Ethereum vs Cosmos How do they compare? Read our detailed analysis of their strengths and weaknesses, so you can decide

Issue 10

December 16, 2022

Growth in Web3 Social Media, Music NFTs, & Liquid Staking

Contents

Introduction

By Ivan Liljeqvist

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. SBF was arrested in the Bahamas, Elizabeth Warren continues her plight against blockchain, but Donald Trump has seemingly changed some of his opinion of the technology and launched his first ever NFT collection on Polygon.

SBF had been scheduled to testify to the House Committee on Financial Services earlier in the week by remote video. Between the submission of his planned written testimony and the scheduled hearing, however, he was arrested by Bahamian authorities. He’s now pending extradition to face eight federal indictments in the US and the maximum sentence for all indictments would be 115 years in prison.

In the planned testimony SBF was set to blame others for the downfall of FTX, but prosecutors are instead alleging he’s responsible for orchestrating a years-long fraud using platform customers’ money, money laundering and campaign finance violations with donations to political parties. These are unlikely to be the only charges filed against SBF either, and more could come from state level or other sources. The indictments also mention ‘individuals known and unknown’ so it’s likely other people will also be implicated as well.

Now Elizabeth Warren and Roger Marshall have proposed the Digital Asset Anti-Money Laundering Act to directly target the blockchain industry. Two years ago FinCEN proposed similar rules but it was never finalized after many people in the industry spoke out against them. This bill would finalize those originally suggested requirements and then direct FinCEN to enforce them.

The catch-all bill would treat all blockchain network users as money service businesses and require them to have KYC and AML procedures with anybody they dealt with. This wouldn’t just be for businesses but also individuals with self-hosted wallets who would also be required to have these bank and financial institution level practices. That would be totally impractical for most and the implication would be to push the individual further towards Centralized Exchanges, or towards DeFi which is equipped to perform like a bank.

It’s a critical time because with all the implosions that have happened this year it’s like they sense their moment to try and get this passed. As has been said in the past it’s likely that a set of sweeping rules would stifle innovation and discourage developers and individuals from participating in anything to do with blockchain.

At least we’ve got some more positive news though that a previous critic of Bitcoin, Donald Trump, has just launched his own Digital NFT collection! For years Trump was calling Bitcoin a scam and love him or hate him it’s a representation of the interest in NFT’s from increasingly varied quarters.

Some entities may be less inclined to embrace the idea of cryptocurrency often due to the regulatory uncertainty, but do embrace NFTs and see the potential for enhancing their marketing and community building activities. You can now add Trump to the long list of brands like Starbucks, Prada and Disney that have all launched NFT collections or projects in 2022, despite the depths of the bear market.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

Cryptocurrency Market Overview and Analysis

By CTO Larsson

December 16th, 2022 | 14:00 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday

movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods

of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information,

I will adjust my opinion accordingly.

Disclosure: I hold Bitcoin, Ethereum, Luna and Solana ETP price tracker certificates in ISK through my bank. Through company ownership I also hold small exposure to misc. additional tokens.

Trend Analysis

Bitcoin (BTC)

Failed Breakout

Bitcoin (DOMINANCE)

At top of minor range. Watching for breakout.

Bitcoin

(BTC) Failed Breakout

Last few weeks I felt quite optimistic that Bitcoin will attempt a breakout.

It did attempt a breakout – but it failed.

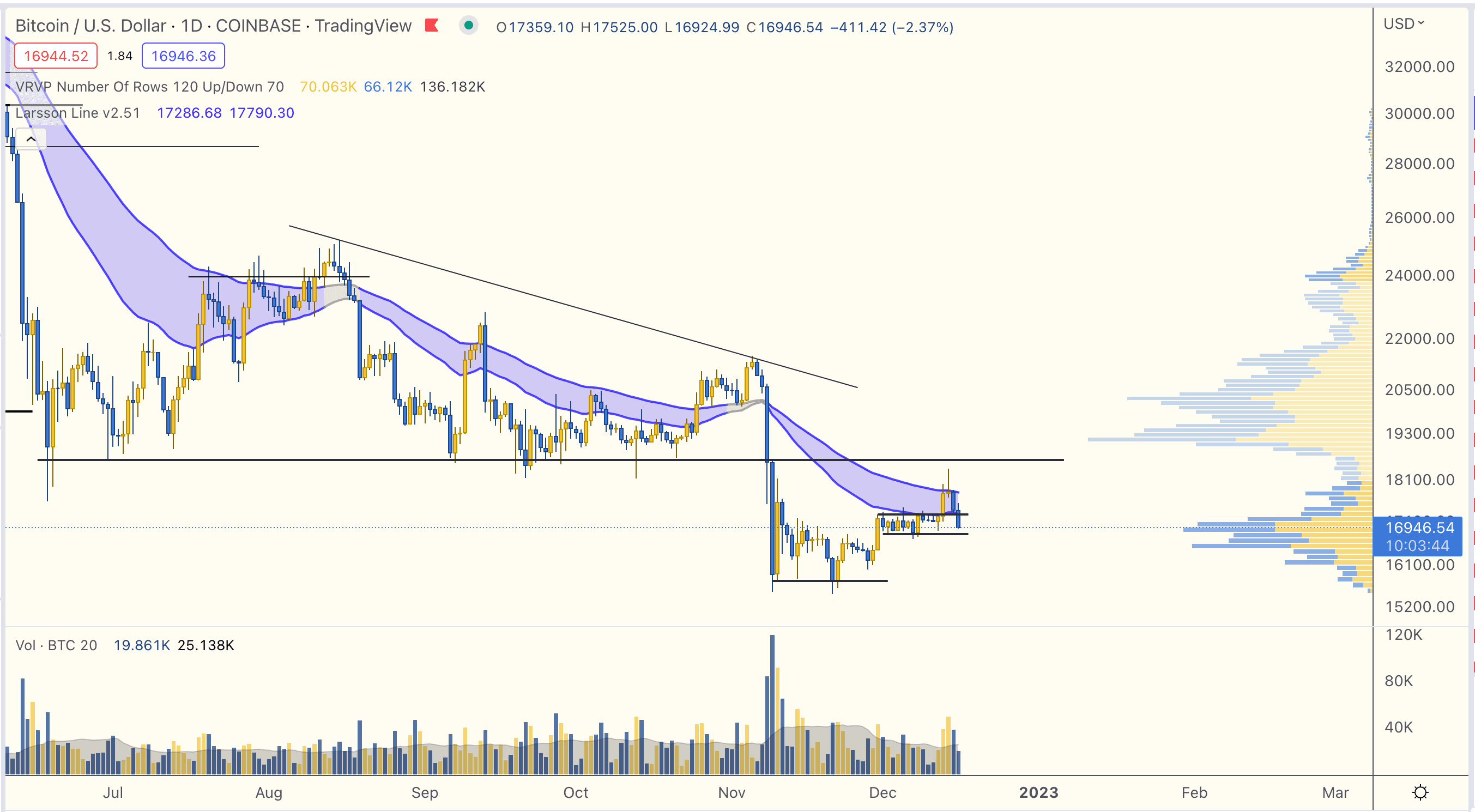

In this edition we cover only Bitcoin and DXY. There is little point in looking at anything else right now. Altcoins are mostly a leveraged bet on the next direction of Bitcoin at this point of the market. We need resolution of Bitcoin first.

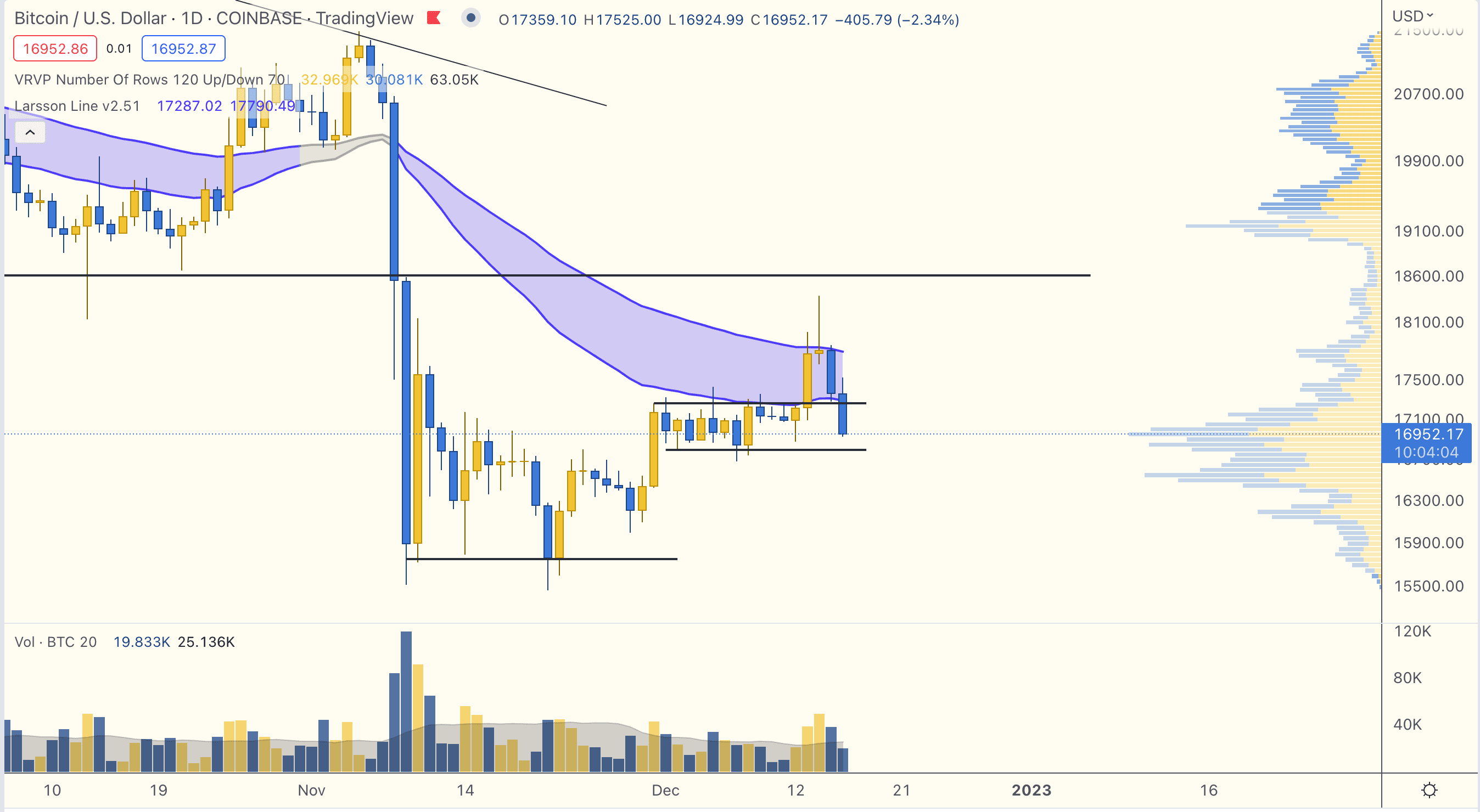

As you can see, price came close to the support/resistance area at $18,600 that we have discussed here for the longest time. Then we got a huge rejection candle, followed by a nasty bearish engulfing movement yesterday and today are back into the range we were in since early December.

If we zoom out a little on the same chart, we see very clearly how this level is what matters here. If we break above that $18,600 resistance level, and reclaim it as support, I’m interested.

But as of right now, this break-out attempt got the hammer.

Not all is dark though:

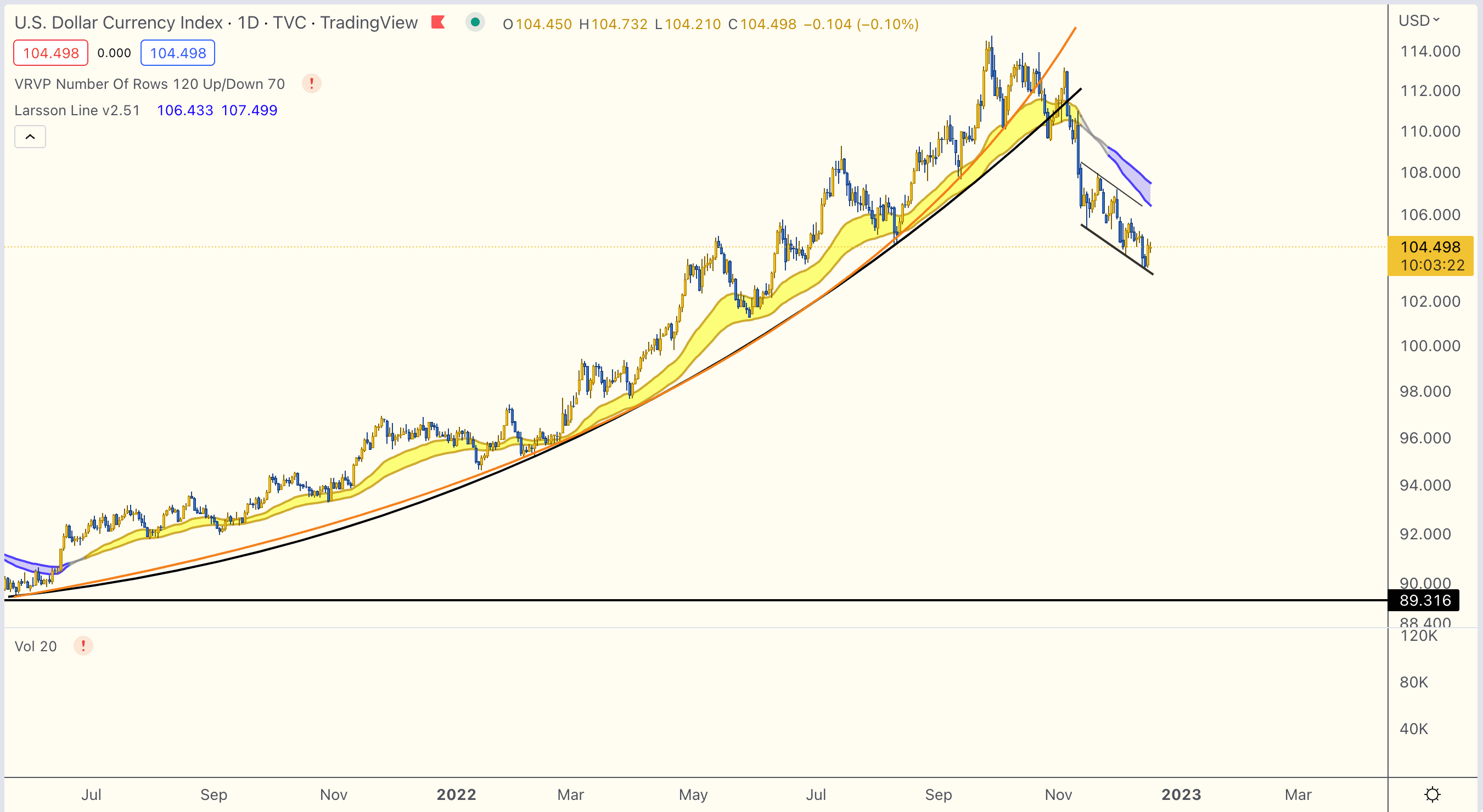

If we review DXY again, despite the recovery the past two days, that doesn’t change the situation. DXY is still in a downwards sloping channel, completely intact.

So it’s definitely not out of the question for new breakout attempts to the upside for Bitcoin and other speculative assets very soon.

But.

Larsson Line remains down for Bitcoin.

That hasn’t changed. Someone should really fix that thing ;-)

And due to that, I’ll continue to stay almost completely on the sidelines.

People Also Read

The trend is up. The LTF H&S pattern has been invalidated. The HTF IH&S pattern is still in play, with

Bitcoin has tested $28,600 resistance on 7 separate days now. If the supply at that level eventually exhausts, the move