Anyone keeping up with the cryptocurrency market will know that it can be subject to powerful price swings. In fact, one of the most common criticisms levied against the cryptocurrency industry is that it is ”too volatile”. As such, this article takes a closer look at crypto volatility and Bitcoin volatility to make sense of them. The recent weeks’ shaky market performance is once again putting crypto volatility into the headlines. Let us, therefore, make sure to explain crypto volatility and put some myths to bed once and for all in our 2021 crypto volatility guide!

The cryptocurrency market is no stranger to price volatility, which can be challenging for new traders. Consequently, the best way to make sure you are ready for the cryptocurrency market is to do your own research. However, a lot of people are still relatively new to crypto and might lack the basic knowledge to do this. If this is the case for you, fret not! Ivan on Tech Academy is the biggest online blockchain academy and contains world-class courses for all your needs. Get the necessary knowledge to master crypto trading with us!

Are you looking to get into cryptocurrency trading after learning more about crypto and Bitcoin volatility? If so, you should make sure to check out our courses on Technical Analysis and Algorithmic Trading. No matter what area of blockchain or cryptocurrencies you want to delve into, our Crypto for Beginners is a great starting point. Additionally, our Bitcoin and Blockchain, and Ethereum 101 courses require little to no prior blockchain knowledge. We also provide highly practical courses about some of the most popular blockchain-based projects, like our Chainlink, Polkadot, and OriginTrail courses. Upskill yourself by enrolling in Ivan on Tech Academy and join our more than 30,000 existing students!

What is Crypto Volatility?

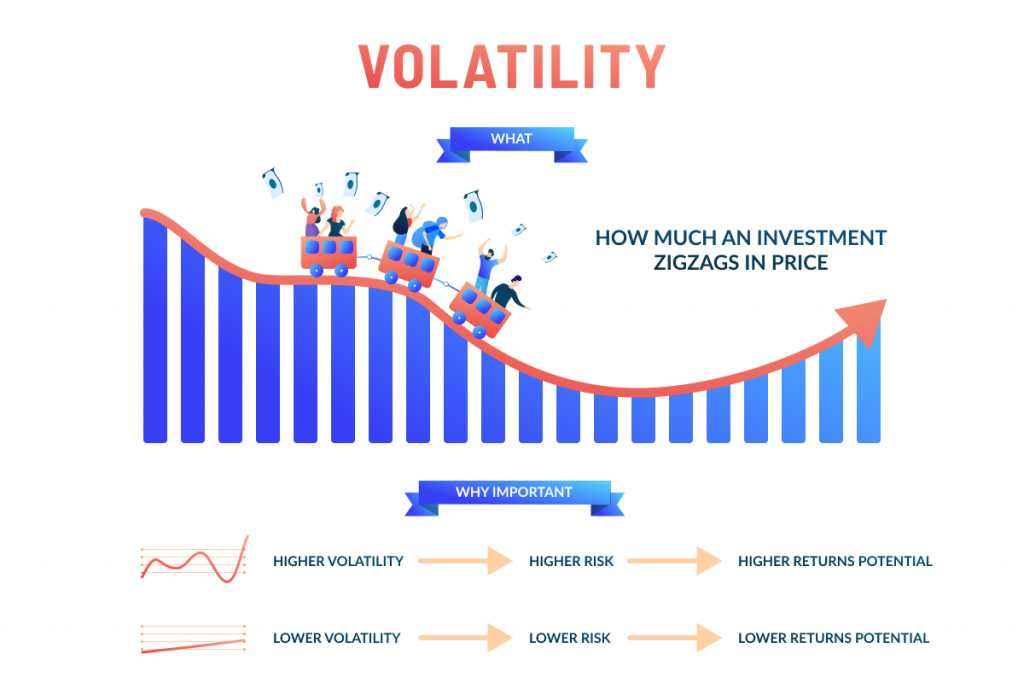

To properly understand the issue of crypto volatility – or Bitcoin volatility – we first need to grasp volatility. Volatility, as a general concept, refers to something’s instability or likeness to suddenly change. In a stock market or cryptocurrency context, however, volatility refers to price volatility. Put in the simplest possible terms, price volatility can be understood as the fluctuations in the price of a commodity. Price volatility is generally measured in percentages and does not relate to a commodity’s absolute price. Rather, it measures the percentage change in the price of a certain asset. Volatility is simply how something’s price moves.

For example, an asset with a very stable price over a long time will have low associated price volatility. On the other hand, an asset with a fluctuating price will have high volatility. Investors generally dislike high volatility, as it comes with a degree of uncertainty and risk. Granted, the associated risk could also be interpreted as an opportunity for investors with an appetite for risk. Nevertheless, most major corporations want to be able to plan for the long term without worrying about uncertainty. If an asset class is highly volatile, this may dissuade corporations from holding the specific asset. For example, if an imaginary asset had massive price volatility of 25%, this means it could either drop 25% in value or increase 25% in value on any given day. Holding such unpredictable assets is not preferable for most legacy companies.

Keeping this in mind, it makes sense that ”crypto volatility” refers to the price stability of cryptocurrencies. In traditional markets, volatility is often driven by supply and demand. So, what causes crypto volatility? Although this question is a multifaceted one, it can easily be answered by ”speculation”. Generally speaking, speculation drives crypto volatility and Bitcoin volatility.

Crypto Volatility vs. Bitcoin Volatility

Nevertheless, it is important to make a significant distinction when talking about volatility among cryptocurrencies. Specifically, this distinction is to separate crypto volatility and Bitcoin volatility. While those unfamiliar with the cryptocurrency industry might view crypto volatility and Bitcoin volatility as largely synonymous, this is not the case. Granted, Bitcoin is still for many ”the face” of the cryptocurrency industry. According to TradingView’s Bitcoin dominance chart, Bitcoin’s market capitalization dominance is less than 45%. True, this is still significant, but Bitcoin’s long-term market cap dominance trend seems to be negative.

If we assume the cryptocurrency industry will continue to grow more diversified, crypto volatility could diverge further from Bitcoin volatility. As the name indicates, Bitcoin volatility technically refers to the price volatility of Bitcoin. On the other hand, crypto volatility can be seen as the overall volatility of the crypto market. It is easy to see how differentiating between the two will potentially become more important in the future. As Bitcoin’s industry dominance appears to be waning, this distinction potentially becomes even more significant.

Additionally, many would argue that Bitcoin is becoming a far more ”mature” asset than other cryptocurrencies. We’ve previously covered the emergence of altcoins and memecoins like Dogecoin and the Shiba Inu token. Such cryptocurrencies are inherently more volatile than Bitcoin, which is beginning to see increasingly widespread adoption. To begin with, legacy corporations are already recognizing various very real blockchain use cases in their industries. As such, institutional investment in Bitcoin is reaching new highs – but this doesn’t necessarily extend to altcoins or other cryptocurrencies. Altcoins with smaller market capitalizations generally see greater price fluctuations. As such, the difference between overall crypto volatility and specific Bitcoin volatility could very well diverge in the future. This article aims to explain both of these trends.

What Time Does the Crypto Market Have the Most Volatility?

So, is there any serious answer to the question ”what time does the crypto market have the most volatility”? At first, this can seem like a simplistic question. Keep in mind that crypto price volatility can, in simple terms, be understood as crypto trading activity. After all, volatility is largely due to market events that are of a macroeconomic nature and, as such, unpredictable. With that said, however, there actually seems to be some certain times and days that stand out in terms of crypto market volatility. A Forbes study over what time the crypto market has the most volatility found that Wednesdays are quite volatile. Specifically, 16:00 UTC on Wednesdays is the most volatile period of the week. At 4 PM UTC, the report finds that the cryptocurrency markets have 36% more volatility than usual.

With that said, however, Fridays are also found to be more volatile than other days. Although the cryptocurrency markets never actually close, this behavior could be a relic from the stock market. Specifically, investors are generally more likely to trade and settle their upcoming investments on a Friday, seeing as the stock market will be closed in the coming days. Saturdays, on the other hand, are the least volatile days for Bitcoin trading. This can likely also be explained by the fact that investors do not traditionally make big moves during weekends, as the traditional markets are closed during this time.

Traditional stock market opening and closing times seemingly affect crypto volatility

It is worth taking into account that the data behind this article is a few years old. What’s more, it is primarily based on data from four different exchanges; Kraken, Coinbase, Binance, and Gemini. Moreover, the report in question looks at Bitcoin volatility rather than overall crypto volatility. It is possible that there is a growing disconnect between crypto and Bitcoin volatility.

Pros and Cons of Volatility

Some of those skeptical of Bitcoin, or cryptocurrencies in general, point to the asset class’ volatility as detrimental. Keeping this in mind, let us look at why volatility of crypto makes it unsustainable in the eyes of the crypto naysayers. In addition to what we’ve previously gone through regarding how uncertainty is tied to volatility, there is also more. Someone placing their assets in a relatively volatile asset class, like cryptocurrencies, is open themselves up to risk. More accurately, they run the risk of having the marketing erode the value of their holdings with price swings. However, it is worth remarking that although this can be seen as a drawback in the eyes of some, others view it as a benefit. There are plenty of traders out there who relish the relatively substantial crypto and Bitcoin volatility. Even after recent weeks’ price corrections, Bitcoin has still increased in value nearly tenfold year-over-year.

Those who view Bitcoin volatility as such a large problem that they don’t want to get into cryptocurrencies can relax. Specifically, there is another cryptocurrency asset class that combines all the pros of crypto without the price volatility. This is the asset class generally known as ”stablecoins”. Stablecoins are cryptocurrencies that are tied to a single asset or basket of assets. This can be either rare metals, resources, or existing fiat currencies. Those using a US dollar-backed stablecoin, such as USD Coin (USDC) essentially miss out on crypto-specific price volatility. However, stablecoins aren’t protected from the price volatility of their underlying assets. For example, if the US dollar was to be dramatically devalued from surging inflation, then this would essentially erode the value of USDC in comparison to other cryptocurrencies. This can also be understood as that USDC’s ”price volatility” would spike.

Bitcoin Volatility Index (BitVol) and Crypto Volatility Index (CVI)

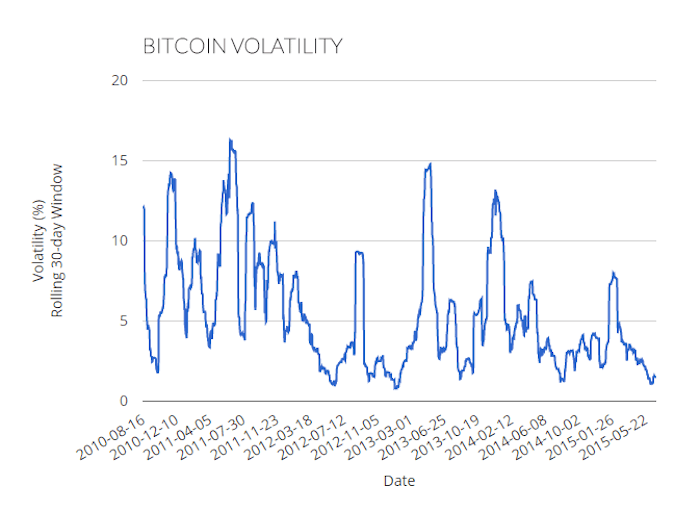

With Bitcoin volatility being a relatively important aspect of cryptocurrency trading there are, of course, efforts to measure it. One recent contender on the scene is the Bitcoin Volatility Index, or ”BitVol”. Specifically, this volatility index – which has an Ethereum volatility twin in EthVol – comes from financial indexing firm T3 Index. The Bitcoin Volatility Index, or BitVol, works by comparing the volatility of tradable Bitcoin options across various exchanges over a 30-day period. As such, BitVol draws inspiration from how the Chicago’s Board Options Exchange’s VIX Volatility Index works for the stock market.

The VIX Index is oftentimes said to describe the stock market’s current uncertainty, risk, and ”fear”. This can be an important factor when making long-term investment decisions. Consequently, there are also indexes trying to track not only specific Bitcoin volatility, but also overall crypto volatility. For example, the Crypto Volatility Index, or CVI, is another tool that measures total crypto volatility. The CVI is another index in the same vein as VIX. Moreover, the CVI is based on the classic Black-Scholes option pricing model.

Nevertheless, volatility indexes like these are nearly useless without the underlying knowledge to understand them. Be sure to check out Ivan on Tech Academy, the best place to learn about blockchain, to get all the basic knowledge to become a trading pro. What’s more, our blog is updated with free, in-depth articles like this one on a daily basis.

Summarizing Cryptocurrency Price Volatility and Bitcoin Volatility

Since Bitcoin and cryptocurrencies in general are still in the price discovery phase, price volatility could likely remain relatively high. However, as Bitcoin reaches greater adoption, it is possible that Bitcoin volatility could subside. At the very least, it is likely that more mainstream adoption of the premier cryptocurrency will lower its volatility. With that said, it is not guaranteed that a reduction in Bitcoin price volatility will immediately spill over into lower overall cryptocurrency volatility.

Granted, Bitcoin still holds considerable dominance over the cryptocurrency markets. Nevertheless, this dominance appears to be shrinking as the crypto markets grow more diversified. As such, it is conceivable that as Bitcoin matures as an asset class, Bitcoin volatility will sink and become more clearly distinguished from overall crypto volatility. As Bitcoin becomes less of a speculation-driven asset, its volatility could reflect it becoming a store-of-value asset. With that said, however, the sheer breadth of the cryptocurrency market virtually guarantees that there will always remain low market cap alternatives that have sizable price volatility.

If you want to learn more about cryptocurrencies, volatility, or the blockchain industry in general, be sure to check out Ivan on Tech Academy. The Academy is the premier source of online blockchain education, and offers countless top-notch cryptocurrency courses. Getting into the cryptocurrency markets can seem daunting even without taking the relatively substantial crypto volatility into account. At Ivan on Tech Academy, you get to learn everything you need to understand the cryptocurrency market. This means you will get the best tools available to not be at the mercy of analysts. Instead, you will be able to make sense of the markets yourself, and do your own research. What are you waiting for?