If you’ve just entered the world of decentralized finance, you may be asking yourself: “What is Ethereum gas?” or “What is Gwei?”. Well, you’re not alone! Rarely is Ethereum gas explained to new users or understood properly. Gas is the fee paid to Ethereum nodes to mine transactions. Therefore, Ether gas price is the cost of an Ethereum transaction fee. This applies to any token transacted on the Ethereum network. The Ether gas price can fluctuate dramatically depending on network congestion. This is something that many newcomers fail to understand, and as a result, get “rekt” as a result.

In this article, we’re going to explain what happens when someone pays an Ethereum transaction fee. Also, we’ll explore the dynamics of Gwei and Ether gas price and the function it plays in the Ethereum ecosystem.

Ethereum is the second-largest cryptocurrency following Bitcoin. Also, Ethereum is the backbone for decentralized finance, with over 200 projects built on Ethereum. Ethereum developers are highly sought after. Also, blockchain is the number one most in-demand skill on LinkedIn currently.

There has never been a better time to invest in yourself and your education. Ivan on Tech Academy offers courses covering all aspects of blockchain and crypto. These include Ethereum 101 and DeFi 101. If you’d like to learn more about Ethereum and the crucial role it plays in the world of blockchain, Ivan on Tech Academy has all the tools and resources you need in one place to start your journey.

Blockchain Fundamentals Review

Before we dive right into Ethereum gas and the concept of Gwei, we’ll first do a brief recap on the fundamentals of how blockchain technology works.

The first blockchain to be created, Bitcoin, is the largest and arguably strongest blockchain network on the planet. The network consists of thousands of computers called nodes that process, or “mine” transactions, and are rewarded with Bitcoin for doing so. The process of mining includes mathematically verifying transactions and then placing them into a block, each transaction is cryptographically linked to the previous one. Once blocks are full they are appended to a blockchain.

Usually, it takes 6 blocks to be appended before a transaction is confirmed to the user. This is in place for the prevention of difficulties with forks – an instance where 2 miners simultaneously mine the same transaction. If this happens, the longest chain will continue the blockchain and the other forked chain will be removed and transactions returned to the mempool.

Introducing Ethereum

A few years after the inception of the Bitcoin blockchain, the Ethereum blockchain was launched with the revolutionary feature of smart contracts. Smart contracts are programmable money – where you can specify for funds to be moved upon a certain outcome or event. For example, if you want your child to do well at school, you could motivate them through smart contract positive reinforcement. If your child receives an A, $50 would be transferred to their account. If they received a B, $30 would be transferred into their account, and so on. The specifics of a contract are defined by the individual.

Smart contracts can be programmed to be deployed upon an event happening, mathematically confirmed by the use of oracles. This means you don’t have to be present on a website or app at the time of the event, as transactions will be deployed automatically. Also, smart contracts are immutable, meaning they cannot be changed or altered. Diving a little deeper, smart contracts on the Ethereum blockchain are created using the Solidity programming language.

Contracts are written by creating a list of demands requiring computational power to be executed. It is this computational power that runs the Ethereum ecosystem and maintains its functions. This “cost” for this computational power is called gas.

What Is Ethereum Gas? What Is Gwei?

Before we dive into Ethereum gas explained below, it’s first worth understanding the definitions and terms we’ll be using. Contrary to how the terms are often used, ETH, Gwei, and gas are not the same thing.

Gas is a unit representing computational power that is required to process requests or transactions on Ethereum. Gas is measured to estimate the fees needed for a transaction to be processed within the network. ETH or Ether is the currency that pays for gas units to be processed. Gwei is a unit of ETH that is used to pay the transaction fee.

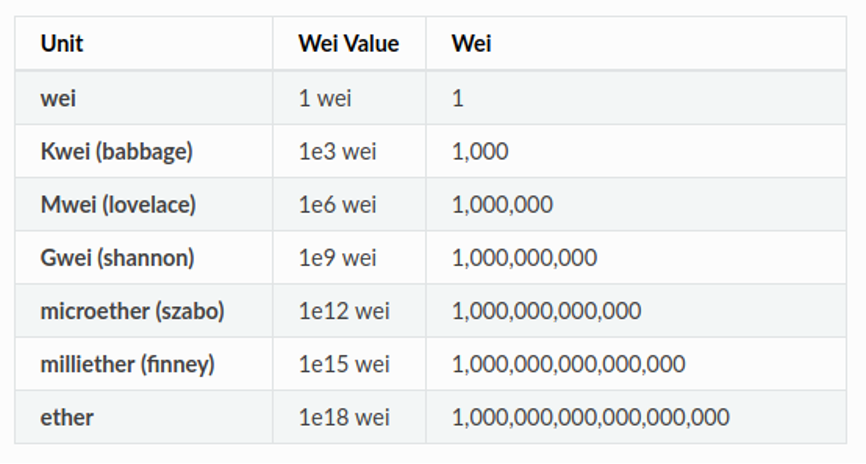

One Gwei is equivalent to one billionth (or a nano) of an ETH. Conversely, 1 ETH is valued at 1 billion Gwei. Gwei is short for gigawei, or 1,000,000,000 wei. Wei is the smallest denomination of ETH, like satoshis are to Bitcoin.

Different units have nicknames after various mathematicians and computer scientists that have influenced the creation of blockchain and Ethereum.

Ethereum Gas Explained

Why Ethereum Needs Gas

Gas can be thought of as the oxygen needed for Ethereum to remain alive. Similar to our own human life-supporting element, Ether gas is used in different ways to facilitate and expedite transactions on the Ethereum network.

Mining Fees

Every transaction or smart contract deployment requires computational power from the nodes across the Ethereum network. This computational effort is measured in units of gas. Ether gas price fluctuates. This is because the computational power required for mining the transaction is paid for in Ethereum transaction fees. Although Ethereum is currently transitioning from a proof-of-work consensus mechanism to proof-of-stake, Ethereum transactions are mined in a similar way to Bitcoin transactions. When transactions are mined, the miners receive fees for their work. Ethereum transaction fees are paid to cover gas, plus a small additional fee for their time in the network. Without gas, the Ethereum network would cease to function.

Transaction Deployment

Gas is required to execute every line of code created in a transaction or written into an Ethereum smart contract. The more complex the smart contract, the more gas required to deploy and execute it. Also, gas is needed to run the Ethereum Virtual Machine (EVM). The EVM is where all smart contracts function on the Ethereum network.

Incentivization

Furthermore, Ethereum gas is required as the incentivization within the ecosystem. Incentivization is needed for decentralized communities to be sustainable and grow.

Basically, the Ethereum community consists of nodes who will use their computational power to confirm and fulfill smart contract deployment requests. Requests are from the front end-users and the blockchain developers using dApps. Incentivizing miners keeps the Ethereum ecosystem running smoothly.

Gas to Ether

The fuel used to power the Ethereum network is gas. Gas is measured into smaller units and paid for in Gwei.

There is no fixed price for the conversion of Ether to gas, or vice versa. Ether gas price is optional, and users can specify the amount they’d like to send to miners.

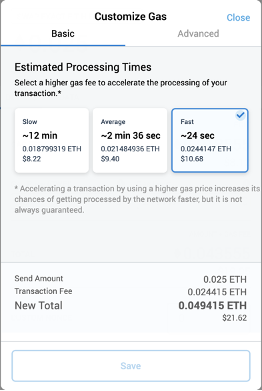

The average Ether transaction fee is 20 Gwei (0.00000002 ETH). However, this varies significantly. For example, Web3 wallet Metamask suggests options for users with slow, average, or fast speeds. The higher the Ether gas fee paid to the miner the faster transaction is processed. Furthermore, miners are incentivized to mine transactions with higher gas fees first as they return higher rewards. As a result, low gas fees during times of high network congestion often result in transactions being rejected.

Ether Gas Limits

Each transaction will use a certain amount of computational power, with different actions within smart contracts requiring different amounts of gas.

Gas price for transactions is determined by the user. Users are normally prompted with a suggested amount to send, however, ultimately the decision is with the sender. This can sometimes confuse newcomers when entering the world of DeFi, but it’s nothing to be intimidated by. We’ve explained both possible scenarios when encountering gas limit issues.

Let’s say a particular transaction consists of several smart contract requests amounting to 80 units of gas worth of computational power needed to complete the executions.

Gas Too Low

If the user specifies a transaction fee covering 60 units of gas, there will be insufficient gas to carry out this computation, and the transaction will be rejected with an “Out of Gas” error.

The transaction will be rejected and the ETH sent for gas will be returned to the account. However, the user would not receive all gas funds back, as they would still pay for the miners’ estimates of calculations. The transaction is recorded on the blockchain, however, the transaction will return to its original state.

Gas Too High

Gas fees are used for the computational power needed to complete a transaction or request and pay a fee to the miner. Thereafter, any unused gas is returned to the user. Logically, one may assume from this, just setting a high gas fee would process their transaction quicker without losing out on any ETH.

However, it doesn’t exactly work this way in practice. For this reason, there is a block gas limit that restricts the number of transactions a miner can place within a block.

Imagine you are a miner presented with a choice of 2 transactions to place into a block – one with just enough gas to cover computation and mining fees, and another with a high amount of gas which will then require a portion being refunded.

It makes logical sense for a miner to choose the first transaction, as this saves space within the block to add more transactions.

When setting the Ether gas price for a transaction, it is often best to set it only slightly higher than the required gas to have the transaction processed faster.

ETH Gas Station

The ETH Gas Station is an open-source platform where you can track transaction times and analyze miners’ behavior. The Ethereum Network appreciates that to maintain a decentralized community, there needs to be a clear and transparent gas decentralized marketplace. Therefore, ETH Gas Station was created.

Here, you can view the latest or chosen period of block confirmations showing how much gas is being used. Also, you can see how much is being spent on fees, and have a chance to find the best estimate for transaction fees to be processed as soon as possible.

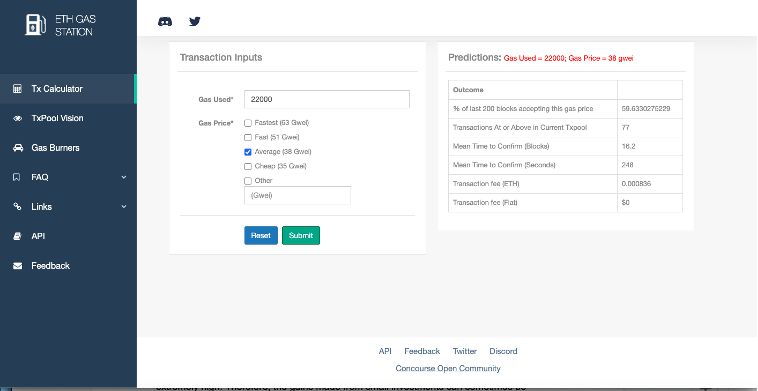

According to the site, ETH Gas Station has a model that takes an estimated average of how many blocks are needed for a transaction to be confirmed. Then they calculate the amount of gas used and the cost of said amount of blocks. The gas price and gas use are categorized into 4 different levels:

Gas Price

- Below average

- Average

- Above average

- Fastest

Gas Use

- Median or below

- Median to 75th percentile

- 75th to 90th percentile

- 90th percentile and above

The Gas Price Recommendations are broken down into 3 sections:

Safe Low – this estimate will be high enough to be received by miners, low enough that it may take 5 minutes to be confirmed. This gas price is determined “by the lowest price where at least 5% of the network hash power will accept it”.

Average – this estimate is the price accepted by miners who have contributed to at least 50% of the most recent 100 blocks that have been mined safely and promptly.

Fastest – the highest estimate is an average of the lowest gas price accepted by top miners in the pool. Anything higher than this will be unlikely to increase transaction times more so than already.

The ETH Gas Station has a Tx Calculator to estimate different gas price recommendations. For example, you could punch in the amount of gas used for a transaction, with a choice of gas price estimates. Once submitted, you’ll be presented with a list of predictions including gas use and price, and the percentage of the last 200 blocks accepting the gas price.

Saving a couple of dollars on gas here and there may not seem important, but over the course of a year it could add up to a substantial amount.

The Future of Ether Gas Price

In June this year, Ethereum increased its block gas limit by 25%. However, this capacity was instantly filled as usage increased. At times, Ethereum transaction fees were above 450 Gwei. Gas prices can act as a barrier for entry into DeFi for smaller investments. A solution is needed as soon as possible. High gas fees on Ethereum can be prohibitive and this is posing a threat to mass adoption.

Ethereum 2.0 aims to solve this issue by tackling scalability. Soon, Ethereum will be capable of processing approximately 3,000 transactions per second with the help of rollups. Furthermore, the Ethereum network aims to be capable of processing up to 100,000 transactions per second when sharding comes into play.

Sharding occurs when the Ethereum network is split into several sections, known as “shards”. Each shard will be allocated to a particular set of smart contract functions and transactions. Sharding is expected to be one of the final pieces of the Ethereum 2.0 puzzle. This is partly since it is extremely complex, and will require extensive testing before launch.

Ideally, each shard will be responsible for transactions of a similar value or complexity. This would mean that Ethereum transaction fees are lower as competition between miners is compartmentalized into larger and smaller value transactions.

Ethereum Gas Explained Summary

Many newcomers to DeFi only see Ethereum gas explained at the point of making a transaction on Uniswap. During times of high network congestion, these fees can be extremely high. Therefore, the gains made from small investments can sometimes be difficult to realize if selling cancels out any profits. Also, be sure to keep enough ETH in your Web3 wallet for any Ether gas prices you incur in the future. When the time comes to selling, this could be pivotal to your trading success.

With the correct education and risk management, gas shouldn’t be an issue. Ethereum gas explained correctly will ensure that you can take advantage of lower fees and avoid higher fees where possible. Gas is an unavoidable part of DeFi. For this reason, don’t be deterred!

If you’d like to learn how to build your own decentralized applications, check out the Ethereum Smart Contract Programming 101 course at Ivan on Tech Academy. Here you can learn the many different functions of smart contracts, and how to create and deploy them. Also, be sure to check out our Ethereum Smart Contract Security course to stay safe when building your first dApps!