As we dive into the core of today’s article, we’ll first cover the basics of the project behind the WINR token – WINR Protocol. So, you’ll get to find out what the protocol is all about, what its unique aspects are, and how it operates. Then, we’ll focus on the WINR crypto asset. Again, we’ll cover the basics first and then proceed to specifics. In doing so, we’ll look at WINR’s tokenomics, use cases, and more.

Next, we’ll shift our attention toward the WINR token price. We’ll first look at the asset’s entire price action. Then, we’ll use the basics of technical analysis (TA) to determine some WINR token support and resistance levels. These levels and using some other tools will help us speculate on some of the asset’s price predictions.

In the last part of today’s article, we’ll focus on helping you determine if you should buy $WINR. This is where you’ll learn how Moralis Money makes that decision a whole lot simpler. And, for those of you who may decide to get a bag of WINR, we’ll also explain where and how to do so.

What is WINR Protocol? Exploring the Decentralized On-Chain iGaming Infrastructure

WINR Protocol is a crypto project that provides smart contract tools, a liquidity engine, and an incentive framework for other developers and projects wanting to step into the Web3 iGaming realm. Or, as the project’s official website states: “WINR protocol is a decentralized on-chain iGaming infrastructure.”

By using the WINR SDK, developers can plug their games into the project’s deep multi-asset liquidity pool. Plus, the protocol’s incentive framework allows them to incentivize their players and themselves as builders.

Essentially, WINR Protocol allows other projects to easily utilize the protocol’s infrastructure to implement Web3 functionalities. As such, these projects can focus on creating exciting and engaging games and not worry about the “Web3” aspects of their iGaming venture.

What Problems Does the WINR Crypto Project Solve?

According to the project’s official website, there are four specific aspects that the WINR crypto project solves.

First, it delivers a transparent liquidity engine. In turn, it prevents fractionalized liquidity; it takes the load off of new Web3 iGaming platforms in order to attract new liquidity pools (LPs).

Second, this protocol helps other projects cut development costs. As a result, by using WINR’s smart contract SDKs and on-chain tools, projects can save on expenses.

Third, the protocol claims to ensure that platforms built using its tech are provably fair. It does so by offering transparent and verified tools and the process of approval executed by the WINR DAO.

Fourth, projects interested in entering the Web3 iGaming arena get to avoid the need to create new tokenomics. Instead, they get to plug into the WINR tokenomics. By doing so, the WINR ecosystem also covers their marketing needs.

How Does it Work?

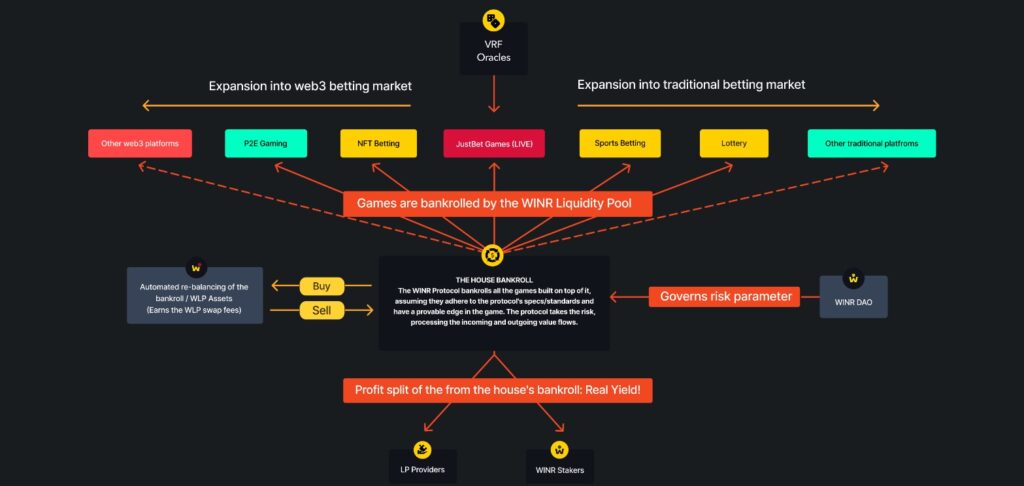

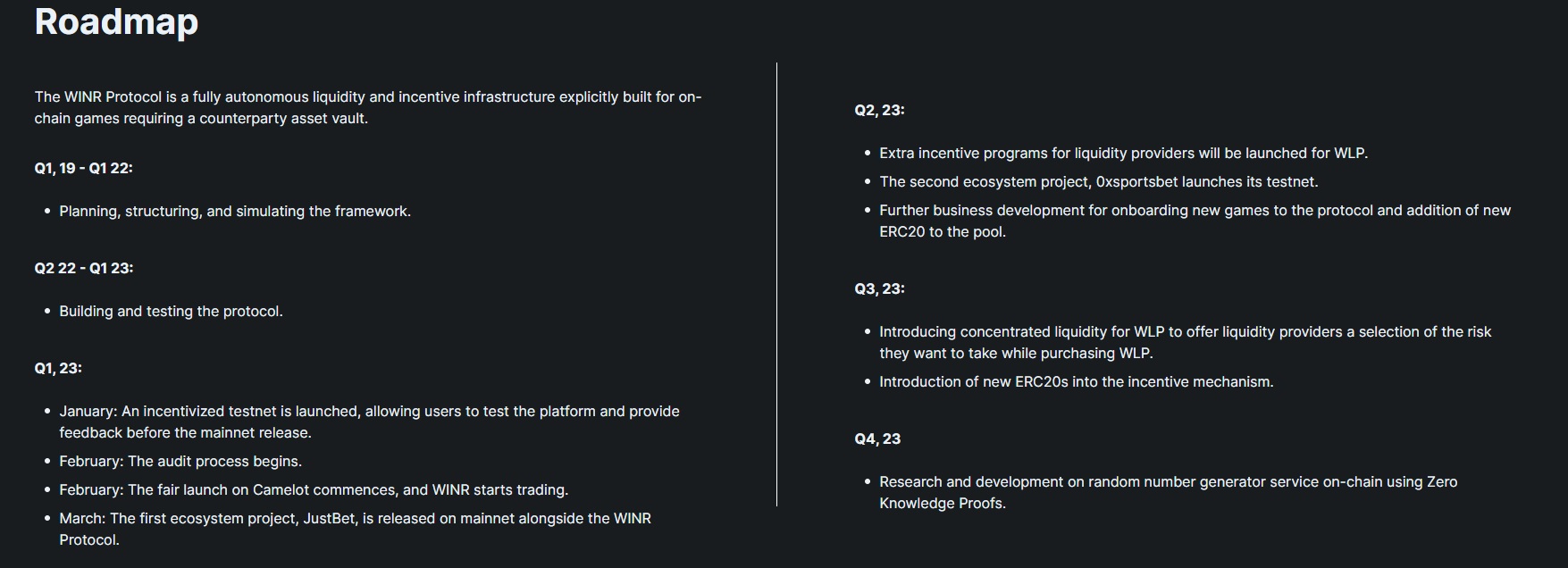

As outlined in the above image, here’s how WINR Protocol works:

- Projects build their on-chain game using the WINR SDK.

- They propose their games to the WINR DAO.

- Once the WINR DAO approves it, they plug their games into WINR Protocol.

- The projects then incentivize gamers through $WINR.

- The protocol and the game’s builders get to enjoy shared revenue.

- Projects that plug into the protocol become part of a growing ecosystem.

The “winr.games” website further explains that projects built using WINR’s tech use WINR’s WLP bankroll and WING game engine. However, projects are in complete control over their UX/UI.

At the time of writing, the protocol’s official website lists three dapps currently using WINR tech. One is already live, and it’s known as JustBet, while two other projects, 0xsportsbet and DegensBet, are set to launch relatively soon.

According to the protocol’s documentation, projects building on top of WINR’s smart contracts also have the opportunity to leverage WINR games. But what are WINR games? Well, these are popular Web2 games modified for Web3. Essentially, WINR games allow projects to expand their Web2 user acquisition reach.

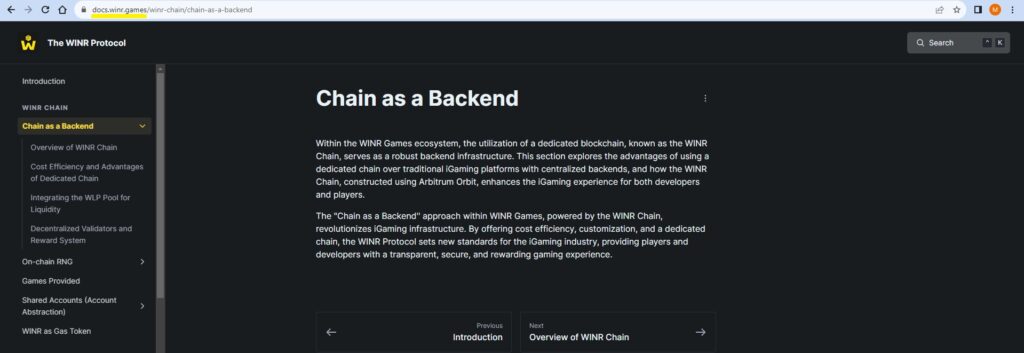

From a technical perspective, the WINR crypto project presents its backend as WINR Chain. The latter is the backbone of the protocol’s infrastructure, and it was constructed using Arbitrum Orbit.

Note: If you wish to dive deeper into the technical aspects of WINR Chain, the WINR liquidity pool, and the WINR game engine, make sure to explore the protocol’s docs:

Community and Roadmap

Unless you are new to crypto, you know that communities for projects are a great source of helpful information. And the more decentralized the project, the greater the role of its community.

So, if you wish to get involved with the WINR community, you ought to follow its X account, join its Discord server and Telegram channel, and explore the WINR GitHub repo. You can find links to all these outlets on the project’s official website.

Here’s also the protocol’s roadmap:

What is the WINR Cryptocurrency?

The WINR token is WINR Protocol’s native cryptocurrency. It is an essential part of the mechanics of the entire WINR ecosystem, particularly of the protocol’s incentive model.

With that said, it’s important to get better acquainted with this crypto if you wish to know what WINR is all about. As such, make sure to look at the coin’s tokenomics and its use cases, which we cover below.

Tokenomics of the WINR Token

- Symbol/ticker: WINR or $WINR

- Network: Arbitrum

- Token type: ERC-20

- Smart contract address: 0xD77B108d4f6cefaa0Cae9506A934e825BEccA46E

- Minting timestamp: March 5, 2023, 06:02:02 PM (+UTC)

- Maximum total supply: 1,000,000,000 $WINR

- Tokens are minted over time via generation events

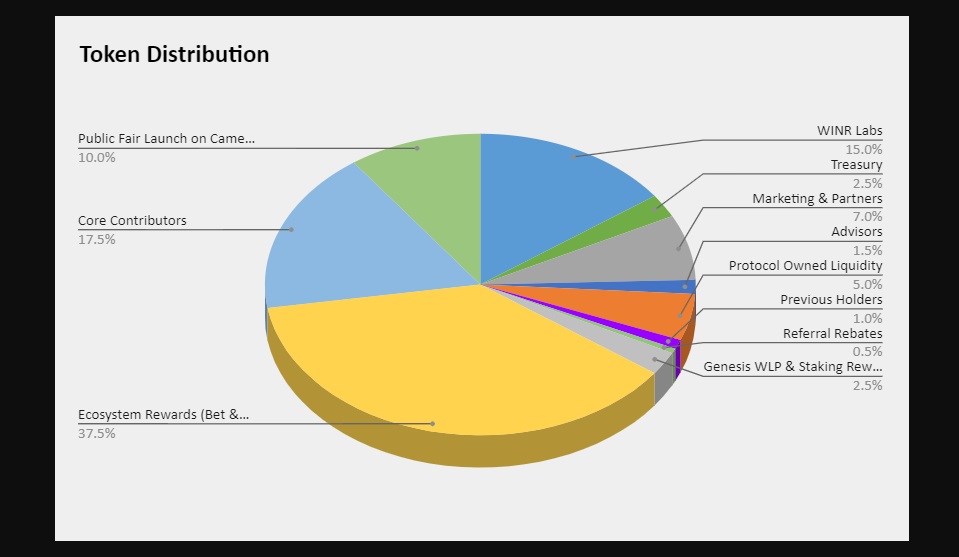

- Token distribution (see image below):

Note: More details regarding WINR’s tokenomics await you in the protocol’s docs.

WINR Crypto Role and Use Cases Within WINR Protocol

The role of the WINR token is multi-fold. Users can stake WINR and earn tokens, and WINR serves as a gas token on the layer-3 WINR Chain and grants governance rights.

As outlined above, a large portion of WINR’s total supply is allocated to the ecosystem’s rewards. The latter is done via the vWINR token, which is the vested (v) version of WINR.

Users can stake both WINR and vWINR to earn real yield in the form of WLP, which represents the underlying assets in the WINR liquidity pool. The addresses that stake these tokens are eligible to participate in WINR DAO voting proposals.

WINR, as a gas token, covers transaction fees, and the protocol’s mechanics burn a portion of WINR used in each transaction. As such, this creates a deflationary mechanism to enhance the token’s long-term value. This further means that any project building on top of WINR Chain gets to use WINR as the medium to cover transaction fees.

Note: To explore the use cases of the WINR token, dive into the protocol’s documentation. This is particularly important if you wish to use WINR games or build your unique games on top of WINR Chain.

WINR Token Price Analysis

The above chart covers the entire history of the WINR token price. As you can see, the token started to trade on March 16, 2023, at $0.04-ish. Over the five days following the token’s listing, its value increased by nearly 200%, reaching as high as $0.12-ish.

However, the initial asset’s momentum ran out at the level mentioned earlier, and the WINR token price took a downturn. It first bounced off of the $0.07-ish level, but eventually, it went significantly lower than that. After setting new lows at $0.03-ish in mid-May 2023, $WINR nearly doubled its price. But the $0.06-ish level rejected the WINR token price, which set the asset on another down-trending path. This time, $WINR found its bottom at $0.012-ish on July 20, 2023.

Next, the chart printed a clear double-bottom pattern, which played out in early August 2023. This took the WINR token price up to $0.07-ish. However, these new local lows couldn’t hold, and the price returned to the lower regions. First, it bounced off the $0.036-$0.04-ish region. But eventually, it went again as low as $0.023-ish on September 9, 2023.

Since the aforementioned low, WINR’s price managed to reclaim its position above the $0.03-ish level. At the time of writing, the asset sits just above that support, fluctuating around $0.034-ish.

WINR Token Price Forecast

Compared to some other crypto gambling tokens, the WINT crypto asset’s performance so far is far from impressive. But it’s worth pointing out that WINR games and projects using the protocol are just getting started. And that could spur the token’s growth.

Looking at the above chart, you can also see that the WINR price broke out of a descending trendline (white line) and is currently retesting it. So, it is likely for the price to go higher from the current level. Of course, for that scenario to unfold, the rest of the crypto market must show some strength.

So, if WINR were to go higher, the above-outlined levels of significance (blue line) are the most likely price targets. However, if the crypto market were to plunge further, the $0.023-ish and $0.013-ish supports would come into play.

As for the WINR price in the upcoming bull market, given the current popularity of Web3 iGaming, there’s more upside potential. As such, it is highly likely that $WINR will manage to break above its current ATH level. And based on the Fibonacci retracement tool, the asset could reach $0.46-ish.

However, at the time of writing, WINR still has a meager market cap, which gives it a lot of room to grow. So, a 100x or more price increase might be possible for $WINR.

Buy the WINR Token – Where, How, and Should You

The above sections should help you determine whether or not the WINR crypto project and its native token interest you. If not, then you can leave this Web3 iGambling ecosystem in your rearview mirror and focus on other altcoin opportunities.

However, if you find WINR interesting, you should decide if you should buy it. In case you decide to take that path, you’ll also want to be able to know when, where, and how to do so. And that’s exactly what the following sections will help you with.

Should You Invest in WINR Protocol?

Presuming you find WINR interesting, then you need to research the token further to answer the above question with confidence. And the best place to do that comes in the form of the Moralis Money $WINR token page.

On that page, you can find all the links to the project’s outlets that you may use to further explore the project. By investigating further, you can decide whether or not you should buy it.

Plus, the page provides other useful resources and tools, including the token’s price chart and the asset’s real-time, on-chain metrics (a.k.a. alpha metrics). Moreover, it is the combination of these two insights that will allow you to determine when to buy the token.

So, follow the above “$WINR” link or use the interactive widget below to properly research this cryptocurrency:

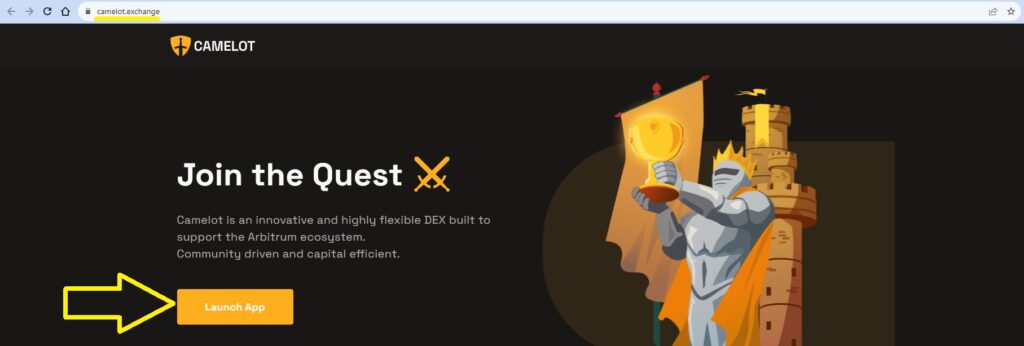

Where Can You Buy the $WINR Token?

While there are a couple of markets where you can buy WINR, Camelot is the only one with significant trading volume. This is a popular DEX on the Arbitrum network that anyone with internet access can visit.

How to Buy WINR Protocol ($WINR)

To buy the WINR crypto token, you’ll need an EVM-compatible Web3 wallet (e.g., MetaMask). You’ll also need to ensure you add the Arbitrum network to your wallet in order to be able to buy $WINR. Plus, make sure to have enough ETH or ARB in that wallet.

To access the Camelot swap, you need to hit the “Launch App” button on the “camelot.exchange” page:

Once inside the app, connect your Web3 wallet. You also need to select the token you want to use to buy $WINR as well as the target asset itself. To avoid landing on a scammy trading pair, use the above-provided smart contract address and paste it into the search bar. Then, enter the amount you wish to buy and execute the swap.

Note: If this is your first crypto-swapping feat, we encourage you to check out our step-by-step guide on how to swap ERC-20 tokens.

What’s the WINR Protocol iGaming Infrastructure and WINR Token? – Key Takeaways

- The WINR Protocol is a layer-3 blockchain network that facilitates the creation of Web3 iGaming projects.

- It allows projects to create their own games and use WINR’s incentive mechanism while also offering WINR games that projects can add to their arsenal.

- The protocol lives on top of the Arbitrum network.

- WINR crypto is the protocol’s native token with multiple use cases, such as covering gas fees, incentives, and governance.

- At the time of writing, the WINR token price sits at the lower end of the asset’s price range.

- If the popularity of crypto gambling coins continues to rage during the upcoming bull market, the price of WINR can go much higher.

- To determine if/when to buy $WINR, use Moralis Money’s page for that token.

- The only place where you can currently buy WINR is the Camelot DEX.

Whether you decide to buy WINR or not, you need to remember that there are countless other altcoin opportunities in various cryptocurrency categories. That said, if you wish to focus on crypto gambling tokens, you have several options (e.g., RLB, BAZED, BETS, etc.).

Still, the best way to make money is not by focusing on any particular token category. Instead, you should find the best altcoins at any given moment based on their real-time, on-chain metrics. And there’s no better tool for the job than Moralis Money’s Token Explorer.

Plus, you get to do this on all the leading chains, including Ethereum, BNB Smart Chain, Polygon, Arbitrum, and several others.

Learn more about how to get started with Token Explore in our guide on how to find the next coin to blow up. Also, if you are serious about your altcoin investments, don’t forget to lock in a Starter or Pro plan!