In today’s article, we’ll explore the GHO stablecoin. As we begin our venture, we'll start by analyzing the basics of the GHO token. Plus, we’ll explain what the Aave stablecoin proposal is. As such, the following sections will give you a chance to learn about the ins and outs of the GHO crypto asset, and you’ll be able to find out how the Aave GHO stablecoin works, explore its tokenomics, what backs GHO, and what its main use cases are.

As a bonus, we’ll also explain how to make money with Aave. This is where you’ll find out that there are several different options, all depending on your personal preferences, risk tolerance, and other factors. Fortunately, the insights Moralis Money provides can help you improve your chances of entering profitable trades.

Last but not least, we decided to include a section providing basic information about stablecoins. So, in case you’re not sure what a stablecoin is, starting with the “About Stablecoins” section might be a good idea.

Exploring Aave's Decentralized Stablecoin: The GHO Token

The best place to start learning about any project is to look at its official website, whitepaper, documentation, and socials. And yes, that’s exactly what we did for the Aave GHO stablecoin.

We first encountered the tagline pointing out that GHO is the only decentralized over-collateralized stablecoin native to the Aave protocol. That means there is no central authority behind this stablecoin. It also means that the collateral backing the GHO token is greater than its worth. Nonetheless, since it's based on the Aave protocol, it also operates according to its rules.

Another, even larger “selling” point comes from its website's “For Internet People” statement. This indicates Aave’s ambition to achieve wide adoption for the GHO crypto asset. Moreover, the Aave DAO’s goal is for anyone with internet access to use GHO to transfer value. The website further backs this ambitious goal with the “Imagine GHO” section:

That section suggests that the GHO token can have all sorts of purposes. The three examples it provides include paying back a friend, buying sneakers, and tipping a DJ. Plus, the section backs that claim with an invitation to dream of a future where $GHO functions as the efficient online payment layer.

The project’s homepage on gho.xyz shows us that the Aave GHO stablecoin has multi-collateral backing. This means it is by the assets supplied into the Aave protocol. Thus, users get to utilize their Aave v3 deposits to mint GHO.

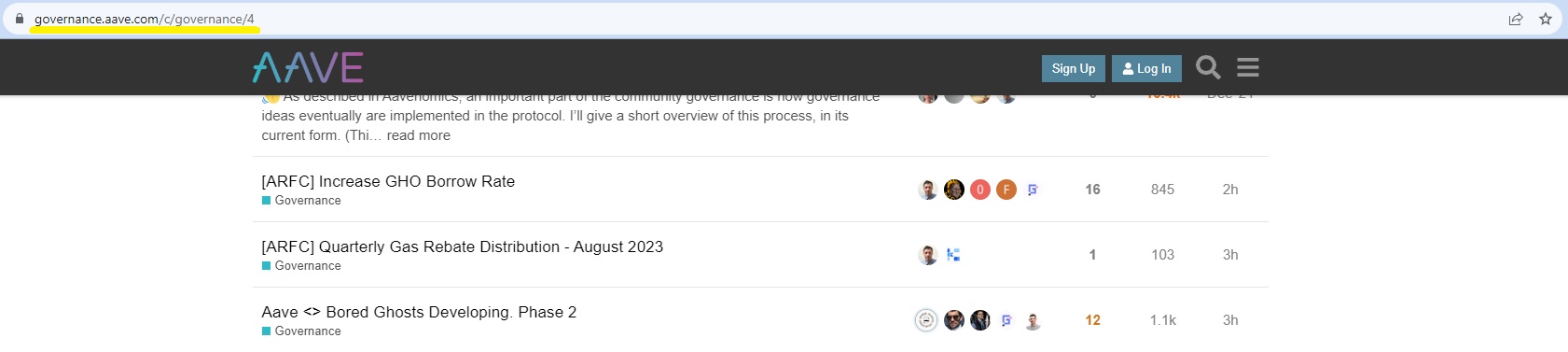

Regarding the token’s decentralization and transparency, the Aave DAO plays a key role. After all, this decentralized autonomous organization (DAO) governs the GHO token.

Aave's Stablecoin Proposal - What Is It?

The Aave stablecoin proposal is an Aave DAO proposal. It passed with 99% votes in favor in the summer of 2022. As such, this proposal served as the base for the creation of the GHO token.

The latter went live approximately one year later (July 15, 2023), following another successfully approved Aave DAO proposal. The latter addressed the suggestion that users of Aave v3 on Ethereum will be able to mint GHO against their collateral.

These two proposals are just two of many issues that the Aave DAO covers via its governance forum:

The Ins and Outs of the GHO Cryptocurrency

Let’s first repeat the basics. GHO (pronounced “go”) is a decentralized, overcollateralized stablecoin native to the Aave protocol. This means that the token is initially minted from crypto assets supplied to the Aave protocol. Additionally, the token lives on the Ethereum blockchain, just like Aave, and on that leading programmable blockchain, it follows the ERC-20 token standard.

The GHO token is programmed to be aligned with USD via market efficiency. So, despite market volatility, GHO should always stay pegged to the US dollar (with minor deviations).

It’s also important to point out that the GHO crypto asset fits into the existing Aave protocol natively. Accordingly, the process of minting GHO is similar to the process of interacting with other Aave Pool assets.

How Aave's GHO Stablecoin Works

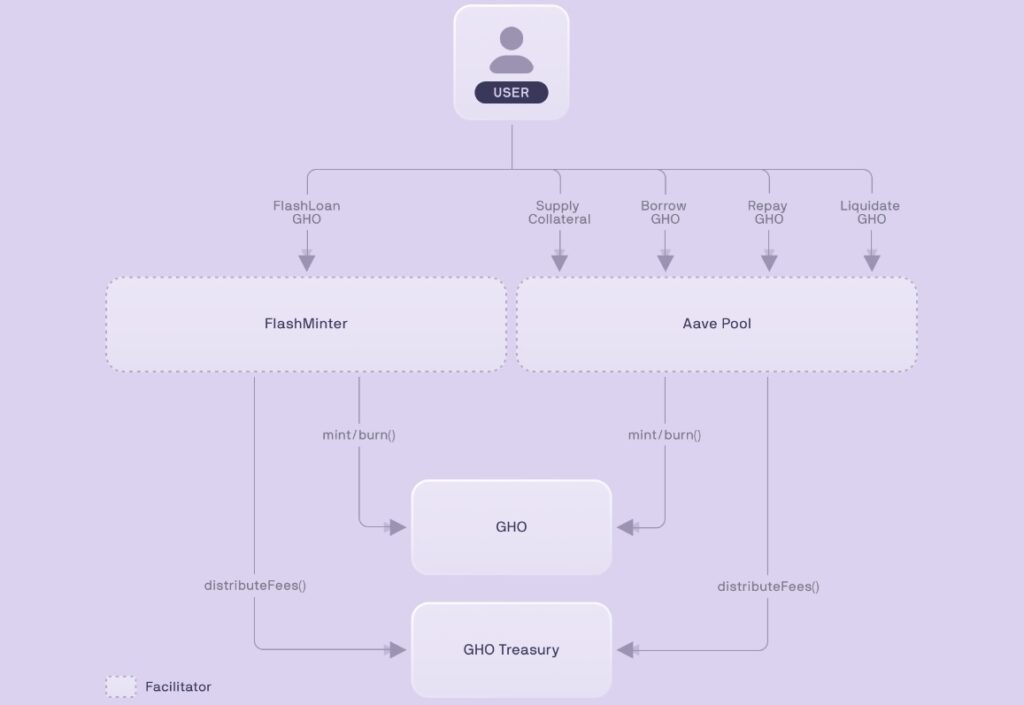

The above schematic shows the gist of how the Aave GHO stablecoin works. Users providing collateral at a specific ratio create (mint) GHO tokens. Once a user repays their borrow position, the mechanism automatically directs their GHO into the Aave pool for burning.

As for interest payments that accrue during the aforementioned borrow/repay process, they go directly to the Aave DAO treasury.

In short, we can sum up the process of GHO mechanics in the following three steps:

- Supplying collateral

- Borrowing GHO

- Repaying GHO debt

What are known as "facilitators" play a vital role in this process. But what are facilitators?

Being a facilitator is a concept introduced by GHO. It points to entities that can deploy different strategies to mint and burn the GHO cryptocurrency trustlessly. Further, the Aave DAO assigns each facilitator a specific upward limit of how much GHO the entity can mint. This limit is known as a "bucket".

Of course, to ensure that the above-presented mechanisms run smoothly and automatically, the Aave GHO stablecoin utilizes smart contracts. In case you wish to dive deeper into GHO smart contracts and explore that aspect at a technical level, make sure to visit the GHO developer documentation:

Tokenomics

Unlike most other ERC-20 tokens with a relatively fixed and capped max supply, stablecoins are more dynamic. After all, the constant minting and burning of GHO tokens (as presented above) is an essential part of the on-chain mechanisms.

With that said, let’s highlight the gist of GHO’s tokenomics:

- Symbol/ticker: GHO or $GHO

- Network: Ethereum

- Protocol: Aave protocol

- Token type: ERC-20

- Token smart contract address: 0x40D16FC0246aD3160Ccc09B8D0D3A2cD28aE6C2f

- Deployment time stamp: July 15, 2023, 11:23:47 AM (+UTC)

While GHO is officially pegged to the US dollar, it’s worth noting that its price has been slightly below $1. However, it’s not uncommon for stablecoins to "depeg" slightly from their specific price mark, especially during their initial phases. But if the mechanism is working properly, the price should eventually stabilize at (or very close to) $1.

What is the GHO Stablecoin Backed By?

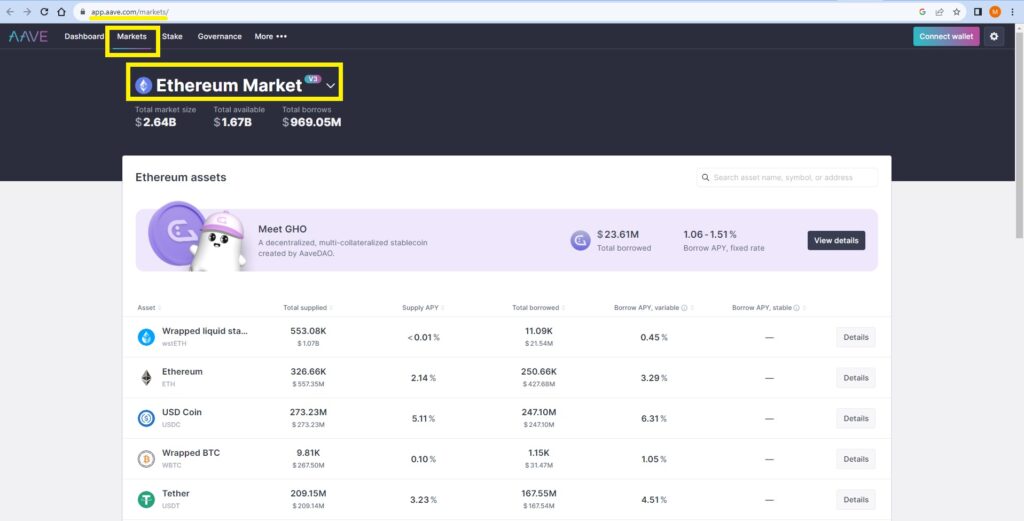

The Aave GHO stablecoin is backed by various assets accepted as collaterals by the Aave protocol. Of course, this included ETH and AAVE tokens. To see all assets, select “Ethereum Market” on the “Markets” page of the Aave app:

And since users need to provide a greater value of these collateral assets than the value of GHO that they can mint (borrow), GHO is classified as an over-collateralized stablecoin.

GHO Cryptocurrency Use Cases

As outlined earlier, the Aave DAO ambitiously aims to position the GHO token as the currency of the internet to serve for all sorts of value transfers. While no one can say that this is not possible, it definitely can’t happen overnight. After all, there are other stablecoins with much greater market caps already serving similar purposes.

However, it is true that many of the leading stablecoins (e.g., USDT, USDC, BUSD) are rather centralized. Thus, DAI, MakerDAO's stablecoin, remains the only significant competitor of GHO.

In the GHO docs, the project provides a dedicated “Why GHO?” section, which is a good place to explore the benefits of GHO. After all, these benefits spur various use cases. And the following sums it all up:

- Truly decentralized stablecoins are in high demand.

- GHO utilizes the already well-positioned Aave protocol.

- This stablecoin is configurable and over-collateralized.

- Borrowers who are staking AAVE in the safety module are entitled to discounts.

- With multi-collateral positions, users get to mint the GHO token based on their entire set of supplied collateral assets across the Aave protocol.

- The collateral used to mint GHO actively earns interest.

- Thanks to facilitators, the minting and burning of GHO is trustless.

Aave and GHO - How to Make Money with Aave

As one of the leading borrowing/lending DeFi protocols, Aave offers many channels to earn money. By depositing supported assets into the Aave protocol on any of the supported chains, you can earn passive income as you lend assets to borrowers.

As explained above, the GHO crypto asset fits into this established process just like other supported cryptocurrencies on the Aave protocol.

Of course, there’s another way to pocket rather large profits (when done properly) with Aave. You can do this by trading the protocol’s native token, $AAVE. With proper timing, you can earn a lot of money through spot or leverage trading.

A quick glance at the $AAVE price chart shows you that the asset has the potential to offer massive returns. After all, in the last bull market, the token increased by approximately 2,500%. However, it is now more than 90% below its ATH level. So, in the upcoming bull run, $AAVE could increase a lot again.

As for the Aave GHO stablecoin, you can also explore arbitrage opportunities when the token is not pegged to 1$. You can read more about arbitrage in the GHO docs. If that interests you, you’d also want to consider GHO’s real-time, on-chain metrics. And that’s where Moralis Money’s $GHO token page will help you.

Whether you go with arbitraging or trading altcoins, remember the potential risks. However, altcoins are also one of the greatest opportunities to make life-changing profits in a relatively short period.

And if you want to get the ultimate edge when trading alts, learn how to use Moralis Money’s Token Explorer. With this amazing tool, you get to find tokens before they pump!

About Stablecoins

A stablecoin is a cryptocurrency that is pegged to a traditional fiat currency. With the US dollar still holding the number one spot among fiat, all the leading stablecoins peg to it.

Stablecoins use different mechanisms and methods of backing the token's value. However, to ensure that things run smoothly, every stablecoin uses a smart contract or several of them – depending on the complexity and the nature of the project behind the stablecoin. If nothing else, most stablecoins are ERC-20 tokens and have their own ERC-20 smart contract managing the ownership and transactions of tokens.

It’s also important to note that the two leading stablecoins – USDT and USDC – are centralized. Thus, those of us who believe in a decentralized future should applaud attempts like Aave’s GHO crypto project. But at the same time, keep in mind that while stablecoins already represent a large portion of the total crypto market cap (especially during bearish times), they are still at various risks (attacks, regulations, etc.).

What is Aave's GHO Stablecoin? Analyzing the GHO Token - Key Takeaways

- The GHO token is a newly launched (July 2023) decentralized stablecoin on the Aave protocol.

- GHO is over-collateralized using Aave protocol-supported assets.

- Every user with Aave protocol-supported assets can use them as collateral to borrow (mint) GHO.

- It will be a long path from GHO’s current stage to fulfilling the Aave DAO’s vision of becoming the money of the internet. However, this ambitious goal is not impossible.

- Following the token's launch, $GHO has been ranging slightly below the $1 mark.

- The most lucrative opportunity to make money with Aave is still by trading the AAVE token.

- If you decide to trade AAVE or try arbitraging GHO, make sure to use Moralis Money’s taken pages for these assets and consider their real-time, on-chain metrics (a.k.a. alpha metrics).

Whether you decide to get involved with GHO and Aave in any way or not, you ought to keep in mind that there are countless other altcoin opportunities. You may find these in meme-based tokens, including MOG, BOBO, DOBO, and/or PEPE. Also, you may find opportunities in tokens with actual use cases (e.g., SHIA, HYTOPIA, OX, ESPR, etc.).

The next bull market is slowly getting ready. So, now’s a great time to learn how to spot altcoins with potential. And there’s no better tool for that task than Moralis Money’s Token Explorer! Join traders in the know, sign up for Moralis Money's Starter or Pro plan today, and make the upcoming bull run count!