Blockchain-driven innovation is heating up. However, Bitcoin is still the elephant in the room when it comes to discussing crypto with the average person. In terms of sheer brand recognition, it always wins hands down. However, there are more interesting things going on right now in the crypto space, and one of them is Decentralized Finance or DeFi.

Not to dismiss Bitcoin or minimize its role in bringing about the blockchain revolution, but let’s just say that while Bitcoin’s price has been lurching sideways like a dawdling old grandpa (falling off its walker each time it bumps into the $10k resistance barrier), DeFi has been sprinting around the track like Usain Bolt. In fact, some observers are already predicting that DeFi might well be the next big thing in the blockchain field.

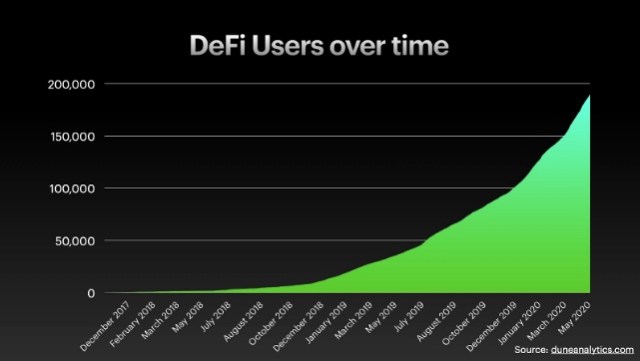

Things can change quickly in crypto, but presently, DeFi is performing well as a family of assets and frankly, it’s a more exciting space to be in. So, if you’re new to crypto or you’ve only been interested in Bitcoin up to this point, why not dig a little deeper into DeFi and learn about the various opportunities it affords? First and foremost, users are flocking to DeFi. So, why is this – and what is DeFi?

DeFi users are increasing

What is DeFi?

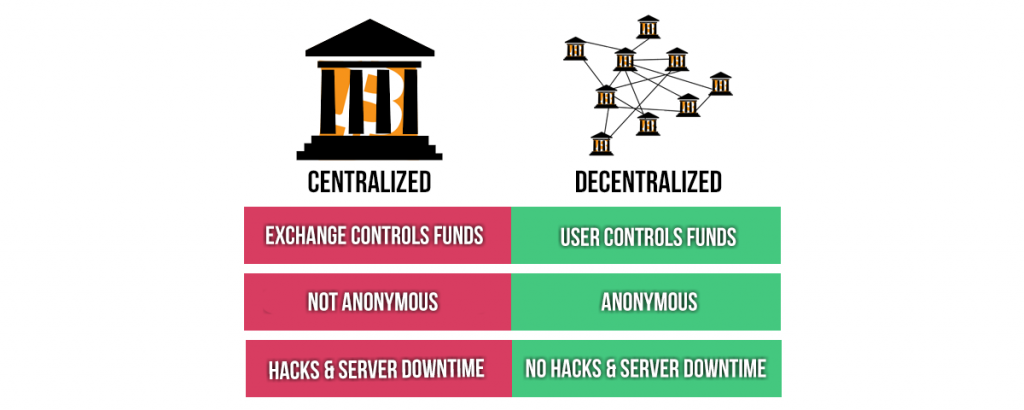

So, what is DeFi? The short answer is, DeFi is a system of finance that utilizes protocols, digital assets, smart contracts, and decentralized applications (dApps) on Ethereum to build a financial platform that’s open to everyone. But before we talk more about what DeFi is, let’s talk about what it is NOT. To do this, let’s look at the way traditional finance is set up.

Traditional finance is centralized, plain and simple. It is managed by a central, governing body; it is about as transparent as the tinted windows on El Chapo’s Mercedes; bankers hours haven’t budged from their traditional 9-to-5 routine; a bank branch is the only place to deposit funds; transferring funds takes forever; excessive regulations make it next to impossible for outsiders to compete and start a bank; wire transfers are littered with high fees and cumbersome processes, and opening a bank account can take up to 30 days depending on where you live.

The purpose of DeFi is to create a financial ecosystem that’s the opposite of all that: one that’s open-source, permissionless, transparent, and devoid of any central authority. Within DeFi, users get to control their assets and they interact with the DeFi ecosystem through what’s called dApps.

Similar to the time Apple computer launched its “1984” Super Bowl ad that bade fair warning to the stiff, buttoned-down, blue-suits in the IBM computing world, DeFi is likewise trying to build something different. Apple disrupted the computer space and computers at large have disrupted nearly every industry over the years. Each innovation builds on top of its predecessor, so why wouldn’t the world of finance eventually be disrupted?

Cryptocurrency promised to make money accessible to anyone, regardless of where they lived or how shoddy their country’s payment system was. When Bitcoin launched, its cheerleaders celebrated foreign workers in the US being able to send money home to places like the Philippines without being gouged by middlemen bankers exacting enormous cross-border fees.

Well, think of DeFi as taking that a step further. Besides just payments, consider the traditional financial services you use every day, like savings, loans, trading, insurance, etc., becoming accessible to anyone in the world. And through DeFi, an individual can access a variety of financial services in a truly global marketplace where costly middlemen are replaced by interoperable apps.

Built on the Ethereum Blockchain

DeFi applications are built on top of blockchains, and overwhelmingly the blockchain of choice has been Ethereum. Why Ethereum and not Bitcoin? Well, there is some DeFi activity on the Bitcoin blockchain, but Ethereum is a better match at this point and we’ll see why.

If you took the Ethereum 101 course at the Ivan on Tech Academy, then you already learned that Ethereum is all about smart contracts. Smart contracts are small pieces of code that run on the Ethereum blockchain. They are written in Solidity which is a Turing Complete programming language. This means that more complex dApps can be written on top of Ethereum than on Bitcoin. Devs can program dApps that can manage digital assets, called smart contracts.

Now, a smart contract is similar to any other contract between two parties that is overseen by a lawyer. However, the main differences are:

1) You can nix the lawyer and

2) A smart contract is self-executing.

In other words, a smart contract is a protocol that allows parties to interact directly with each other without a third-party overseer. Just like when you drink your coffee black, you will find there is no milk or sugar involved—with smart contracts, there is no lawyer involved.

And since it was Ethereum that capitalized on smart contracts to become the first Dapp development platform, it has become the blockchain of choice for many companies seeking to build out their financial products. Thus, not only are a majority of DeFi applications built on Ethereum, but it’s also why the greatest share of innovation is happening on their blockchain.

So, these smart contracts are running on the Ethereum blockchain and they can execute automatically without human intervention when the right conditions are met. And it’s these smart contracts that enable developers to shred the former boundaries of simply sending and receiving cryptocurrency.

Developers build dApps, and these decentralized applications are different than traditional apps because they’re not controlled by central entities like private companies.

And contrary to what some uninformed Bitcoin maximalists might say, that Ethereum is “nothing more than a den of thieves where sh*t coins are regularly pumped and dumped by ICO hucksters”—DeFi is a different animal. Those who prematurely dismiss DeFi with a wave of the hand, are typically the same ones wearing horse blinders that don’t allow their eyes to roam anywhere lower than the top spot on CoinMarketCap.

If you don’t know what any of that means, it’s okay. Just know that DeFi is a different playground than earlier times when Ethereum was home to a lot of over-hyped initial coin offerings. DeFi has some legs to it, so, let’s take a look under the hood of this race car and see what’s going on.

First off, the primary features that distinguish public blockchains from private networks used by traditional financial institutions are:

- Programmable: Developers can program dApps that provide low-cost financial services.

- Trustless: Transactions can be securely validated without the use of central parties.

- Permissionless: Anyone can create and use DeFi dApps.

- Decentralized: Records are not stored on a single server or central network.

- Transparent: Transactions are public so anyone can audit.

- Censorship Resistant: A central party or authority cannot invalidate transactions.

Problems That DeFi Solves

And some the problems of the financial world that DeFi can fix are:

- Limited Access to Worldwide Financial Services: Global access to financial services already exists, but they come with a litany of barriers (see below). Got a computer or cellphone with internet access? That’s all you need to get started with DeFi.

- Too Many Barriers To Entry: A lot of documentation and a well-funded bank account—not to mention a favorable geo-location near a financial service provider—are all barriers to entry in the traditional space that DeFi aims to eliminate.

- Lack of Privacy and Security: Centralized institutions can inadvertently put their client’s wealth and private information at risk. In DeFi, users are in control of their money and don’t need a central authority.

- Hefty Fees for International Payments: DeFi aims to reduce global remittance fees (that stand around 7%) by more than half (to a manageable 3%). By simply eliminating unnecessary fees commanded by middlemen, cross-border payments can be greatly reduced.

- Censorship: As we move into the dystopian age of social scores, political censorship can also mean financial censorship. Just like on a bad episode of “Black Mirror,” if you anger the wrong tyrant, not only can you get banned from social media, you can also get your accounts blocked by institutions like PayPal or Patreon—making it very difficult to transact business. DeFi offers immutable transactions and blockchains that can’t be shut down by central authorities like governments, big banks, or big-tech tyrants. And although your transactions can be publicly audited, your identity remains pseudonymous.

- Complexity: Devs are getting the user interfaces of their dApps to look more appealing and simpler to use every day. And simplicity will help the masses to migrate away from the traditional, complex, centralized systems.

What Financial Products are Available in DeFi?

Okay, you’re probably saying, “Enough theory already! How do I make money off this? And what are some of the financial products being offered in DeFi?

There are many ways you can make money, but as in any speculative venture, there are lots of ways to lose money as well. So, keep your risk tolerance in mind as you proceed.

Decentralized Money Markets

The fastest-growing sectors of DeFi are the borrowing and lending platforms. Users simply deposit their funds and they can earn interest off others who borrow their assets. Many lending opportunities in DeFi offer superior interest rates, particularly in this age where zero or negative interest rates are the norms.

So, it’s no wonder there is a buzz around DeFi. And, as mentioned earlier, even though what’s happening is different than the earlier ICO craze, the level of excitement DeFi is creating is comparable.

Decentralized Exchanges (DEXs)

DEXs allow you to stay in control of your funds whilst you trade between tokens, and because maintenance costs are less, trading fees cost less. Centralized exchanges share your financial info, there is more custodial risk, and really, why would you go to the trouble of taking control of your money by buying cryptocurrency just to turn around and cede control back to the central authority running the exchange?

Decentralized Stablecoins

Stablecoins are the building blocks of the DeFi ecosystem and it’s their job to remove volatility and ensure stability. This is accomplished by pegging. In other words, some dApps allow you to peg a stable coin to the value of a currency in a predetermined ratio.

Cryptocurrencies are volatile and this volatility contributes to frightening the mainstream. Investors, speculators, and the like, who gravitate to crypto have a higher risk tolerance than the average citizen. And while we may be used to it, these vicious ups and downs scare a lot of people. So stablecoins play a big role in removing volatility by being pegged to something more traditional like the US dollar.

There are currently three kinds of stablecoins in use:

- Fiat Collateralized.

- Crypto Collateralized.

- Non-Collateralized.

Decentralized Insurance

The safety net for DeFi loans comes in the form of collateralization. Many of the loans are overcollateralized which makes them appear completely safe on the surface. However, should a hacker find a bug in the source code for a dApp, it’s open to poaching. This potentiality could leave smart contracts vulnerable and loads of money at risk.

To help counter this, different forms of DeFi Insurance are being developed.

Interoperability

One of the most exciting features of decentralized financial apps is how they can be combined to create completely new products. If you’ve watched the DeFi 101 course on the Ivan on Tech Academy, you will hear the instructor, Amadeo Brands, talk a lot about piecing Lego bricks together. And that is a great way to visualize it.

For example, a developer could combine a stablecoin, with a decentralized exchange, along with a synthetic to form a completely new financial product! Now, that is truly amazing. There is no reason for devs to have to reinvent the wheel each time they want to make something new. There are plenty of building blocks already created to be combined with or built on top of.

Decentralized Synthetics

These projects promise to democratize access to financial products such as gold, the US dollar, or even decentralized prediction markets.

This article is just an introduction, so we are only scratching the surface to show what’s possible. We will be getting into more sophisticated financial instruments in the future.

The Risks of DeFi

One of the greatest things about DeFi is that it allows people to take control of their assets. One of the worst things about DeFi is that it allows people to take control of their assets. Like the old man in the “Spiderman” movie says, “With great power, comes great responsibility.”

The potential for big returns can incentivize people to take big risks. But big risks can exact big losses if you’re not responsible. One minute you can be sailing above the skyscrapers thinking you’re the amazing Spiderman of DeFi, and the next minute you can come crashing down to Rekt City. And you don’t want to end up in Rekt City.

This is not financial advice, but if you will just remember that the bigger the potential return, the bigger the risk, then you can decide on the appropriate amount of money you want to risk.

Who Can Access the Wonderful World of Defi?

You can. All you need is an internet connection and a crypto wallet to get started. But you should learn more first. This is only an introduction and more advanced articles are to follow, but why wait? You can take two courses right now at the Ivan on Tech Academy, DeFi 101 and DeFi 201 are both available.

See you there!

MindFrac