Bankers see cryptocurrencies as an existential threat. Follow us as we explore the reasons why banks don’t like cryptocurrencies, but before digging into why banks want to ban or regulate crypto, let’s first look at the traditional role of banking.

Banks Role in the Economy

Before banks came along, people had to keep their precious metals with them at all times. Paying for goods and services was awkward, and people could have their wealth wiped out in one theft or robbery.

However, with the invention of banks, people had a place to store their gold and receive paper notes in exchange. Paper currency was much easier to carry and use for transactions. Even though the paper itself was worthless, the denominations represented the reserves held by the bank. They carried value.

Want to read more about other crypto topics such as What is Phantom Wallet? Find all our articles on the blog, where we post articles on a daily basis.

Fractional Reserve System

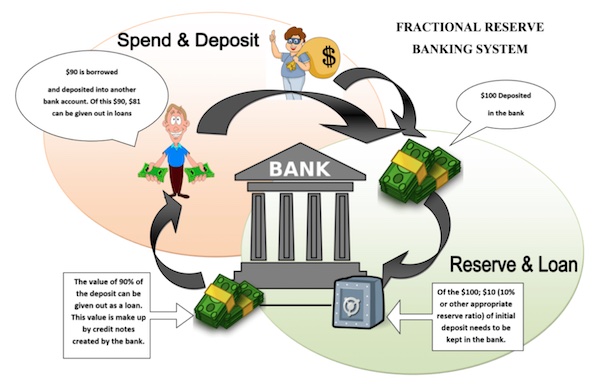

What bankers soon learned, though, was that people rarely came to take all their assets out of the bank at once, so purchases were sitting idly. Bankers saw that as a tremendous waste. So, they began charging interest for lending out currency based on the assets held. Greed eventually set in, however, and banks began lending more cash than the assets they had to back them up. This situation led to problems when economic downturns caused debtors to default on their loans en masse.

So bankers organized central banks to bail them out when their risky lending practices got clipped by a black swan event that negated borrowers’ ability to repay their loans.

The Power of Centralization

Smaller retail banks only had to keep a fraction of their deposit reserves on hand, with big central banks waiting in the wings. The rest they could lend out to make more interest. The central bank thus became an insurance policy.

Centralized systems like central banking come with advantages and disadvantages. One of the positives is that retail banks backed by a trusted central bank-issued currency carry universal value.

Advocates for central banking point to the “bank runs” of old that caused convulsions throughout the U.S. economy. Before the Federal Reserve (Fed) came into being, municipal corporations could issue various currencies with no solid justification for their valuations.

U.S. Central Bank History

Going back a couple of hundred years, the National Currency Act of 1863 and the National Bank Act of 1864 laid the groundwork for the centralized Federal Reserve system that came afterward in 1913. Along with it came promises to bring financial stability to the economy.

However, the problem with the Fed is that decision-making power is concentrated in the hands of a few. This centralized distribution of power has brought us debilitating recessions and financial havoc.

For example, before the Fed, if a bank in Missouri churned out a bunch of dodgy loans and crashed, the local townspeople suffered. But the ensuing bank run and financial calamity stayed local.

When the Fed mismanages the money supply, the entire U.S. suffers. Further, because so many other countries worldwide are affected by the U.S. economy, a ripple effect ensues.

The Great Depression and the 2008 Financial Crisis

An example is the Great Depression. It was the most significant financial crash in U.S. history. The whole fiasco resulted from mismanaged economic policy and poor decisions by the Fed’s reserve banks. In 2008, the Fed helped tank the economy with loose interest rates. The result was moral hazards galore when banks that engaged in ultra risky investments got bailed out with no consequences.

Central bank apologists maintain they’re vital to keeping the economy afloat with stable prices and are the best institution to prop up the financial system in times of crisis.

Critics of the system think the opposite. They contend that institutional banking has harmed the economy and is responsible for debilitating recessions.

Central Banks Role in the Economy

Nowadays, central bank mandates vary between countries. But their policies drive the entire global financial system. Among other things, they create monetary policy and manipulate interest rates and the money supply in the U.S. The Fed calls the shots to control employment levels and inflation. Likewise, the Bank of England operates the financial system in the U.K.

They distribute money via a network of banks like spokes on a wheel. So, if a country’s economy is sluggish, the central bank can increase the quantity of money circulating to get people spending again. When the economy gets running too hot with inflation, the bank can raise interest rates to cool things off. Thus, their policy mandates trickle down through the system and are responsible for economic booms and busts.

Modern-Day Banking

The modern financial system has evolved into a complex infrastructure that has further complicated central banks’ role in the economy.

As money gets more digital, it circulates through the global economy quicker. As such, modern financial products and transactions are more abstract and complicated. Again, the most recent crash in 2008 is an example of this complexity.

Various academics, reporters, and financial analysts point to exotic derivative trading as the culprit. Insolvent borrowers got their dodgy loans repackaged into more complex products that made them seem more attractive to prospective investors. Banks painted lipstick on many pigs before selling them to unsuspecting buyers, who in turn resold them around the world.

Before the bubble burst, it was one big profit party. Citigroup CEO, Chuck Prince, encapsulated the period with his quip, “as long as the music’s playing, you’ve got to get up and dance. We are still dancing.”

When the dancing stopped, however, working people throughout the world suffered. All in all, this interconnected global economy demonstrated that one central bank’s poor decisions matriculate across many nation-states. It didn’t take long for the Great Recession of 2008 in the U.S. to leapfrog across continents and contribute to a global downturn in the markets.

Bitcoin to the Rescue

The invention of Bitcoin was a direct response to this crisis in 2008. If you’re wondering why banks don’t like cryptocurrencies, it all started with Satoshi Nakamoto’s creation. Learn about Bitcoin mining companies here.

With its decentralized blockchain technology, Bitcoin’s creator(s) hoped to dismantle the tired, old, central banking system that has way too much influence in negatively impacting the economic fortunes of entire nation-states. Moreover, with its restricted supply of only 21 million Bitcoin, the cap means developers can’t print more of it whenever they get their tail in a crack and need stimulus.

The reason why banks don’t like cryptocurrencies (and more specifically, the first cryptocurrency) is that Satoshi Nakamoto created Bitcoin as an alternative to central bank domination. It serves as a peer-to-peer version of digital cash whereby users can send payments directly to each other without going through a financial institution.

The scarcity factor was purposeful. The 21-million cap prevents future central banker types from printing money out of thin air and flooding the economy with it. Nothing could be more antithetical to their system.

Learn about Bitcoin at Moralis Academy.

Why Banks Don’t Like Cryptocurrencies – the Bitcoin Solution

1. Counterfeit Currency

Bitcoin eliminates the double-spending problem since Bitcoin is cryptographically secure and unique. That means it can’t be hacked or counterfeited.

2. Trustless

Bitcoin is decentralized, and transactions get approved by nodes spread out across its network, thus taking power out of the hands of the few.

3. Decentralized

There’s no need for a centralized infrastructure with third-party intermediaries. Peer-to-peer transfers between two addresses occur on Bitcoin’s blockchain without the help of bankers.

Therefore, the old chain of banks in a network chartered by central control is no longer necessary for cryptocurrency distribution. Is it starting to make sense why banks don’t like cryptocurrencies?

Some Drawbacks to Crypto

Crypto promises economic freedom, but there is a catch, well, actually several: Since Bitcoin’s release to the public, consumers still don’t use crypto as a medium of exchange. Firstly, people expect their crypto to increase in value, so they want to hold it, not spend it on everyday items. Furthermore, volatile price swings make it difficult for people to use in daily transactions even if they want to.

Bitcoin is the largest cryptocurrency by market cap, but most nations still suspect it. India is working to ban crypto, and China is routinely cracking down on Bitcoin in some form or fashion. Even Britain just banned Bitcoin ATMs. Only El Salvador considers Bitcoin to be a legal currency. So, mass adoption as a medium of exchange still seems far off.

Nevertheless, Bitcoin’s issues have not stopped central banks from copying some features for their digital currencies.

CBDCs

At first, banking authorities tried to ban crypto, but now they’re saying, “If you can’t beat them, join them.” Imitation is the sincerest form of flattery, and banks are working to create their central bank digital currencies (CBDCs).

CBDCs are central bank digital currencies to use in their economy, and banks in various countries are in different stages with their progress. JPMorgan started its digital currency in 2019, while others are still tinkering with the idea. But banks will have to up their game to prevent DeFi platforms on Ethereum from continuing to race past them. That said, more central banks will likely introduce their CBDCs to try and compete.

After all, CBDCs are a boon for central bankers. They can capitalize on the best parts of the technology while eliminating decentralization and scarcity. More importantly, governments will salivate over the possibility of its central bank tracking every expenditure of its citizens.

Learn about DeFi by taking the Master DeFi in 2022 course at Moralis Academy.

If You Can’t Beat Them, Join Them

Most people agree that all assets will move to a digital format in the future. After bankers failed to shut crypto down with earlier lobbying efforts, their latest strategy is to co-opt what they like best about blockchain solutions to avoid going extinct.

Their strategy is two-pronged: Experiment with digital currencies while lobbying politicians to implement regulations to hamstring the competition. After all, banks are nervous. A decentralized and private way for individuals to trade freely worldwide without third-party intermediaries regulating and controlling them is antithetical to how banks operate.

They rule the present-day global financial infrastructure, with most countries bowing to their authority to manage their economies. That’s why banks don’t like cryptocurrencies. They are the dreaded competition that could eliminate banks’ stranglehold on the financial system.

Can Crypto Replace Banks?

Yes, cryptocurrencies could one day replace fiat as not only a store of value but also a medium of exchange. Further, decentralized blockchains could one day replace banking with better security, faster transactions, and lower fees. With DeFi, users can already lend, borrow, make payments and raise capital, and it’s only just getting started.

Read about the most expensive NFTs sold.

Crypto pioneers believe its decentralized economy is already more efficient. But will crypto ever replace banks? Big banks and big governments are affable bedfellows and wield the most power in the world. So, it’s probably naive to think they’ll gladly stand by and let it happen without a fight.

Bankers have a lot more funds available to fill the pockets of key politicians in a lobbying effort to help pass laws favorable to them. Nonetheless, they have to be careful not to get too heavy-handed, which could cause a backlash.

That’s because the public at large appreciates innovation and wants solutions to their problems. The growing interest in crypto from individuals to institutional investors is bringing the world to a financial tipping point. The average person feels like they have a shot at creating exorbitant wealth with crypto investments, while the old system seems rigged.

Avid Investors Migrate to Cryptocurrencies

Multiple thousand percent ROIs are possible in crypto, and this factor alone has brought short-term speculators and long-term holders of value cryptos like Bitcoin and Ethereum alike.

Ages 25-34. This younger demographic, in particular, is more likely to participate in crypto. 58% of cryptocurrency owners belong in this age group based on a 2021 survey.

One study concluded that 27% of 18-34-year-olds prefer Bitcoin over traditional stocks. Younger investors are more impatient for sky-high returns and less averse to volatility than their elders. Losing investment dollars from this energetic, youthful market segment is another reason why banks don’t like cryptocurrencies.

See the top crypto YouTube channels.

Why Banks Don’t Like Cryptocurrencies – Summary

Blockchain technology and cryptocurrencies are forcing the banking system to evolve. Banks know their power and influence are waning and will do anything their position in the world.

Whether cryptocurrencies will ultimately ruin and replace the banking system remains to be seen. One thing’s for sure. They offer a worthy alternative. And that is reason enough as to why banks don’t like cryptocurrencies.

Ready to learn more? Take the Crypto for Beginners course at Moralis Academy today!