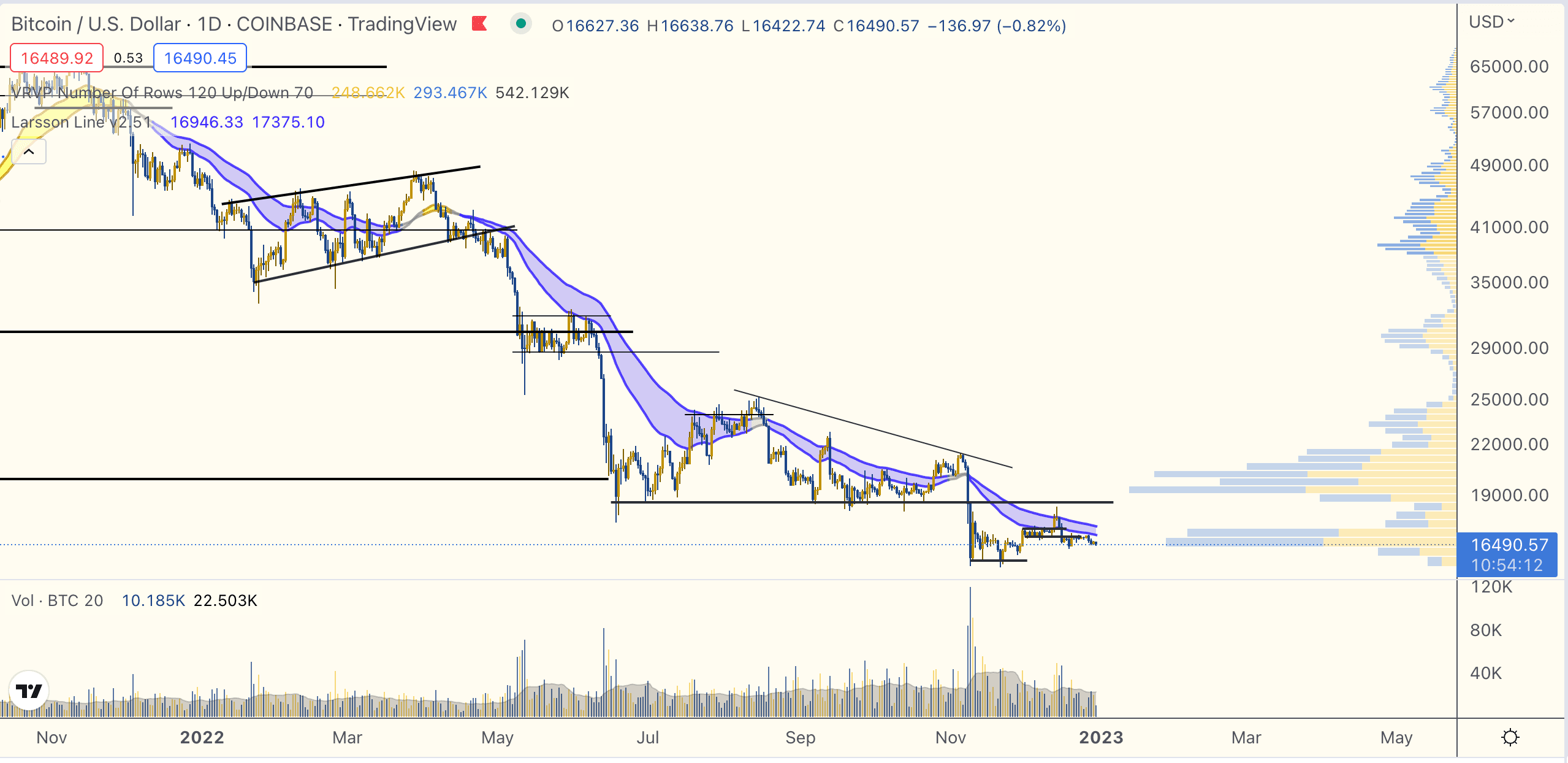

Bitcoin in 2022 has been easy: The trend has been down from start to finish.

The only exception was that brief gold flip in April, but it got promptly stopped out.

So unless something dramatic happens tomorrow, Larsson Line has nailed this entire year, for the 5th year in a row in actual forward testing (as opposed making an indicator to fit the data, after the event).

So after a brief 5 second celebration 🥳 let’s look forward. What next?

2023 Outlook

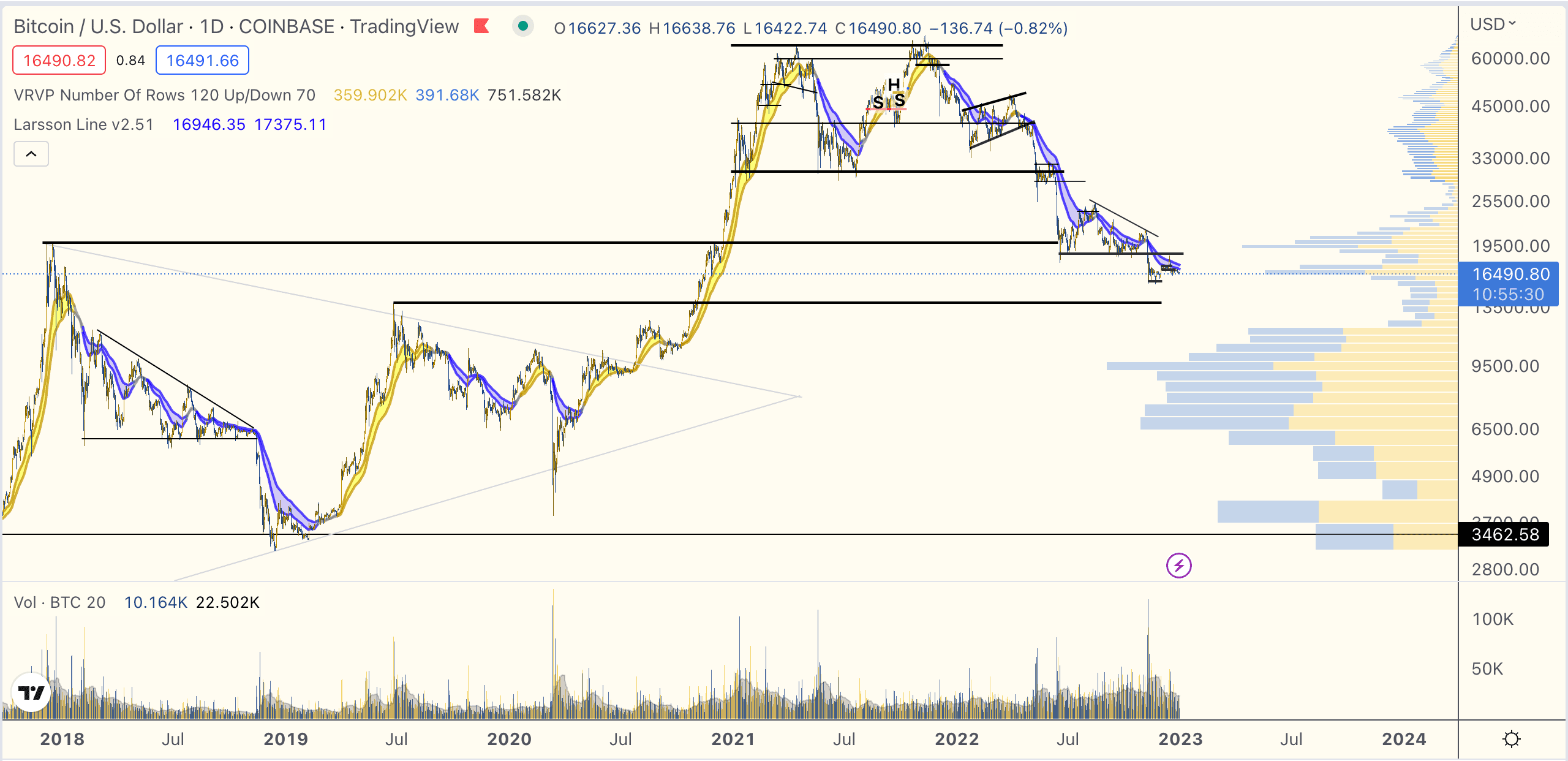

I see on social media that most people – as usual – think that prices next year will be approximately the same as today, just a little more or less depending on who you ask. I don’t think so at all.

There is no “fair value” for cryptocurrencies. No floor. No ceiling. No reasonable price. Price is set as a result of the behavior of buyers and sellers. And there are no limits. I think we will either see a massive collapse of the crypto ecosystem next year, or market makers and shakers will wait until the last bull gives up and shorts, and then run price up to crazy levels.

The last wave in the ocean hasn’t come yet and the last boom and bust in crypto hasn’t either.

I won’t HODL in a downtrend, but I remain optimistic about this industry. I’m going to stick to my process and I will buy when there is an indication of an entry. And I will cut that entry if conditions change. So let’s swallow the champagne, put on our HODL Sucks Socks and get ready for 2023, because there could be fireworks.

If we turn around, where? Who knows. Current support levels have broken. Next support is 13.8k (marked by the 2019 top) or 11.8k (marked by volume history). While HODLing in a downtrend isn’t a valid strategy, buying strong support with a tight stop loss is.

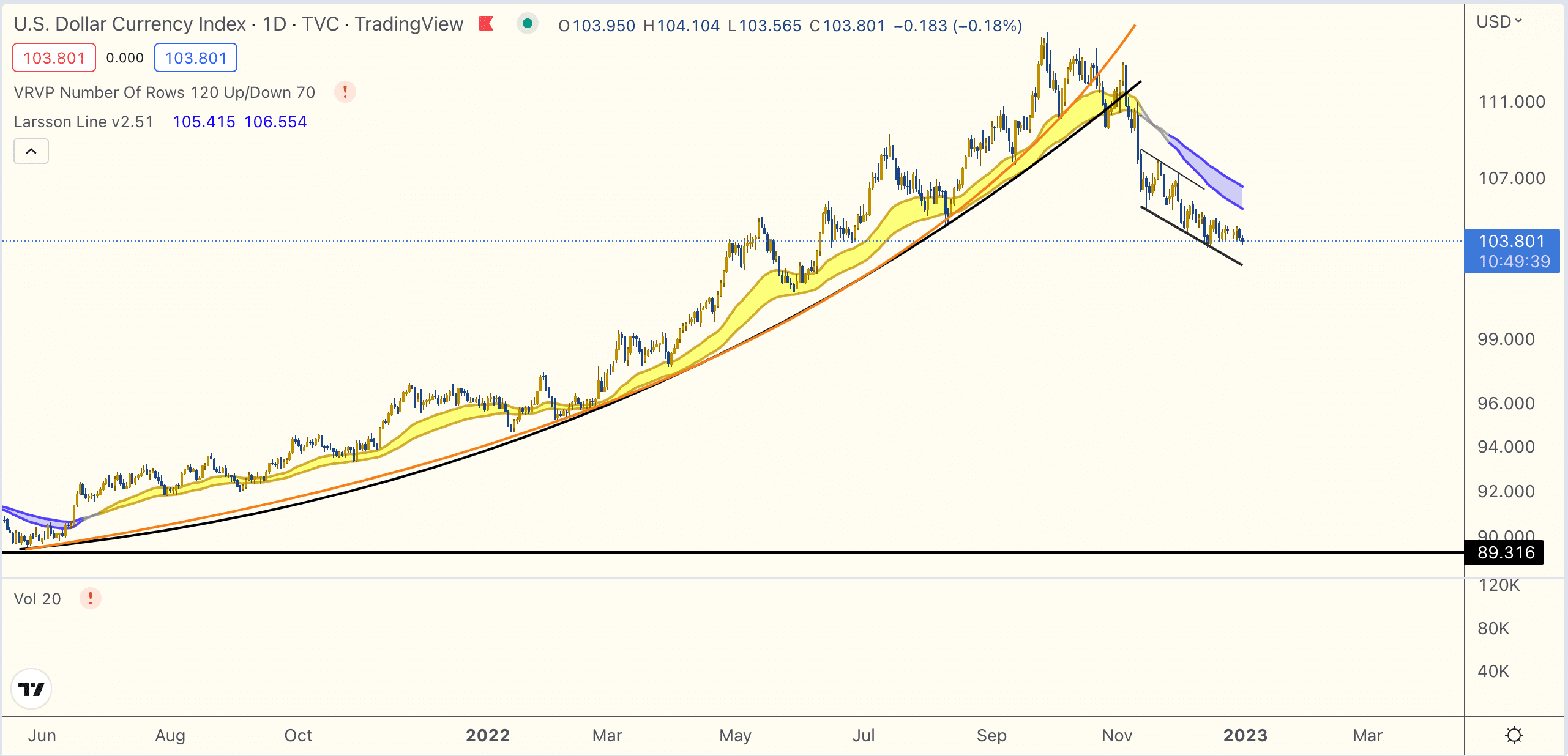

DXY Pump Fuel

I’m not pulling the careful optimism out of thin air. The DXY parabola remains broken and is still trending down. Weaker dollar => Usually more appetite for risk-on assets like Bitcoin.

People Also Read

Despite price action drama yesterday, when taking a step back, the situation remains the same as last week, and it’s

Bitcoin has tested $28,600 resistance on 7 separate days now. If the supply at that level eventually exhausts, the move