DeFi Pulse is the world’s leading resource for everything related to DeFi or decentralized finance. We are pretty sure that you are very well-familiar with the term “DeFi” by now. It’s an all-encompassing term for decentralized protocols that deal with a variety of financial services like lending, derivatives, payments, exchange, etc. The lion’s share of these protocols is ETH-based, which is why the rise of DeFi has been a huge Ethereum price growth factor.

With its rise in popularity, the DeFi space has welcomed a barrage of newcomers. This is why websites like DeFi Pulse are so incredibly valuable. Crudely speaking, you can think of DeFi Pulse as the CoinMarketCap of DeFi projects. However, as you will soon find out, it packs quite a punch with the sheer amount of value it gives to its users.

What is DeFi Pulse? An Overview

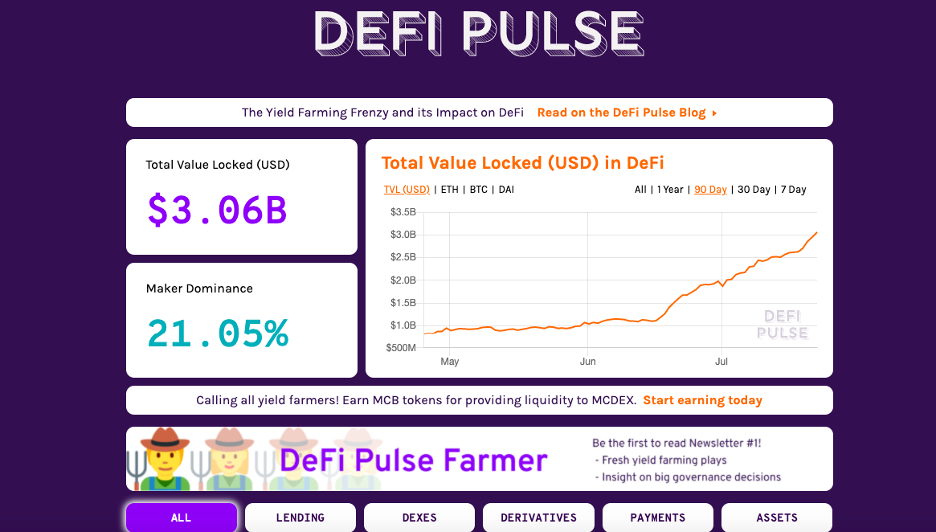

The moment you enter the website, you will see the following the screen:

Let’s see what all is happening here:

- First up, we have the all-important “Total value locked” or the TVL metric. This basically shows how much money investors have locked up in various DeFi contracts. Obviously, the higher the amount locked up, the more thriving the economy. If the quantity of TVL is on the higher side, it tends to have a positive effect on Ethereum price.

- On the side, you can see a simple graph that shows you the daily progression of TVL. As per the graph, the TLV jumped from $1.11 billion 16th June to $1.83 on 1st July. That’s a staggering 64.86% increase in just two weeks!

- Below the value locked up square, you have the market leader share metric. As of writing, Maker is the market leader and owns 21.05% of the market.

- Right at the bottom of the screenshot, you will see the different DeFi categories available on the website, mainly – Lending, DEX (Decentralized Exchange), Derivatives, Payments, and Assets.

- You also see the banner for “DeFi Pulse Farmer,” which happens to be their newsletter.

Alright, now let’s scroll down.

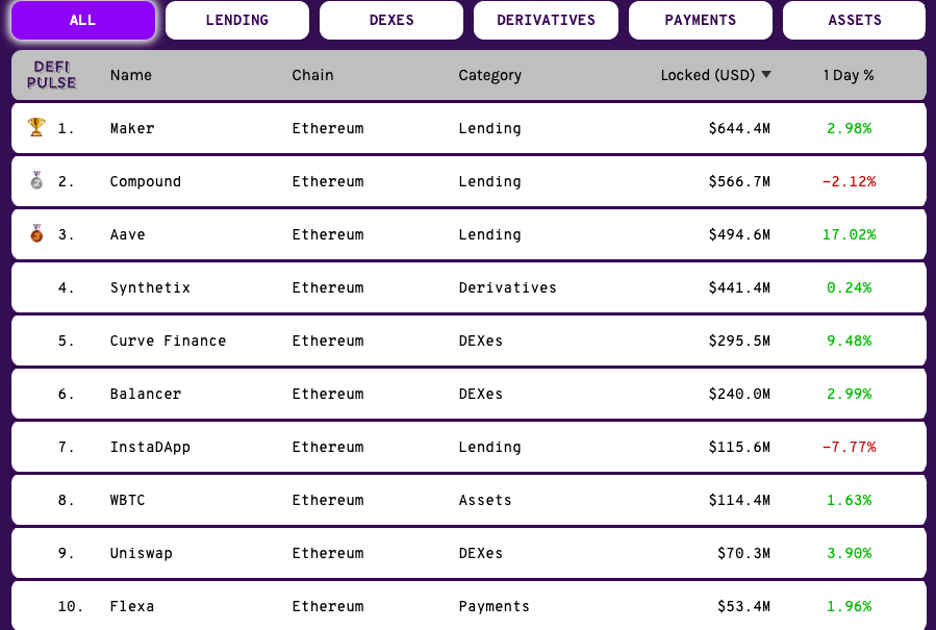

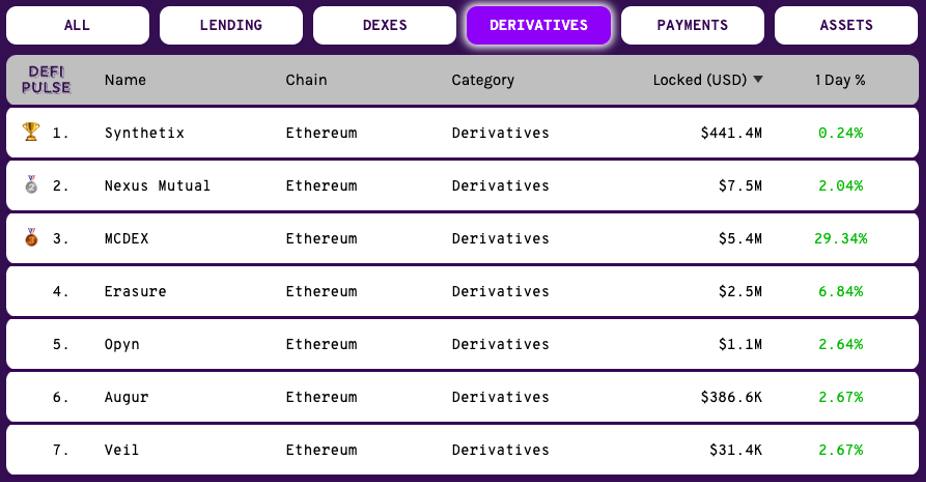

Over here, you will see a list of the top 35 DeFi projects in the space right now by TVL. As you can see, Lending projects dominate the top 3. Now, if you click on the individual tabs, you will see top projects in each of the categories. So, let’s click on “derivatives” and find out the top DeFi derivatives projects.

So DeFi Pulse lists seven DeFi derivatives projects, of which Synthetix is the runaway winner.

Concourse Open Community – The Team Behind DeFi Pulse

Concourse is an open community of builders, enthusiasts, and researchers. Along with DeFi Pulse, the group has built several more interesting tools and websites. Examples of such include:

- DEX.AG: Instantly compare and contrast prices across decentralized exchanges.

- Concourse Data: All-in-one subscription for our APIs.

- ETH Gas Station: An extremely popular website that shows real-time ethereum price, ethereum gas prices, and other network stats.

- Whisp: Automated crypto-based alternative to legacy financial payroll solutions.

- Rek.to: Professional-grade BitMEX liquidations monitor that can be fine-tuned to your needs.

Scott Lewis, one of the co-founders of the Concourse Open Community, had this to say about DeFi Pulse:

One area I’m especially excited about is decentralized finance (or DeFi). It’s been awesome to watch DeFi projects gain real traction over recent months, and the growth shows no sign of slowing. We built DeFi Pulse as a place for tracking that growth.

DeFi Pulse: DeFi Lending

Up next, let’s look at DeFi lending protocols.

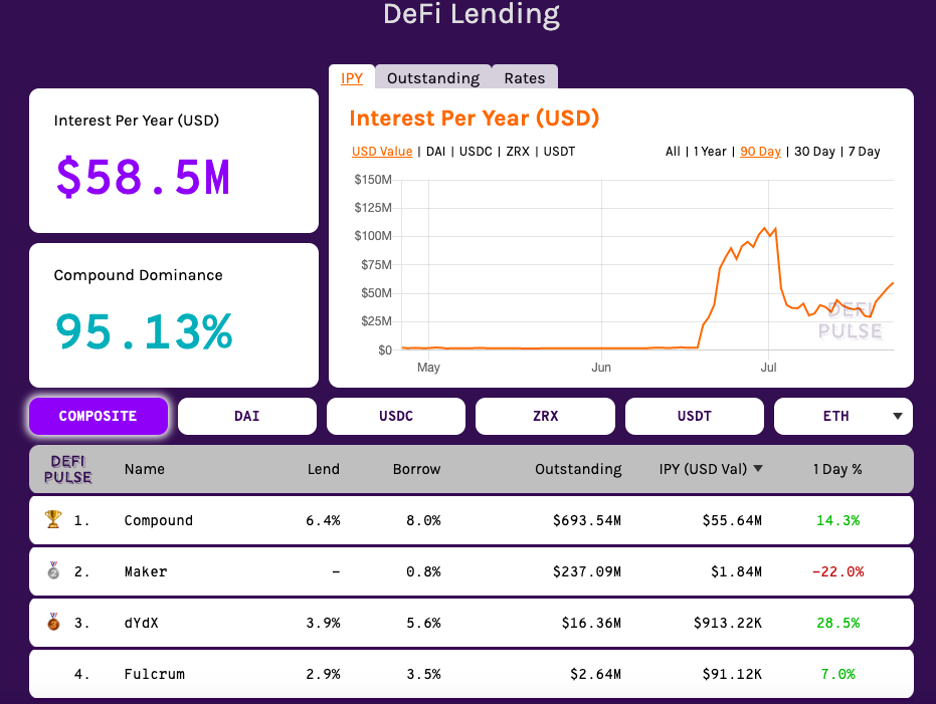

Alright, so lots of things are happening here again. Let’s break it down:

- The first thing that you will see here is the total amount of interest generated per year by these protocols (in USD).

- The project that’s generating the most interest happens to be Compound by a whopping 95.13%.

- You can also check the projects that are generating the most interest in deposits made in DAI, USDC, ZRC, USDT, ETH, WBTC, REP, BAT, and SAI.

What is DeFi Pulse Income?

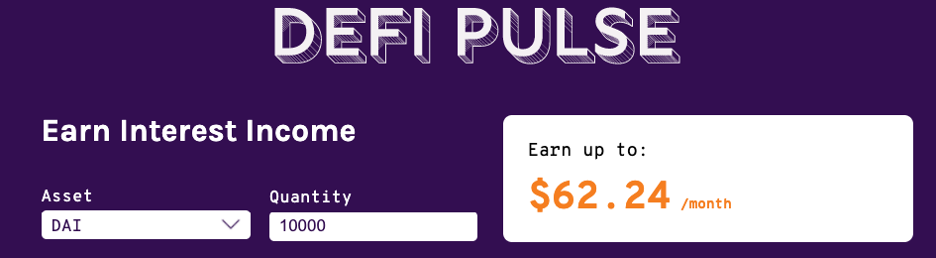

One of the primary factors behind DeFi’s immense popularity is the opportunity to make passive income. DeFi Pulse has a handy little calculator that shows how much monthly interest you can earn by locking up certain units of a specific asset. So, as per the calculator, you can make up to $62.24/month if you lock up 10,000 DAI.

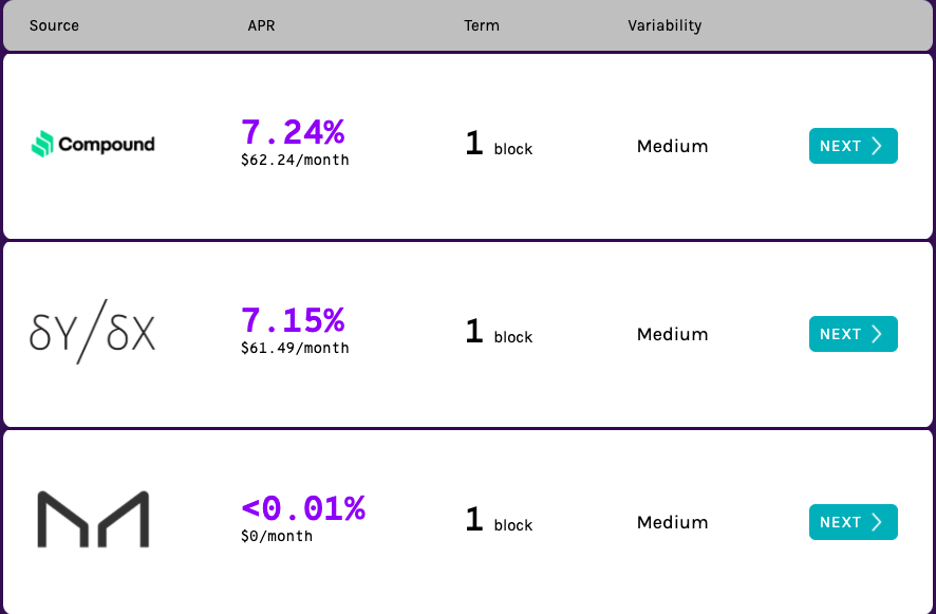

If you scroll down, Pulse also calculates how much the chosen token, in this case, 10,000 DAI, will give you in Compound, dYdX, and Maker.

DeFi Pulse: Individual project data

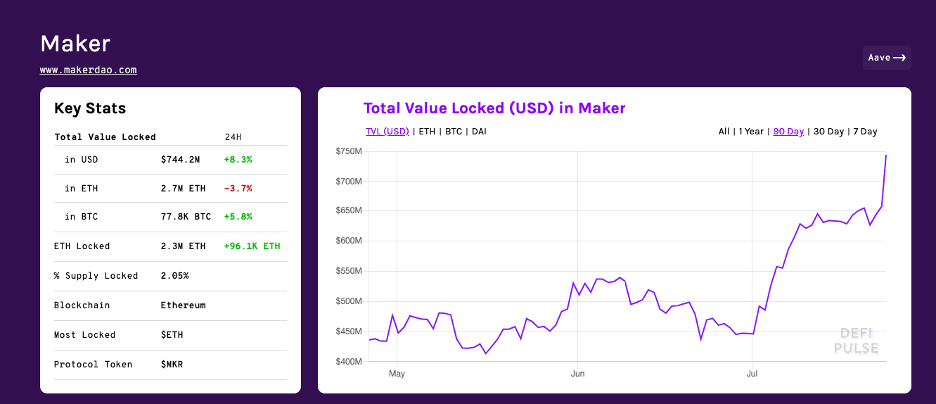

DeFi Pulse also gives you a full overview of each project that it lists. This is what happens when you click on Maker.

- The total value locked up, represented by – USD, ETH, and BTC.

- The percentage of circulating supply of the token of the underlying blockchain that’s locked up.

- The underlying blockchain. In this case, that’s Ethereum.

- The token that’s most locked up in the protocol.

- The native DeFi token, which in this case is MKR.

Alright, so what happens when you scroll down?

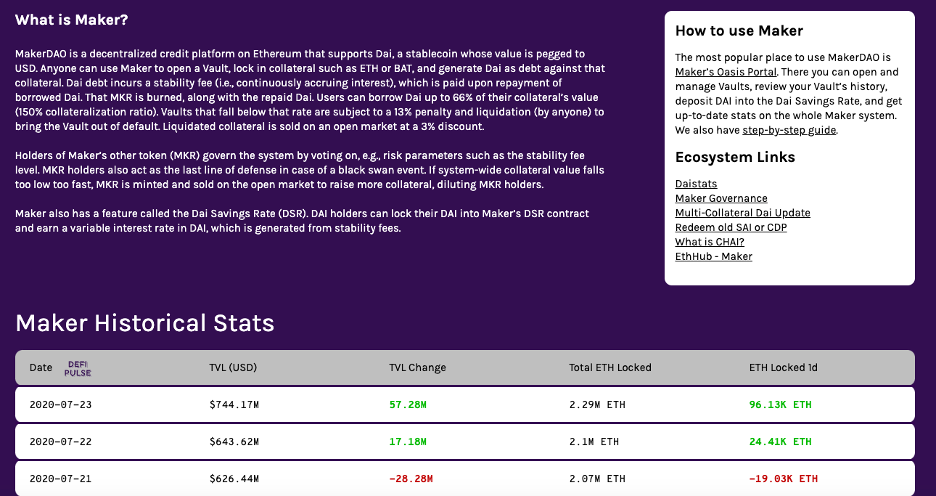

- Firstly, we have a nice little brief description of the project.

- You see that widget on the side? It has a short explainer about what you can do with the project and many ecosystem links.

- Finally, you have a day-by-day historical snapshot of some key stats, namely – TVL, TVL change, Total ETH locked up, amount of ETH locked up or removed on that day.

What is DeFi Pulse listing process?

DeFi Pulse has created a detailed Project Template Repository on GitHub. Third-party developers can use the instructions provided in the repo to build, validate, and update their own project adapter for DeFi Pulse. Here is a brief overview of the whole process:

- The first thing to do is to get successfully listed on The DeFi List.

- Request for the SDK Key from DeFi Pulse on either their Discord channel or Telegram group.

- The project needs to have a well thought out framework to count its total value locked.

- Code a proper project adapter.

- Thoroughly test out the code and the adapter with the DeFi Pulse team

- Ensure that the adapter is up to date. DeFi Pulse may delist outdated adapter.

Project Adapter for DeFi Pulse meaning?

Every project gets its own sub-directory. This will have an index.js file which contains the main code and settings. The projects have the freedom to add extra files and folders to their sub-directory to help organize code. However, they should take care not to overdo it.

TVL Function for DeFi Pulse meaning?

The project adapter’s tvl function plays the vital role of fetching token balances and runs every hour. The adapter should be able to execute itself properly way back to its starting time. This is necessary because:

- It may need to collect historical data that existed prior to the release of a newly added project.

- The developers may need it to fix issues in the protocol.

As per DeFi Pulse, they believe that the most effective solution is for the adapters to work internally with token addresses.

Defi Pulse SDK

If the SDK provided by DeFi Pulse doesn’t have the functionality required to run a particular adapter, the project can contact a DeFi Pulse team member to add necessary support when applicable or find an alternate solution. If the project in question has a critical dependency on off-chain data, it needs to be discussed with the DeFi Pulse team prior to implementation.

Metadata for DeFi Pulse Meaning?

Some metadata best practices, as laid down by the team, are as follows:

- The project and token should be simple.

- Project must be categorized appropriately. This influences the project’s classification. Plus, this also lets DeFi Pulse know which section its TVL is contributing to. Eg. Compound is classified as a lending project.

- The start time should also be set accordingly. It defines how far your protocol can retrieve back data.

Testing DeFi Pulse

The team behind the new protocol needs to run and check the code for possible errors continually. If the project has reached completion, the team will need to execute the “validate” command to conduct a thorough and complete check. This command runs the adapter through a series of points spread over its lifespan. It also checks the validity of metadata exported by the adapter.

Easing up the DeFi Pulse listing process

Back in February of 2020, The DeFi Pulse team brought along some changes that made the listing princess considerably simpler. Earlier the DeFi Pulse team used to create the adapter for the project. However, this inevitably led to a huge bottleneck. It used to take as much as two weeks to add a new protocol.

However, the team then adopted a freer stance by allowing the project to create their own adapters. DeFi Pulse would make a final curation decision for a project based on the following questions:

- Is the project fitting the criteria of decentralized finance?

- Does it have the potential for high user adoption?

DeFi Pulse Feature: Yield Farming

According to a blog post written by the DeFi Pulse team, yield farming may end up becoming the defining characteristic of this space in 2020. In yield farming, you are leveraging DeFi’s fantastic variety and investing in various protocols at the same time to earn a return on your investments. The blog noted that some investors had obtained 100% APY through a combination of interest and token incentives.

Yield farming has already made a tremendous impact on the DeFi space:

- Yield farming boosted TVL on DeFi to easily zoom past the $2 billion level. Not only does this increase mainstream exposure of DeFi, but it has a positive effect on the Ethereum price as well.

- It has profoundly impacted projects like Balancer, Curve, MCDEX, Uniswap V2, and Compound.

Yield farming took over after Compound’s governance token, COMP, went live. It then promptly proceeded to overtake Maker in the leader’s board and get more than $600 million locked up in its contract. A few days later, Balancer, another project, leveraged yield farming to experience tremendous growth as well.

Is the Yield Farming hype similar to the 2017 ICO hype?

Many people are comparing the current yield frenzy to the ICO hype of 2017, wherein millions of dollars were invested in useless projects, ultimately leading to the bear market of 2018. However, such a comparison is a little unfair.

Back in 2017, investors were blindly throwing their money on different projects, hoping to chance upon the “next bitcoin.” The difference now is that people are investing money in projects that actually have a working product. However, it would be naive to say that nothing wrong can happen to this market. Anything that goes up, will inevitably have to come down. However, this yield farming craze may bring a whole new batch of users into the space. Plus, it will definitely affect Ethereum price positively as well.

What is DeFi Pulse Token List?

One of the best things about Ethereum, or any public blockchain platform, is that they are entirely open. This gives users complete control over their products and applications. Unfortunately, this also means that anyone can create any tokens for their projects and name them whatever they want. A normal user will probably not be able to tell the difference between two tokens if they have the same name and ticker. As such, any malicious developer can take advantage of this and create bogus projects with token names similar to those of other more successful projects.

This is where the Token List can be immensely helpful. It is an accurate directory of authentic tokens on Ethereum. If developers integrate the token list into their apps, then it gives them an extra layer of credibility. It proves to their users that they are dealing with the correct project. Any token that will not be confused for an already existing token is eligible to be a part of the Token List.

DeFi Pulse Competitors

While DeFi Pulse is the market leader for DeFi analytics, there are other similar services out there that you can check out:

- DeFi Portfolio Tracker – A portfolio tracker and reporting tool that keeps you updated on your DeFi holdings, trades, stats, APR performance, and history.

- DeBank – An interactive dashboard that tracks your portfolio with data and analytics for various DeFi offerings like stablecoins, margin trading platforms, and DEXes.

- Defi.review – Interactive dashboard with charts that track key metrics of major DeFi projects.

- Bloxy – Reports on real-time data DEX Trades Analysis, DEX Arbitrage Analysis, Margin Trade Positions.

- MyDeFi – Dashboard displays your global DeFi balance and gives you access to important information.

What is DeFi Pulse – Conclusion

It goes without saying that the good folks over at Concourse have created a highly useful and interactive platform for both novice and expert DeFi users. While there are other similar projects in the market, DeFi Pulse is quite clearly the market leader.

By the way, did you like reading up on DeFi Pulse and want to gain a broader knowledge about this space? If yes, then consider checking out our blockchain courses at Ivan on Tech Academy. We have some of the industry’s best experts on the subject, giving you hours of valuable content on DeFi. Come join us!