Liquity Protocol is a decentralized borrowing protocol that offers interest-free collateralized borrowing and DeFi lending. As one of the top-performing decentralized finance (DeFi) lending platforms of 2021, Liquity has seen a surge in usage. This is thanks to the novel dual-token model that issues both the LUSD stablecoin and the Liquity token (LQTY). Liquity facilitates collateralized loans with a 110% minimum collateral ratio, which is attracting the attention of DeFi users. Many of you may be wondering, “what is Liquity?”, and, “how do LUSD and the LQTY token work?”. If this is the case, then you’ve made it to the right place!

In this article, we’re going to explore the various inventive mechanisms that make up the backbone of Liquity Protocol. Also, we’ll discuss LUSD and the LQTY token, and how this novel dual-token model works on a technical level.

Liquity was created on the second-largest blockchain network, Ethereum. To learn more about the Ethereum blockchain, check out the Ethereum 101 course at Ivan on Tech Academy! This simple-to-follow course explains the core differences between the two biggest blockchains (Bitcoin and Ethereum) and how decentralized finance (DeFi) first came about.

If you have no crypto experience but would like to learn how to interact with DeFi protocols, see first our Crypto Basics course. Ivan on Tech Academy provides an expert-led video tutorial for buying, trading, and storing your first crypto investments. From here, our DeFi 101 course will provide a breakdown of how to install and navigate the most popular Web3 wallet, MetaMask. Ivan on Tech Academy provides a wealth of educational material for people of all experiences to get started in cryptocurrency.

What is Liquity Protocol?

Liquity is a decentralized finance (DeFi) protocol that facilitates interest-free collateralized borrowing. Users can borrow the LUSD stablecoin by locking up Ethereum (ETH) with a 110% minimum collateral ratio. When doing this, users pay a one-off borrowing fee. Furthermore, Liquity is a governance-free protocol that uses an innovative batching and instant liquidation model that has seen a surge in popularity, according to DeFi Pulse. Moreover, the total value locked (TVL) in Liquity Protocol went from $0 to $1 billion in just ten days!

The Liquity platform uses collateralized debt positions (CDPs) known as “Troves’’. Users can deposit LUSD into the “Stability Pool’’ which is used to absorb any debt from liquidations. When Troves are liquidated, holders of the LUSD token within the Stability Pool receive a portion of the ETH locked up as collateral. Each LUSD token can be redeemed for $1 worth of ETH using the Liquity platform. However, this is subject to a redemption fee.

The value of the collateral that has been liquidated usually exceeds that of the debt. As such, LUSD holders can often make a net gain. This is because the Liquity token (LQTY) is rewarded to users that deposit LUSD into the Stability Pool. Moreover, users can stake rewarded LQTY tokens and in return, receive a portion of borrowing and redemption fees.

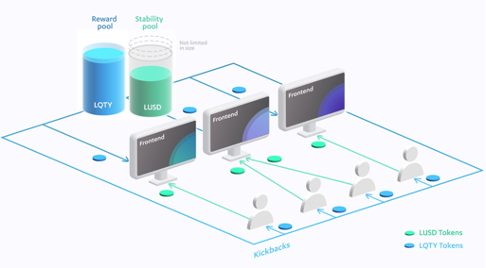

Liquity Protocol can be accessed via a network of third-party Frontends. A list of active Frontends can be found at Liquity.org. Users can open collateralized debt positions (CDPs), or Troves by depositing ETH. This allows depositors to access LUSD liquidity which can then be staked to earn ETH and LQTY token rewards.

LUSD

Unlike most stablecoins, LUSD is a novel stablecoin that can be redeemed for Ethereum (ETH) at any time at face value. This means that one LUSD can be redeemed for $1 of ETH, minus a redemption fee. LUSD has a price floor and ceiling that helps to maintain the $1 price target. This innovative system creates arbitrage opportunities known as "hard peg mechanisms" that are based on direct processes.

Also, LUSD utilizes "soft peg mechanisms" that ensure USD parity. This includes “parity as a Schelling point” - an implied state of equilibrium across the protocol, and, borrowing fees on new debts. As LUSD falls below the $1 target, this creates arbitrage opportunities as LUSD can be redeemed for $1 worth of ETH. An increase in LUSD redemptions would cause the base rate for borrowing to increase also. As a result, borrowing becomes less attractive. In turn, this helps to moderate the supply of LUSD and keep it from falling below $1.

Liquity Token (LQTY)

The second token issued by Liquity Protocol is the LQTY token. The LQTY token is rewarded to Stability Providers and is used to incentivize Frontend Operators and early adopters. By depositing LUSD into the Stability Pool, users can earn Liquity token rewards.

Also, by staking LQTY tokens, users earn a share of fees paid for the issuance of loans and LUSD redemptions. Furthermore, staking LQTY tokens requires no minimum lockup period, and rewards are distributed on a pro-rata basis.

Liquity Protocol Core Features

Alongside the novel dual-token model implemented by Liquity, there are several key elements in place that maintain the robustness of the platform. Below are some of the core features of Liquity Protocol.

Third-Party Frontends

The Liquity protocol uses third-party Frontend Operators to run its web interface. Frontends are required for connecting users to Liquity to make deposits and take out loans. Running a frontend is simple, just download the Liquity launch kit or Frontend software development kit (SDK) and implement Liquity Protocol into your environment. By doing this, users earn a passive income in the form of LQTY token rewards. In turn, this makes the Liquity borrowing and lending facility more decentralized.

For our non-programmer readers, if you’re interested in learning how to become a programmer to make use of such exciting SDKs, see our Javascript Programming for Blockchain course at Ivan on Tech Academy. Designed for people with no coding experience, this course will teach you the basics of programming that can be used to move onto our blockchain programming courses.

For example, our Ethereum Smart Contract Programming 101 course is perfect for anyone with some coding experience to learn the Ethereum Solidity programming language. From here, our Ethereum Smart Contract Programming 201 course shows students how to deploy their own decentralized exchange! Alternatively, our Ethereum Game Programming course provides tutorials for creating non-fungible tokens (NFTs) and a decentralized marketplace! The opportunities are endless! Start today, at Ivan on Tech Academy.

Censorship-Resistant

Because the frontend operations of Liquity Protocol are carried out by third parties, Liquity is decentralized and is censorship-resistant. Furthermore, as there are no governance proposals to vote on, this makes the monetary policy of Liquity more robust than many other decentralized finance (DeFi) lending protocols using a decentralized autonomous organization (DAO) model.

Interest-Free Borrowing

LUSD tokens are generated by the Liquity protocol. As such, there is no requirement for capital costs to be passed on to borrowers, or for monetary supply regulation in the form of interest rates.

By simply locking up Ethereum (ETH) as collateral, users can take out LUSD loans to generate interest-free liquidity and DeFi lending facilities. Instead of paying interest, users must pay a one-off borrowing fee instead. The rate of the borrowing fee is determined by the current base rate. The base rate is algorithmically-governed based on the volume of redemptions.

Low Collateralization Ratio

To avoid being liquidated, most DeFi loans must be over-collateralized. Popular DeFi lending protocols such as Aave, Compound, and Maker, often require a minimum collateralization ratio of 150% and above. This means that in order to take out a collateralized debt position (CDP), users must lock up more than they borrow. This is to hedge against price fluctuations that could result in liquidations.

However, Liquity Protocol offers an “unprecedented minimum collateral ratio” of just 110% thanks to the protocol’s “instantaneous liquidation mechanism”. This creates an extremely capital-efficient borrowing system that can provide up to 11x leverage for trading and investing. To learn more about collateralized debt positions (CDPs) and over-collateralized loans, save our DeFi Money Markets article for later!

Governance-Free

Despite the name “decentralized finance”, many DeFi protocols are prone to manipulation by whales when it comes to voting on governance proposals. This is because the voting processes to make changes to a protocol can become seemingly centralized if there is a small number of governance token holders that hold a majority of the tokens in circulation. However, because Liquity is governance-free, the protocol is not susceptible to such manipulation. This creates an additional layer of decentralization that is absent in many DeFi platforms.

Stability Pool

The Stability Pool is where users known as “Stability Providers” can deposit LUSD to safeguard the borrowing mechanism against fluctuations in the price of ETH. Stability Providers who deposit LUSD tokens into the Stability Pool are incentivized to do so in two ways.

Firstly, Stability Providers are incentivized by liquidation gains. As liquidations tend to result in a net gain for the Stability Pool, Stability Providers can accumulate collateral as a result of liquidated debt positions at a substantial discount. In turn, this creates highly attractive arbitrage opportunities that are quickly scooped up.

Secondly, Stability Providers receive LQTY token rewards proportional to the amount of LUSD deposited in the Stability Pool. These rewards began high to incentive early adopters, however, they are reduced over time as the platform sees increased adoption.

Incentives for Staking

Liquity Protocol also incentivizes users to stake LQTY tokens in the Liquity staking contract. This makes users eligible to receive a portion of borrowing and redemption fees, paid out on a pro-rata basis in ETH and LUSD.

Liquity Updates

Liquity has a thriving and engaging community interacting through Twitter, Discord, and YouTube. Plus, Liquity provides newsletter updates through its Medium blog each month! In the most recent newsletter (March 2021), the team announced the launch of Liquity on the Ethereum mainnet. Moreover, Liquity announced the successful ‘Series A Fundraise’, orchestrated by Pantera Capital. The decentralized borrowing protocol attracted the likes of Nima Capital, AngelDAO, and Alameda Research. Additionally, Liquity received backing from individual angel investors including George Lamberth and David Hoffman.

In the ecosystem content update section, the team breaks down the project’s monthly achievements. This month includes links to the Coinspect Audit Report, which carried out a pre-launch code audit of Liquity before going live on Ethereum mainnet. Also, the Gitcoin Grants R9 Hackathon winners have been announced. Liquity sponsored the hackathon and awarded three bounties consisting of an LUSD arbitrage bot, a “Maker to Liquity migration tool”, and a “shared Trove implementation”.

Liquity likes to keep users in the loop around the decentralized borrowing protocol’s updates and news. As blockchain technology is a fast-moving industry, there are often new adaptations and innovations surrounding decentralized finance (DeFi) lending. Liquity frequently communicates the team’s passion with its users about DeFi lending through social media and punctual Medium blog updates. Be sure to sign up to the newsletter to receive updates about the Liquity decentralized borrowing protocol straight to your inbox!

Liquity Protocol and LQTY Token Summary

With a 0% interest rate, a mere 110% collateralization ratio, and directly redeemable liquidity and rewards, Liquity is proving to be a compelling decentralized borrowing protocol. By removing the complexities of governance, Liquity can offer extremely competitive DeFi lending services that are completely censorship-resistant.

The novel dual-token system utilizing the LUSD stablecoin and the LQTY token makes for an attractive alternative to traditional decentralized applications (dApps) and services built on smart contract-enabled blockchains.

Since hitting the DeFi Pulse charts in early April 2021, the total value locked (TVL) in Liquity has shot up to over $3 billion at the time of writing. With a diverse team of multinational industry leaders, including Ashleigh Schap, formerly of Uniswap and MakerDAO, Liquity Protocol is certainly a project to keep an eye on!

If you’d like a further breakdown of how blockchain technology operates on a fundamental level, see our Blockchain & Bitcoin 101 course. Blockchain technology can be used in many other industries alongside finance. This includes supply chain, fashion, sports, insurance, media, and the energy industry to name but a few.

To discover how blockchain can be implemented into current centralized IT systems, be sure to see our Blockchain Business Masterclass. Ivan on Tech Academy provides all the knowledge and tools for students to become skilled and confident enough to organize and manage a blockchain-based project.

Moreover, our FinTech 101 course provides a great breakdown of regulatory procedures for the converging of the world’s two largest industries. Also, our Blockchain for Enterprise course showcases how some of the biggest international businesses are incorporating Baseline Protocol. Join Ivan on Tech Academy today to learn the latest in cutting-edge technologies! Also, don’t forget to follow us on Twitter @Academy_IOT and let us know your thoughts about Liquity Protocol!