This article will cover the future of crypto mining amidst such difficulties as environmental protests, governmental regulations, and outright bans. To start our examination of what the future holds for crypto mining, let's look closer at China's ban on crypto mining!

At this point, if you're still wondering, "what is crypto?", make sure to follow the link and read up on that subject. Better yet, take the Crypto for Beginners course at Moralis Academy!

China's Ban and the Effects On Crypto Mining

With China's "blanket ban" on the practice, crypto miners had to close shop and redeploy elsewhere. Within months, China lost two-thirds of the world's Bitcoin mining operations. All that hoopla created a boom in North America, with miners in the US and Canada locking in stellar gains in 2021. On the other hand, miners relocating had to ship lots of equipment out of China. Primarily, they moved to the US, Canada, Russia, and Kazakhstan. Moreover, it turns out Kazakhstan is building a reputation as a crypto mining hub.

However, things change quickly in crypto and not always for the best. Recently, Kazakh regulators began considering upping the tax on crypto mining. If regulators engage in overreach to the point where taxation becomes too punitive, the affected miners may be on the move again.

Crypto Mining - Bans and Regulations

The worst thing that could happen to the future of crypto mining is that more countries follow China's lead. Some other countries that have banned Bitcoin are Iraq, Qatar, Oman, Morocco, Algeria, Tunisia, and Bangladesh.

While countries that ban crypto mining remain in the minority, at the very least, the industry can expect more regulation. Certainly, miners will need to be more creative in striking agreements with nation-states to continue operating. For instance, with so many mining operations shifting to North America, US government officials voiced concerns about crypto.

So, with all this disruption, regulation, and potential bans, one has to ask, where is the future of crypto mining headed? Will more countries follow China's lead and impose bans? Or will regulators soften their stance due to the mining industry's efforts to pursue more eco-friendly innovations?

Bitcoin and Crypto Mining

Before we get too far ahead of ourselves, let's look at crypto mining and what it entails. Since Bitcoin is the original crypto, let's start with that.

Mining is the process of bringing new Bitcoin tokens into circulation. Furthermore, it uses a proof-of-work (PoW) consensus mechanism that requires miners to solve complex mathematical equations. The short version is that PoW involves a lot of energy consumption, and that factor has environmentalists up in arms. Miners solve PoW math problems to earn Bitcoin rewards known as block subsidies. The only way to get more Bitcoin into circulation is to mine it. One difference between traditional mining and crypto mining is that Bitcoin mining rigs are high-powered, energy-intensive computers.

PoW has served Bitcoin well. Throughout its history, there is still no record of double-spending. Moreover, legions of miners expending electricity to verify transactions incentivize them to keep the ledger accurate. Hence, PoW keeps the cost of writing a block excruciatingly high which maintains Bitcoin's robustness. So there are opposing forces at work here, as we'll explain.

The PoW Public Relations War

"Bitcoin maxis" still regard PoW as a modern wonder. However, PoW is attracting criticism as more environmental groups rally against its industrial-scale electrical power usage, and not all of the complaint is without merit.

The Bitcoin electricity consumption index from Cambridge places the Bitcoin network's energy consumption higher than the country of Ukraine (before the war) and just less than Egypt's. Moreover, Bitcoin ranks 27th in-country energy consumption rankings. So, should crypto mining be allowed to consume more electricity than entire nations? For environmentalists, that would be a hard "no." But the answer is a resounding "yes" for those who believe the world desperately needs decentralized digital currencies.

Regardless of the controversies, miners remained undeterred in 2021, raking in their highest collective revenues ever. Last year, they took home nearly $17 billion in revenues. Hence, China's ban didn't hit miners in the pocketbook as many predicted.

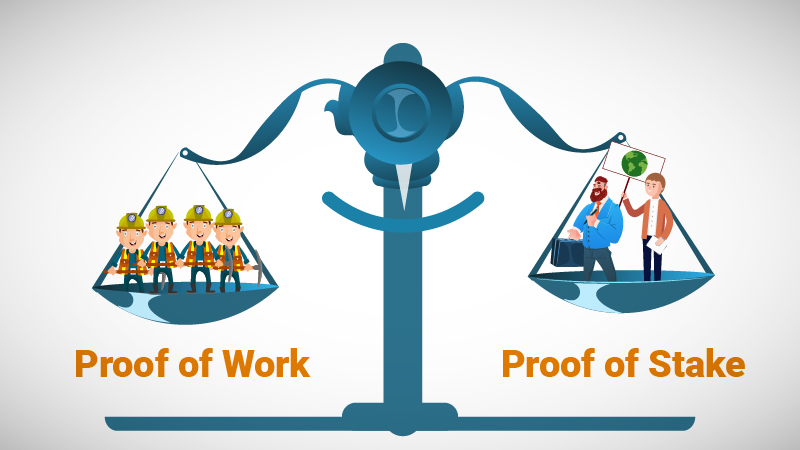

The Proof of Stake Alternative

Some crypto advocates believe the entire industry should move to proof-of-stake (PoS). The simple explanation of PoS is that users stake tokens to become validators. More importantly, PoS is less energy-intensive than PoW mining. With PoS, staking replaces the intensive computational efforts Bitcoin and other blockchains require.

Ethereum, the number two blockchain behind Bitcoin, is transitioning from PoW to PoS. Some estimates claim it will reduce its energy consumption by over 99%. Further, other blockchain networks opt for the PoS consensus mechanism straight out the gate. For now, at least, the Bitcoin network isn't abandoning its PoW mechanism. This model is battle-tested and has stood the test of time, and Bitcoin bulls wouldn't have it any other way. Therefore, Bitcoin miners will have to find workarounds to coexist, and such alternatives are already underway.

A lot of decentralized finance (DeFi) protocols use PoS. If you want DeFi explained, read our article on the Moralis Academy blog. You can also take a deeper dive at our academy by taking the Master DeFi in 2022 course. In addition, if you have JavaScript skills, why not try to create a DeFi dashboard? If that sounds interesting, read our guide on the Moralis blog!

Alternative Energy Sources

Michael Saylor's firm, MicroStrategy, is one of the world's top Bitcoin holders. Currently, they hold 125,051 BTC. That is over $5 billion worth in today's value. More importantly, this Bitcoin bull co-founded the Bitcoin Mining Council. Its purpose is to dampen the anti Bitcoin mining fervor by promoting more transparency in mining energy usage and sustainability initiatives. The point is that there are other ways to ensure the future of crypto mining without forcing PoW chains such as Bitcoin to switch to the PoS validator model. Let us explore this topic further in the following sections. Moreover, in this article, we've jumped straight into Bitcoin mining. But what is Bitcoin? Find out in our recent blog article.

Buying Excess Energy

One way to reduce greenhouse gas emissions is by consuming excess methane that would otherwise go into the atmosphere through flaring. For example, ConocoPhillips confirmed it was selling its extra flare gas to Bitcoin miners.

Such use cases could make Bitcoin a load balancer for energy waste. Companies that cannot store energy can sell the excess to crypto miners, making it a win-win.

Semiconductor Technology to the Rescue

Advances in semiconductor technology should also help Bitcoin mining's energy efficiency. Intel is a high-profile company that recently entered the crypto mining business, looking to release its first crypto-focused chip. This chip should provide 1,000x better performance per watt than mainstream SHA-256-based mining.

Energy Reduction, Hydroelectricity, and Hardware

Some in the industry are adapting by mining greener blocks with hydroelectricity, while others aim to reduce the energy required. Furthermore, the criticisms of PoW are not falling on deaf ears when it comes to existing hardware specialists. BITMAIN's new mining rig, the S19 Pro+ Hydro, uses a liquid cooling technology to reduce power consumption while extending the machine's lifespan. US mining firm Merkle Standard predicts it can be net carbon-negative at the end of 2022 using the S19 Pro+ Hydro machines.

Energy consumption is a direct cost for Bitcoin miners. Therefore, they have an incentive to find and use less expensive sources such as renewables. Further, extensive Bitcoin mining operations are often located near energy sources to capitalize on lower energy costs that would otherwise go to waste. Some firms, such as Mawson Infrastructure Group, are even eyeing nuclear sources. When the energy balance is not carbon-free, Mawson offsets its emissions with carbon credits.

In sum, the crypto mining industry is pulling away from polluting energies and adopting a more sustainable energy set that includes wind, solar, geothermal, and hydro-electrical.

Crypto Mining Investors

The future of crypto mining investing may well lie in ETFs such as the Valkyrie Bitcoin Miners ETF on Nasdaq. It doesn't operate like the typical exchange that sells BTC directly. Instead, it offers investors exposure to companies specializing in software or hardware for mining operations. It functions as a proxy for investing in Bitcoin. It's a way for traditional investors who are still nervous about buying crypto to own a piece of a real business.

Hence, there's no need for non-technical people from traditional finance to struggle with a crypto wallet when they can stay in their comfort zone and call their stockbroker. Investing in Bitcoin mining can be tricky! Learn how to invest in crypto at Moralis Academy!

Crypto Mining and Capital Requirements

Besides overcoming the growing criticism of PoW's energy-intensive nature, what is the outlook for the future of crypto mining regarding funding? Access to capital is crucial to any industry. But it's especially true for crypto mining firms because they need a large amount of funding for equipment and infrastructure.

When Bitcoin hit new highs in 2021, plenty of investors poured money into mining. But with the recent downturn in 2022, the capital market has dried up as investors become more risk-averse. So, experts and participants alike believe miners will have to get creative to raise capital.

Creative Financing

The conundrum miners face is that they need to keep spending to add computers and processing power (hashrate) to expand their operations. But the problem with the rally of 2021 is that it brought many new entrants saturating the sector with too many miners offering similar business models. Investors are frustrated with this lack of differentiation, and it will become increasingly difficult for miners that cannot distinguish themselves from the herd. Therefore, more significant differentiation amongst miners is likely to occur in the future.

One way for miners to diversify is by owning their infrastructure for power and hosting. For example, Stronghold Digital Mining uses power for mining and electricity sales. In addition, Hut 8 bought a cloud and data center business for mining and cloud computing and will use it to branch into Web3. Further, CleanSpark stated it would use its top-of-the-line ASIC mining machines as leverage to raise capital.

Other options include monetizing the company's Bitcoin holdings by selling them or depositing some with a lender to earn yield. Bitcoin-backed loans are among the least expensive forms of debt for miners, followed by machine financing.

So, differentiation to obtain capital has become the theme for miners. As crypto investors mature, the financial products will need to as well. Consequently, there are likely to be more financial options as time goes on.

Is Consolidation Coming for Crypto Mining?

The mining industry's cash crunch could lead to more changes as margins compress and capital remains scarce with competition intensifying. Consequently, as more miners enter the sector, margins will shrink.

This crunch could lead to an age of consolidation for the future of crypto mining. Cash-strapped companies with lots of mining computers are likely to become targets for acquisition. Many specialists believe that mergers and acquisitions will manifest and become a big thing soon, maybe even in 2022. In such an environment, it makes sense that the more prominent companies will look to gobble up assets of the smaller ones.

On a positive note, consolidation and competition will hopefully usher in more efficient mining operations rather than more centralization and potential monopolies. Regardless, miners with more efficient machines and lower costs will be in the best position, while those with older devices will struggle.

In this article, we've talked about crypto mining, but what about the blockchain? If you'd like to know more about blockchain technology, make sure to have the blockchain explained at Moralis Academy!

The Future of Crypto Mining - Summary

In PoW ecosystems, winning future miners will be the ones who remain competitive with energy costs. But what about the future of Bitcoin mining? Miners have already dredged up over 90% of Bitcoin's total supply. So what happens when the last Bitcoin gets mined somewhere in 2140? Will Bitcoin mining cease to exist?

One can only speculate about the future. But it's entirely possible that mining will continue in 2140. Bitcoin has a hard cap of 21 million, so miners also have a cap on their production. However, Bitcoin's purchasing power may be strong enough in the future to motivate miners to keep mining block rewards to maintain the ledger even without new Bitcoins to mine.

Some experts believe that many countries will use Bitcoin as an asset strategy in the future, and those who don't will only succeed in sacrificing their prosperity. Whatever the future holds, crypto mining will likely stay front and center in the coming debates in social and political circles regarding energy usage vs the peoples' rights to self-sovereign cryptocurrencies.

Now, let's talk about your future. If you want a career in a red-hot industry that will still be around even after the last Bitcoin gets mined, join Moralis Academy and learn how to become a blockchain developer today!