Back-Office Dapps (Dapps for Business)

Introduction

Welcome back, everybody. It’s been another exciting week in crypto and we’re pleased to bring you the next edition of The Blockchain Review. Bitcoin and crypto continues to show high correlation with the traditional markets and they’ve continued to rally this week. With the US FED announcing the second consecutive 0.75% hike in the base interest rate, and by some measurements confirmation that their economy has gone into recession, then the positive market reaction might seem contrary to expectations.

For months the fear of a global slowdown or recession spurned selling in traditional markets. Crypto suffered further in the ensuing spiral of liquidations of individuals and entities who were overleveraged or poorly managed. This can be seen as a symptom of an unregulated and still maturing market with few checks and balances on how much leverage can be taken on positions.

The impact has been devastating for some, and anybody adversely affected will do well to learn from their mistakes and remember how important good risk management is for the future. Over the long term this ‘clear out’ will be seen as a natural consequence of the gradual maturation of the crypto markets, as well as a reaction to the macro conditions. And the macro cycles will continue.

By most economists’ definitions a recession is dictated by 2 consecutive quarters of negative growth in GDP and we finally got confirmation that the US has had this negative growth, yet markets have rallied. Firstly this is a lagging indicator which shows results of what has already happened. Secondly, this is a very crude indicator and doesn’t give a detailed view of how the economy is faring.

Rather than follow the textbook definition of a recession some economists prefer not to rely only on GDP, but also rate the strength of an economy by other metrics such as jobs available, and employment rate. The US Treasury Secretary Janet Yellen came out with the opinion that the US isn’t in recession and that the economy is exceptionally strong. Let’s remember that no government would want the economy to be seen as weak, especially heading into mid-term elections which take place at the end of the year.

But let’s also keep all of this in perspective. It’s been an exceptional two and a half years. It was never easy to predict how the macro conditions would play out. We’ve always taken the position that it’s long term progress of the blockchain industry that’s most important, so what definition we use to determine a recession matters less. However, the markets care a lot, and it doesn’t take much to shift the sentiment!

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge.

It’s likely the markets have rallied at this opportunity as a predictor that inflation has already peaked and even with reduction in GDP the economy is strong enough for a so-called soft landing following several months of interest rate rises. The ever so slightly more dovish tone from the Federal Reserve was enough to get things going.

Dovish in this context means lighter control from the FED, like the slowing of interest rate rises and reduction or cessation of quantitative tightening measures. The market is trying to get a head start for what then happens next in the control cycle- a return to quantitative easing aka. money printing. As we’ve seen in the past when there’s excess capital available it provides the fuel for continued growth and a return to all time highs becomes feasible once again.

We’ll always provide you with our research to help with your education. We’ll keep close track of the main developments and evolution of the niches in blockchain so that you get the best of the new knowledge. When you’ve finished reading your report then please remember to fill out the feedback form, your research is valued and we’re always open to suggestions.

With Great Respect,

Ivan Liljeqvist

Cryptocurrency Market Overview and Analysis

July 29th, 2022 08:30 UTC

For those new to my analysis, I do trend trading over long timeframes.

Global tech only has two outcomes: Giant success or catastrophic failure. Tech either does a 100x or goes to zero, with little in-between. Before reaching either end point, the asset price will trend for extended periods.

My process aims to give exposure during those periods of established trends. That way I can enter with more capital for any given risk, compared to a hold only approach. I don’t try to catch tops or bottoms. I don’t worry about intraday

movements. My style of analysis is not suitable for day traders or range traders. When it comes to tech, the big gains come from catching big moves over long periods

of time.

This is an analysis at one moment in time. Market structure can change in an instant. When presented with new information,

I will adjust my opinion accordingly.

Disclosure: I hold Bitcoin, Ethereum, Luna and Solana ETP price tracker certificates in ISK through my bank. Through company ownership I also hold small exposure to misc. additional tokens.

Trend Analysis

Bitcoin (BTC)

Bitcoin continues to follow other risk-on assets...

Ethereum (ETH)

ETH is in a good mood...

Binance (BNB)

Binance the company has really shown strength...

Cardano (ADA)

ADA/BTC has failed to rally...

Solana(SOL)

Larsson Line remains grey...

Bitcoin (DOMINANCE)

Bitcoin dominance remains range bound...

(BTC)

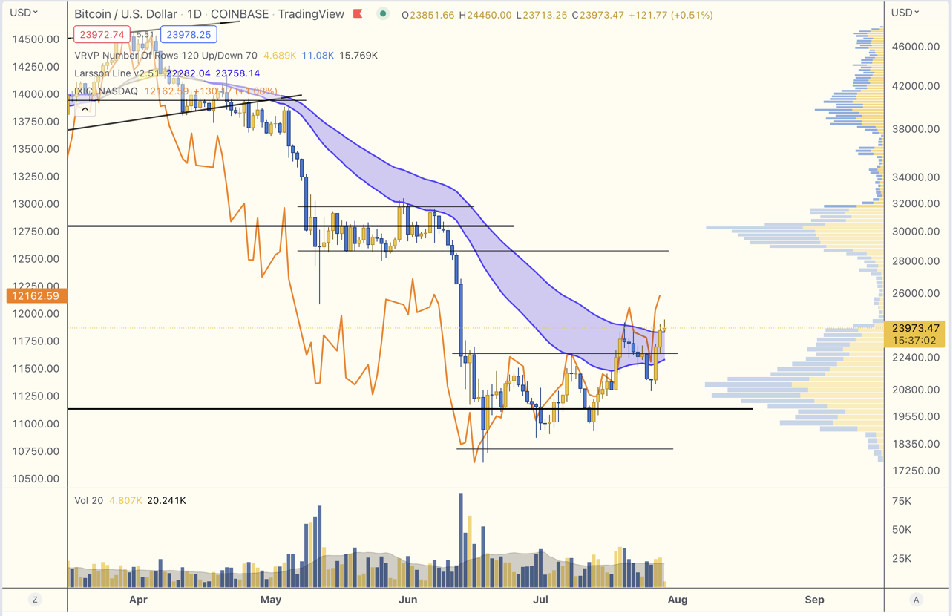

Bitcoin continues to follow other risk-on assets with only small deviation in amplitude and timing.

With that in mind, the answer to whether Bitcoin has bottomed or not is probably found in whether the larger risk-on markets have bottomed or not. Consequently, at this point, we need to

not only outsmart the rest of the crypto market, but the entire world to catch an entry as close to the bottom as possible. Remember if something was obviously going to happen, it would already be priced in.

The truth is that we don’t know. I listened to a macro economics professor yesterday who said that we have never experienced quite this situation in modern times, so there is no real guide book to how this will all play out with regards to inflation, interest rates and markets. I don’t claim to understand macro economics better than a professor in macro economics.

I think the best we can do here is to be humble and play the scenario that happens, and be diligent with stop loss if the scenario we thought we are in suddenly doesn’t play along any more.

Most people on social media who have been totally wrong throughout the past 1-2 years seem to have learned nothing. They are still sure of what will happen tomorrow. I am not.

- I do think it’s possible that this becomes “the shortest ever bear market”, that the political incentives to turn the markets around before the next round of elections are so strong that they will somehow find a way to do it while shoving the problems forward to “later”.

- I also think it’s possible that we are still only halfway down the decline, and that relief rallies will fail. Stock markets vs GDP are still at historically very high valuation levels, even after the decline that has already happened.

- Then there is gold. The gold chart actually looks good here. If Bitcoin truly is digital gold and gold gets a real run from here, could that help Bitcoin too? Seems reasonable to me.

- Finally there is the consideration of timeframes. Since I started dabbling with my indicator systems which finally became the Larsson Line in 2018, the optimal timeframe to catch the true underlying trend in crypto vs USD has been the 1D (daily) candles. Since the world is accelerating (change happens faster and faster) I fully expected the optimal timeframe to shorten. I thought that would already have happened, in 2019 or 2020 or 2021, but it hasn’t. Is now the time? Larsson Line is still down on the daily candles for BTC/USD but it has turned neutral on one stop shorter timeframes, meaning 12h candles. Looking back during the past year or so, performance has been similar with 12h. It’s at least worth serious consideration when the gold flip happens on 12h. Though any entry I try here will come with diligent stop-loss execution, because I’m not confident the bear market is over yet.

Web3 Wallet: Start Guide

Metamask Wallet

In this overview we are using Metamask, the most popular Web3 wallet and ID system. Alternative methods do exist but are not explained in this overview. For a more detailed tutorial navigate to Moralis Blog.

STEP 1 Download and install the Metamask wallet

Bitcoin dominance remains range bound, as drawn below.

A range can break out in either direction and it’s usually a mistake to try to guess in which direction, before it has actually happened.

At one point it will, and that will be my clue for how to position myself between BTC and alts for the next major move of the markets.

The chart is here shown with 3 day candles.

STEP 2 Get Started

Once downloaded and installed, we are presented the option to [Get Started].

STEP 3 Import or create new wallet

Once downloaded and installed, we are presented the option to [Get Started].

STEP 4 Opt out of Data collection

Once downloaded and installed, we are presented the option to [Get Started].

STEP 5 Set up your password

Next we must specify a password for our wallet, this password will be used when signing transactions (we specify a password and agree to terms in order to continue). This is not a private key.

STEP 6 Watch the instructional video

Next, the wallet displays an instructional video on seed key security. The video is highly recommended for new users, or anyone generating a seed for the first time.

STEP 7 Create your seed phrase

Selecting the [Next] button, prompts the generation of a new seed phrase, a related warning is displayed.

STEP 8 Verify your seed phrase

After revealing our seed phrase and storing it securely, the [Next] button becomes selectable. Proceeding from here, we are asked to confirm the phrase as a final security check, to make sure that you have stored the seed phrase accurately. By simply selecting the words in the correct order, our seed phrase is verified, and the [Confirm] button becomes selectable.

STEP 9 Complete wallet setup

Once selected, the final confirmation page indicates that our wallet setup is now complete. Here we select [All Done] and our wallet is ready.

STEP 10 Start using your wallet

When looking to receive funds (cryptocurrency or NFTs), the public address can easily be copied from the top of the browser extension wallet.

Back-Office Dapps

New decentralized applications are being developed every day to meet the needs of individuals and businesses. Competition among SaaS providers is already incredibly high and the introduction of new permissionless SaaS alternatives powered by blockchain technology is about to give Web2 platforms a run for their money. In this report, we aim to identify a few back-office applications that are powered by decentralized technologies. These Web3 alternatives offer more secure, verifiable, and affordable solutions than their centralized counterparts.