If you're one of those people trying to figure out why the cryptocurrency markets have been crashing lately, it will help you understand the macro factors driving crypto. After all, it helps to understand the entire puzzle when considering one piece of it, which requires some economic knowledge.

For those who don't know, "macro" stands for macroeconomics and involves looking at the bigger picture of the economy. Notably, macroeconomic factors have affected nearly all the asset markets, not just cryptocurrency, as investors struggle to find a safe haven for their money. Currently, we're experiencing labor shortages, international conflicts, and supply chain issues. But, in this article, we'll be looking mainly at inflation and some of its leading indicators. In addition, we'll look at some other macro factors driving crypto. Lastly, we'll see how they're all interconnected.

Now is the time for you to get connected to the crypto world by taking the Crypto for Beginners course at Moralis Academy!

The Federal Reserve's Role

When researching the macro factors driving crypto, we must consider each one from the Fed's perspective. The point is whether the Fed will raise or lower interest rates in response to how these macro factors behave. Because of today's "Fed-centric" economic paradigm, macro factors such as the declining unemployment rate that would typically be a bullish signal could wind up being bearish for investors. It all depends on how the Fed responds.

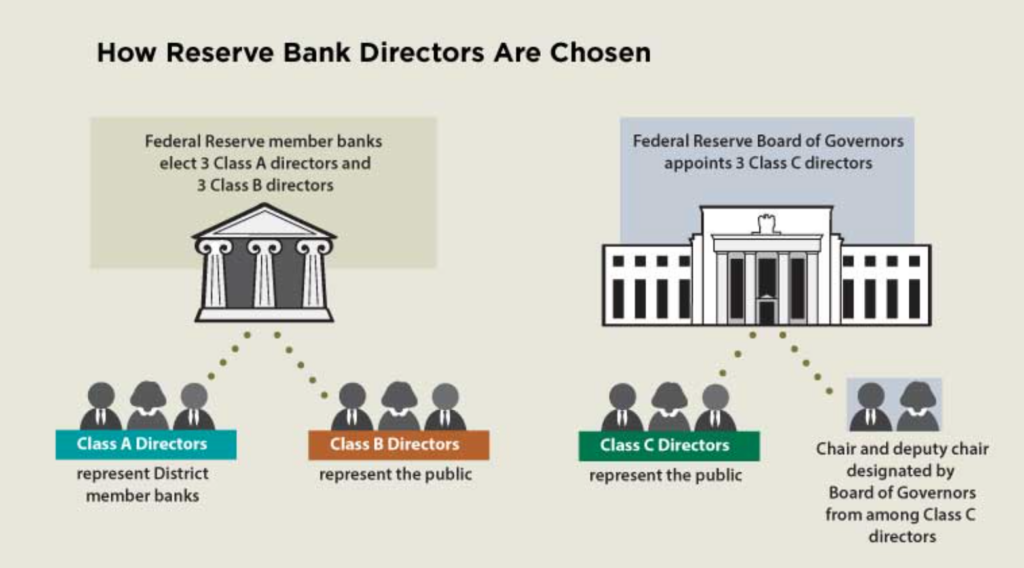

The main thing to understand is if a macro factor can cause inflation to spike, it could trigger the Fed to raise interest rates. Higher interest rates make it more difficult for banks and asset managers to get their hands on capital. When the Fed tightens the money supply on member banks, it has a trickle-down effect. It makes things more complicated (or impossible) for entrepreneurs and other businesses to get start-up capital to create jobs. The overall effect is slowing the economy with the intent of lowering the inflation rate.

With this recent market downturn, now is an excellent time to learn how to invest during a crypto bear market!

The Fed and Interest Rates

The first point is that the Fed's recent interest rate hikes are causing asset markets to tank. Ironically, some would argue it was the Fed's low-interest rates starting in 2020 that caused the markets to rally in the first place.

Regardless, investors are struggling to find profitable asset markets. Historically, they could move into precious metals or saving accounts when the stock market tanks to earn interest. However, with the inflation rate hovering around 8%, any small interest earned by going to cash gets gobbled up by inflation.

So, what makes it different this time is that former harbors of refuge such as precious metals and government bonds are not holding up very well. Even the hot real estate market is cooling in some parts of the world. So, what should investors do? Buy fine art or classic cars?

How Did We Get Here?

Not long ago, the Fed was pumping trillions of dollars into the economy in response to the pandemic. Wild money printing sessions with no precious metals or worker productivity to back them were one way to inflate the economy artificially. Cutting interest rates to zero or less was another.

These trillions inevitably wormed their way into every crevice of the economy. But now, all that money is getting sucked out to sea like an unfavorable tide.

Asset Market Interconnectivity

Since nearly every asset class got an artificial pump, it's only natural that they're all feeling the pinch now as the Fed tightens its grip on the money supply. The retraction started in November when chairman Jerome Powell stated the Fed would have to raise interest rates to combat inflation. The result is that investors now have to consider the macro factors driving crypto and other markets through the lens of the Fed. Whether they take action and raise rates (or even hint at it), the Fed's actions and words affect investors' reactions.

Because of the pandemic, assets are more interconnected. So much so that a slogan has popped up, "it's all one trade". Nonetheless, of all the macro factors driving crypto, and other asset markets, the one thing they have in common is the Federal Reserve's monetary policy.

Bitcoin is still the most prominent cryptocurrency. Learn more about it by taking the Blockchain & Bitcoin Fundamentals course at Moralis Academy.

Factor #1 - The Fed's Communiques

Since the Fed's decisions on interest rates have become so prominent, any communique is noteworthy and includes:

1. Press Conferences

2. Meeting Minutes

3. Announcements

First, the Fed holds regular press conferences. Second, it releases the minutes from its monthly meetings, where it logs its interest rate decisions. Small rallies can kick off when these decisions get unveiled and align with investor expectations.

Third are the formal announcements. When the Fed's interest rate announcements exceed investor expectations, big rallies for asset markets tend to occur.

Interest Rates and Investor Expectations

Investors like certainty. So, if the Fed lowers interest rates or raises them less than expected, it can usher in asset rallies to different degrees. On the other hand, when the Fed's interest rate announcement is worse than investor expectations, asset markets can crash, particularly when the Fed announces it will aggressively raise rates.

Most importantly, the Fed's governing board and chairman Jerome Powell call the shots, with the chairman having the final say on interest rates. Therefore, investors hang on their every word to get insights into their next move. Interestingly, the meeting minutes are released about three weeks after they occur. The belief is the Fed does this to help prepare investors for their following formal announcement. Again, if the minutes suggest the Fed aggressively raises rates, markets tend to crash. But markets tend to rally if they hint the Fed will ease off.

Now that you know what to look for, you can check out the Fed's schedule for press conferences, meeting minutes, and announcements and see if market volatility ensues afterward.

Factor #2 - Inflation Indicators

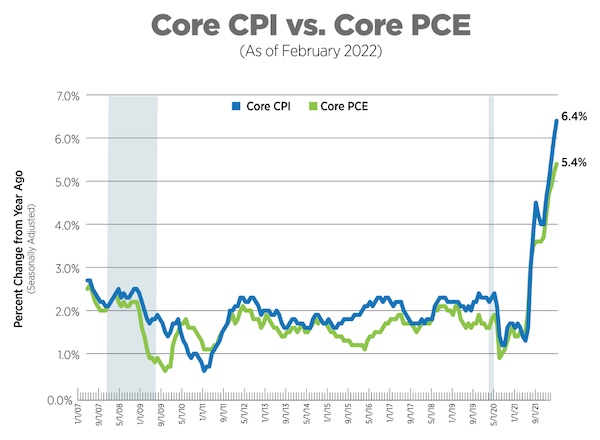

The next factor to watch for is the US inflation rate measured by the consumer price index (CPI) and the personal consumption expenditures price index (PCE).

Both measure how much money Americans spend on goods and services. However, the Fed prefers PCE because of its broader scope and how it better reflects how consumers alter their buying habits to account for rising prices.

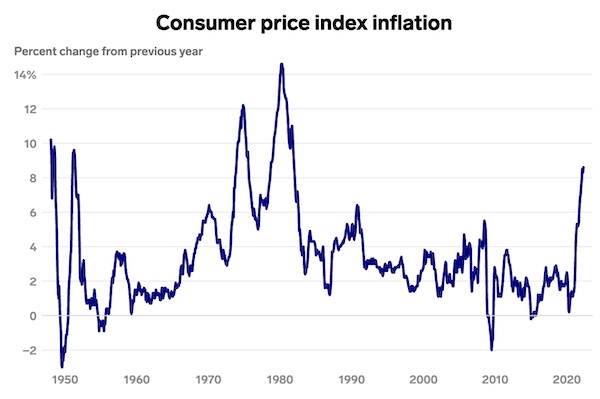

Both measurements are essential because the Fed raises interest rates to curb inflation when consumer prices get too high. More specifically, the Fed allows for a 2% inflation rate, so anything above that is too high. In May of this year, the CPI increased by approximately 8% from last year. That data could prove to be a harbinger of hikes to come. Moreover, despite the Fed preferring the PCE, markets react to CPI prints similarly to how they respond to the Fed's press conferences and meeting minutes.

So, if the CPI is in line with investor expectations, asset markets can experience a small rally. When gauging the CPI, you must also be aware of the producer's price index (PPI). This is because it is a leading indicator of the CPI. The CPI is further down the trail since the PPI measures the producer's costs that eventually trickle down to the consumer.

Note: The next PCE print comes out on June 30th.

Factor #3 - Other Causes of Inflation

The third macro factor to be aware of is anything that can trigger the inflation rate. Remember that much of the inflation we're seeing today results from the Fed's response to the pandemic. The loose money supply created an artificial demand for all sorts of assets. But many macro factors that could increase inflation from here forward remain outside the Fed's control.

The Fed can monkey with the interest rates all they want, but global factors can still stifle its effectiveness. For example, the Fed can't strong-arm Russia into exporting its natural resources. Nor can it prevent Chinese authorities from locking down more cities. Even in its origin country, the US, the Fed can't force policymakers to relax the restrictions on fossil fuel production to get energy costs under control. Therefore, the potential for disruptive global events leads some analysts to believe that the Fed's interest rate increases will have little to no effect on inflation. However, interest rate hikes could further sap the US economy's strength.

If you want to become a blockchain developer but don't know how, check out our "How to Become a Blockend Developer?" article at Moralis!

High-Interest Rate Scenarios

This characteristic of global anomalies has led others to speculate that the Fed could jack interest rates into the double digits if smaller incremental increases do not halt inflation. If the Fed takes drastic measures to battle inflation, it will directly affect all assets, including cryptocurrencies. This does not come as a surprise, especially since crypto is still considered high risk by many institutional investors.

The bad news is that these random outside macro factors don't keep a neat schedule as the Fed does with its meeting minutes, press conferences, and announcements. They typically happen with little forewarning and are tough to predict.

We've already learned a lot about the macro factors driving crypto; however, understanding crypto crashes is another topic many have benefited from!

Factor #4 - Unemployment Rate

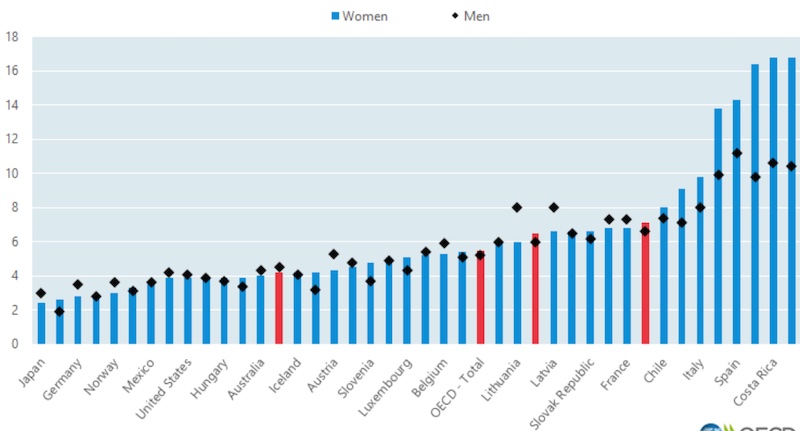

The jobs report (and other employment indicators) are essential to the Fed because they maintain stability by keeping unemployment at 4%. Remember, the unemployment rate is the percentage of people actively looking for work who can't find any. This calculation draws its share of critics. Some more vocal ones claim that politicians torture this data to make it say what they want. Nonetheless, the rate stands at 3.6%.

Since rising interest rates typically raise the unemployment rate, The Fed stays mindful of where it stands. Further, the Fed considers 4% acceptable, which means 3.6% is still low enough to give the Fed some wiggle room to raise interest rates. So if there is any good news of new job creation, it could get flipped to bad news for investors if it encourages the Fed to hike the rates further. The jobs report comes out on July 8th.

Ethereum is the second-largest cryptocurrency in the world, and its price has also suffered during this recent crash. But what are other blockchain solutions that compete with Ethereum? Solana is one, and you can learn more about Solana vs Ethereum in one of our blog articles. Also, you can learn about Rust & Solana as well!

Other Macro Factors Driving Crypto

We've looked at some of the top macro factors driving crypto, but there are others. For one thing, the tech sector is highly correlated with the cryptocurrency market. This factor is especially true for those invested in cryptocurrencies. When we see their stock prices crash, we expect a ripple effect in crypto. Nonetheless, the Fed still seems to be the elephant in the room and the prime mover driving asset market prices.

With their centralized control of the money supply, we seem caught in this never-ending see-saw battle of the Fed trying to stimulate the economy or cool it off.

Macro Factors Driving Crypto - Conclusion

Regarding predicting the future for crypto markets in the near term, Blackrock CIO, Rick Rieder, believes the last job report was the best one we'll see for a long time. In addition, interest rate hikes will push unemployment even higher if that's the case.

Billionaire investor Ray Dalio goes a step further. He believes the next phase is a period of "stagflation". Stagflation is a term to describe the dreaded combination of stagnant economic growth with high inflation. It results in anemic asset markets, high unemployment, less consumer spending, and an overall reduction in profits. Since Dalio believes stagflation is coming, he also predicts it will force the Fed's hand in 2024 to start slashing interest rates before the next US presidential election. If his prediction comes true, this slump could last another couple of years.

However, that's no reason to get depressed! Downtimes are when the most successful companies and individuals dig their heels in and prepare for the next rally. The best way to position yourself is to learn to become a Web3 developer at Moralis Academy. Check out their course catalog today!