In today’s article, we’ll kick things off by diving into the ins and outs of crypto portfolio management. From there, we’ll explore some fundamental principles on how to manage your portfolio properly. Next, we’re going to cover three things to consider when choosing the best crypto portfolio management platform for you. And to top things off, we’ll explore some of the industry’s most prominent crypto portfolio management solutions!

Crypto Portfolio Management – What You Need to Know

Crypto portfolio management is the process of selecting, analyzing, and managing a group of investments to meet particular financial objectives and manage risk. To effectively achieve this, you need to master the skill of using the right tools and mental models to improve and maximize your return on investment (ROI).

Boosting returns and becoming a better investor through technology is often overlooked when it comes to crypto trading. And proper tools and the correct knowledge/data are both freely available on the internet and easy to use. However, the difficult part is staying consistent.

Both novice and experienced traders get carried away by their emotions when trading and investing, which can significantly sabotage their efforts. Investing based on hype, not tracking assets, and the fear of missing out (FOMO) are three pitfalls most traders struggle with. But we’ll return to these later.

Fortunately, with proper crypto portfolio management, it’s possible to keep your emotions in check, track the performance of your assets, and identify what you’re doing right/wrong!

So, how do you properly manage your portfolio?

How to Properly Manage a Portfolio

Depending on your altcoin trading strategy, the way you should manage your crypto portfolio differs. However, a few fundamental principles apply to portfolio management in general. Below, you’ll find three key concepts:

- Asset Allocation: Asset allocation refers to how much of a portfolio is invested in various asset classes. This can be the portion invested in stocks, crypto, bonds, etc. However, if your portfolio is solely crypto-based, it can also refer to classes within the industry – e.g., meme coins, DeFi tokens, etc. By investing in different asset classes, you can hedge your bets and minimize risk.

- Diversification: A fundamental principle of any investment strategy is to have a balanced portfolio. Consequently, it might not be the best idea to ”put all your eggs in one basket” and bet on a single coin. After all, you need an actual crypto portfolio if you want something to manage in the first place.

By spreading risk, you minimize the chance of losing it all. You also keep your emotions in check, as diversification helps you make less fatal impulse decisions. As such, diversification is a fundamental principle that should not be overlooked!

However, diversifying your assets is easier said than done, especially in the crypto industry, where many assets highly correlate. A popular strategy to minimize the chance of capital loss is to invest a majority of your portfolio in large-cap coins like Ethereum and Bitcoin. While these established coins are less likely to skyrocket, they’re also less likely to plummet.

- Tracking Performance: As you diversify, you must also track your investments. That said, investing in more assets makes it increasingly hard to keep track of their performance. This is why professional traders leverage crypto portfolio management software to stay on top of their investments and adjust their strategies accordingly.

Avoid These Crypto Portfolio Management Mistakes

When you start trading crypto, you’ll most likely make mistakes. And this is okay, as long as you learn from them. However, to help you minimize your errors, let’s explore common pitfalls you’ll likely stumble upon as you get into crypto investing.

Investing On Intuition – The Importance of Research and Dollar-Cost Averaging (DCA)

A common mistake for novice traders is immediately jumping on an opportunity due to a social media post or recommendation. However, the less thought you put into an investment decision, the more likely you are to regret it when everything goes south.

Instead, always do your own research (DYOR), find coins and other assets you like, and apply a long-term strategy like dollar-cost averaging (DCA). With a DCA strategy, you invest in a token at fixed intervals regardless of the price. That way, you’re more likely to hit both highs and lows when buying to counteract the short-term volatility of coins.

Not Monitoring Your Portfolio

Unless you’re invested in only one coin – which would be the opposite of diversification – you should monitor your portfolio. It’s essential to keep track of your holdings and their performance over time so you can adjust your strategy accordingly.

To help you monitor your portfolio, it’s always helpful to leverage crypto portfolio management software and platforms. There are multiple platforms available, and we’ll return to some examples in the ”Crypto Portfolio Management Software and Platforms” section further down below.

Not Having Realistic Expectations and No Exit Strategy

With every purchase and investment, you must manage your expectations and have a clear purpose. And even if you hit a home run with your initial two investments, you can still get tripped up by not having a clear exit strategy outlined. Moreover, even though you have heard the stories of coins going to the moon, not all your investments will. As such, for each asset, ask yourself the following four questions:

- Why am I investing?

- When do I plan to realize the profits? And why?

- When will I cut losses? And why?

- What information can influence my decision?

By having realistic expectations and a clear-cut strategy, you reduce the impact emotion has on your investment decisions.

Not Knowing How to Deal with FOMO

With the ever-growing crypto market, you’ll most likely have read about or heard of someone becoming a so-called Bitcoin millionaire. And the question, ”Hey, did you miss out on PEPE? Everyone made a fortune on the coin,” is one every investor fears. This is precisely why the fear of missing out (FOMO) is so common among crypto traders.

FOMO makes people trade emotionally. In doing so, they usually invest based on hype, buying assets at their peak only to see them drop shortly after.

Not knowing how to deal with FOMO is a big problem. And one you need to learn how to deal with. This is where a crypto portfolio management platform enters the equation to help you keep your emotions in check.

If you’d like to learn more about avoiding FOMO, check out our guide on crypto FOMO explaining how to deal with it!

How to Choose the Right Crypto Portfolio Manager

There are multiple crypto portfolio management software out there, and to determine the best platform for you, you have to consider your needs as a trader. For instance, one crypto portfolio management platform might focus on tax reports, while another focuses on bringing you the best features for trading.

However, to help you find the crypto portfolio management platform for you, here are three factors to consider:

- Easy-to-Use: Intuitiveness is an essential factor in choosing a crypto portfolio management platform. There’s no need to go for the most advanced portfolio tracker bombarding you with unnecessarily complicated charts, info, etc. Instead, find one that is easy to use with an intuitive user interface (UI).

- Comprehensive Coverage: You should also consider the coverage of the crypto portfolio management platform. As such, find one that covers a wide range of blockchain networks and tokens.

- Surrounding Features: Most crypto portfolio management platforms provide the basic functionality to view, analyze, and manage all your assets. As such, consider a platform with niche features, making it stand out. Also, make sure these features suit your particular needs as a cryptocurrency trader.

Nevertheless, now that you know what to look for in a crypto portfolio management platform, let’s explore some prominent examples!

Crypto Portfolio Management Software and Platforms

As the cryptocurrency market expands with new coins, networks, and exchanges, so does the demand for and number of crypto portfolio management platforms. To help you find a crypto portfolio management platform that suites your needs, we have gathered a list of five prominent alternatives:

1. Moralis Money

At the top of this list, you’ll find Moralis Money. Moralis Money is the best crypto portfolio manager for traders, and the platform provides everything you need to track, manage, and analyze all your holdings across networks, including Ethereum, Polygon, BNB Smart Chain, and others. However, what makes Moralis Money stand out in the crowd is the surrounding features allowing you to find up-and-coming crypto before everyone else!

2. Delta

Delta is another prominent portfolio management platform. This alternative lets you track your holdings across asset classes, including equities and cryptocurrencies. You can also manually add assets to the platform to track their performances.

3. Koinly

A third alternative is Koinly which is an established crypto portfolio management platform. It works for both experienced and new traders alike, giving them an overview of all their assets. What’s more, with Koinly, it’s possible to effortlessly generate in-depth tax reports.

4. Nansen Portfolio

Nansen Portfolio is a crypto portfolio management platform that supports a wide range of EVM-compatible and non-EVM-compatible chains. What’s more, like Moralis Money, Nansen Portfolio also allows you to monitor the activity of other Web3 wallets.

5. CoinMarketCap

CoinMarketCap is the last alternative on this list. CoinMarketCap is most well-known for its popular price-tracking feature. With the token tracker tool, users can manually add tokens and thoroughly follow the development of their crypto assets.

Nevertheless, in the above list, we briefly covered some prominent crypto portfolio management platforms. If you’re looking for a more detailed breakdown and a comparison between them, please check out our guide on the best crypto portfolio trackers in 2023!

The Best Crypto Portfolio Management Platform

Among the crypto portfolio management software in the list above, Moralis Money stands out as the best platform. But how so?

To begin with, Moralis Money’s crypto portfolio management feature provides you with the necessary functionality to follow, analyze, manage, and track your crypto portfolio. Moralis Money even lets you follow another trader’s wallet by simply inputting an address.

If you’d like to explore the power of Moralis Money’s portfolio management feature further, check out our article on how to follow a crypto wallet using the #1 token portfolio tracker!

However, what really makes Moralis Money stand out as the premier crypto portfolio management platform is all the surrounding features. Moralis Money is an industry-leading blockchain analytics tool and crypto volatility indicator. The platform leverages blockchain data in real-time, giving your true market alpha. So, by using Moralis Money, you can stay on top of the market and find new exciting altcoins before everyone else to maximize your gains!

This combination of features makes Moralis Money the ultimate one-stop shop for cryptocurrency traders, as you can find, manage, monitor, and even swap crypto directly through Moralis Money!

If you’d like to learn more about this, check out our article on three crypto trading tips or our guide explaining the differences between a crypto swap vs. exchange.

You can also experience the power of Moralis Money yourself down below. Use the interactive widget to apply a premade search strategy. Or, create a new one from scratch by combining the metrics of your choice:

Summary: The Ultimate Guide to Crypto Portfolio Management

Crypto portfolio management is the process of picking, monitoring, and managing your investments to reach a financial objective. To properly manage your portfolio, it’s beneficial to apply a few fundamental principles. Some prominent examples include asset allocation, diversification, and monitoring the performance of your investments.

To help with the latter, professional traders generally leverage crypto portfolio management platforms. Here are some prominent examples:

- Moralis Money

- Delta

- Koinly

- Nansen Portfolio

- CoinMarketCap

At the top of the list, you’ll find Moralis Money – the ultimate crypto portfolio management platform!

Moralis Money provides everything you need to find, swap, analyze, and monitor your crypto assets. It’s the perfect one-stop shop for traders, making it a must-have tool for all crypto enthusiasts.

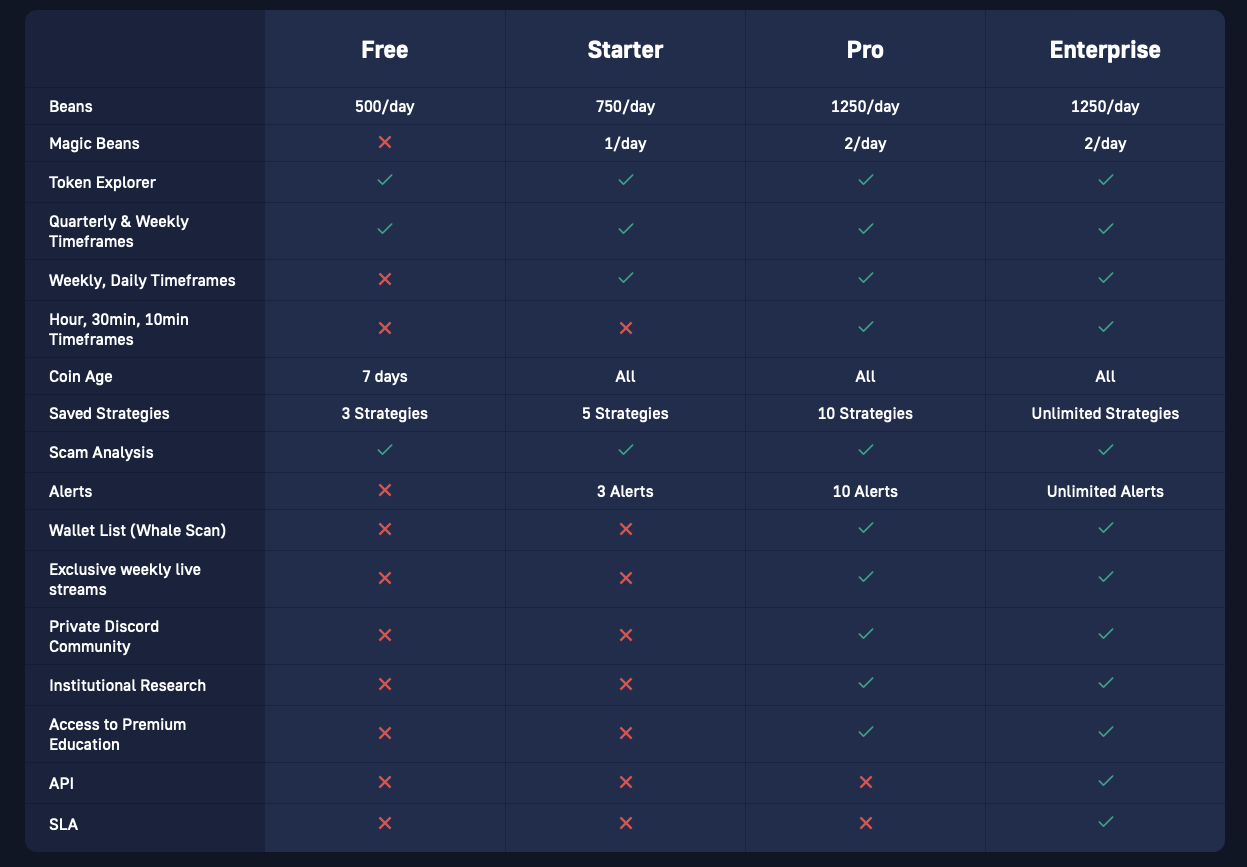

Also, did you know that it’s possible to supercharge the features of Moralis Money with the Moralis Money Pro plan? By becoming a Pro plan user, you get access to narrower timeframes for all search parameters, can access a private Discord server, get premium education, and much more: