The narrative around cryptocurrency is changing rapidly, as the world begins to recognize the legitimacy of crypto as an asset class. Nevertheless, the relative complexities of the crypto market can be overwhelming for some. So much so, it can be a huge barrier that prevents investors from entering the space. The world of crypto never sleeps, and keeping up with the latest projects can be a full-time job. However, thanks to BASE Protocol and the BASE token, there is now a crypto index fund that gives exposure to the entire crypto market via a single token.

In this article, we’re going to dive deep into BASE Protocol and explore some of the unique functions of the BASE token. Also, we’ll explore the tokenomics of BASE and some of the use cases for the BASE token in DeFi and beyond!

If you’re interested in learning more about cryptocurrency and DeFi, make sure to check out Ivan on Tech Academy. The Academy has a huge range of courses, from DeFi 101 to blockchain gaming. Ivan on Tech Academy is the best place to find all the latest information you need to get up to speed in crypto, regardless of your prior experience!

What Is BASE Protocol?

BASE Protocol is a decentralized financial application created on the Ethereum blockchain, an open-source platform with an active GitHub repository. The project uses the number one oracle service in the crypto space, Chainlink, as part of their price data feed.

Base Protocol's BASE token is price-pegged to the entire cryptocurrency market cap. The BASE token is pegged at a ratio of 1:1 trillion. In short, BASE enables speculation on the whole crypto market with a single token.

For Example:

- If the total crypto market cap was $450 billion, the BASE token would be worth $0.45

- If the total crypto market cap was $800 billion, the BASE token would be worth $0.80

Rather than speculating on the price of multiple crypto assets individually, BASE allows traders to invest in the overall performance of the cryptocurrency market and the future growth of the industry with a single token.

BASE works very much like a crypto index fund. For anyone new to the crypto space or with little knowledge about specific crypto projects, BASE is a tool that can be used to diversify investment portfolios and increase crypto exposure.

If you’d like to learn more about cryptocurrency and blockchain, we recommend taking a look at some of the courses available at Ivan on Tech Academy. Regardless of your current level of knowledge, the Academy is tailored to each individual student! Students can create a personal study plan, and have access to mentors throughout! There has never been a better time to learn a new skill, so now is the ideal opportunity to find your perfect job in crypto!

How Does Base Protocol Work?

BASE Protocol is an innovative investment vehicle that has several core features. Below are some of the fundamental aspects of BASE Protocol and the BASE token:

Synthetic Assets

The BASE token is a synthetic asset. This means it carries the same properties and is price pegged to another asset. Popular DeFi platform Synthetix allows users to mint synthetic assets on the blockchain known as “synths”. Also, synths simulate the market behavior of the asset they represent and allow for additional avenues for asset exposure.

Similarly, the BASE token is a synthetic token, pegged to the value of all cryptocurrencies. The BASE token allows traders to speculate on an entire asset class without the need for multiple unfamiliar assets overtaking a portfolio.

Elastic Supply

The BASE token has an elastic supply. Unlike Bitcoin, which has a max supply of 21 million, BASE Protocol expands and contracts the token supply programmatically. This is done to achieve the target price equilibrium, keeping the peg to the overall cryptocurrency market cap.

The target price for the BASE token is one-trillionth of the total market capitalization of all cryptocurrencies. To bring the token price back to its target price, the token supply is adjusted. Surprisingly for some, this means that the number of tokens in your wallet can change daily.

Rebase

These expansions and contractions of the BASE token supply are known as rebases. An expanding supply decreases scarcity and drives the token price down as new tokens enter circulation. Conversely, a contraction of the token supply increases scarcity and pushes the price of the token up towards its target.

Rebasing was made popular by Ampleforth. The native Ampleforth token AMP is designed to stay as close as possible to the dollar. To achieve this, the protocol must rebase every day to rebalance the supply of tokens in accordance with the market cap. Theoretically, this novel concept means that, over time, token holders own a larger portion of the market cap as the project grows.

However, beware! Despite this exciting new opportunity, many people do not fully understand the concept of rebasing. Rebases can be great if you understand how to time the market, but if you buy at the top just before a rebase occurs, you might think you have teleported to Rekt City overnight. Rebasing is a novel concept in crypto, so just be careful and do your own research before making any major moves.

If you’d like to learn more about how rebasing works, go and check out our What is Ampleforth article for more information!

Cascade

The BASE token is available to purchase from the Uniswap liquidity pool. BASE Cascade is a feature that rewards liquidity providers of the BASE Pool. Returns are increased by a multiplier that returns higher rewards the longer a user stakes. The more liquidity provided over a longer period, the higher the returns from Cascade. Therefore, when this occurs, liquidity providers own a greater share of the liquidity pool.

BASE Token

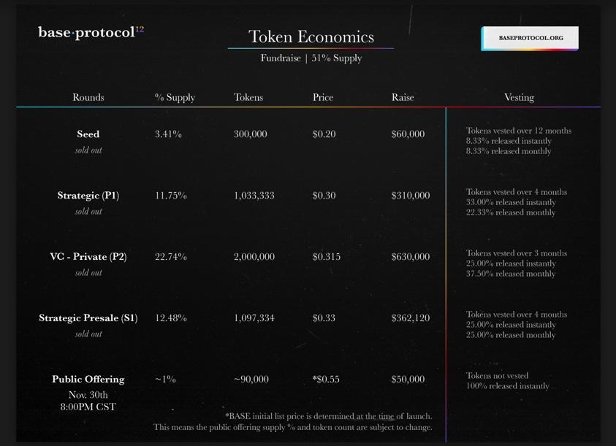

The BASE token launched with an initial market cap of $725,000. The market cap breakdown is based on the launch price of $0.55/BASE.

BASE has a total token supply which is capped at 8,795,645 BASE, with an initial circulating supply of 1,313,785 BASE. The total token supply will not be subject to change through any governance proposals or other means.

The majority of tokens sold in the fundraising round and those allocated for the ecosystem are vested. Resultantly, this means that the initial circulating supply of BASE tokens is under 25% of the total supply. By locking up the majority of the token supply, BASE Protocol is incentivizing long-term investment from people who believe in the future of the project.

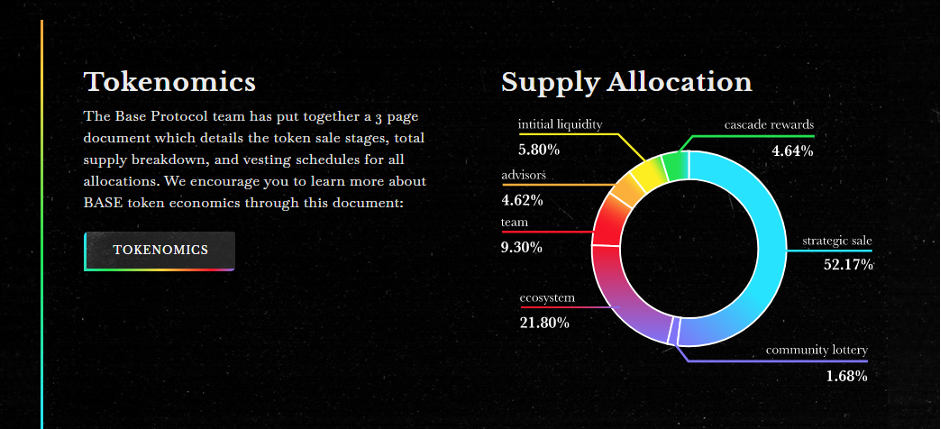

Tokenomics

51% of the supply of BASE was allocated for the fundraising round. The remaining 49% is allocated to operational reserves. This has been broken down into the following:

- Ecosystem - 20.48%

1,801,342 BASE tokens have been reserved for partnerships, marketing, and exchange listings. BASE tokens will be distributed over 36 months.

- Foundation - 8.98%

789,798 BASE tokens are reserved for the BASE Protocol Foundation team. Also, team members will receive 9.09% of their BASE tokens monthly after an initial lock-up period.

- Advisors - 4.46%

392,019 BASE tokens have been allocated to The BASE Protocol advisory board. Furthermore, these tokens will be vested over 12 months to show long-term commitment to the project, with 8.33% of tokens released monthly.

- Initial Liquidity - ~3.30%

The first Uniswap liquidity pool will have a liquidity allocation of $160k ETH and $160k BASE. The BASE token allocation equates to approximately 3.30% of the total BASE token supply. The matched ETH comes from the initial fundraising, resulting in a total of $320,000 of liquidity for the launch. All liquidity from the initial launch will be locked for 12 months.

- Cascade Rewards - 11.37%

1,000,000 BASE tokens were allocated for the BASE Protocol’s unique staking rewards scheme. This allocation is a one-off “launchpad allocation”, moving forward, the BASE Cascade will be rebalanced with each rebase. Furthermore, Cascade is an innovative and unique self-sustainable program for liquidity staking that incentivizes early adopters with greater returns.

BASE Token Use Cases

- For newcomers that are unsure which crypto to buy, the BASE token offers a simple and easy solution. Also, BASE removes the need for investors to track the gains and losses of multiple altcoins.

- Additionally, the BASE token is extremely appealing to institutional investors looking to diversify their portfolio and gain exposure to the entire crypto industry. BASE provides a hassle-free alternative to investing in thousands of cryptocurrencies, saving endless hours of time management.

- The BASE Protocol works to absorb the volatility of the entire crypto market, making it more appealing to low-risk investors. Also, the project provides the opportunity to gain exposure to the price of every cryptocurrency, at an affordable price. To gain this much exposure across the crypto ecosystem without the BASE token, would require a substantial initial investment.

- Many businesses and high-net-worth individuals place a percentage of their portfolio in a hedge fund, as a way of balancing their investments. This means that should one share or asset not perform as well as expected, there would be a counterbalance of other shares that have increased in value. Also, BASE token offers crypto traders the opportunity to hedge or diversify their crypto investments.

- Furthermore, the BASE token can be used as a base pair with any token. Often, traders will follow the value of an altcoin against BTC or USD. Now, traders have the alternative to gauge the value of an altcoin against the entire crypto market - which is useful trading information to have.

BASE Protocol Roadmap

BASE Protocol has laid out a roadmap outlining the long-term goals for the project. However, this is a projection made by the team. Consequently, it’s worth bearing in mind things may change and the timeline may be re-forecasted in the future. Consider that some goals may be achieved earlier than expected and some may take longer than anticipated.

2020 Quarter 4 - Launch

- BASE Token Sale,

- Community Lottery

- Token Distribution

- Chainlink Oracle Integration

- Cascade Launch

- Initial Uniswap Liquidity

- Staking Rewards Program

- Establish BASE governance protocol

- Launch Initial Governance Proposals

2021 Quarter 1 - Execution

- CEX Outreach & Listings

- Major Post-Launch Marketing Campaign

- Development of BASE Brokerage Platform And Fiat Gateway

- Protocol Updates

- Team Expansion

- Actioning BASE Governance Proposals

2021 Quarter 2 - Exploration

- Explore BASE DEX

- Propose BASE as Price Basis For Token Pairs On Popular DEXs

- Explore using BASE for collateral in hedged lending

- Engage BASE Governance

2021 Quarter 3 - Expansion

- Major Outreach To Institutional Investors

- Consider Foundation Layer For Rebase Token Creation Platform

- Continued Governance Actions

BASE Protocol Conclusion

Rebasing is a relatively new technology. Some traders use it for quick, predictable flips, but this requires a strong knowledge of the markets. Fundamentally, rebasing is a wholesome notion, but many newcomers to the crypto space are quick to get rekt when investing in exotic altcoins such as the BASE token.

Nonetheless, BASE is offering an appealing introduction to new crypto investors, wanting exposure to digital assets without the volatility of small-cap alts. BASE Protocol has opened a new door for investors to gain exposure to all crypto assets simultaneously efficiently and affordably. The innovative project will be sure to assist in the growing mass adoption of cryptocurrency. Additionally, BASE tokens can be used to absorb any extreme price action on long or short positions. Meaning, if you had placed a long position on an asset and it went down, the price of BASE would also have gone down. You would only need to pay the difference in the value of BASE at a lower price.

In conclusion, there are plenty of weird DeFi platforms out there. However, BASE Protocol is just another example of how experimentation and innovation are flourishing in the blockchain industry. You too could do the same. There has never been a better time to learn a new skill. Furthermore, Blockchain is the most in-demand skill on LinkedIn currently.

By educating yourself in the workings of the blockchain, you could position yourself at the forefront of an emerging industry. If you’re interested in crypto, Ivan on Tech Academy has tailor-made study plans and courses covering all aspects of the industry. Regardless of your current level of knowledge, now is the perfect time to start your crypto career! Enroll in Ivan on Tech Academy with the promo code BLOG20 and get 20% off!