Vega Protocol has been around for quite a while – its origins date back to 2018. Despite that fact, many newcomers, as well as experienced crypto enthusiasts, aren’t able to answer the “What is Vega Protocol?” question. Thus, moving forward, we’ll first answer that fundamental question. Before we get to the “How to buy Vega Protocol?” concern, you’ll also have a chance to get acquainted with this protocol’s technology. We’ll also explain what Vega Protocol’s objectives are and what its main use cases are.

Additionally, we’ll make sure you learn what the VEGA token is. As such, we’ll cover the basics of the VEGA crypto asset, including its tokenomics and utility.

Then, we’ll focus on the Vega Protocol (VEGA) price. We’ll analyze the asset’s price action and offer some speculative price predictions. Nonetheless, you’ll also discover how Moralis Money – the ultimate on-chain analysis tool – can help you determine if/when to buy $VEGA. For those of you who may decide to go down that path, we’ll also explain where and how to buy Vega Protocol.

What is Vega Protocol (VEGA)?

Vega Protocol is a blockchain network designed to cater exclusively to crypto trading. Specifically, it is a protocol that allows other projects/individuals to create trading derivatives in a decentralized network.

From the screenshot above, the project’s official website shows that the VEGA crypto project also aims to position itself as the world’s most advanced DEX.

There is an obvious complexity to this project. On the one hand, it is a public blockchain network (layer-1 or L1). Hence, it allows other devs and projects to build their decentralized trading tools/dapps on top of it. On the other hand, the project also has its own console (dapp) that runs on the Vega network. The latter allows Web3 users to interact with the Vega testnet and mainnet networks.

So, what is Vega Protocol? Primarily, it is an L1 blockchain network – the Vega testnet and the Vega mainnet. However, it also refers to the entire Vega framework built by the protocol’s core contributors. The aforementioned project’s console is a great example. And so are Vega Wallet and the Vega Governance dapp.

Exploring Vega Protocol Technology

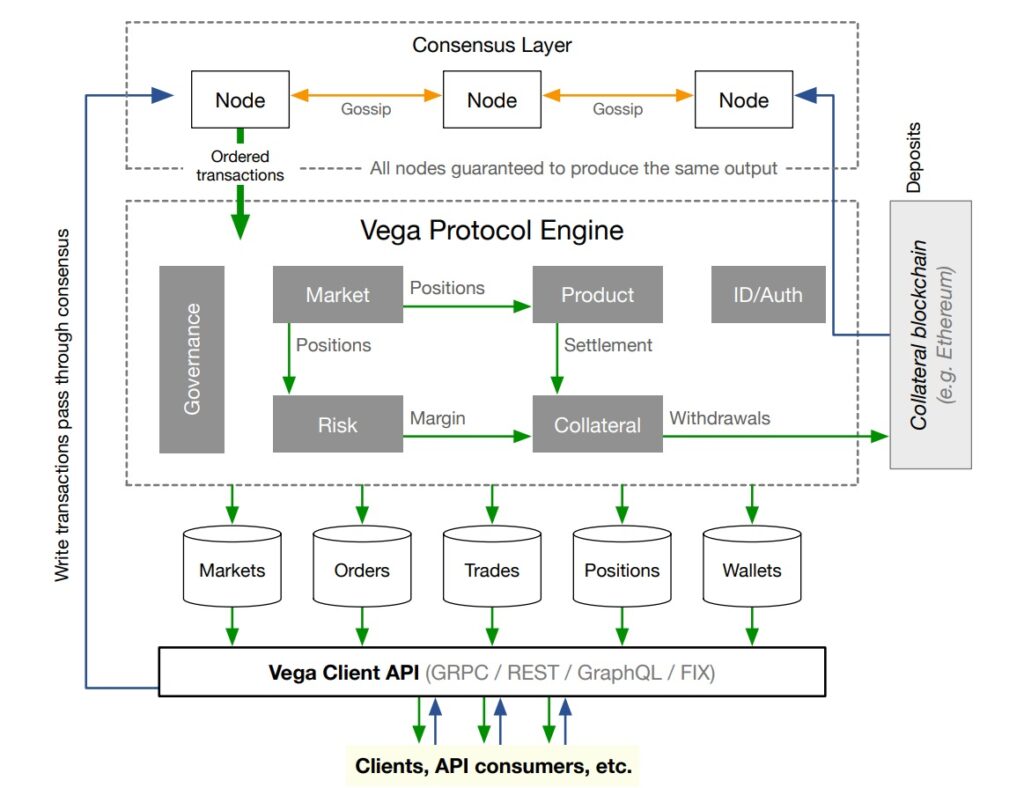

After covering the above “What is Vega Protocol?” section, you know that at the very core of Vega Protocol’s technology is the Vega mainnet network. And since a picture is worth a thousand words, we encourage you to take some time to properly analyze the above graphical representation of the Vega network’s logical architecture.

As you can see, the network has a consensus layer, which uses the proof-of-stake (PoS) mechanism. All nodes maintain a mirror of the state of the Vega network. They also process transactions to operate markets and their governance.

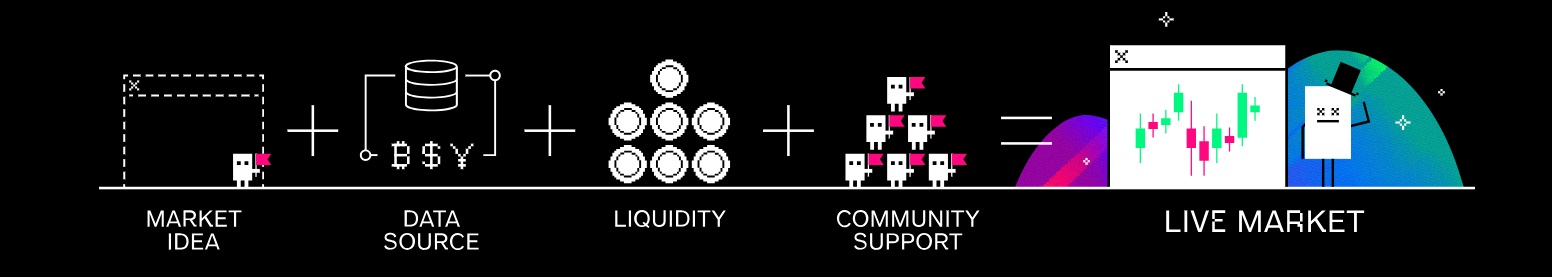

In order to deliver on the above-outlined advantages, Vega Protocol outlines some key concepts that enable trading and creating derivatives on a fully decentralized network. They are as follows:

- Specific purpose-built blockchain

- Built-in, anti-front-running mechanism

- Permissionless market creation

- Built-in liquidity incentives

- Optimization for high capital efficiency

- Efficient price discovery

- Pseudonymous trading

- Community curation of markets

- Dynamic margins with cross margins

- Pegged orders for automated order management

- Completely decentralized network

- No gas fees on trades

- Cross-chain support

- Scalable DeFi infrastructure

By successfully implementing the above-outlined concepts, Vega Protocol aims to be better than CeFi and to help DeFi mature.

Note: Below, we offer a quick overview of each of the above-listed concepts. However, in order to dive even further into these concepts, make sure to visit the Vega project’s documentation and whitepaper.

Specific Purpose-Built Blockchain

The VEGA crypto project points out its belief in the advantages of creating a blockchain network, so it exclusively focuses on specific features. Further, Vega outlines several benefits over general-purpose networks, such as Ethereum, that emerge from its decision to focus the Vega blockchain exclusively on trading.

The following image shows an overview comparison between Vega and Ethereum offered by Vega Protocol:

Anti Front-Running

Vega has a pre-protocol widget called “Wendy”. This pre-protocol ensures all nodes see the same sequence of transactions. It also provides cryptographic proof that all traders have fair access to its order book. Hence, no participant can gain an unfair advantage. Consequently, this creates a fair marketplace.

Permissionless Market Creation

The protocol believes that the key to delivering on the promise of blockchain and DeFi is permissionless market creation. This means that anyone can propose a market. Then, the community gets to decide whether the proposed market gets created.

Built-In Liquidity Incentives

This concept is all about shifting the power and reward from exchange owners to market liquidity providers. So, whoever creates a market and provides liquidity gets to earn incentives from every trade.

Optimization for High Capital Efficiency

The VEGA crypto project also believes that its protocol’s innovations significantly lower the capital costs of opening up hedging instruments. This means that new players can enter the scene.

Efficient Price Discovery

By not charging gas fees, Vega allows better price discovery. In addition, Vega combines the power of subsecond latency with price protection mechanisms and auctions to discover true market prices.

Pseudonymous Trading

Vega points out that lowering the barrier to wealth and value creation calls for pseudonymous identities. Thus, the protocol makes its network accessible to anyone in the world without any restrictions.

Community Curation of Markets

The purpose of Vega’s market governance is to allow the network to operate and grow freely. There’s no manual or centralized intervention. Instead, according to the community allocation (staking), the community curates markets via weighted voting. These decisions include the creation and closure of markets as well as the setting of parameters that influence market behavior.

Dynamic margins with cross margins

The protocol aims to offer a rigorous framework that continuously monitors and manages credit risk. It’s supposed to do that more efficiently than CEXs. So, by offering best-in-class stochastic models and a plugin-like architecture for risk models, traders get to adjust their positions quickly.

Pegged Orders for Automated Order Management

Pegged orders allow users to place orders and automatically track another price on the market. Vega claims that this concept supports advanced trading strategies and fast reaction times. Plus, according to Vega Protocol’s docs, pegged orders also remove concerns about latency and maintaining liquidity manually.

Completely Decentralized Network

Levels of decentralization vary throughout Web3. For instance, many DEXs use centralized order books and central governance. However, Vega is committed to making all aspects of its protocol properly decentralized.

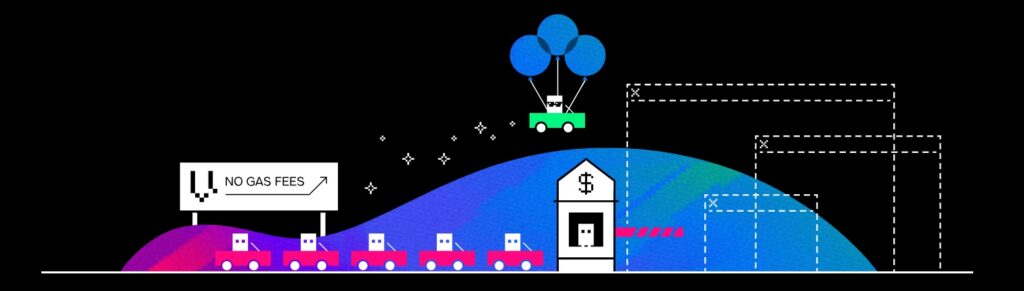

No Gas Fees on Trades

By using a different fee structure, Vega doesn’t charge gas fees. Fees that accrue on every trade in continuous trading are the price taker’s responsibility. And during a market’s opening auction, the protocol doesn’t collect any fees.

Cross-Chain Support

At the time of writing, the Vega alpha mainnet, which is the second step of a three-stage launch process of the Vega v1 mainnet, supports ERC-20 tokens. So, current Vega users may use these types of tokens as collateral.

However, the project’s goal is to become fully blockchain-agnostic and support trade settling in any crypto asset on a supported chain. This will pave the way for widespread asset tokenization.

Scalable DeFi Infrastructure

By working alongside other L1 blockchains and offering open-source APIs and libraries, Vega Protocol aims to contribute to scalable DeFi infrastructure.

All of Vega’s above-outlined core concepts support the protocol’s mission of being the go-to network for creating and trading derivatives. And, of course, creating and trading derivatives is also the Vega network’s exclusive use case.

Now that you have a pretty solid understanding of Vega and have had the “What is Vega Protocol?” question answered, let’s focus on the VEGA coin. After all, this token is a key aspect of the quest related to how to buy Vega Protocol tokens.

What is the VEGA Token? Exploring the VEGA Cryptocurrency

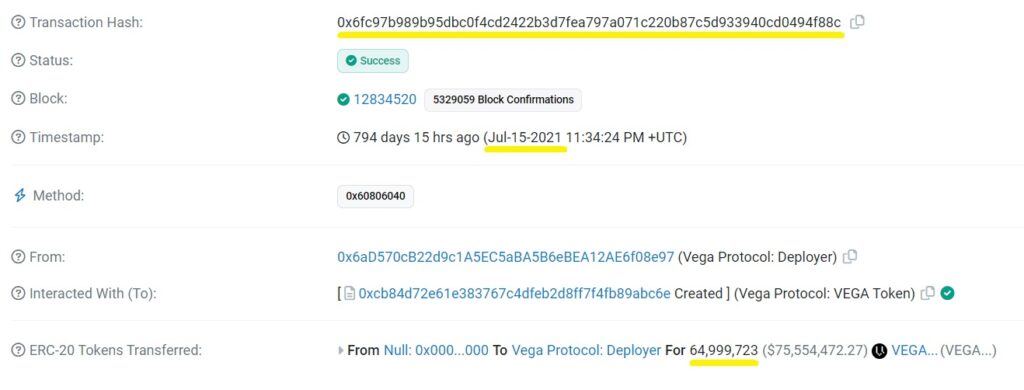

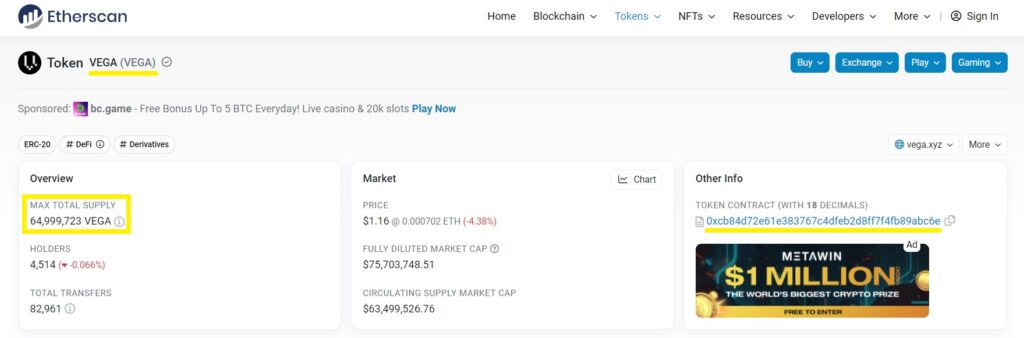

The VEGA token is an ERC-20 token that lives on the Ethereum chain. The asset went live back in July 2021 with a supply of 64,999,723 $VEGA tokens. However, that supply is not fixed indefinitely.

VEGA is different than most L1 tokens. First of all, it wasn’t even minted on the protocol’s native chain. Also, $VEGA also doesn’t serve as gas for transactions on the Vega network.

Tokenomics

- Symbol/ticker: VEGA or $VEGA

- Current total supply: 64,999,723 $VEGA (fixed until January 2024)

- Native network: Ethereum

- Smart contract address: 0xcB84d72e61e383767C4DFEb2d8ff7f4FB89abc6e

- Token type: ERC-20

- Minted on: July 15, 2021

- Initial token allocation (percentage of its current total supply):

- 26.5% to seed round and early backers

- 11% to strategic round

- 29.5% to the team

- 7.5% to Coinlist sale

- 5% to community bounties and grants

- 9% to on-chain incentives

- 11.5% to the project treasury

VEGA Crypto Use Cases/Utility

The VEGA coin has two main functions in regard to the Vega network:

- Security – It secures the Vega network and the Vega-Ethereum bridge via its PoS consensus.

- Governance – Token holders get to create Vega Protocol governance proposals and vote on existing ones. Thus, they are able to create and update markets and manage the protocol’s network parameters.

VEGA holders that stake their tokens for the above-outlined purposes get to collect rewards and share of fee revenue.

Full VEGA Token Price Analysis

$VEGA started to trade at the end of August 2021. At that time, most of the altcoin market already hit that cycle’s top. As such, the Vega Protocol price has been in a clear downtrend from its listing. You can see this in the following weekly logarithmic chart below:

The chart above also shows the asset’s maximum ($48.59-ish) and minimum ($0.56-is) values. The latter came into play approximately two years after the token’s listing.

At the time of writing, the Vega Protocol price sits at $1.2-ish, as it nearly doubled over the last 28 days. Despite this recent bounce of the token’s low, VEGA is still approximately 97% below its ATH (all-time high).

So, given such a discounted price, we understand why many want to know how to buy Vega Protocol tokens. However, before we get to that topic, let’s offer some Vega Protocol price predictions. After all, this “What is Vega Protocol” article just wouldn’t be complete without some price speculations.

Vega Protocol Price Forecast – What is the Price Prediction for Vega Protocol?

First, make sure to take all crypto price predictions as speculations. After all, crypto markets are highly volatile, and no one can predict their future prices. The only way to have an increased chance of determining the asset’s next move is to look at the asset’s live price action in combination with its real-time, on-chain metrics.

Still, using TA has proven to offer some levels of increased likelihood. So, by marking significant price levels of Vega Protocol, we can speculate that these levels are the most likely targets.

If the crypto market as a whole decides to move to the upside, the levels above the current price will come into play. And if the crypto market were to lose its value further, the levels below the current price would be legit Vega Protocol price targets:

Is Vega Protocol (VEGA) a Good Investment?

If you covered the above sections, you should be able to confidently answer the “What is Vega Protocol?” question. Plus, by knowing what the VEGA token is and seeing its price action, you should be able to decide whether you want to learn how to buy Vega Protocol tokens.

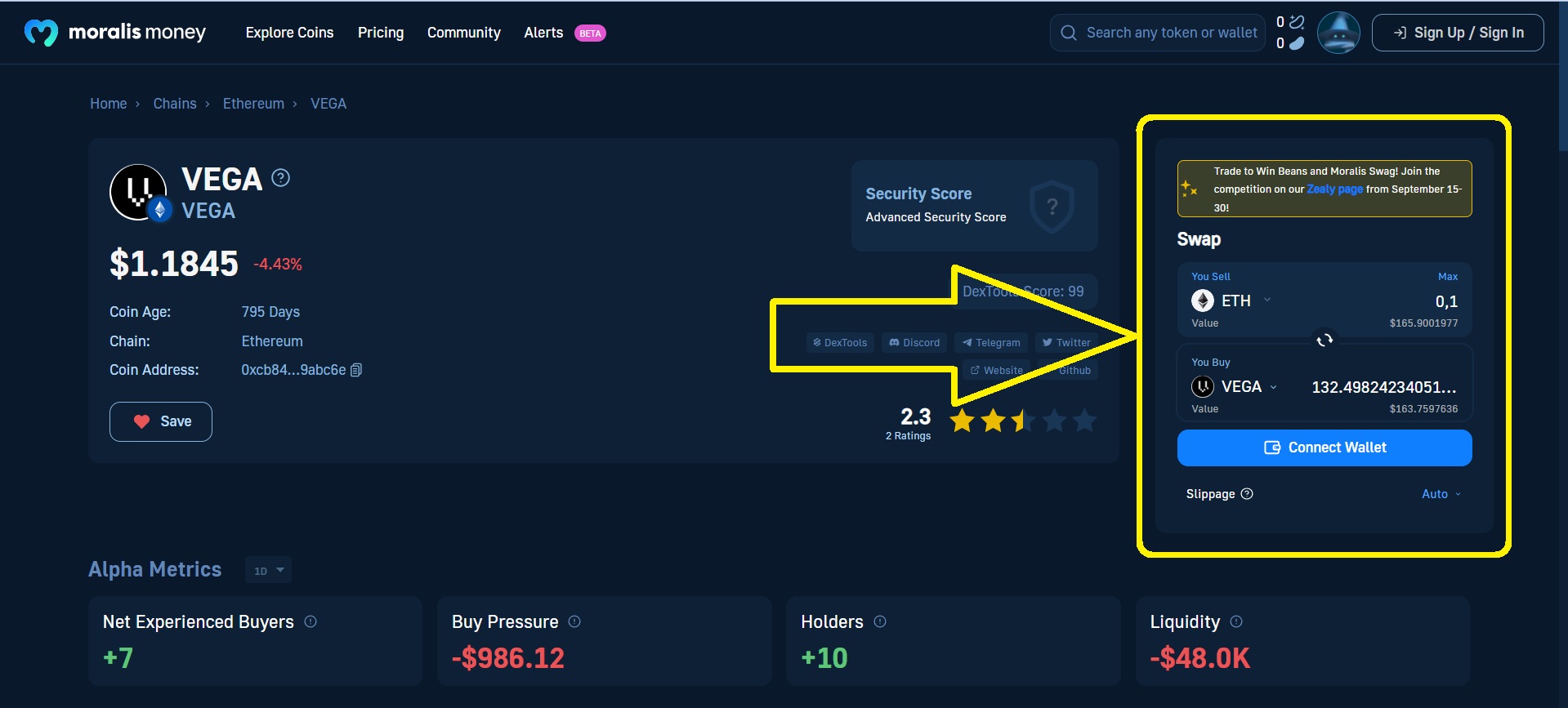

However, before you focus on our instructions on how to buy Vega Protocol coins, make sure to research $VEGA further. And there’s no better place to do that than Moralis Money’s VEGA ($VEGA) token page. On that page, you will find all the links to the project’s outlets and socials, as well as several invaluable tools to properly analyze the asset.

Some important metrics to focus on are the token’s real-time, on-chain metrics (a.k.a. alpha metrics). After all, based on the coin’s on-chain activity, you get to determine if now’s the right time to buy it or not.

So, follow the above “$VEGA” link or use the interactive widget below to determine whether or not to take action on your newly obtained knowledge:

Buy VEGA – Where and How

After using the above-presented Moralis Money token page, you’ll be able to decide if and when to buy $VEGA. If you decide this is the right path for you, you fortunately don’t have to sweat over the concern regarding how to buy VEGA; after all, once you know where to buy $VEGA, the how part is as straightforward as it gets.

Where Can You Buy VEGA Coins?

Since the VEGA crypto asset has been around since 2021, there are several markets where you can buy it. Your options include some relatively popular CEXs, such as KuCoin. However, given your interest in Vega Protocol, you probably prefer decentralized ways of buying cryptos.

As such, you need to focus on DEXs that support VEGA trading pairs. But you don’t need to start searching for those DEXs, nor use those DEXs’ dapps. Instead, you can take the most user-friendly, safe, and cost-efficient path offered by Moralis Money’s instant crypto swap feature.

You can find this crypto-swapping tool right at the top of the VEGA page:

How to Buy Vega Protocol (VEGA) Crypto?

So, how to buy Vega Protocol? Using the above-introduced Moralis Money’s swap feature makes it super easy. Essentially, you just need to complete these steps:

- Connect your Web3 wallet.

- Select the token that you hold in your wallet and wish to use to buy $VEGA.

- Enter that token’s amount.

- Execute the transaction.

- Confirm the transaction in your wallet.

If you are new to swapping crypto assets, make sure to check out our step-by-step guide on how to swap ERC-20 tokens. However, the animation below will most likely be enough to put your “how to buy Vega Protocol” process on the right track.

What is Vega Protocol and How to Buy the VEGA Token? – Key Takeaways

- What is Vega Protocol? It is a blockchain network with an exclusive use case for trading purposes. It allows anyone to create derivative markets and trade cryptos in a truly decentralized manner.

- The protocol’s mainnet is in its alpha stage, with v1 mainnet launch pending.

- The VEGA token is the protocol’s ERC-20 token used for network security (PoS) and governance purposes.

- $VEGA has lost most of its value during the last bear market and is still 97% below its ATH value.

- To determine if and when to buy $VEGA, make sure to use Moralis Money’s token page dedicated to that crypto.

- That page also includes the token swap feature that allows you to buy the VEGA crypto asset.

- How to buy Vega Protocol? Use the Moralis Money’s swap feature on the $VEGA page.

Whether you decide to buy $VEGA or not, do not sleep on other altcoin opportunities. After all, the average altcoin tends to increase in value by 50-70x during a bull market. And you can generate a dynamic list of altcoins with potential with just a couple of clicks with Moralis Money’s Token Explorer.

This amazing tool is free and allows you to explore all the leading chains, including Ethereum, BNB Smart Chain, Polygon, and Arbitrum. However, if you are serious about your altcoin investing and wish to find the next coin to blow up, you’ll want to opt for the Starter or Pro plan sooner rather than later.