Obtaining cross-chain compatibility and interoperability is all the rage in crypto. After all, in the early days when tribalism reigned and users were fanatically loyal to their cryptocurrency of choice, cross-chain interactions might not have been such a big deal. But these days, it is. As the blockchain industry grows, new projects will be more interested in making their tokens blockchain agnostic from the start. That’s where cross-chain solutions like Multichain come in.

What is Multichain? A Short History

Multichain first launched as Anyswap in July 2020 as a cross-chain decentralized exchange (DEX). Soon after, it transformed into a platform that provides cross-chain solutions. The goal was to make arbitrary cross-chain interactions possible so that users’ assets on different blockchains could work with other chains. If you’ve ever tried to move your crypto assets around to different blockchains, you already know this can be challenging.

With all the various blockchains onboarding to the ecosystem, each providing unique services to its community, the team at Anyswap recognized there needed to be a fast, inexpensive, and secure way for users to exchange data across these chains.

Are you ready to find a fast and inexpensive way to learn blockchain development? If so, visit Moralis Academy and check out its complete catalog of courses. Crypto for Beginners is an excellent place to start!

Anyswap Becomes Multichain

Desiring to provide better cross-chain services, Anyswap relaunched as Multichain. Now, blockchains such as Ethereum and BNB Chain, Bitcoin and Litecoin, or layer-2 solutions like Polygon or parachains like Polkadot are integrated (or on their way to becoming integrated) thanks to Multichain’s nearly universal interoperable layer. Speaking of Bitcoin, investors often refer to it as “digital gold.” Read more about crypto backed by gold in one of our recent blog articles.

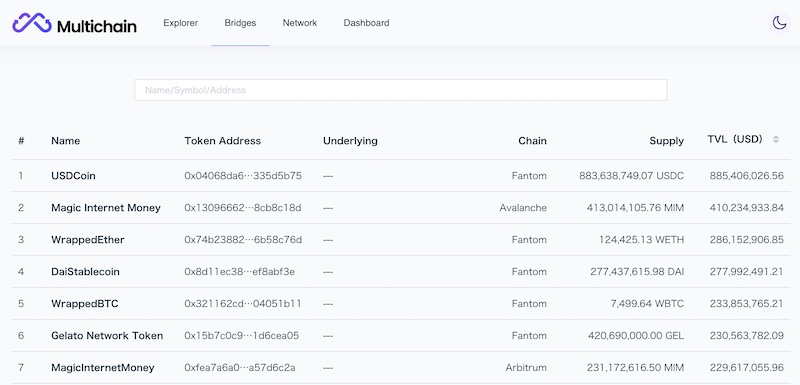

Nowadays, Multichain claims to lead the competition with its family of cross-chains numbering 26 and daily volumes exceeding $100 million with a TVL (total value locked) over $5 billion and thousands of daily users taking advantage of its services. Furthermore, because it abides by the principles of decentralization, it’s not surprising Multichain is an open-source platform that anyone can use. Code controls its operations rather than a central authority.

The MULTI Governance Token

Suppose you’re wondering, “what is Multichain?”, and “what is its governance token now that it’s no longer Anyswap?”. In that case, it’s helpful to know that MULTI is replacing the original ANY token. In addition, MULTI’s total supply is 100 million, and the exchange rate for switching from ANY to MULTI is 1:1.

Once the conversion from the ANY token to MULTI is complete, the supply of MULTI in circulation should hit the 18,639,320 mark, while the uncirculated tokens will make up 81% of the supply locked in smart contracts. These tokens will remain in the Multichain DAO’s custody until the governing body votes on the token’s utility at a future date. If you’re interested in DAOs, learn how to build your own DAO at Moralis.

Furthermore, Multichain financing uses tokens from the Multichain foundation allocation. Their locked periods are listed below:

- 60% locked for eight years

- 30% locked for three years

- 10% locked for one year

Multichain’s Token Support

So, now that you know about the MULTI governance token, what is Multichain and its plans for supporting other tokens? First, Multichain supports over 1,100 coins and offers the following advantages for those looking to launch cross-chain tokens:

1. Simple Multiple Chain Token Opportunities

Multichain offers new projects the opportunity to link their tokens to multiple blockchains in one step.

2. Free Listings

Listing requests are free.

3. Fast Deployment

Deployment takes from three days to one week.

4. Simple Integration

Cross-chain services enable a convenient integration process with a list of supported tokens available on the Multichain website.

Supported Blockchains

Thus far, Multichain offers routing channels between 25 blockchains. In short, some of the more popular ones include Avalanche, BNB Chain, Bitcoin, Ethereum, Fantom, Litecoin, Polygon, and Telos. Also included are L2s such as Arbitrum.

If you’re new to the Web3 realm, it’s time to learn all about it. Take the Blockchain and Bitcoin Fundamentals course at Moralis Academy, where you’ll find answers to all your questions!

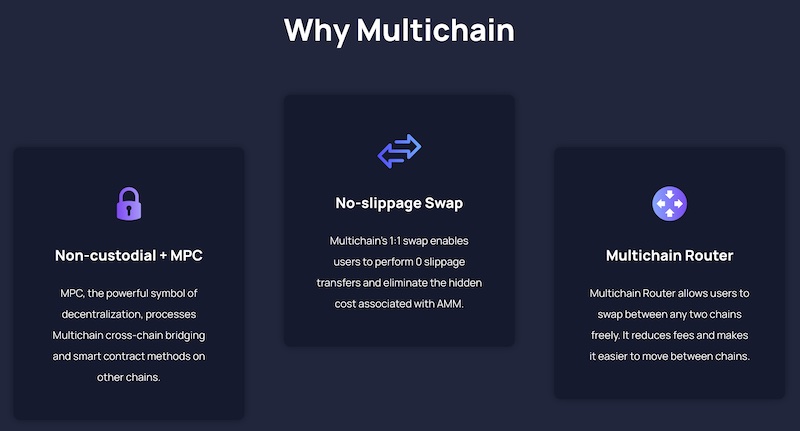

Multichain’s SMPC Network

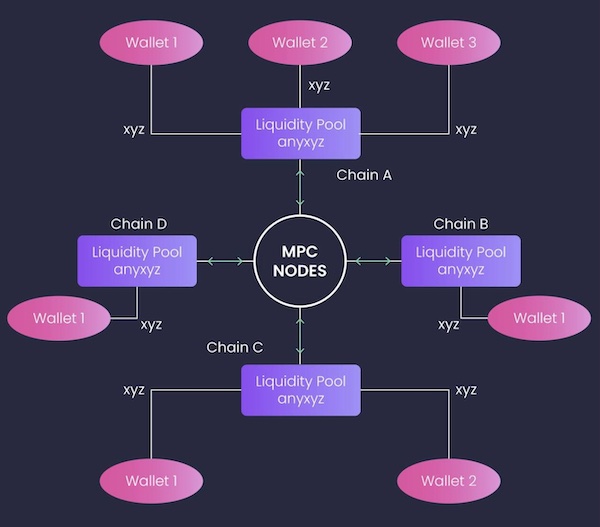

So, what is Multichain, and how does it accomplish cross-chain interoperability? First, it uses a “secure multi-party computation” (SMPC) network of nodes. These nodes help keep the operation stable and secure.

Second, different institutions and individuals operate SMPC nodes to prevent one central authority from going rogue. Third, each node runs independently from the others when generating its part of the private key used for signing transactions. This requirement prevents bad actors from colluding.

However, a crucial step is that the nodes can only sign transactions collectively. That means one node cannot sign off on a transaction alone. Further, no attacker can intercept it because the private key doesn’t get fully assembled beforehand.

Node Requirements

The nodes conduct several rounds of communication during this validation phase. It’s also essential for them to identify a node that’s sending bad information during this process. Otherwise, DDoS attacks become possible. Multichain deploys the GG20 algorithm to solve this problem using a property that allows for checking the signature part of a node to determine if it is the bad actor.

In sum, to prevent one corrupt node from accessing all the information and snatching the key that “unlocks the safe,” each node only gets a small piece of the puzzle that makes up the private key. Further, the nodes receive plenty of incentivizes to keep them functioning honestly.

Achieving Speed and Efficiency

Multichain’s SMPC network has to sign transactions on each blockchain and perform multiple tasks to manage smart contracts and asset accounts. It also has an asynchronous approval feature whereby many signatures get pre-computed. This action takes care of most of the computation process. After that, only a final round of communication is necessary to sign the transaction. Thus, there is no need for all the nodes to be online simultaneously to complete the lion’s share of work.

Another issue that can limit cross-chain transaction speeds is the potential security flaws on each blockchain. Finality cannot be agreed upon until a sufficient amount of confirmations take place. This requirement prevents any short-lived forks from causing a double spend. However, additional verifications slow down transaction times. So achieving faster speeds will always be a challenge for any cross-chain solutions provider.

What is Multichain Bridge?

Now that we’ve looked at the nodes, what is Multichain Bridge? First off, at the core of Multichain’s offerings are cross-chain bridges. Each Multichain Bridge provides a link between two blockchains so that a user can send an asset from one chain to another.

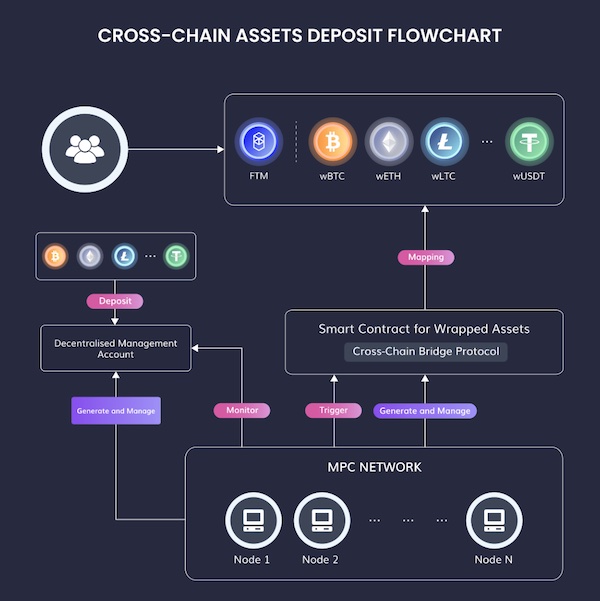

The asset waiting to be bridged goes to an SMPC wallet for secure storage on the chain of origin. Next, a smart contract then mints wrapped tokens on the destination chain at a 1:1 ratio and sends them to the user’s wallet.

Here’s how the Multichain Bridge function works. A user wants to bridge from blockchain A to blockchain B – more specifically, they want to transfer “TokenX” from blockchain A to blockchain B. Therefore, a smart contract locks up the asset (TokenX) on the source chain (blockchain A). Next, it mints a corresponding wrapped asset on the target chain (blockchain B). We’ll call this wrapped asset “anyTokenX.” Remember the ANY token mentioned earlier? Hence the “any” prefix.

If this seems confusing, remember that a bridge operates between two blockchains. So, to bridge an asset across two chains, Multichain smart contracts lock up the asset on the origin chain and then mint a wrapped version of the token on the target chain.

Multichain Bridge and Its Assets

The team developed its cross-chain service in July 2020 and called it “V2.” Multichain now has over 600 bridged assets. The good news is this service is available upon request at no charge.

The platform still considers its custodial Multichain Bridge offering its best solution for most clients. That’s because they don’t require liquidity on each chain much of the time. Custodial bridges work alongside the other cross-chain transfer mechanisms and work best for projects that launch tokens based on the ERC-20 standard for new chains that don’t have them.

In other crypto news, ApeCoin has been all the rage lately, causing its price to fluctuate. Check out our article as we go on exploring ApeCoin (APE) to learn more about this project.

SMPC Nodes and Multichain Bridge

When linking an origin blockchain to a destination blockchain, the SMPC nodes go into action and must perform multiple functions:

- Decentralized Management Account

When creating a new Multichain Bridge, SMPC nodes generate a “decentralized management account”. This address gets used for receiving assets and holds them securely while cross-chain assets get minted on the destination chain. More importantly, SMPC nodes control this address with no human intervention.

- Wrapped Assets

When a new bridge gets created between two blockchains, the nodes connect to a new smart contract on the destination chain. This contract mints new tokens (wrapped assets) on the destination chain or burns them as assets get redeemed from their origin chain.

- Smart Contract Triggers

Nodes monitor the decentralized management account. Thus, whenever a new asset arrives, it triggers the wrapped asset smart contract on the destination chain to mint tokens.

- Redeeming Assets

When users redeem their assets, the SMPC nodes trigger the wrapped asset smart contract to burn the tokens. The nodes then release the tokens from the decentralized management account. Lastly, they send these assets back to the user on the origin chain.

- NFT Bridges

The platform also has a bridge and router for NFTs using ERC-721 and ERC-1155 standards. It’s important to note that some assets are not suitable for bridges. These include elastic supply tokens.

The Multichain Router

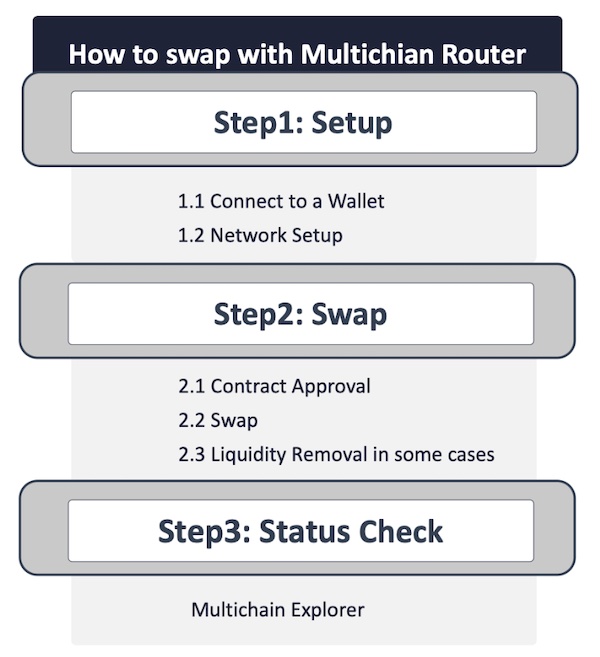

Multichain Router V3 launched in June 2021. The router incorporates bridges which opens up possibilities for including assets generated on a third-party bridge. Below are some of its other features:

a) It allows asset transfers between all chains.

b) The router works with already existing blockchain assets via liquidity pools.

c) It also works with bridged assets, where Multichain mints the assets on-chain.

This way, assets are not confined to returning to their source chain before transferring to another chain. This system works particularly well for assets originating on Ethereum.

To sum up, Multichain creates bridged assets that the router can use. Furthermore, bridged assets don’t require a liquidity pool since Multichain controls its supply. Therefore, we can say that bridged assets have an unlimited pool supply.

Bridged Assets vs Native Assets

If you’re still not sure of the answer to “what is Multichain?” and its treatment of bridged assets vs native ones, remember that bridged assets are those that Multichain mints. On the other hand, a “native asset” refers to a token that already exists on a blockchain. An example would be ETH. Multichain cannot mint ETH, so when Bridging native tokens across chains, Multichain must use liquidity pools.

However, the cross-chain router enables asset transfers across multiple chains regardless of native or bridged. Notably, clients that rely on the exclusive use of bridged assets in the router will have the best UX because they will never have to worry about liquidity supplies on the target chain.

Conclusion – Multichain’s Roadmap for the Future

So, what is Multichain and its plans for the future? The platform has evolved from a one-to-one cross-chain bridge into a complex cross-chain router system that connects multiple chains. While we’re on the topic of evolving technologies, don’t you want to know what the Polkadot vs Cardano debate is all about?

In addition, Multichain now offers its advanced cross-chain router protocol that operates in real-time and provides cross-chain interoperability to tokens and NFTs across multiple chains. Furthermore, its cross-chain speeds are 4x faster than in the days of Anyswap. It also continues to put a priority on security. After having smart contract security firms, including PeckShield, TrailOfBits, and SlowMist, audit its smart contracts, it retains an ongoing bug bounty service.

Moving forward, Multichain is working to become the ultimate Web3 router. Its roadmap for the future includes support for:

1. More chains, assets, and blockchain innovations.

2. Research on multi-party computation (MPC) and public MPC blockchain networks.

3. Joint research on MPC with top academic institutions.

4. Incentive programs to encourage emerging innovations and Web3 communities.

5. Expanding global Multichain communities.

After reading how Multichain is expanding its ecosystem, isn’t it time to expand your horizons? If you haven’t already learned blockchain programming, check out some significant reasons why to learn Web3 development. After you understand how important it is to your future, you can know how to start a career in Web3 development at Moralis Academy. Get started today!