Several people in the DeFi space have been asking the same question for the last few months; what is Compound? In essence, Compound is an Ethereum money market protocol, which allows lenders to provide loans and borrowers to take out loans. Moreover, the reason behind Compound’s spectacular rise in popularity is pretty apparent.

For a long time, people thought that Maker’s lead at the top of the DeFi list of projects was unassailable. However, Compound, seemingly out of nowhere, has since taken the lead and now rules the roost when it comes to DeFi. So, in this article, let’s examine what Compound is and what it does.

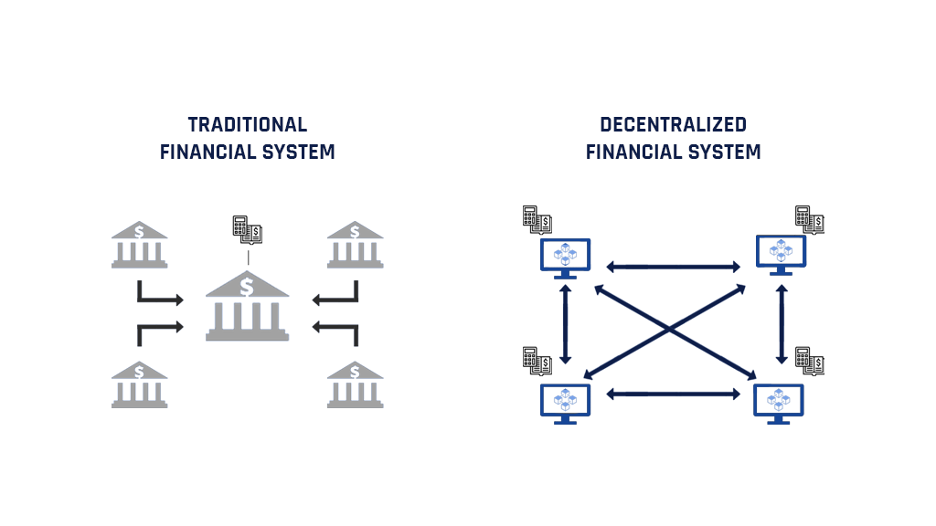

Before getting into Compound, however, let’s understand what a DeFi project, or decentralized finance, is. This is especially important seeing as analysts predict that the DeFi space will see huge growth in the coming years.

What is DeFi?

DeFi or “decentralized finance” is an all-encompassing term that refers to the digital assets, financial smart contracts, decentralized applications (DApps), and protocols that run on top of public blockchains.

Decentralized Finance vs Traditional Finance

| Decentralized Finance (DeFi) | Traditional Finance | |

| Trust Allocation | No need to trust a third-party since the system itself has an in-built incentivization system. | Centralized regulators and banks control and govern the financial system. |

| Transparency | DeFi is inherently permissionless and transparent as it’s blockchain-based. | Banks and traditional financial institutions are unwilling to expose their internal operations to the public for confidentiality purposes. |

| Innovations | An open-source protocol that encourages developers to build and create their own applications. | System burdened by cumbersome red-tape that inhibits innovation. |

DeFi vs Cryptocurrencies

Now, you might be wondering, well…. I already have so many cryptocurrencies, why will I need DeFi on top of that? To understand this, let’s look at the differences between the two:

- DeFi is a field of purely financial services that often happen to be governed by tokens. Since you can’t compare USD to loans, you similarly can’t compare cryptocurrencies to DeFi.

- Extending the previous point, while cryptocurrencies have managed to decentralize money, they haven’t decentralized the financial system itself.

- A centralized organization is often in charge of governing a cryptocurrency.

What is Compound finance blockchain lending?

Compound Finance is an algorithmically-operated, decentralized, interest rate protocol for lending and borrowing cryptocurrencies. It is a platform where users can frictionlessly supply (lend) cryptocurrencies as collateral, to borrow crypto assets based on interest rates set by real-time supply and demand.

The process of earning interest or borrowing assets against your collateral is pretty straightforward.

- You can immediately earn compound interests by supplying assets to Compound’s liquidity pool.

- The compound interest rates adjust accordingly, depending on supply and demand.

- There is no lockdown period when it comes to Compound. You have the freedom to withdraw or repay your collateral whenever you want.

Compound has already been audited and formally verified. Since May 2020, Compound has adopted community governance. Holders of the COMP token and their delegates debate, propose, and vote on all changes to Compound.

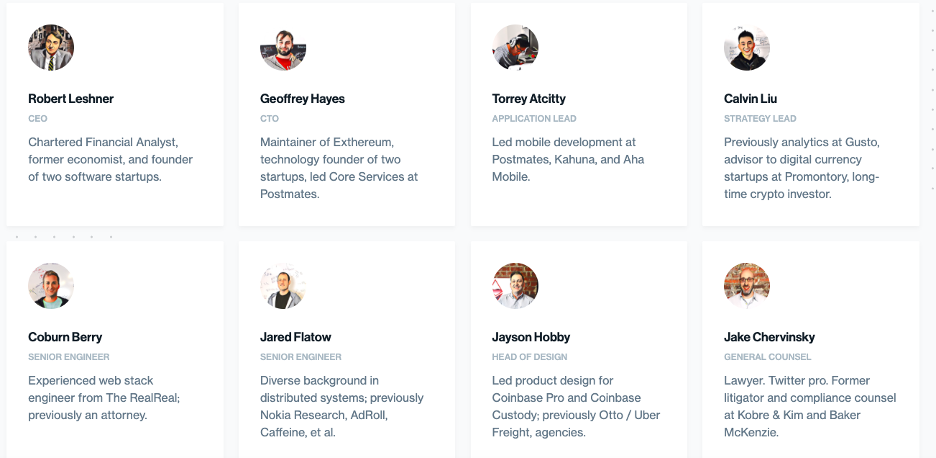

What is Compound – Team and Investors

One of the essential metrics you can use to judge a project’s credibility is by looking into its team and investors. Let’s start with the team.

- Robert Leshner is the CEO. He is a Chartered Financial Analyst and former economist. He was also a Product Lead at Postmates, a popular delivery app.

- Geoffrey Hayes, the CTO, and Torrey Atcitty, the Application Lead, also used to work at Postmates.

- Jake Chervinsky, the General Counsel, is an adjunct professor at Georgetown University Law Center. His work has landed him on several prestigious lists, like The Cointelegraph Top 100.

Some heavy-duty investors have financially backed Compound as well. Examples of such well-known investors are:

- Andreessen Horowitz: Marc Andreessen, the co-founder of this firm, was the co-author of Mosaic – the first widely used web browser. Furthermore, he was also the co-founder of Netscape.

- Polychain Capital: One of the biggest crypto investment funds in the world.

- Bain Capital: The investment arm of Bain & Company. Incidentally, it’s one of the “Big Three” management consulting firms.

- Coinbase is one of the largest cryptocurrency exchanges globally. In addition to having offices all over the world, it has more than 20 million customers worldwide.

As you can see, Compound has a solid team and a powerful group of investors.

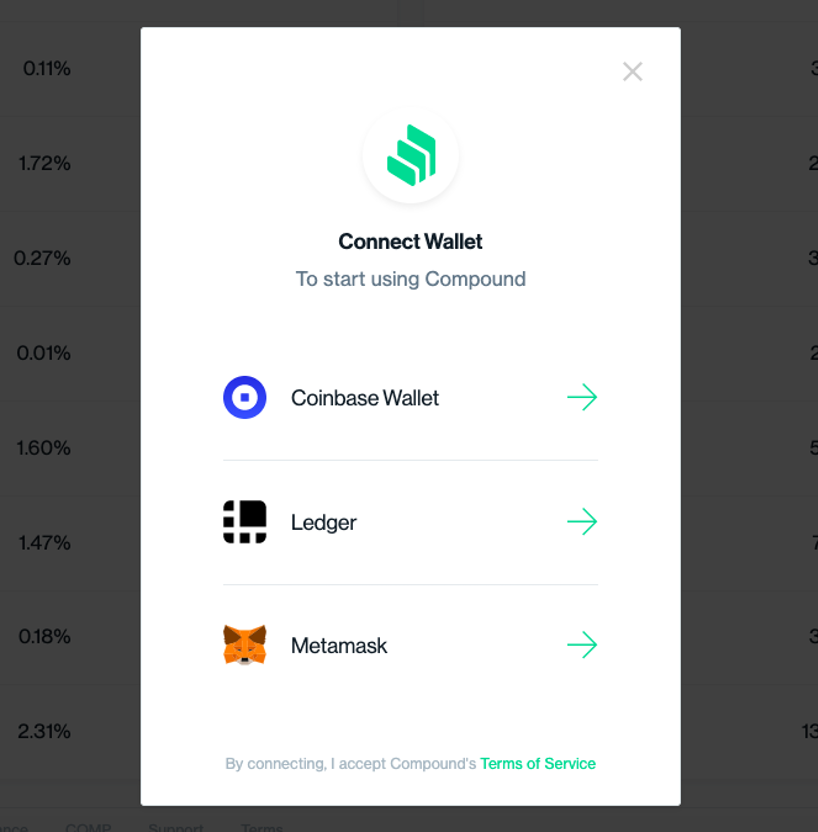

What is Compound – Functionality

The concept is pretty straightforward, deposit collateral, and earn interest. However, instead of depositing your money into an intermediary like a bank, you put it in a smart contract. This ensures that you are not giving up control of your assets to intermediaries.

Now that you have some background information let’s look at how you can interact with Compound. The first thing that you need to do is to connect your wallet to the site. You have the option to connect the Coinbase Wallet, Ledger, and Metamask.

Compound Finance Blockchain Lending: Deposit

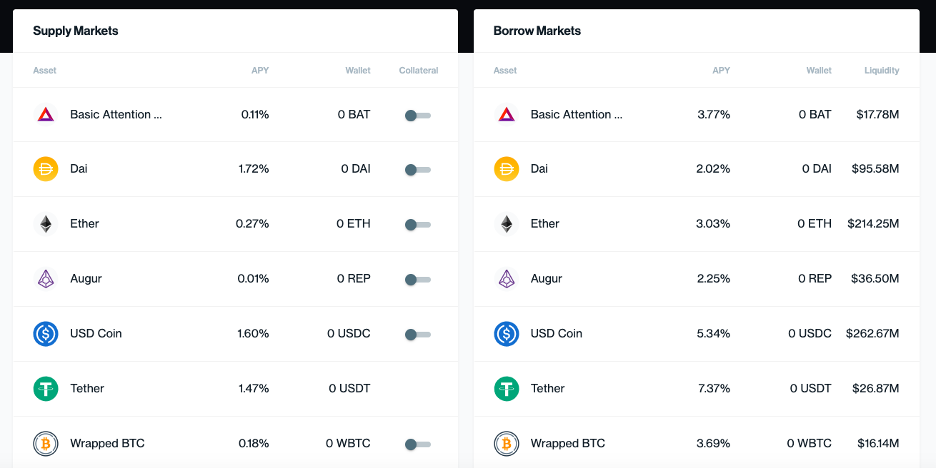

After you connect your wallet to the website, you’ll see the following:

Thus, you have all the assets that you can:

- Deposit to the website with a bit of collateral.

- Borrow from the website.

Anyway, so how does the deposit process work? It’s actually pretty straightforward:

- Choose which coin from the list you want to supply to the website.

- Each list has a different Annual Percentage Yield (APY). In the image above, you can see that USDC has an APY of 1.6%. This means that you earn 1.6% of your deposit if you supply USDC to the platform.

- If you want to supply USDC, simply click on it and you will something similar to the image shown below:

- Provided you have the wallet loaded up, you should be able to interact with the Website’s wallet.

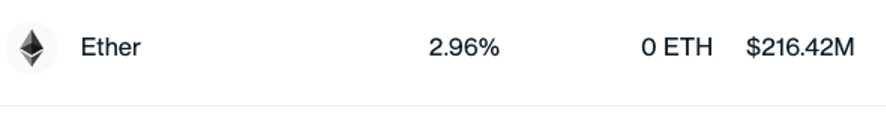

Compound Finance Blockchain Lending: Borrow

- The borrowing process is as straightforward as the deposit process.

- Borrowing cryptocurrencies requires you to pay some fees. Eg. If you want to take a loan of Ether, you will need to pay 2.96% per year.

- The differential between the amount of interest generated from depositing and the fees you need to pay for borrowing is the fees collected by Compound for their services.

What is Compound blockchain dual-token system? cTokens vs COMP

Compound Blockchain Tokens #1: cTokens

cTokens represents your balance every time you choose to interact with the Compound liquidity pool. The underlying asset represented by cTokens allows you to earn interest and serve as collateral. It works similarly to ERC-20 tokens as it can be traded, or programmed by developers to create new technologies.

To illustrate how this works, consider the following example. Suppose you supply 1000 BAT to Comound’s liquidity, wherein the exchange rate is 0.02. In this case, you receive 50,000 (1000/.02) cBATs, in return. After a few weeks, you decide to withdraw, but this time, the exchange rate is 0.021. Your 50,000 cBAT will now be equal to (50,000*0.021) 1050 BAT.

In this case, you can withdraw your 1050 BAT, redeeming all your 50,000 cBAT tokens. Likewise, you can just withdraw your initial investment (1000 BAT), withdrawing 47619.0476 cBAT tokens in the process and keeping the rest in your wallet.

Some features of cTokens are as follows:

- You can borrow up to 50-75% of their cTokens’ value, depending on the quality of the underlying asset.

- You can add or remove tokens anytime.

- If your debt becomes undercollateralized, anyone can liquidate.

- Liquidators receive 5% on liquidated assets as an incentive.

- Coinbase Wallet and MetaMask integrate cToken balances.

- cTokens are visible on Etherscan.

How to get cEther?

The method of getting cETH is quite different from, say, cBAT or cDAI.

- When you send ETH to the Compound, an application can send it directly to the payable mint function in the cEther contract.

- Upon activating the feature, cEther shows up in the wallet.

- As a result, due to the invocation, the cToken contract retrieves the indicated amount of underlying tokens from the sender’s address.

Compound Blockchain Tokens #2: COMP

The second token in the Compound ecosystem is COMP, which is the native governance token. As we have mentioned before, Compound has transitioned to community governance since May 2020. COMP tokens holders can make proposals and vote to decide on the direction the protocol takes in the future.

The features of COMP are as follows:

- The total supply of COMP is 10 million. 42.3% is reserved for users to earn when they use Compound.

- Within each of these markets, the amount of COMP is divided 50:50 between the suppliers and borrowers within that market.

- Users can check the amount of interest paid per day by checking the User Distribution page.

- COMP holders can earn more COMP token by voting on various governance proposals.

- Available on various exchanges like Coinbase and FTX.

What is Compound finance blockchain lending interest rate?

Alright, time and again, we have talked about the interest rates provided by Compound. In this section, we will gain a deeper understanding of what it actually means

- Interests are dependent on the liquidity available in each market.

- The rates fluctuate depending on real-time supply and demand.

- When the liquidity is high, the interest rates are low.

- When the liquidity is down, the interest rate increases.

How is the interest calculated?

The interest rate, as seen on the website, is an annual interest rate. Upon the mining of a new Ethereum block, i.e., every 15 seconds, the interest is generated.

Why is supply rate > borrow rate?

Excess liquidity can only exist when the assets supplied are higher than the number of assets borrowed. As a rule, this simple mechanism ensures that users can withdraw or borrow funds from the pool with ease. There are two things you need to keep in mind regarding this:

- If a market has more suppliers than borrowers, the interest rate earned by the supplier is comparatively lower. In fact, the asset’s utilization rate measures the interest.

- A portion of the interest paid by borrowers is set aside as reserves. Furthermore, COMP holders are responsible for this action.

What is Compound Community Governance?

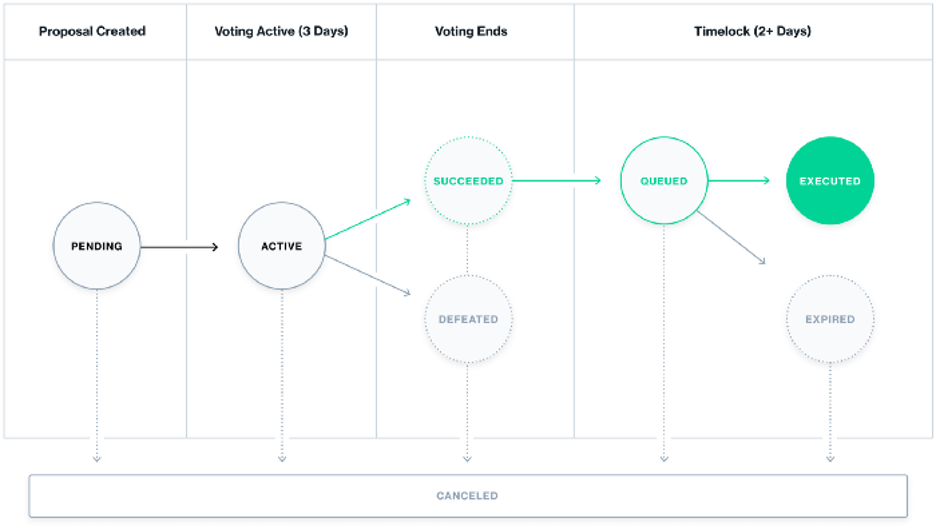

Compound has a very straightforward and simple governance framework. This is how it works:

- Anybody with 1% COMP delegated can propose a governance action.

- Any proposal made has a 3-day voting period.

- Any address which has voting power can vote for or against the proposal.

- If the proposal receives at least 400,000 votes, it’s queued in the Timelock and implemented after two days.

- However, if it doesn’t receive the appropriate amount of votes, it gets dropped.

The examples of actions taken by COMP holders are as follows:

- List a new cToken market.

- Update the interest rate model of the market.

- Update the oracle address.

- Withdraw a cToken reserve.

What is Compound decentralized governance?

As community governance adopts complete decentralization to enhance security and stability, Compound will be utilizing the following protocols:

- The company’s shareholders will receive a portion of the COMP tokens during the initial sandbox period. The shareholders can either delegate the voting weight to themselves or someone else.

- Most of the COMP tokens will be escrowed, and hence, will not participate in governance.

- Compound developers are encouraged to participate in governance actively.

What is the Compound Finance Blockchain Lending Use Case?

- Holders can use Compound to earn interest without going through the pains of personally managing their assets or taking speculative risks.

- Dapps and exchanges can use Compound as a source of monetization in the Ethereum ecosystem.

- Traders can borrow Ether from the liquidity pool buy putting in their existing portfolio as collateral to participate in a crowdsale.

- Traders looking to short a particular token can borrow it from the liquidity pool, and sell it immediately.

What is Compound Finance Blockchain Lending: Conclusion

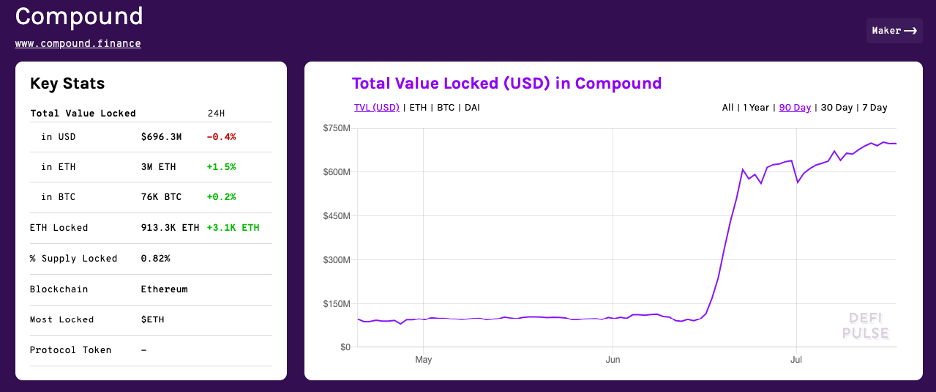

The graph above is taken from DeFi Pulse and perfectly captures how suddenly the project has catapulted itself into prominence. As of writing, the Compound protocol has $696.3 million locked in it. If you are interested in the DeFi space, it’s paramount to learn about the nuances of the Compound finance blockchain lending protocol. We hope that this guide was able to give you a fresh perspective on this fantastic project. Compound blockchain showcases the real power of DeFi and how it can engineer a whole new and innovative financial ecosystem.

By the way, if you liked knowing what is Compound and want to know more about DeFi, consider checking out our blockchain courses at Ivan on Tech Academy. Ivan on Tech Academy is one of the top places available to learn blockchain. This platform has some of the industry’s best experts on the subject, giving you countless hours of valuable content on DeFi. Come join the Academy!