To kick things off, we’ll start by exploring the ins and outs of crypto FOMO. From there, we dive into some common factors causing the fear of missing out when trading crypto. Lastly, we explore the best solution to avoid crypto FOMO: Moralis Money – the ultimate crypto scanner!

With Moralis Money, you can easily find coins before they break out by picking and choosing between 15+ unique search parameters. For a little sneak peek, here’s how easy it is to generate a list of new coins gaining buy pressure:

What’s FOMO in Crypto? The Meaning of Crypto FOMO Explained

FOMO is an abbreviation for the fear of missing out. It refers to the anxiety or fear people experience when they feel like they’re missing out on profitable investment opportunities. As a response, traders act emotionally and make irrational investment decisions without proper research.

In the cryptocurrency world, FOMO occurs when a trader makes an irrational decision to invest or sell a token based on information received without verifying its accuracy. This often leads to investors buying assets at their peak or selling them at their lowest. This is, as you might already have figured, lousy practice since selling at the top and buying at the bottom is the preferred outcome.

What’s more, not only can FOMO in crypto cause financial problems, but it can additionally result in health hazards. When someone loses trading capital due to a bad investment, it can affect their mental health. This can, in turn, reflect on other aspects of their life, such as relationships, connections with family, etc.

As such, as you can imagine, it’s vital that you find a way to deal with FOMO, as it can impact multiple aspects of your life and has already been devastating for many!

Examples of FOMO in Crypto

FOMO is quite common within the cryptocurrency world. And there are multiple examples highlighting this problem. In this section, we’ll take a closer look at two cases where FOMO played an essential role:

- Dogecoin: A familiar crypto FOMO example is Dogecoin. Dogecoin is a so-called meme coin that, during 2021, experienced some volatile price movements due to Tesla CEO Elon Musk’s tweets.

On multiple occasions, Dogecoin both surged and plummeted, depending on the words of Musk. The price initially skyrocketed as he praised the coin, causing many people to invest. However, shortly after, his sentiment changed, which caused the price to slide by almost 30% in 24 hours.

As a result, the people that bought in due to FOMO when the coin peaked lost a significant portion of their original investment. In fact, only a couple of months after the peak, Dogecoin had already lost almost 90% of its value.

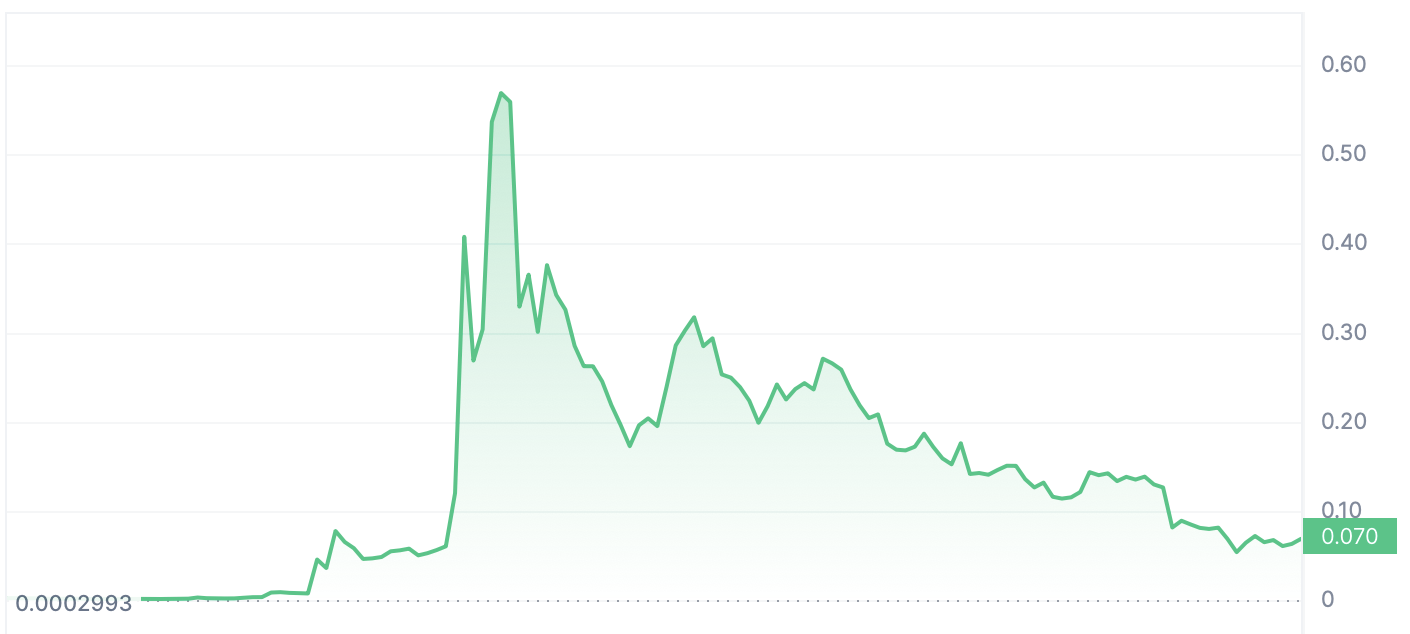

- PEPE Token: Another prominent example is the PEPE token that received an abundance of attention during the meme coin season of 2023. The token quickly emerged and broke out, giving early investors quite astonishing returns.

As you can imagine, the price surge induced FOMO, and many investors bought the token based on the hype. Unfortunately, the token took a turn for the worse shortly after, leaving people that bought at the top with devastating results. In only a few months, the price plummeted by almost 75%:

Don’t Fall Prey to Crypto FOMO when Altcoins Skyrocket

With a better understanding of what FOMO is and how devastating it can be, let’s try to understand how you can avoid trading emotionally. And to do so, it can be a good idea to identify and explore the causes of FOMO!

- Catching the Next Big Crypto: Major cryptocurrencies like Bitcoin and Ethereum have seen incredible growth since their inception. The idea of catching similar price rallies is a big reason people FOMO into new opportunities.

- Avoiding Losses: FOMO is often viewed from a profit-oriented perspective; however, the reverse is also true. Traders additionally experience FOMO when trying to prevent significant losses.

- Too Much Info: Information and data are crucial to making profits within the cryptocurrency space. However, too much information can also drive FOMO, mainly where there’s access to an abundance of data from several sources.

- Untested Market: Compared to the conventional stock market and foreign exchange, the crypto market is relatively new and untested. What’s more, it isn’t as regulated, and the barriers to entry are low. These factors lead to an influx of inexperienced people with a limited understanding of the market. And with limited knowledge, they’re often more prone to FOMO.

Signs of FOMO to Look For

Understanding some of the causes of FOMO is a great first step; however, detecting its signs is just as important. Here are a few behaviors that could indicate that you might be falling victim to FOMO:

- You feel the need to buy a cryptocurrency as soon as you hear that it has experienced a massive price rally.

- You only want to buy a token because it has surged in popularity.

- You’re obsessed with social media and only let the data from these outlets guide your investment decisions.

The three examples above illustrate how greed can drive you to make risky investment decisions based on emotion. Now, the big question is, how do you avoid FOMO?

The Solution on How to Avoid the Fear Of Missing Out When Trading Crypto

There are multiple ways to combat FOMO. This includes developing a solid altcoin trading strategy, relying on trusted media outlets, realizing that you can’t win them all, knowing that the market is cyclical, learning from previous mistakes, and much more!

However, one of the most important things you need to do to avoid FOMO is to do your own research (DYOR). You should not mindlessly trust the recommendations of others as you’re unaware of their motives and competency. Instead, take your time to DYOR to make more informed investment decisions based on irrefutable data.

But where do you start?

Well, professional traders leverage blockchain analytics tools like Moralis Money to get an edge in the market and find up-and-coming crypto before everyone else!

So, what is Moralis Money?

Moralis Money is the industry-leading crypto breakout scanner. It leverages irrefutable blockchain data in real time, giving your true market alpha. This means you can find the next 100x crypto before everyone else, making it the ultimate solution to avoid crypto FOMO!

One of Moralis Money’s core features is Token Explorer. With this tool, you get to combine 15+ unique search parameters to target tokens you’re looking for. This means you can set up a search strategy tailored to your needs as an investor and find the coins you’re looking for early before they break out and become mainstream.

So, how can you leverage Moralis Money to avoid crypto FOMO?

How to Avoid Crypto FOMO Using Moralis Money

In this section, we’ll explore how you can use Moralis Money to avoid the fear of missing out when trading crypto. In doing so, we’re going to show you how to create a search strategy targeting new coins with increasing buy pressure. And thanks to Token Explorer, we can do so in three straightforward steps:

- Step 1: To begin with, launch Token Explorer and add the Coin Age metric to filter for coins minted within the past month:

- Step 2: Next, let’s combine the Coin Age metric with the Experienced Net Buyers and Net Volume. With Experienced Net Buyers, you filter for coins gaining interest from other experienced buyers. And with Net Volume, you get coins with increasing buy pressure:

- Step 3: Combine the three metrics above with any additional filters to make your query even more unique.

By combining three straightforward metrics, you were able to generate a list of potential altcoin gems. What’s more, this list is based on irrefutable, real-time, on-chain data, which is one of the most valuable sources of information for you as a trader.

From here, you can now click on any of the coins in your list and be taken to its token page. On these pages, you find a bunch of information, including alpha metrics like net volume, net experienced buyers, holders, and liquidity, along with price charts, security information, and much more:

These token pages are the perfect place to start doing your own research so that you never again have to fall for the fear of missing out (FOMO) when trading crypto!

Beyond Avoiding the Fear of Missing Out – Trade Crypto Like a Pro with Moralis Money

Along with helping you avoid crypto FOMO, Moralis Money also has additional use cases making it the ultimate tool for crypto traders. To further highlight the value of this tool, let’s explore some other benefits and features of Moralis Money!

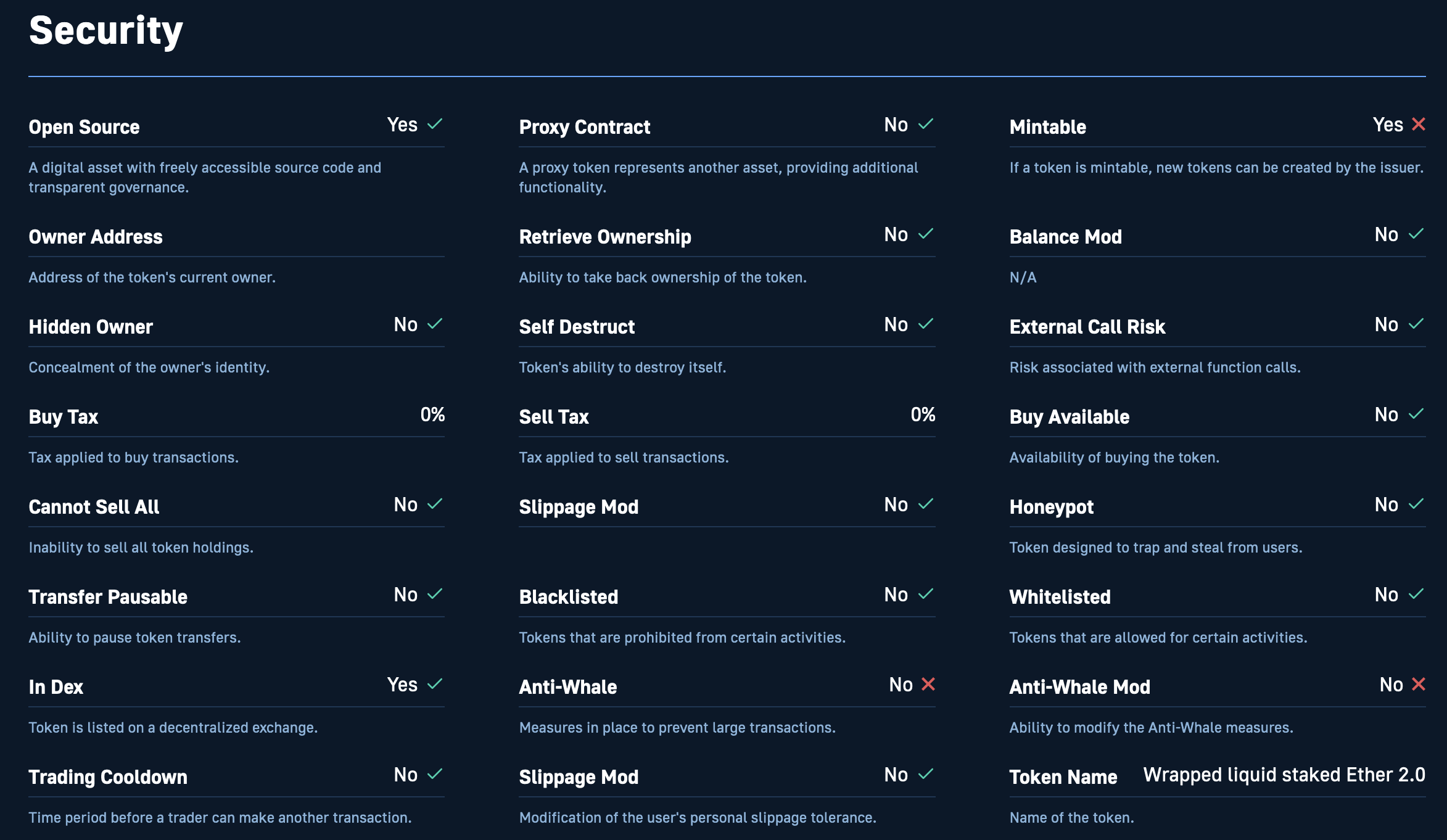

- Token Shield: While Token Explorer helps you avoid the fear of missing out when trading crypto, Token Shield helps you stay safe from scams. The Token Shield feature provides a comprehensive security evaluation for all coins. For a detailed breakdown, visit a token’s token page and scroll down to the ”Security” section:

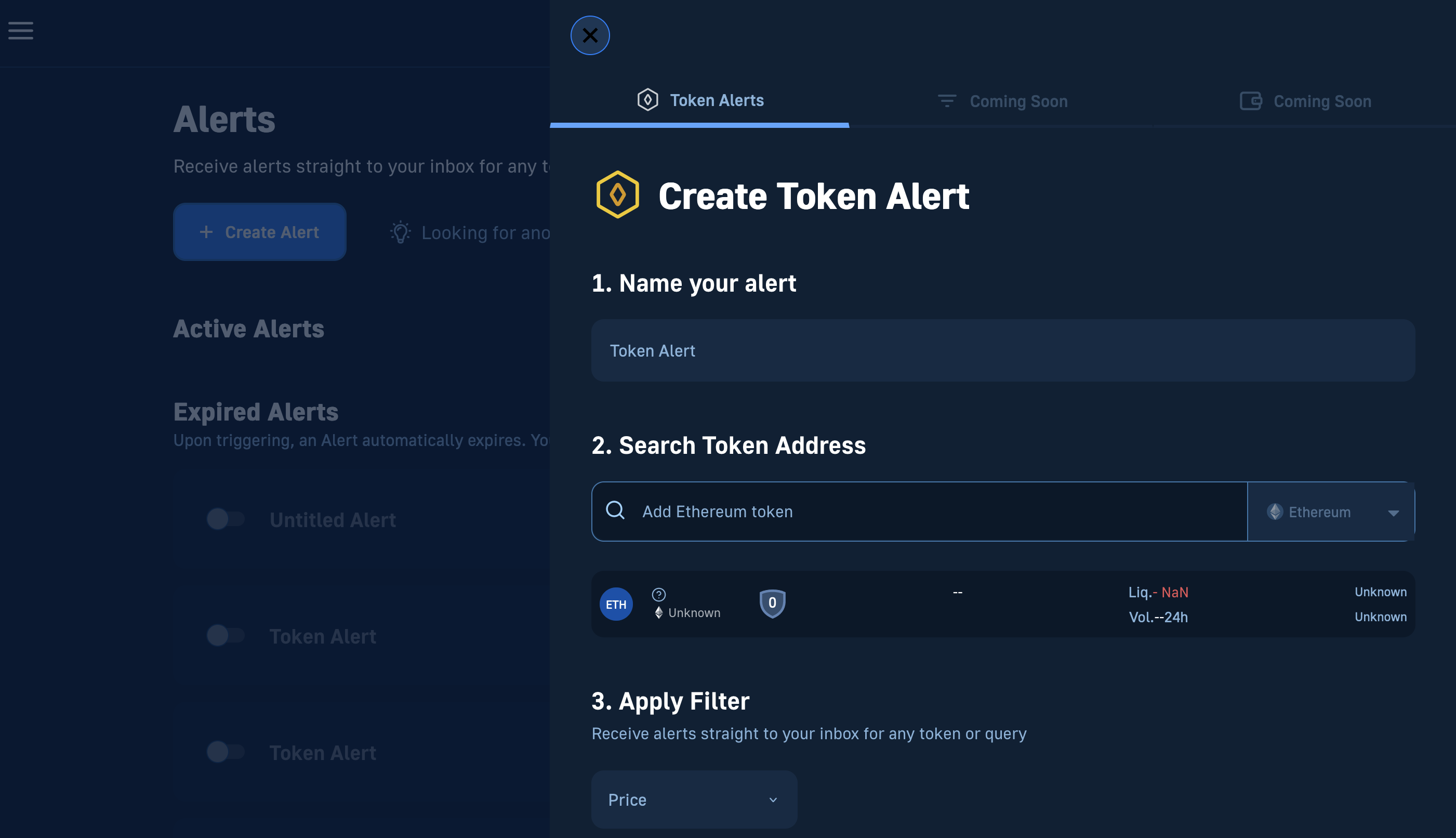

- Token Alerts: With Token Alerts, you can effortlessly set up email notifications to monitor the market and individual tokens even when you aren’t actively trading. This means you’ll never again miss an opportunity and can act on all promising altcoins. To set up an alert, simply go to the ”Alerts” tab:

- Cross-Chain Compatibility: Moralis Money is also equipped with cross-chain compatibility. And among the supported networks, you’ll find Ethereum, BNB Smart Chain (BSC), Arbitrum, Polygon, and others.

- Crypto Swap: In combination with the ability to avoid crypto FOMO by finding new tokens before everyone else, you can also buy crypto directly through Moralis Money. Moralis Money is the industry’s best altcoin exchange, and thanks to the 1inch DEX aggregator, it’s also one of the cheapest crypto swap platforms available.

- Portfolio Manager: With the crypto portfolio manager feature, you can use Moralis Money to track your assets across all supported networks:

Trade Like A Pro with the Moralis Money Pro Plan

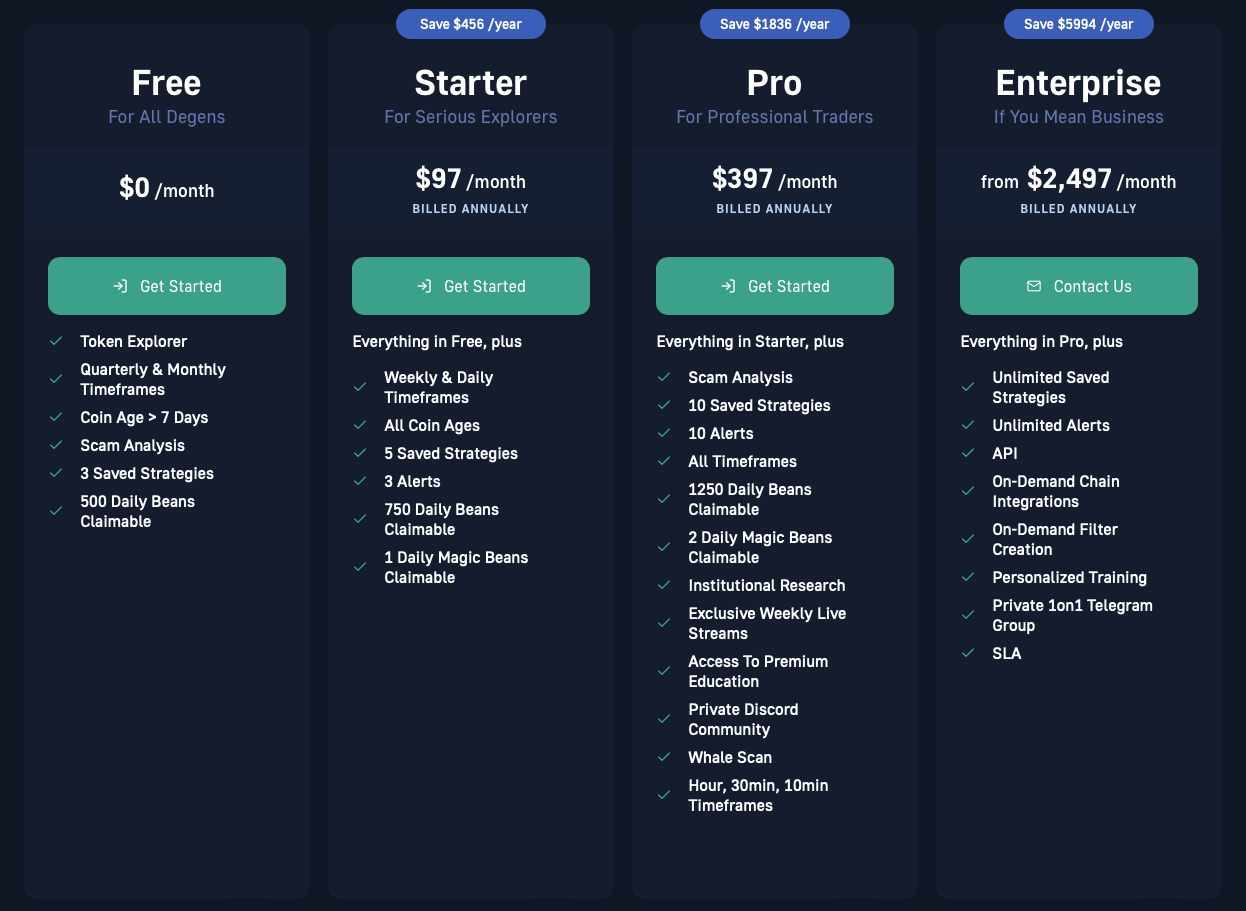

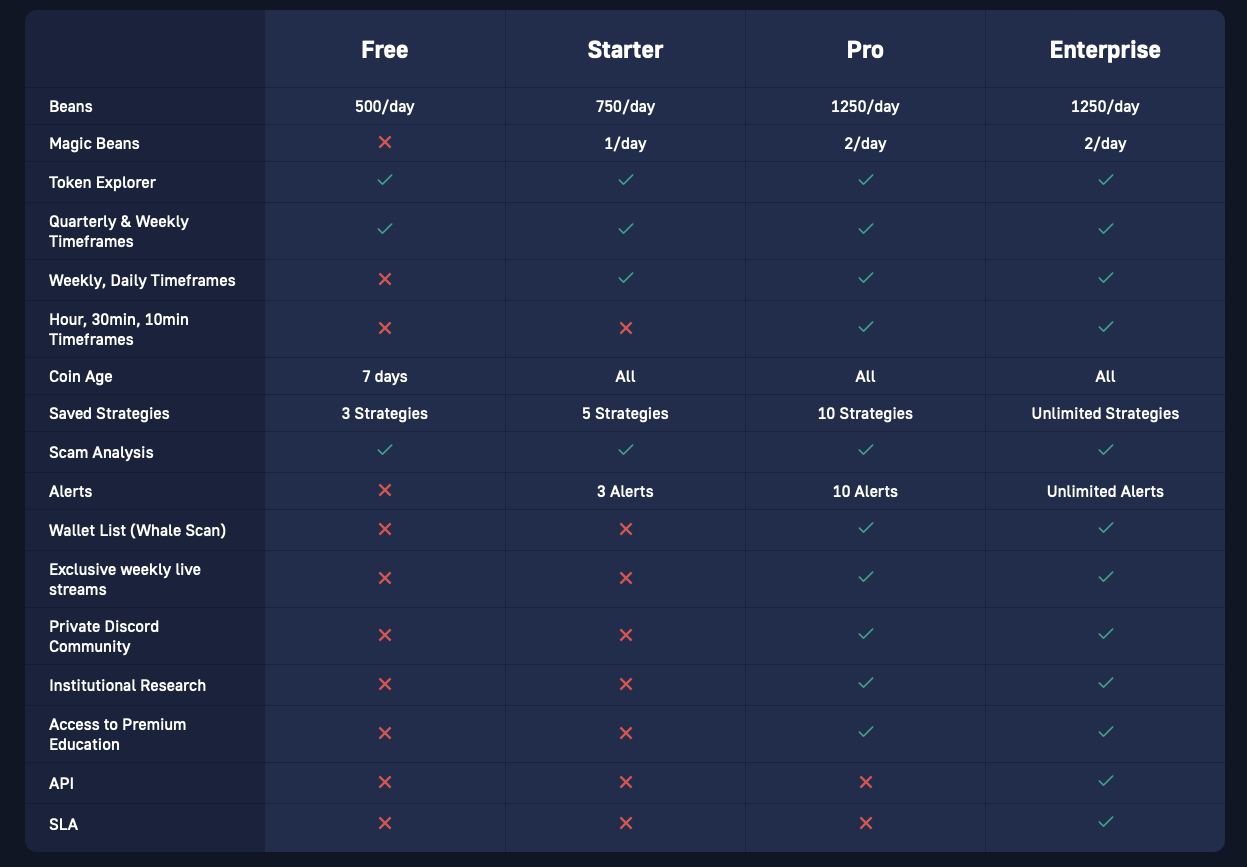

Also, did you know you can supercharge the features above by subscribing to the Moralis Money Pro plan?

As a Pro plan user, you get a bunch of benefits, including the following:

- Narrower Timeframes: As a Pro plan user, you get narrower timeframes for all search parameters when using Token Explorer. This means you can query tokens based on daily, hourly, and even ten-minute timeframes.

- Token Alerts: With the Moralis Money Pro plan, you can save up to ten alerts with Token Alerts.

- Private Discord: Pro plan users get access to a private Discord server. So, by subscribing to the Pro plan, you become part of a more extensive community of professional traders.

The advantages above are only three prominent examples, and there’s much more to the Moralis Money Pro plan. For instance, you also get to save up to ten strategies, access premium education, and much more:

Summary: How to Avoid the Fear of Missing Out When Trading Crypto

In today’s article, we began things by exploring the ins and outs of crypto FOMO. FOMO is an acronym for the fear of missing out, which refers to the anxiety traders experience when they feel like they are missing the next big opportunity.

From there, we learned that FOMO is caused by a number of reasons, including the fact that people desperately chase the next ample opportunity, the untested market, too much information, etc.

Lastly, we showed you how to avoid FOMO with the ultimate solution: Moralis Money. Moralis Money is an industry-leading trading and crypto volatility indicator that leverages blockchain data in real time to give you true market alpha. As such, with this tool, you can easily find crypto tokens before they break out and avoid FOMO.

Thanks to the power of Moralis Money, we were able to create a list of potential altcoin gems in three simple steps:

- Step 1: Launch Token Explorer and add the Coin Age metric.

- Step 2: Combine Coin Age with Experienced Net Buyers and Net Volume to find coins with increasing buy pressure.

- Step 3: Add other metrics to make the query even more unique.

If you’d like to experiment and test the Token Explorer feature yourself, you can do so using the interactive widget down below. Apply a premade strategy, or create one from scratch by combining the parameters you want:

Also, don’t forget that you can supercharge the features of Moralis Money by subscribing to the Moralis Money Pro plan. Doing so gives you narrower timeframes for all parameters, access to a private Discord server, and much more: