The ETH 2.0 delay has been at the top of crypto natives’ minds since developers recently pushed back the Difficulty Bomb (see below). Ethereum 2.0 is an upgrade that seeks to enhance the network’s speed, scalability, and efficiency. The much anticipated Ethereum 2.0 upgrade is near but faces another delay, so the problems of congestion and bottlenecks remain.

But, before we ask why the ETH 2.0 delay? Let’s first get into the nuts and bolts of the upgrade, so we know what is getting delayed. Firstly, the moniker “Ethereum 2.0” doesn’t actually exist because back in January this year, the Ethereum Foundation decided to stop calling the upgrade Ethereum 2.0.

The purpose of this rebranding effort is to reflect more accurately what’s happening. Ethereum 2.0 is a network upgrade rather than a new network launch. The Ethereum Foundation believes that by calling it 2.0, it sounds like a completely new version of the blockchain, which it isn’t. The problem is that so many people have been calling it “Ethereum 2.0” or “ETH 2.0” that the name has become part of the crypto community’s vernacular. So, this article will refer to this latest postponement as the “ETH 2.0 delay.”

Ethereum 1.0 vs. Ethereum 2.0

So, how will the upgrade to Ethereum 2.0 differ from the Ethereum that we know today? For one thing, Ethereum 1.0 uses a PoW consensus mechanism, while Ethereum 2.0 will use a PoS mechanism. We’ve covered these differences extensively on the Moralis Academy blog so you can scan some of our blog posts there. For this article, we’ll only cover basic concepts.

The ETH 2.0 delay comes about amidst a market downturn. That’s why it’s essential to know how to invest during a crypto bear market. Read our Moralis Academy blog article to learn more. Moreover, understanding crypto crashes can help you figure out why the market tanked in the first place.

PoW vs. PoS

So, how does PoS differ from PoW? Firstly, the Ethereum blockchain needs to validate transactions in a decentralized way. Like Bitcoin, Ethereum currently uses a PoW consensus mechanism. In PoW, miners use powerful computers to solve complex mathematical puzzles so they can verify new transactions on the blockchain. The first miner that solves the puzzle gets to add a new transaction to the record of all transactions on the blockchain. Miners get rewards for their work paid in the network’s native cryptocurrency. However, the PoW process is energy-intensive, especially when we consider that the processing power used by losing miners who didn’t solve the puzzle all goes to waste.

With the push towards green energy and lowering the carbon footprint globally, PoW mining is becoming increasingly unpopular. The difference with PoS is that it relies on users to stake a network’s native crypto (in this case, ETH) to become validators. So, PoS needs validators who have similar responsibilities to miners. Further, validators get picked based on the amount of cryptocurrency they stake and the time they lock their tokens.

PoS validators are responsible for verifying and processing transactions, storing data, and ensuring the network isn’t validating fraudulent transactions while adding new blocks to the blockchain. Other validators attest to seeing a block. After enough attestations, a block gets added to the blockchain. Lastly, validators get rewards for successful block propositions. The process is “minting” or “forging.”

ETH 2.0 Validators

So, staking is the process of participating in transaction validation. And to become a validator requires depositing 32 ETH. Even in this bear market with today’s depressed prices, 32 ETH costs $38,400, so that kind of money excludes many people from participating. Fortunately, there are staking protocols that users can join where they can pool their money together, so the minimum requirement to participate in staking rewards is much less.

Currently, stakers have locked 10 to 13 million ETH in the Ethereum 2.0 contract depending on which source you choose. Dune Analytics data shows a large percentage is staked through Lido, a staking application. Other significant staking protocols are operating in this process, and centralized exchanges like Binance and Coinbase also offer these services. Staking protocols are growing in response to the move to PoS, which will help expand the number of stakers.

PoS Advantages

The most significant advantage of a PoS consensus mechanism is that it’s way more energy-efficient than PoW. That’s because PoS decouples energy-intensive processing power from the consensus algorithm. PoS doesn’t require a lot of computing power to secure the network. Thus, this upgrade will finally put Ethereum’s carbon footprint to rest.

Before Ethereum 2.0 materializes, however, the network still faces congestion and high gas fees. This predicament opened the door for other blockchains to try to compete with Ethereum. Solana is one such blockchain, and it uses the Rust programming language. You can learn about Rust & Solana here. If you’re ready to start developing, check out our tutorial on how to build a Solana dapp in three steps.

The ETH 2.0 Delay and Scalability

So what does all this have to do with the ETH 2.0 delay? The pattern you should be seeing is there are multiple factors involved in the ETH 2.0 upgrade that affect each other. One of the reasons for the 2.0 upgrade is scalability. That’s because the current blockchain can only support about 30 transactions per second (TPS) which causes delays and network congestion.

Some predictions show that once Ethereum 2.0 is complete, the network will handle 100,000 TPS and lower gas fees. This improvement means the following billion people using the Ethereum network will have a seamless experience. It’s all about reducing transaction fees and increasing network throughput. Furthermore, short-term volatility should get replaced with a long-term bullish impact. In other words, more scalability means the network can adapt to more usage, which leads to more demand. In theory, it all adds up to a force that propels the price of Ethereum.

Security

Ethereum 2.0 started with security in mind. Many PoS systems only use a small set of validators, which leads to a more centralized system with decreased network security. Ethereum 2.0, on the other hand, will have hundreds of thousands of validators (Bitcoin.com listed the number of ETH 2.0 validators as surpassing the 300,000 mark in March 2022). With more shared responsibility, the network is more decentralized—and thus more secure.

Upgrade Phases – Beacon Chain

The ETH 2.0 delay also occurs because the launch occurs in different phases. The Beacon Chain is the first upgrade. It introduces native staking to the Ethereum blockchain, a vital feature of the shift to PoS. Moreover, it is a separate blockchain from the Ethereum mainnet.

An interesting fact about the Beacon Chain is that it doesn’t change anything about Ethereum as we know it today. But it introduces PoS and serves as the consensus layer while coordinating the Ethereum network. Moreover, the Beacon Chain is essential to upcoming parts of the upgrade, such as Sharding (see below).

We’ve already mentioned Solana. But another blockchain competitor to Solana is NEAR. To learn more on this topic, please read our recent article on the Moralis Academy blog about Solana vs. NEAR.

The Merge

The next phase is “the Merge,” and it signals the end of mining. The Beacon Chain is already live and exists as a separate chain from the Ethereum mainnet. But at some point, the two will merge.

The plan is to swap out the PoW consensus mechanism on the execution layer and replace it with the PoS algorithm that the Beacon Chain provides. “The Merge” is the name for this process, as it will combine the new consensus layer with the existing execution layer and put an end to PoW mining. Additionally, The Merge will have an immediate positive impact on the Ethereum network’s carbon footprint. It will also set the stage for scalability upgrades like Sharding.

When will the Merge join the Beacon Chain with the Ethereum mainnet? Previous iterations of the roadmap put the Merge after the launch of Shard Chains. But that changed after a slew of Layer-2 scaling solutions sprang up. The introduction of Layer-2s helped shift the focus to the Merge.

Sharding

The current Ethereum blockchain consists of a single chain with consecutive blocks. It is secure but also slow and inefficient. With Shard Chains, the blockchain gets split up, enabling parallel chains to handle transactions instead of consecutive chains. Shard Chains speed up the network and make it easier to scale.

Shard Chains will achieve the increase in TPS mentioned earlier. Furthermore, they are in the final phase of the ETH 2.0 upgrade. They will increase the network’s capacity to process transactions and store data. They will also make it easier to run an Ethereum node from a hardware perspective. That’s because one machine will not have to store as much data as before. Shard Chains should be ready sometime in 2023.

The present market downturn is a great time to expand your blockchain skills. By improving your competency during the quiet times, you’ll be ready for the next phase of explosive growth. To study Ethereum in-depth, start with the Ethereum Fundamentals course at Moralis Academy. If you prefer to focus on a more specific topic like NFTs, check out our NFT coding tutorials!

A Quick Timeline of ETH 2.0

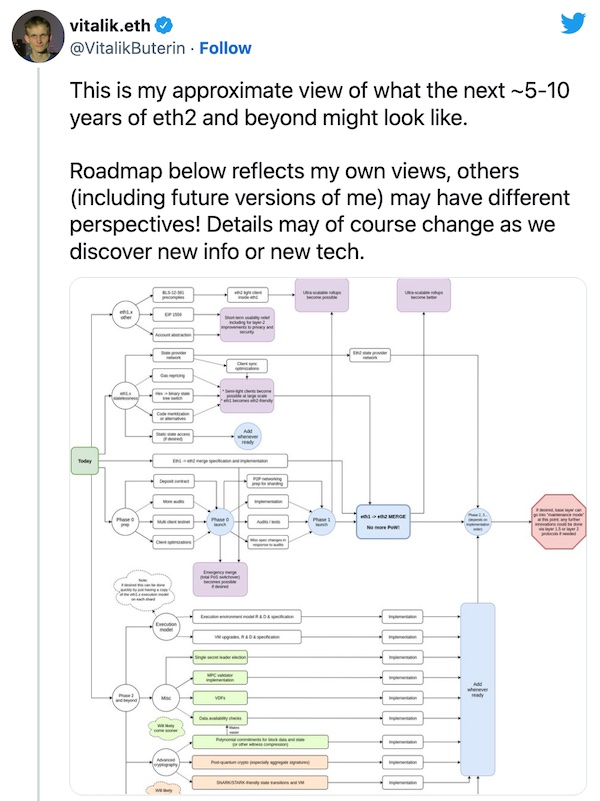

In 2020, Vitalik Buterin laid out the roadmap for the next five to ten-year span on the march to ETH 2.0. He stated that the lion’s share of challenges was now in development. So, whatever ETH 2.0 delay we see will likely come from the developers since they face the most difficulties.

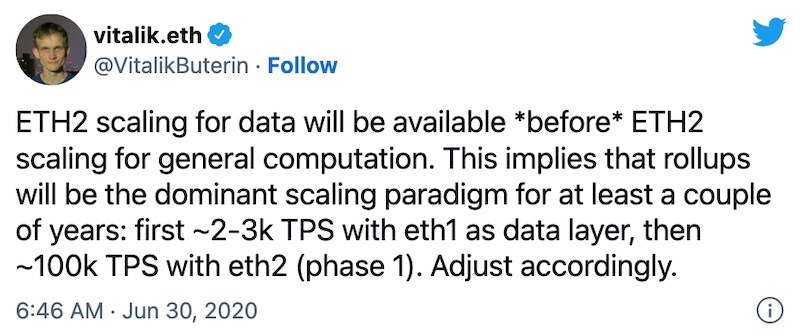

Furthermore, in June 2020, Vitalik stated that Ethereum 2.0 would need to rely on scaling methods like ZK-rollups for at least two years before launching Shard Chains. In August 2021, the London Hard Fork changed how transaction fees work by burning base fees instead of paying Ethereum miners. This action reduces the ETH supply and puts deflationary pressure on the Ethereum network. The London Hard Fork was an excellent trial run for the next phase of Ethereum 2.0, which emboldened Vitalik’s confidence that Ethereum’s ecosystem could handle significant changes leading to the Merge.

Final Upgrade

According to the Ethereum Foundation, the complete upgrade to Ethereum 2.0 should occur in 2023. The most recent significant ETH 2.0 delay came when Ethereum developers pushed back the Difficulty Bomb with the Gray Glacier update on June 30 this year. That announcement means The Merge phase isn’t likely to happen until at least September 2022.

The Difficulty Bomb increases the difficulty of PoW. It seeks to motivate miners to transition to PoS and reduce the chances of a fork. Developers explained they implemented a delay to prevent network degradation that premature activation of the Difficulty Bomb could have ignited. So, the Gray Glacier update effectively pushed it back a hundred days.

So, the Ethereum blockchain will transition to PoS over time. Currently, the network operates under a hybrid system using PoW for the main chain and PoS for the Beacon chain. Many people thought The Merge could happen this August. However, the Difficulty Bomb update kicked the can further down the road with another ETH 2.0 delay.

ETH 2.0 Delay – Conclusion

Bitcoin Maxi and other critics of Ethereum will once again contend that this latest ETH 2.0 delay is another sign that this major upgrade will never materialize. However, at this point, we’re on the final stretch to Ethereum transitioning to a complete PoS chain. So, now that we can see some of the various factors at play, it’s easier to understand how unforeseen difficulties can contribute to delays.

The three main parts of Ethereum 2.0, the Beacon Chain, The Merge, and Shard Chains, are interdependent even though developers are working on them in parallel. And all these dependencies factor into the ETH 2.0 release date and can contribute to pushing it back.