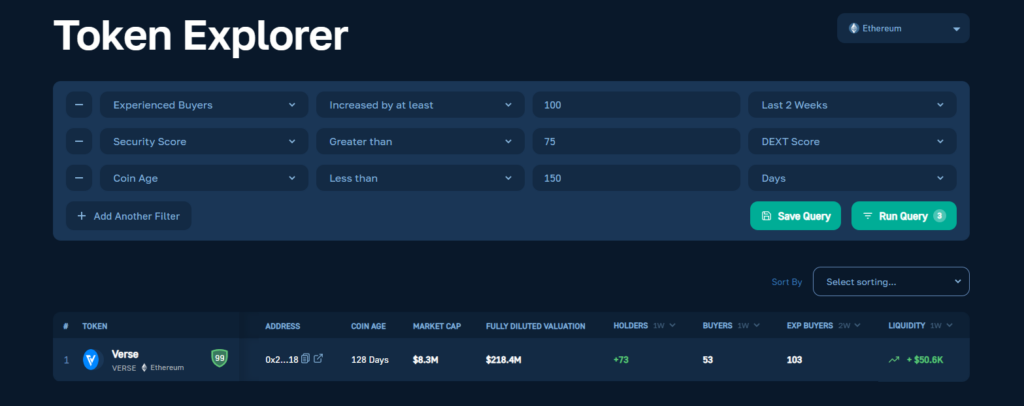

Make sure to use Moralis Money yourself to get the latest on-chain data on the Verse token. By continuously monitoring this project, you might see the Verse token price starting to surge, which, in combination with other factors, might be a great opportunity to get in!

Use the iframe below to select one of the preset filters, use the same filter criteria outlined in the above screenshot, or apply your unique search criteria. Using Moralis Money is that simple!

If you want to learn more about Moralis Money and get some pointers on how to get going with this on-chain tool, we have a section designed for that purpose below. This is where you will be able to learn how to consider Verse crypto momentum using on-chain data before it is reflected in the Verse token price.

That said, what is Verse? We’ll address this question as part of this article’s main topic before we dig into Moralis Money. In addition, we’ll look at the use cases of Verse and explore all the essentials regarding what this project from Bitcoin.com is all about.

Exploring the Verse Crypto Project from Bitcoin.com

In this part of today’s article, you will have an opportunity to get acquainted with Bitcoin.com’s Verse crypto project. We will break things down into the following three topics:

- What is Verse?

- What can Verse be used for?

- Provide liquidity using its DEX and earn Verse tokens.

So, without further ado, let’s find out what Verse is!

What is Verse?

Verse is a crypto project launched at the end of 2022 by Bitcoin.com. It is a part of this well-established digital ecosystem and secure self-custody platform’s mission to create more economic freedom in the world.

The essence of the project is the birth and utilization of the Verse token (VERSE). The latter is Bitcoin.com’s ultimate utility and rewards token. It is a fungible token that lives on the Ethereum chain, and it follows the ERC-20 token standard.

After years of successful operations, resulting in over 29 million wallets created and more than five million monthly active users, Bitcoin.com launched its own token. Primarily, the Verse token is an essential part of this ecosystem’s reward mechanism. After all, Bitcoin.com decided to reward its community for buying, selling, swapping, spending, investing, and staying informed about crypto.

So, what exactly is Verse? It is a crypto project behind the Verse token – Bitcoin.com’s utility and rewards token. Thus, users who participate in and contribute to the Bitcoin.com ecosystem can earn VERSE in various ways.

However, there are other tools that came to life as part of the Verse project. For instance, a great example is Verse DEX.

What Can Verse Be Used For?

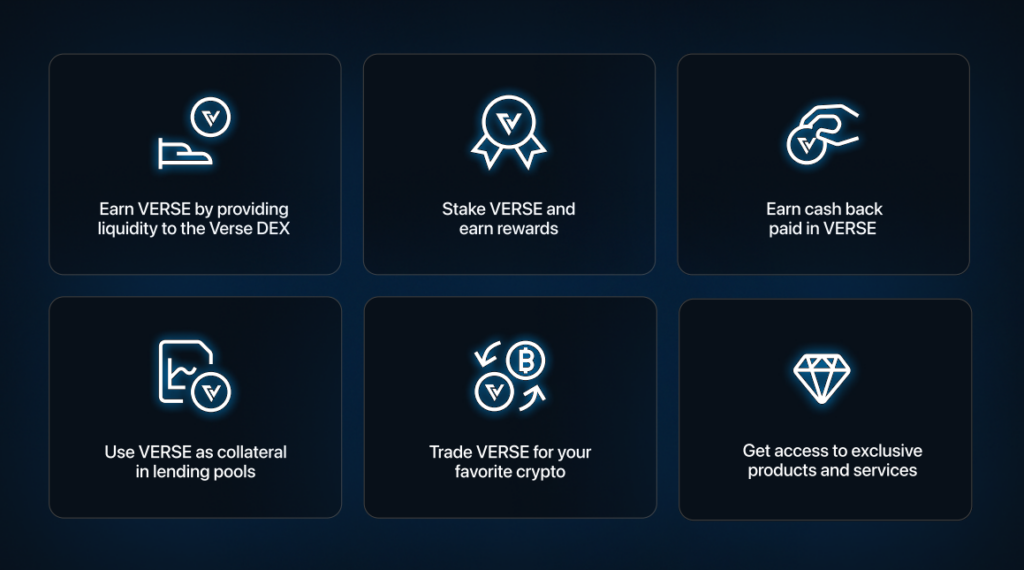

The most direct way to use the Verse token awaits you at Verse DEX. There, you’ll be able to earn VERSE by providing liquidity to different supported token pairs. You can also stake VERSE in order to earn rewards. Another interesting use case of this utility token is the fact that you can use it as collateral in lending pools.

Of course, you can also use VERSE to trade it for other cryptocurrencies. The Verse whitepaper also promises that by holding this token, you get access to exclusive products and services.

If you are familiar with utility tokens like CRO and BNB, you can think of VERSE in a similar manner. However, since Verse DEX is a decentralized exchange, the token is also similar to UNI or JOE. According to Bitcoin.com, their token combines the best of both worlds as it ticks all the boxes.

It comes with a mobile and web app, it can be purchased and sold to fiat, it also comes with a non-custodial wallet, and it has a developed ecosystem with a large user base. Plus, no more than 15% of its tokens are allocated to the team. The project also has a DEX, includes news divisions, and a launchpad. Nonetheless, the Verse token can be used for staking.

Here’s a summary of VERSE utility (some of the use cases may not yet be available):

- Providing liquidity on the DEX

- Yield farming

- Trading

- News (paying for press releases and ads)

- Merchandise

- Staking

- Cashback

- Payments

- Collateral

- Referral program

- Education and insights

Provide Liquidity Using Its DEX and Earn Verse Tokens

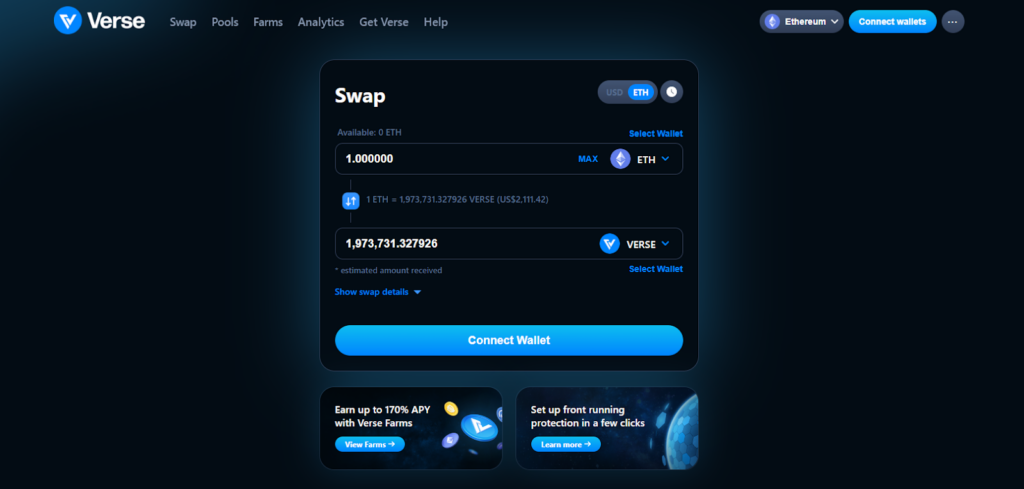

If you are familiar with how DEXs work, you know that liquidity pools are the key to ensuring that things run smoothly. Liquidity providers are important, and they need to be properly incentivized. So, users can earn a portion of DEX trading fees for the assets they provide liquidity for.

As such, you can decide to deposit cryptocurrency or tokens traded on the Verse DEX platform and start earning. As a liquidity provider, you’ll receive liquidity pool (LP) tokens. Then, you can redeem these tokens for VERSE and other cryptocurrencies.

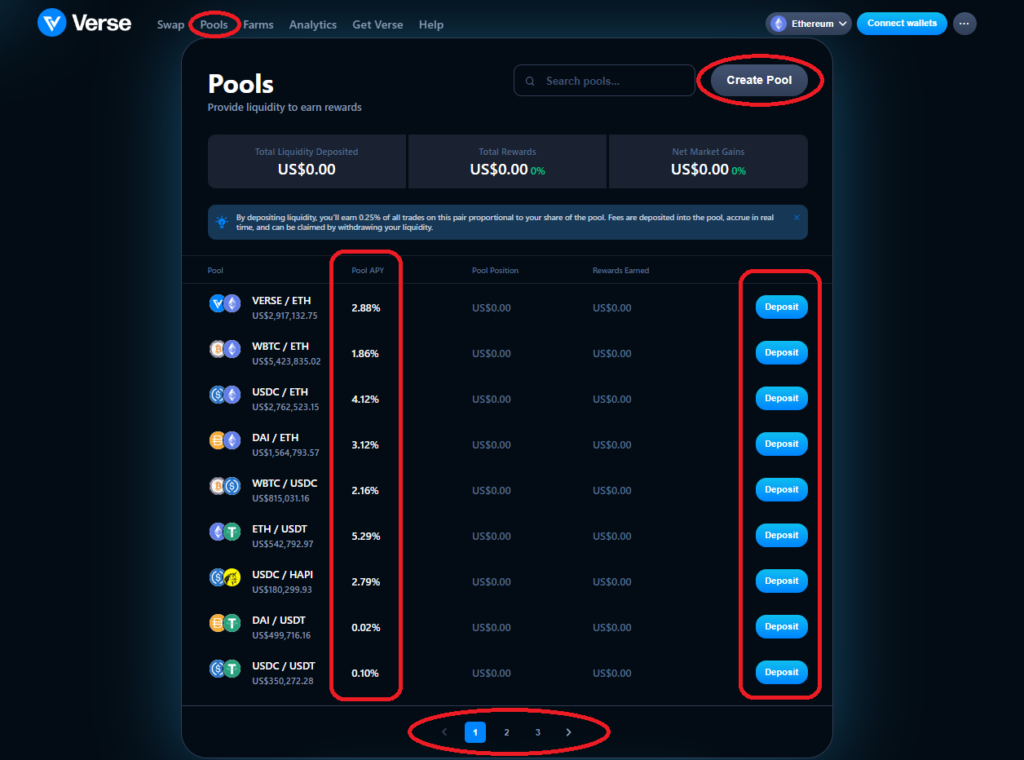

If you wish to provide liquidity and earn yield, visit Verse DEX and select the “Pools” option. There, you’ll be able to deposit tokens into existing pools via the “Deposit” buttons. However, you may also create a new pool.

Just keep in mind that in order to be a liquidity provider, you need to provide both LP tokens that form a trading pair.

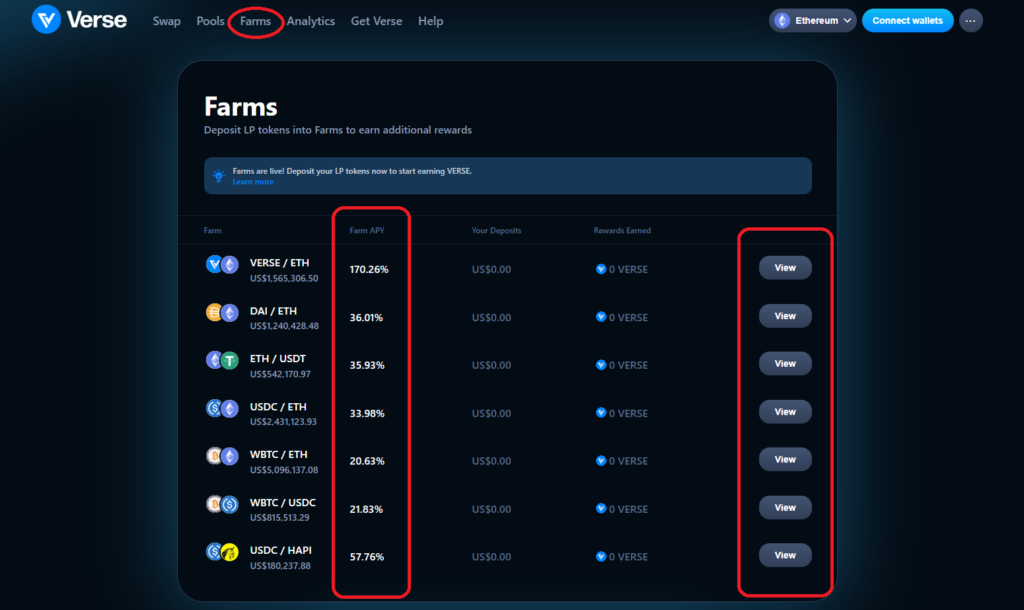

Once you are a Verse DEX liquidity provider, you can significantly improve your yield via farms. Farms are a collection of smart contracts on Bitcoin.com’s decentralized exchange Verse DEX, where you can lock your LP tokens to earn high rewards.

These rewards come in the form of VERSE and are paid on top of the trading fees you already earn by providing liquidity. If your risk tolerance allows you to consider locking your tokens, it may be worth it to consider this option.

In that case, use the “Farms” option of the Verse DEX menu. Then, you’ll be able to view currently available farms and their APYs.

Pros and Cons of Farming

For instance, let’s say you believe the Verse token price will continue to climb, and you also believe ETH has room to grow.

In that case, you can buy both of these tokens, provide liquidity, and join that pair’s farm. Then, you can make profits based on price appreciation and by pocketing rewards.

However, you must study the details of the liquidity and farming terms before committing to them. You also want to consider the crypto market cycles and global economic situations to determine where we are currently at. You can go as far as thinking about the future of crypto in the next five years before making such moves. Always DYOR!

How to Get Verse Tokens

There are several ways to get Verse tokens:

- You can earn VERSE by providing liquidity to the DEX.

- If you stake VERSE, you earn rewards in the form of this token.

- You can earn VERSE in the form of cashback when you buy stuff with a Bitcoin.com card.

- If you have other cryptocurrencies (wETH, DAI, USDC, or USDT), you can swap them for VERSE.

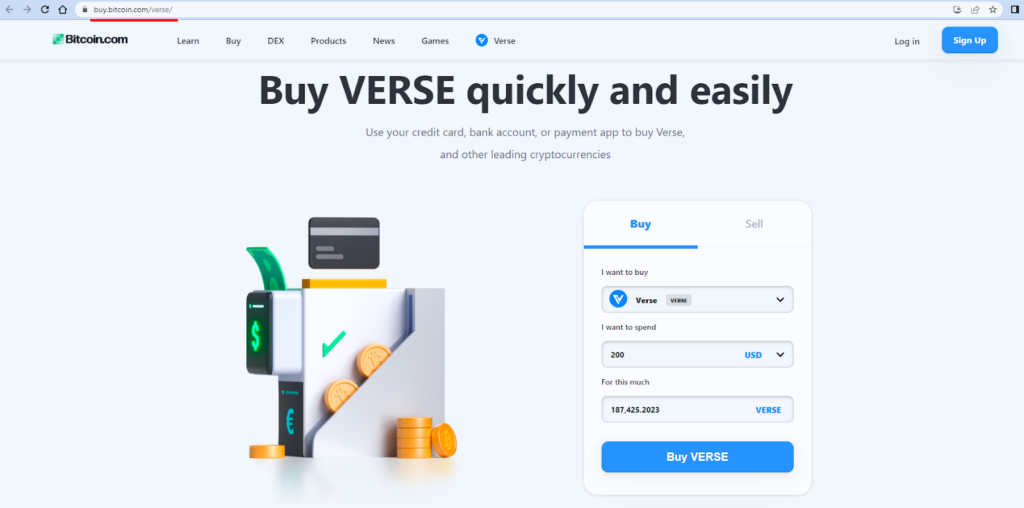

- You can buy VERSE directly with fiat via Bitcoin.com mobile or web app.

Analyze Verse Token Price Data Using Moralis Money

Whether you plan on staking the Verse crypto token or trading it, you ought to do your own research first. Also, you want to look beyond the Verse token price!

Make sure to look at the coin’s tokenomics. You can find some useful information in the project’s whitepaper. There, you’ll be able to get acquainted with the project’s tokenomics. However, also check the current details by using token explorers, such as CoinMarketCap or CoinGecko.

It’s worth pointing out that if you wish to invest in a token as part of your long-term strategy, you ought to make sure that the tokenomics are pretty solid. On the other hand, if you are looking for a short-term trade, tokenomics don’t have to concern you too much. After all, you want to get in before the pump and exit before the dump.

However, whether you are entering a position for the long or short term, you always want to time your entry prior to a price rally. After all, buying a coin and being down on your investment right from the gate is a real downer.

So, how can you avoid that?

Well, one way to analyze potential moves is to perform technical analysis (TA). However, as you probably know, TA considers the historical price and is more suitable to help you properly react to market changes.

But if you look at real-time blockchain data, you can front-run the price action. After all, on-chain activity always precedes price moves!

So, you need a reliable, user-friendly, on-chain tool that returns actionable, easy-to-interpret data. That’s exactly what Moralis Money provides you with!

So, look beyond the Verse token price and see if it’s gaining or losing momentum based on the on-chain data.

Find Opportunities Beyond Verse Crypto

Based on what we’ve seen, the Verse crypto project ticks many boxes and definitely has decent upside potential. So, if you also detect that it’s gaining on-chain momentum with Moralis Money, by all means, go for it.

However, it’s important to keep in mind that crypto offers countless opportunities. These opportunities might arise in already established projects like BitDAO, HEX crypto, and MATIC crypto. Or, in completely fresh coins.

Fortunately, with Moralis Money, you can finally spot those opportunities early and position yourself properly.

Did you know the average altcoin can do a 50x-70x price rally in a bull run? Even so, there are many coins that offer 100x and even 1000x gains!

Just look at EGLD and MATIC:

- EGLD had a 90x run:

- Polygon (MATIC) experienced a 1000x-plus price increase:

We can tell you firsthand how incredible it is to ride such gains. After all, our in-house altcoin experts spotted the above-mentioned coins using the on-chain data that is now at your disposal via Moralis Money!

Say Goodbye to FOMO, Scams, and Time Scarcity

Moralis Money was designed to help you overcome the three main trading obstacles. This powerful and simple-to-use on-chain tool has three core features that tackle FOMO, scams, and time scarcity:

- Token Explorer helps you find opportunities early and never FOMO into coins again!

- Token Shield helps you stay clear of scams!

- Token Alerts enable you to spot opportunities without going full-time crypto. No more missing out due to lack of time!

Other on-chain tools are very complicated and typically cause analysis paralysis. They provide you with countless complicated charts that overload you with information. That’s because these tools are built by data scientists who typically have zero experience with trading and investing in crypto.

On the other hand, Moralis Money is a result of collaboration between a team of seasoned altcoin traders and industry-leading Web3 developers. Together, they designed a powerful tool that presents on-chain data in a user-friendly manner.

Moralis Money is all about simplicity and actionable data. Hence, even casual crypto investors and traders can now find tokens before they pump!

So, start using Moralis Money today!

Find Crypto Opportunities in Seconds

Once you are ready to move beyond Verse token price speculation, you should find other opportunities with Moralis Money Token Explorer. The fastest way to get going is by selecting one of the preset filters on the Moralis Money homepage.

However, those filters are available to all Moralis Money users, so it’s important that you find your own winning search criteria combo. To do that, you can follow the following four simple steps:

- Open Token Explorer.

- Use the Market Cap metric to target more established coins. Or, apply the Coin Age filter to focus on newly minted coins.

- Hit “Add Another Filter” and apply an additional filter to further refine your list of potential candidates. Filters like Holders, Buyers, and Experienced Buyers are perfect for that!

- Narrow your focus further by applying additional filters. So, simply select a metric, select a filter, enter a value, select a timeframe, and run your query!

Once you’ve found opportunities on the Ethereum chain, don’t forget to explore other networks. Moralis Money already supports all leading EVM-compatible chains, including the most popular layer-2 (L2) network. As such, you can use Token Explorer to find new Arbitrum gems.

To switch among networks, just click on the currently selected network. Then, select another one from the drop-down list:

Moralis Money is committed to continually adding support for new chains. So, once PulseChain, for example, goes live, and if it runs smoothly, you’ll most likely be able to explore it with Moralis Money.

What is Verse? Exploring the VERSE Token from Bitcoin.com – Summary

We’ve covered quite some distance herein. You explored the answer to the “what is Verse?” question, what the Verse crypto project is all about, and why it may deserve your attention. You now know that VERSE (a.k.a. the Verse token) is Bitcoin.com’s utility and rewards token that went live at the end of 2022.

While the Verse token price hasn’t seen any serious price action yet, the token has been gaining some on-chain momentum. So, whether you plan on joining Verse DEX liquidity pools and farms or just making a quick trade on this token, now might be a good time to get ready.

Nonetheless, we also reminded you that altcoins offer countless opportunities to those with good timing. Thanks to Moralis Money, you can now spot tokens that are gaining traction before their prices skyrocket. We even showed you how to get started with this powerful tool in seconds. Thus, it’s time you start exploring on your own. Use Moralis Money to monitor which crypto will explode in 2023, and remember to always DYOR!

Aside from investing in altcoins, the crypto space offers great opportunities to those who learn to BUIDL. So, if you like programming, you should definitely learn Web3 development. You can start by finding out what the leading Web3 programming languages are. Also, make sure to get acquainted with testnets and how to get “testnet” cryptocurrency. For instance, you can take a MATIC faucet for a spin.