As uncertainty around the US dollar mounts, faith in the existing financial legacy infrastructure is dwindling. Specifically, this sees many people now searching for possible alternatives to traditional banks for storing their wealth, and opportunities to borrow and lend capital. What’s more, the advent of decentralized finance (DeFi) promises to be able to potentially bank the unbanked. As such, could the notion of crypto banks be a middle-ground solution between the benefits of cryptocurrencies and the traditional financial ecosystem?

One of the driving forces and marketing techniques for banks to acquire new users is offering substantially more interest returns than other banks offers. Traditional bank interest rates currently are at the lowest they can positively be, and various governments around the world – such as the UK’s – propose moving into negative interest rate territory to help stimulate the economy. As such, this means that people could potentially have to start having to pay the banks to store their hard-earned cash.

What’s more, many people are unsure about the future of the stock market. With the stock market pushing new highs even amid a global pandemic, some expect corrections or bubble bursts larger than the 2008 financial crisis or even the Great Depression. Consequently, some of these are beginning to realize the potential and underlying fundamentals for cryptocurrencies and Bitcoin. As such, the question “is it too late to get into Bitcoin” is answered by some with an emphatic “no” – as they choose to invest their wealth into this digital asset instead of stocks or gold.

In this article, we explain the current services available at some crypto banks, the individual fundamentals of each platform, and why banks are more interested in adopting blockchain than ever before. Visit Ivan on Tech Academy to learn all things cryptocurrency-related, from DeFi courses to technical analysis!

Crypto Bank Accounts 2020

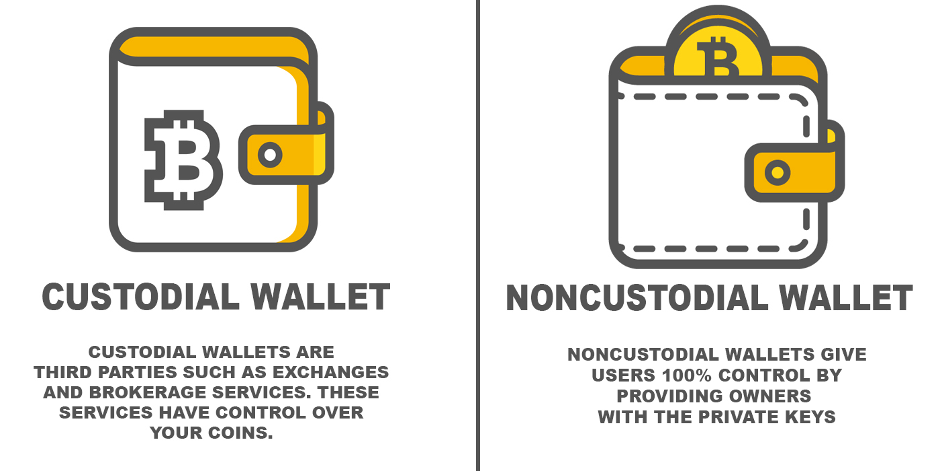

Custodial vs Non-Custodial Crypto Banks

The most crucial thing to know about a crypto banking account is whether or not you will be in charge of your own private keys. There are different services available, each one offering an individual experience which sometimes includes the hosting platform taking charge or looking after your private keys – so you don’t have to worry about the stress of losing them.

Your private key – or seed phrase – is a passcode for accessing your funds from anywhere in the world using only an internet connection. Some crypto exchanges and services offer custodial services, meaning you don’t have to handle this passcode yourself. Crypto custody improves the user experience for beginners by removing the responsibility of being in charge of the security of their private key, or passcode. However, this does mean that, as the saying goes; ‘not your keys, not your coins’. Unfortunately, there have been several instances of centralized custodians ‘losing’ user funds when a CEO or private key holder has vanished, been arrested, or died.

These kinds of unusual events don’t occur frequently, but it is certainly something to bear in mind. Exchanges and platforms offering non-custodial services mean that you are in possession and ownership of your wealth, and have the responsibility to maintain that wealth in a safe and secure manner. It is best to use a cold hard wallet for storing your coins offline. The only way that you could then lose your wealth is if you personally lose your seed phrase.

Looking to learn more basic crypto terms such as seed phrases or the difference between custodial and non-custodial wallets? Enroll in Ivan on Tech Academy to get access to courses suitable for both beginners and experienced crypto traders! Get an exclusive 20% discount when you join using the promo code BLOG20.

Kraken

Kraken, founded by Jesse Powell in 2011 is one of the longest-standing crypto exchanges. Powell’s mission was for anyone and everyone to be able to purchase and store cryptocurrency safely and securely, ultimately leading to global financial freedom and inclusion.

In September of this year, the San Francisco-based centralized exchange became the first Special-Purpose Depository Institution (SPDI) bank in Wyoming. Specifically, September 16th saw the Wyoming Banking Board approve Kraken to offer traditional financial services alongside crypto services. A Nasdaq article noted that Kraken’s “crypto bank” entry in Wyoming was the first newly chartered Wyoming bank since 2006.

Unlike in the traditional banking sector, Kraken’s customer service runs around the clock, 24/7/365. Kraken uses their online live chat support for communicating and assisting their customers regardless of who or where they are. Kraken offers its users a range of services; from staking and trading, to futures, to their own APIs.

Becoming a cryptocurrency bank allows Kraken to gain access to federal payments infrastructure. As such, this makes integration of traditional and blockchain-based banking features easier to implement. Shortly after Kraken’s approval, digital asset startup Avanti Financial Group was approved as well to set up a similar SPDI in Wyoming.

BlockFi

Founded in New York City in 2017, BlockFi was created by Zac Prince and Flori Marquez. The company’s main goal is to provide credit services to markets with limited or restricted access to financial services.

BlockFi services accommodate both retail and institutional investors. What’s more, it has a long list of industry experts onboard, drawing expertise from various finance and technology areas.

BlockFi has three core product offerings:

- An interest-bearing savings account, offering up to 8.6% APY compounded.

- Crypto-backed loans, where you can use your crypto as collateral.

- A crypto exchange, where you can trade several major cryptocurrencies at the market rate.

BlockFi uses the custodial services of Gemini, one of the most highly regulated centralized cryptocurrency exchanges. Regulated by New York’s State Department of Financial Services, Gemini implements high-level hardware security models to keep users’ funds safe.

These services make BlockFi fall into the category of being a so-called “crypto bank”. Specifically, this comes from offering many of the same core features previously expected from traditional banks. Nevertheless, utilizing cryptocurrency to offer much higher returns on investment allows crypto banks to offer more persuasive financial services.

Monolith

Monolith, stylized as “Monolith.”, is a futuristic Ethereum wallet crypto debit card. The platform is a decentralized financial application that gives users full custody of their crypto assets.

Monolith has also integrated an in-app decentralized exchange (DEX) aggregator called Paraswap. Paraswap allows users to make swaps from within a sleek, intuitive user interface at market price without additional fees. Paraswap finds the best price for your token swaps by searching through various DEXs like Uniswap and Kyber Network.

Each time a Monolith card is topped-up, a 1% community contribution is charged and sent to the Monolith Asset Contract. Holders of TKN, the native Monolith ERC-20 token, receive a share of this contribution as a reward for holding TKN.

Monolith is not trying to fit in with the traditional banking sector. Rather, Monolith poses a compelling alternative to financial banking services by offering users access to DeFi from within the Monolith banking app while giving users full custody of their assets.

Plutus

The UK-based financial alternative Plutus is another exciting new platform, offering services just like crypto banks. Nevertheless, it’s worth mentioning that Plutus points out it “is not a bank” – although it offers the same financial services. The service provides you with a crypto debit card, account number, sort code, and IBAN number.

Plutus’ platform includes a decentralized exchange (DEX) with which users can trade and sell ETH and the native PLU token. These can then be loaded onto a Plutus debit card. This can to be used for purchasing goods and services online, or contactless in stores.

To promote liquidity on Plutus DEX, the platform recently ran a campaign whereby users can sell PLU back at a fixed rate. This is just one of many new features offered by the platform. Additionally, it offers users rewards for shopping with brands and stores such as Nike and Amazon. Plutus is currently running a campaign for the new iPhone 12, where users can earn 15% PLU back when purchasing the latest smartphone.

Cashaa

Cashaa is an online banking platform for managing fiat and crypto payments. Offering a hassle-free crypto banking service for both business and personal use, Cashaa makes it simple to use cryptocurrency for all kinds of international transactions. Cashaa aims to offer “better than a bank account” hybrid accounts. These hybrid accounts are fully compliant with regular fiat central banks supporting all major FX currencies. However, they are also crypto-friendly, supporting a slew of cryptocurrencies including Bitcoin.

The platform also offers banking APIs for fintech innovators to integrate wallets, ERP, and accounting software to manage and trigger payments, and comply with AML and KYC regulations. Recognizing the shortcomings of the traditional financial industry including infrastructure and compliance API for transactions, Cashaa aims to resolve this through creating “one account for old and new money”.

Cashaa has acquired an impressive list of accolades, such as reaching the Rise Global Top 100 Most Influential Blockchain Company list, and the KPMG list of Top 50 Emerging Fintech Businesses in 2018.

Anchorage

The San Francisco-based premier digital asset firm Anchorage is a platform primarily for institutions, with offices around the world. Their services include secure, insured, and audited custody of digital assets, trading, staking, governance, and being able to safely grow your capital through crypto-backed lending and line of credit.

Co-founded by Nathan McCauley and Diogo Mónica, Anchorage has been named the preferred custody provider of the token Oasis ROSE. As a launch partner of the up-coming Oasis Network, Anchorage has been working closely with the Oasis Labs and Oasis Foundation to ensure a smooth launch for their custodial needs.

Anchorage has recently applied to the OCC (Office of Comptroller of the Currency) to convert to a fully-licensed US bank. This crypto bank would be named Anchorage Bank. If this application is successful, Anchorage would become the first crypto platform to receive a national charter. This comes in contrast to Kraken’s previously mentioned Wyoming-specific license. Becoming the first nationwide US crypto bank would allow Anchorage to conduct business across all 50 states of America.

Banks Offering Crypto Services

In July this year, the US Office of the Comptroller of the Currency (OCC) sent out a letter to all banks of America clarifying that national banks can provide services to issuers of stablecoins in the US. The OCC also outlined the definition and use cases of cryptocurrencies, alongside the regulatory rules for custodial services of crypto keys for their banking customers.

Brian Brooks

The Acting Comptroller of the Currency, Brian Brooks, is surprisingly committed to implementing cryptocurrency into the financial industry. In fact, he was even criticized by six members of congress for spending time on it during the pandemic.

Highly-regulated centralized crypto exchange Gemini received an Electronic Money Institution (EMI) license from the UK Financial Conduct Authority (FCA) earlier this year. Gemini also received further licensing through the FCA as part of their Fifth Money Laundering Directive (5MLD) registration process of crypto assets. Gemini has been making a larger presence within the UK since, offering more efficient and faster solutions for GBP international payments.

Can Crypto Kill Commercial Banks?

Commercial banks are coming under increasing pressure to adapt, as economic turmoil is forcing negative interest rates. Such low, or even negative, interest rates incentivize consumption rather than placing money into banks’ savings accounts. Crypto banking services, like the ones mentioned above, provide compelling alternatives to traditional financial services. Some even wonder, if crypto can kill the banks entirely, rendering them redundant, and obsolete.

The reality is, that both the traditional financial sector and the crypto industry are becoming interoperable. The tribalism between crypto ideologists and progressives is beginning to dissipate as the legacy system looks towards blockchain technology for its next innovative step.

We will likely see more crypto banks like Kraken appear as crypto regulation ramps up. The more regulation in place, the easier it is for centralized crypto exchanges to offer banking services. Meanwhile, fintech firms such as Square and Paypal have already begun the move to integrate crypto services into their existing platforms.

This is no longer a question about competition, it’s a question of how these two sectors can come together to bring about a higher quality financial landscape for everyday people.

Crypto Banks Conclusion

The global financial landscape is changing. Education regarding money and economics is on the rise and people are beginning to see the shortcomings of fractional reserve banking and irresponsible banks that are too big to fail. Deutsche Bank recently reported that investors are increasingly turning to Bitcoin instead of gold as a hedge against inflation. These types of newsflashes show us that confidence in crypto is growing at a rapid pace.

At the same time, there is a huge push for interoperability in the crypto space, both between different blockchains and between the traditional financial sector and the crypto industry. Blockchain use cases are increasing exponentially, with new financial tools and applications emerging almost every day.

This suggests that the global financial infrastructure is evolving to meet the needs of a new digital era. Central Bank Digital Currencies (CBDCs) are being considered across the world, and soon we will see commercial banks issuing similar digital currencies such as JP Morgan’s JPM coin.

Banks are adopting blockchain technology, and cryptocurrency projects are becoming banks. Soon, as crypto mass adoption becomes a reality, there will be little distinction between crypto banks and regular banks as the two sectors could converge to offer the best of both worlds to their customers. With further regulation, it will become easier for crypto projects to move towards a traditional banking model that provides crypto services.

Those looking to keep an eye on crypto banks and cryptocurrency-based financial services should check out Ivan on Tech Academy. Ivan on Tech Academy is one of the leading blockchain education platforms, and offers a wealth of in-depth information on all things happening in the cryptocurrency field. Additionally, Ivan on Tech Academy allows your to supercharge your crypto career with world-class courses. What are you waiting for?