DeFi Deep Dive

Introduction

Welcome back everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. It was CPI data release time again yesterday and what transpired was a very volatile day in the markets. Some have been quick to say that it was the bottom, but it’s far too early to say so until there’s more clarity over what was an unusual market reaction to the figures.

The CPI figures were above expectations and unsurprisingly a near instant dump took place at release time. Bots and algorithms very quickly interpret the data as soon as it’s published and then compare this to what was expected. They are programmed to react far faster than a human can react and that’s why such big moves take place so quickly.

Then in the minutes following the release human traders interpret the data themselves by looking at the actual inflation figures relative to expectations and then make a decision on which way they think the market will go.

With yesterday’s inflation numbers coming in above expectations the initial selling was to be expected because the interpretation is that there will need to be further interest rate rises and less spending to get inflation closer to the target of 2% per year.

What was unusual though, was the market reaction following the initial dump, a sustained period of buying and new highs being made on the day. Equities and crypto both ended up in positive territory, contrary to what would usually be expected. So there are theories emerging around why this was. Was it just a short squeeze or were there other reasons for buyers’ interest.

We know the IMF have been meeting this week and there have been both public press conferences and private meetings. We won’t know the outcome of those private meetings until economic and fiscal policy decisions from governments and central banks transpire. There could have been something agreed over the past few days and those in the know reacted accordingly.

It’s a timely reminder though that Bitcoin was created to provide a transparent alternative to traditional finance, and so that the public aren’t reliant on the decisions of a select few. It’s designed with predictable inflation and a limited supply of 21 million, to be decentralized and permissionless, so anybody can take part on an equal basis.

Ok so we’ve still got volatility, forks and crypto power players, but it’s important to maintain our belief in this as an alternative system and a choice for regular people going forward. Especially in the scenario where governments and banks begin to launch their own CBDC’s which will make use of blockchain technology but continue to centralize the decisions in the hands of the few.

If there’s something like a ‘Plaza Accord 2’, it would amount to a coordinated effort from central banks to push down the value of the dollar. In 1985 it was the then G5 nations of USA, UK, West Germany, France and Japan who did something similar. This time it could be the G7 nations with Italy, Canada and the European Union included in negotiations.

In 1985 when ‘Plaza Accord 1’ was agreed, inflation had already been brought under control in the US, so many commentators are saying it’s unlikely to happen until their inflation is down. So it’s probably wise to continue to monitor the data and the policy announcements in the coming days and weeks. As well as keep reminding ourselves of the original ethos and longterm goals of decentralized currency.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

With Great Respect,

Ivan Liljeqvist

Cryptocurrency Market Overview and Analysis

September 23rd, 2022 | 12:00 UTC

For those new to my analysis,

I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods

of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information,

I will adjust my opinion accordingly.

Disclosure: I hold Bitcoin, Ethereum, Luna and Solana ETP price tracker certificates in ISK through my bank. Through company ownership I also hold small exposure to misc. additional tokens.

Trend Analysis

Bitcoin (BTC)

Ethereum (ETH)

Binance (BNB)

Cardano (ADA)

SOL

XRP

Bitcoin (DOMINANCE)

Crypto Total Market Cap

(BTC)

I’ve covered many times in this report and in my videos that I prefer to act based on closed daily candles rather than on intra-day movements. The wick yesterday serves to illustrate why.

Price hit $18,131, but instead of being the conclusive $18,600 support break I’ve been talking about in the past editions, price bounced back and the candle closed at $19,378 – safely above support.

The situation thus remains unchanged. The $18,600 support, which had already been defended for an umpteenth number of times, has now been tested umpteenth+1 times. That is the only difference from last week.

- If it finally breaks, we get a continuation H&S in a solid downtrend. Then we can probably look forward to significantly lower prices.

- If it holds and breaks above the right shoulder at $22,600, we get a fulcrum bottom, a powerful bottom in the chart and it won’t take much to turn the trend back up for a real rally.

The trend remains solid down.

The risk appetite in the markets right now depends a lot on DXY and this parabola remains intact, no matter how it’s drawn.

For the alt coins, today we’ll analyze all of them on the daily timeframe and vs USD, to easier see the similarities or differences vs BTC/USD.

The risk appetite in the markets right now depends a lot on DXY and this parabola remains intact, no matter how it’s drawn.

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

Bitcoin dominance remains range bound, as drawn below.

A range can break out in either direction and it’s usually a mistake to try to guess in which direction, before it has actually happened.

At one point it will, and that will be my clue for how to position myself between BTC and alts for the next major move of the markets.

The chart is here shown with 3 day candles.

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

DeFi Deep Dive

Introduction

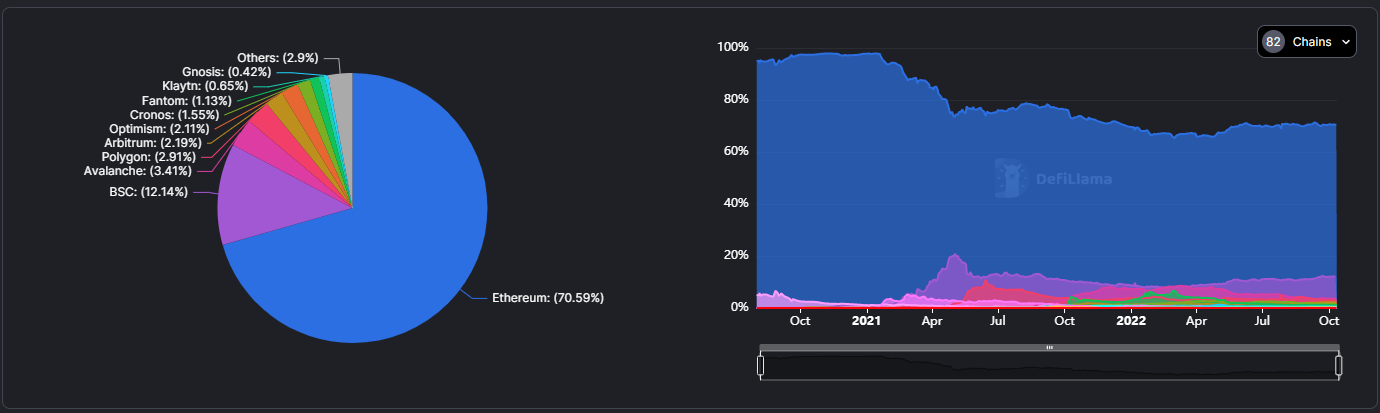

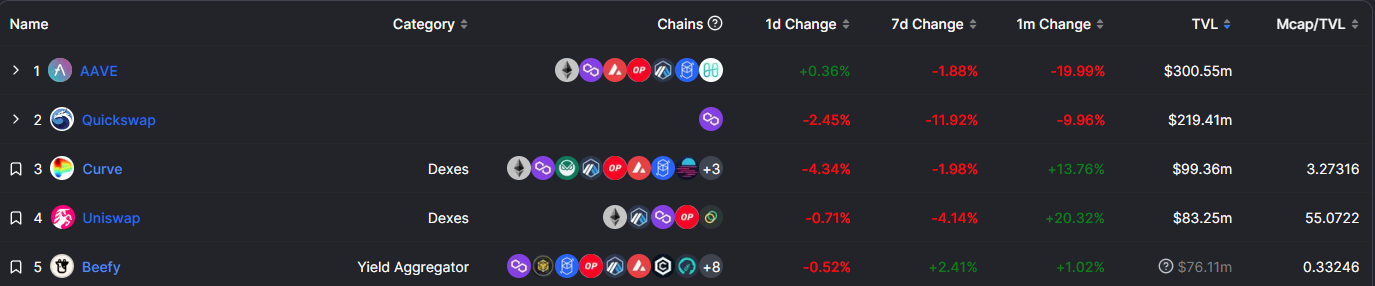

When comparing TVL across EVM networks we can see close competition. Ethereum is the clear leader with over 70% of all TVL in EVM-based networks. The next two, Binance Smart Chain and Avalanche, are the leading EVM sidechains, followed by Polygon, Arbitrum, and Optimism, the top three EVM Layer 2 networks.

The EVM API, provided by Moralis, allows blockchain developers to fetch information such as block data, transaction data, token prices, user balances, DeFi liquidity, and more. The EVM API supports 6 of the top 10 chains, including Ethereum, BSC, Avalanche, Polygon, Fantom, and Cronos.

In this report, we aim to take a closer look at the DeFi ecosystems growing on three different EVM chains:

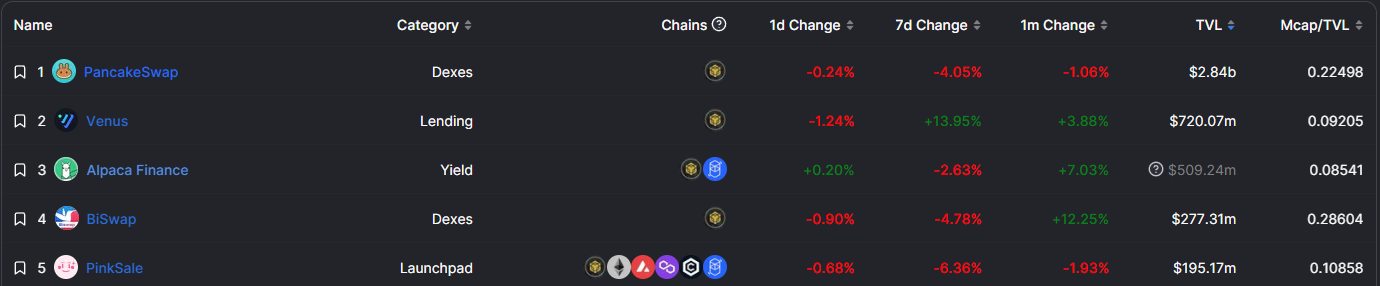

DeFi on BSC

First on the list with over $5.3B in TVL is BSC. BSC has the second-highest TVL across all EVM-based chains, and the third-highest when compared to all chains (after Ethereum and Tron). BSC is an EVM-compatible network that utilizes a PoSA (Proof of Stake Authority) consensus mechanism which contributes to its fast speed and cheap fees. Only active validators are eligible to validate transactions and the number is limited to 21.

A validator’s active status is determined based on the amount of BNB tokens they own. Each of the 21 top validators with the most BNB tokens takes turns validating blocks. The set of all validators is determined once a day and is stored separately on Binance Chain. In comparison to the 21 validators of the Binance Smart Chain, Ethereum has more than 70,000 validators.

In exchange for short block times and lower costs, the PoSA consensus model clearly sacrifices network decentralization and security. The PoSA consensus model limits network validators, making Binance Smart Chain less robust of a blockchain network than Bitcoin or Ethereum.

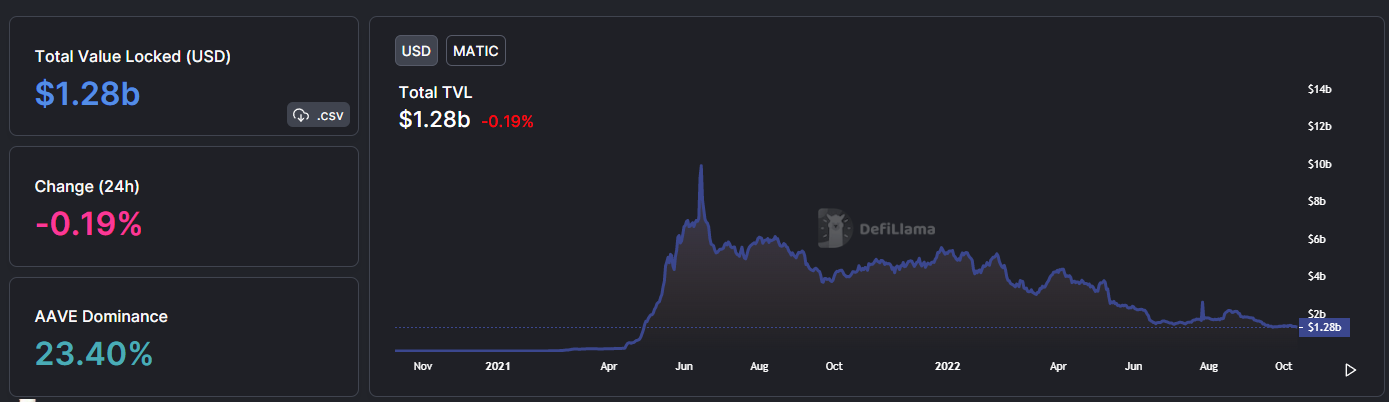

DeFi on Polygon

Next on the list is Polygon, the leading Layer 2 scaling solution, with $1.28B in TVL across all compatible DeFi platforms. Polygon is a Layer 2 aggregator, meaning they provide scaling solutions in a wide variety of flavors, including Plasma, Optimistic proofs, Validity proofs, and several modular solutions to optimize scaling for any Dapp. Their ecosystem is massive, spanning all sectors of Web3. In addition to their developer community, they also have an entertainment division, Polygon Studios, and a digital identity solution powered by Zero Knowledge technology, Polygon ID. Polygon is also a carbon-neutral blockchain and has pledged over $20M in green initiatives that help fight climate change.

The Polygon network currently uses over 14 times less energy than Deloitte and 120 times less than Microsoft. The Polygon team has also formed some heavy-hitting partnerships with major technology companies and brands including Stripe, Instagram, Adidas, Disney, Starbucks, Robinhood, and the list goes on and on. On October 10th, Polygon announced the official launch of their zkEVM for public testnet. This is a huge announcement as Zero Knowledge technology is poised to have a monumentous impact on Ethereum scaling and the blockchain industry as a whole.

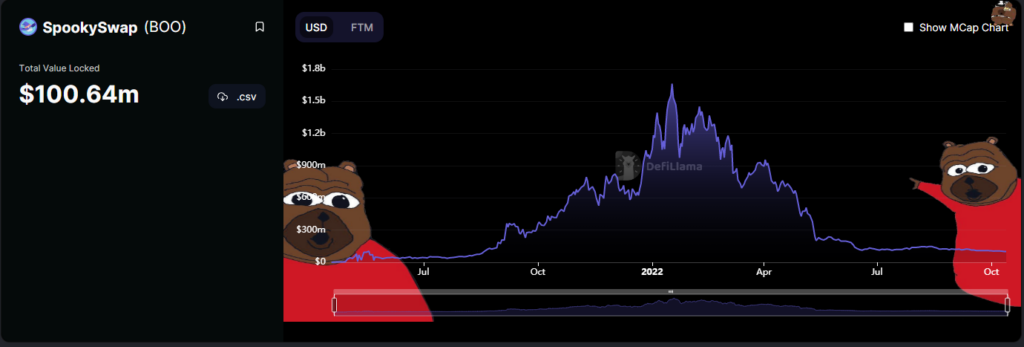

DeFi on Fantom

In terms of TVL, Fantom is the 8th largest EVM chain with just under $500M. Fantom Network is a smart contract platform that utilizes an aBFT (Asynchronous Byzantine Fault Tolerant) consensus protocol which can process thousands of transactions per second. It boasts an average confirmation time of around one second and an average transaction fee of $0.0000001. Accordingly, Fantom is well-suited to accommodate the rapidly evolving DeFi landscape.

The protocol is completely decentralized, currently processing between 500k and 1.5M transactions per day with over 3.5M total unique addresses. It is popular amongst DeFi enthusiasts and developers alike for its fast finality and high speeds. In addition, its native token, FTM, natively conforms to both ERC20 and BEP20 token standards, making it an excellent candidate for cross-chain opportunities.

Overview

| Chain | TVL | Unique Addresses | EVM Market Share | Daily Transactions |

| BSC | $5.36B | 200M | 12.2% | 5M |

| Polygon | $1.29B | 174M | 2.93% | 3M |

| Fantom | $496M | 3.5M | 1.13% | 1.5M |

Automated Market Makers

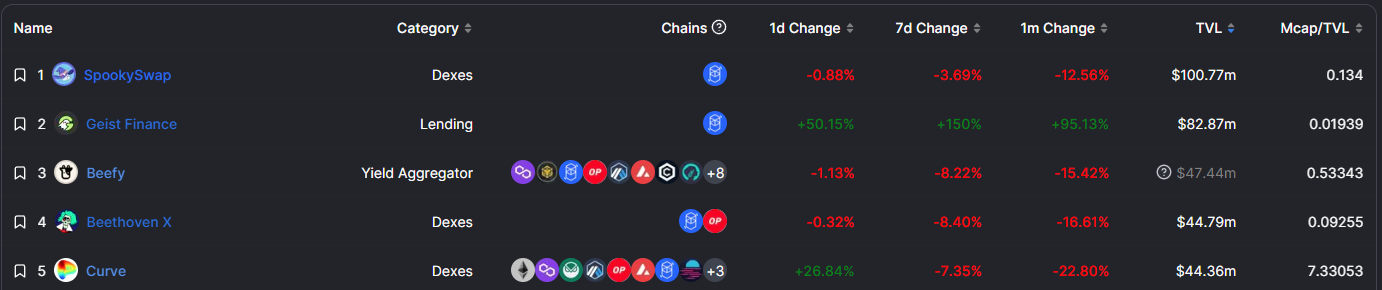

Automated market makers (AMM) or Dexs are decentralized exchanges whose algorithms price assets using liquidity pooled from users. Due to their decentralization, AMMs provide users permissionless access to deep liquidity, low fees, and 100% uptime. AMMs can be better understood by taking a closer look at how they differ from traditional exchanges. In traditional exchanges, buyers and sellers meet on a centralized order book at an overlapped price point. AMMs, however, differ in several ways:

- First, yield farming is used to incentivize users to provide liquidity for crypto trading pairs.

- Next, they utilize an algorithm, usually x * y = k, to ensure a constant price for traders.

- Lastly, AMMs leverage smart contracts to swap assets between traders and liquidity pools.

x*y=k

This algorithm, popularized by the Uniswap protocol, is often used in AMM applications to ensure a constant price for traders based on the variables involved with the liquidity pool. In this equation, the variables are quite simple:

X is the quantity of one token in the pair

Y is the quantity of the other token

K is the fixed constant, which represents the price of tokens in the liquidity poolIn addition, the K variable, which can be used to derive a specific token price, is inversely correlated to the supply of that token in the pool. Meaning, if the supply of X token goes down, its price increases, and the same for Y token. This is because when people buy X tokens, they remove liquidity for that token from the pool, and replace it with Y tokens, decreasing the supply of X tokens and increasing the supply of Y tokens. Therefore, the pool value and token price for X token must reflect an equal total value to its paired token, Y token, causing the price to increase as liquidity decreases.

Advantages of AMMs

Security

In order to prevent attacks, DEXs are often hosted in a distributed manner. Furthermore, hackers can only interact with liquidity pools on a trading platform, they have no way to compromise the users’ accounts individually.

Disadvantages of AMMs

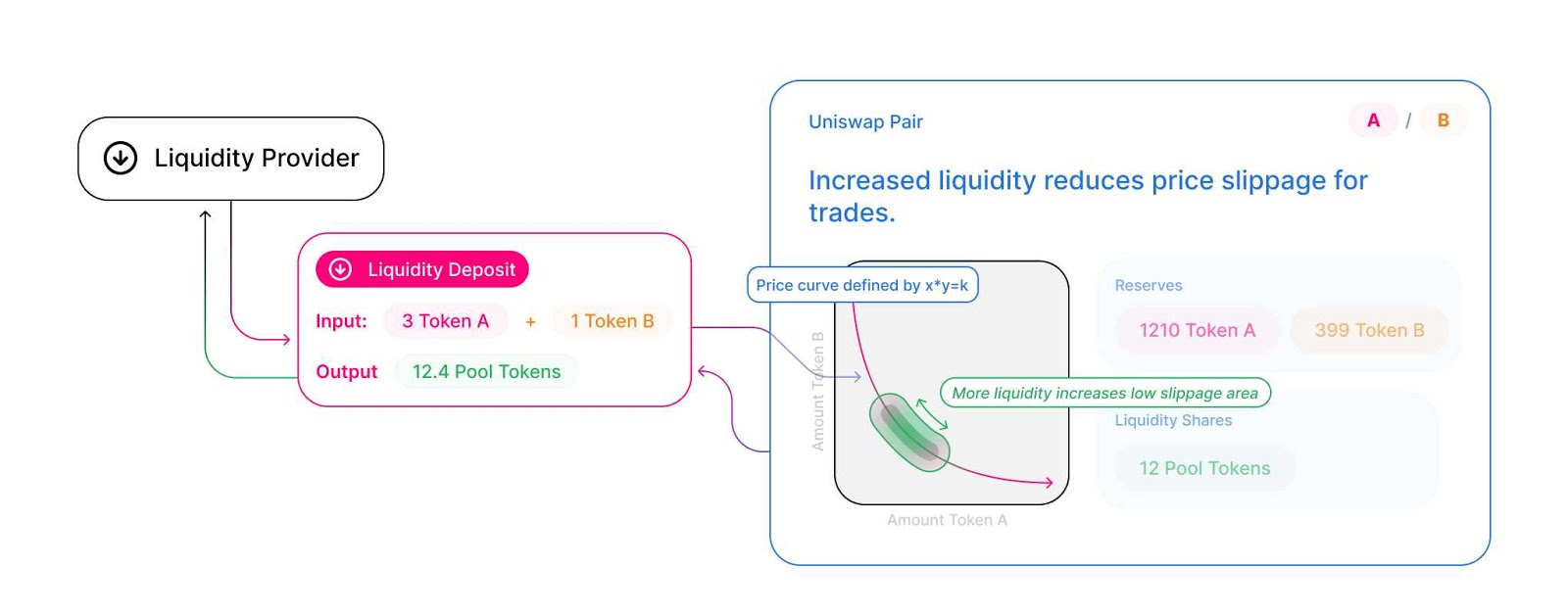

Uniswap

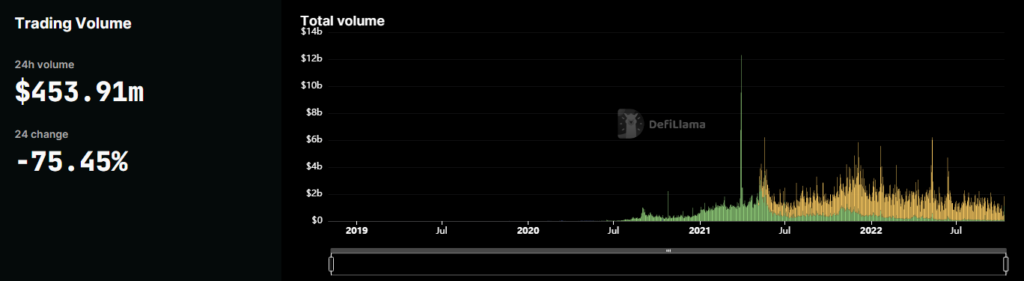

The Uniswap protocol currently supports Ethereum, Arbitrum, Optimism, Celo, and Polygon. With a TVL of over $5B and a 24h trading volume of over $450M, Uniswap is the largest Dex in production. Many leading Dexs on other blockchains are forks of the Uniswap protocol.

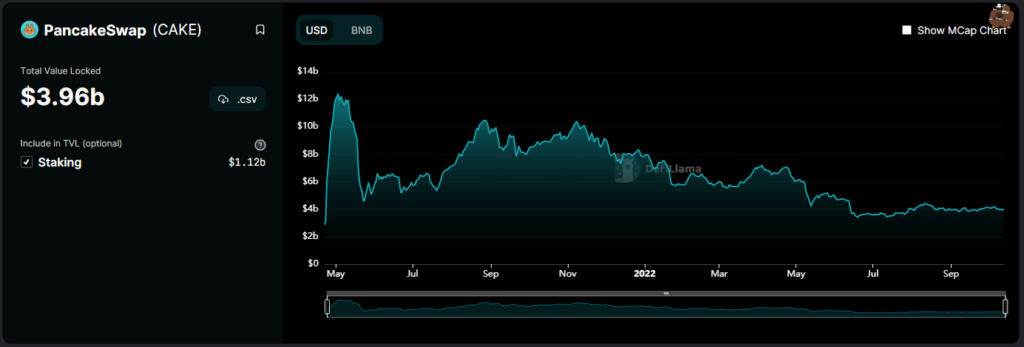

PancakeSwap

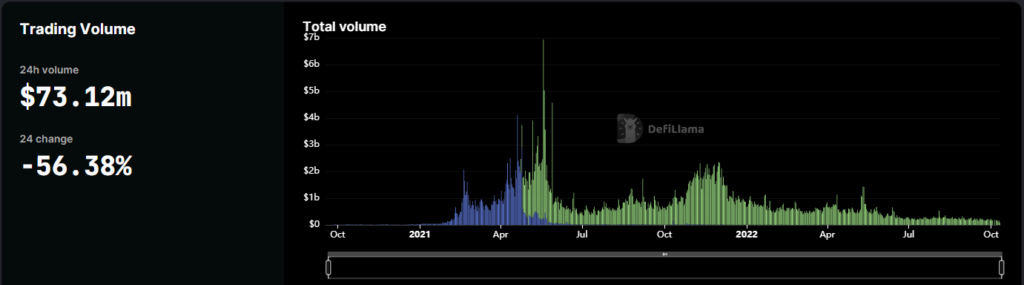

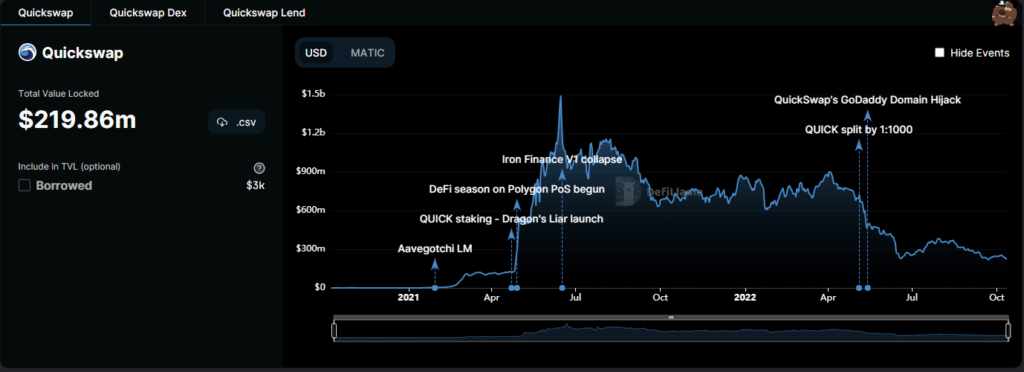

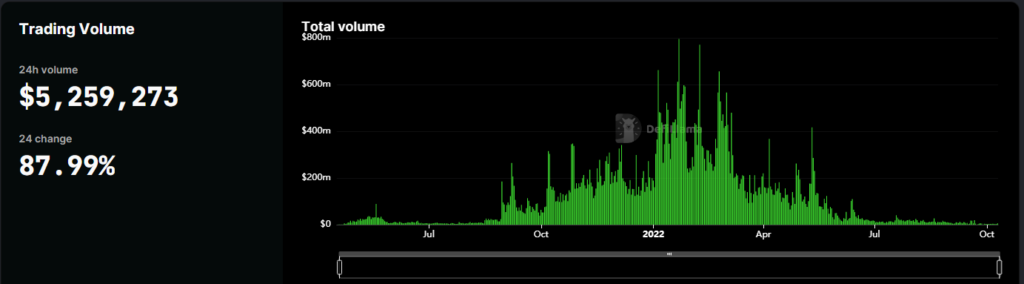

Quickswap

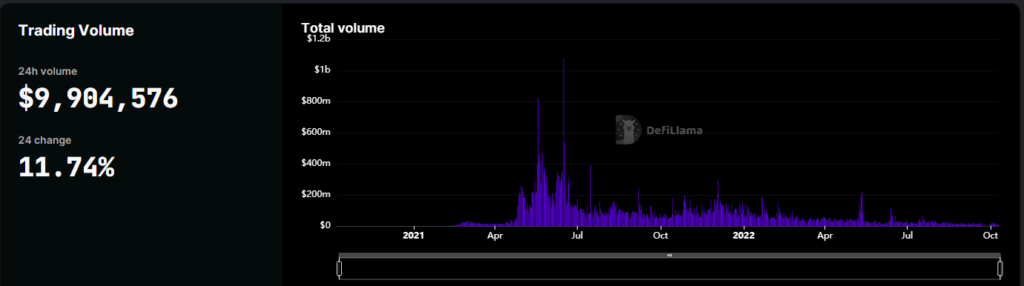

SpookySwap

Dex Comparison

When new Uniswap forks started being deployed on every chain, they all closely resembled Uniswaps front-end design. In addition to mainly catering to their respective chain of choice, each platform now has its own distinct style and identity. While they all have a unique aesthetic, the user interface and token-swapping experience remain almost identical across all Dexs. However, one interesting thing to note is that both Quickswap and SpookySwap offer limit orders while PancakeSwap and Uniswap do not. This could be due in part to the extremely low fees on both Polygon and Fantom networks.

Dex Aggregators

When new Uniswap forks started being deployed on every chain, they all closely resembled Uniswaps front-end design. In addition to mainly catering to their respective chain of choice, each platform now has its own distinct style and identity. While they all have a unique aesthetic, the user interface and token-swapping experience remain almost identical across all Dexs. However, one interesting thing to note is that both Quickswap and SpookySwap offer limit orders while PancakeSwap and Uniswap do not. This could be due in part to the extremely low fees on both Polygon and Fantom networks.

Cross-chain DeFi & Bridging

Cross-chain transactions have never been easier or more frictionless. Interoperability offered by EVM-compatible networks has played a significant role in facilitating the development of new cross-chain communication protocols. Different protocols address cross-chain interactions in unique ways. These implementations primarily include cross-chain bridge and Dex aggregation and messaging and routing protocols. Currently, there are a few cutting-edge tools pioneering this chain-agnostic zeitgeist.

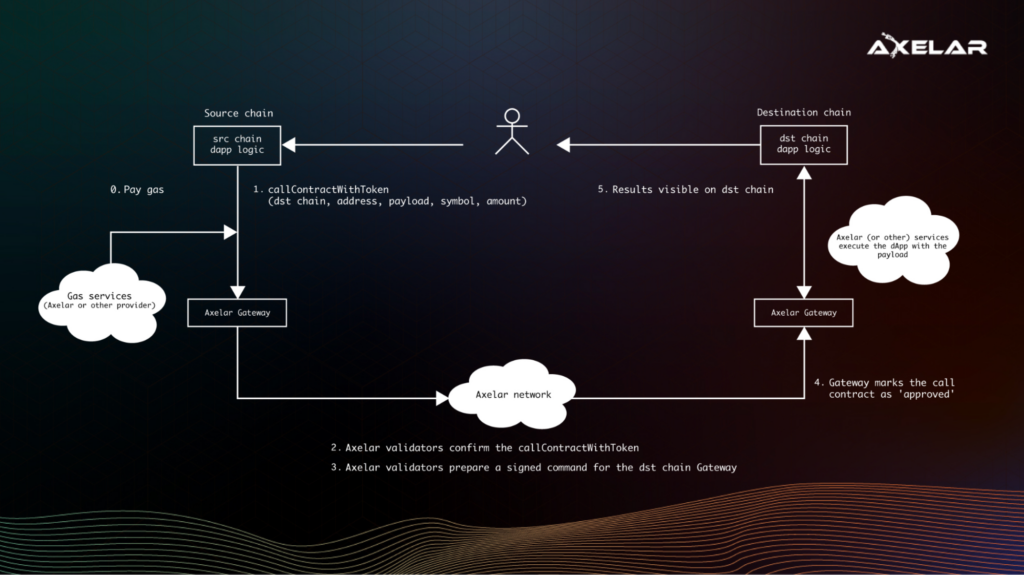

Axelar is a Turing-complete transport layer secured by delegated Proof-of-Stake. The protocol enables permissionless cross-chain communication via Universal Asset Transfers and General Message Passing. Axelar takes it a step further than bridging by allowing applications to call any function on any connected chain and carrying payload securely cross-chain.

Axelar’s General Message Passing (GMP) lets developers build on one chain and call functions on any other connected chain, enabling composability across compatible Web3 ecosystems. Using GMP, users can execute contracts across chains, including sending and receiving tokens. Currently, the protocol is deployed on 7 of the largest EVM chains, as well as a few IBC protocol.

In the event the prepaid gas is insufficient to complete the transfer there are monitoring and recovery steps that can be completed with little difficulty.

Multichain is an open-source, trustless, and decentralized cross-chain communication protocol. With support for all ECDSA and EdDSA encrypted chains, Multichain is a universal interoperability layer for the blockchain industry. It is compatible with all EVM and Non-EVM blockchains, including IBC (Cosmos), Parachains (Polkadot), and Bitcoin-style blockchain networks (Litecoin, Dogecoin, etc.). In addition, Multichain is a leader in cross-chain DeFi, with some of the most impressive usage statistics of any bridge protocol.

Total Volume | Total TVL | Tokens Supported | Chains Supported |

$88B | $2.26B | 2,967 | 65 |

How it works

Cross-chain Router

Native Assets

A token is considered native when its functionality on a specific chain is supported by design. To facilitate native token bridging, Multichain utilizes liquidity pools on each respective chain. This is a popular technique to allow cross-chain bridging quickly and cheaply; however, the problem often arises when there is not enough liquidity on the destination chain to support a native transfer. The protocol compensates for this by minting a synthetic token with the “any” prefix.

When bridging native assets via Multichain, the following sequence occurs:

- The token (XYZ) is added to a pool on chain A

- An equal amount of anyXYZ tokens are minted on chain A

- The SMPC node network detects the newly minted anyXYZ tokens on chain A and mints the same amount on chain B, thereby burning the anyXYZ tokens on-chain A.

- The protocol then balances itself by comparing the ratio of XYZ tokens to anyXYZ tokens. If the number of XYZ tokens on chain B is greater than the anyXYZ created, they are sent to the user’s wallet on chain B before burning the excess anyXYZ tokens. If the number of XYZ tokens is less than the number of anyXYZ tokens, then the user is left with holding their anyXYZ tokens, which are redeemable for the native assets later when the liquidity pool is replenished.