Commonalities And Differences Between Blockchain And Dlt: “Non- Identical Twins”

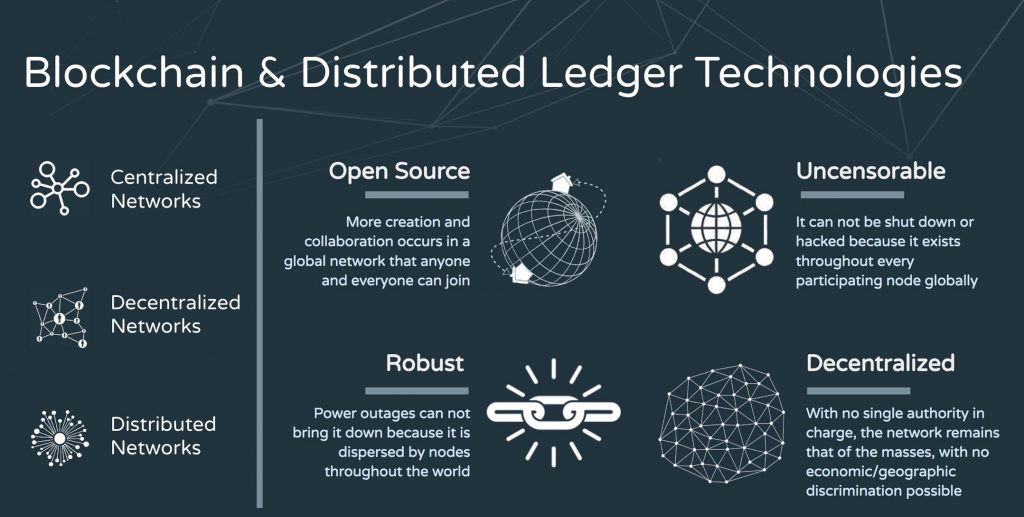

Blockchain and Decentralized Ledger Technology (DLT) are interrelated however they are not completely the same thing.

Blockchain is a branch of DLT whereby DLT is a subset of a blockchain. For instance – the block explorers associated with Ethereum, Bitcoin or any other blockchain for that matter are live examples of a distributed ledger.

DLT is a part of blockchain whereas DLT is a specific breed of blockchain technology. They are non- identical twins!

What Is The Difference Between Blockchain and DLT?

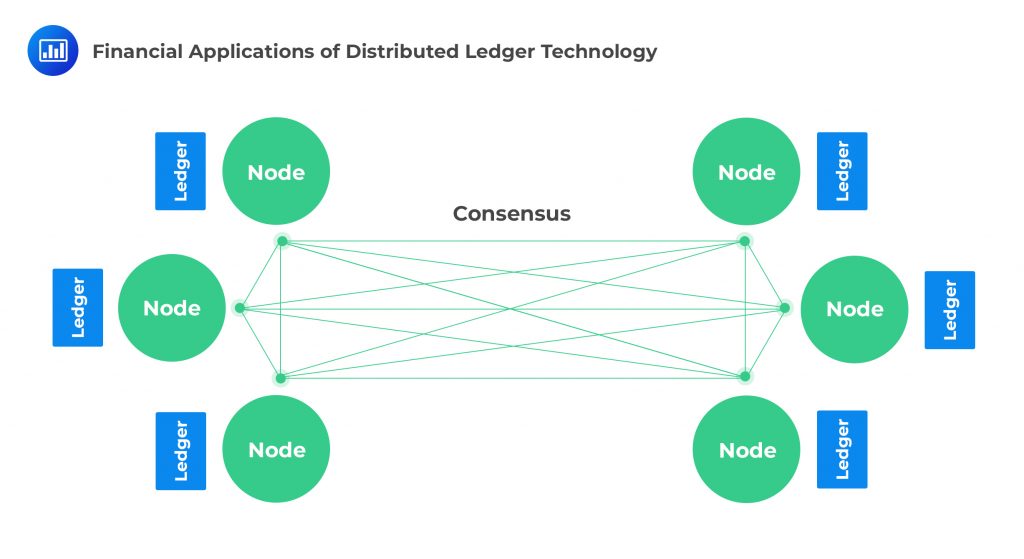

The above expressions explain why it is so easy for people to make interchangeable and erroneous use of the two terms. Perhaps we could turn to a more eloquent expression to help you draw conclusive distinctions – “DLT is a decentralized database managed by multiple participants, across multiple nodes. Blockchain is a type of DLT where transactions are recorded with an immutable cryptographic signature called a hash. The transactions are then grouped in blocks and each new block includes a hash of the previous one, chaining them together, hence why distributed ledgers are often called blockchains.” – R3.

Fundamentally, they both have the resources and capabilities to solve the same problems.

Aspects Of A Blockchain

There are added-qualities incorporated into a blockchain to give it its full make-up or DNA.

One or two of those aspects being cryptography and mining algorithms. They are used in collaboration to achieve robustness and decentralized ecosystems.

Blockchain has a sum of growing nodes all showing the same state of events and information whilst periodically appending new blocks to the network using hash functions of the previous block. That is the basic cryptographic manner in which blocks are chained together (R3).

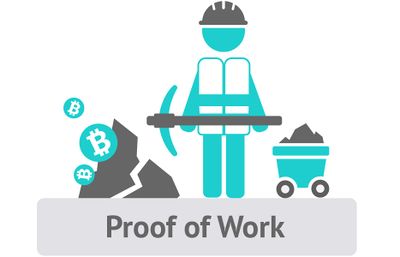

Furthermore, there are mining algorithms – proof of work is Bitcoin’s baby. Other projects have since emerged using the same mining philosophy to protect the integrity of their networks. Miners are then incentivized for securing the network with their mining-power.

Proof of stake is the latest consensus algorithm. It promises the security of PoW but it is more eco- friendly, and it enjoys higher transactional throughput.

Transactions per second (TPS) is an important metric for crypto analysts and enthusiasts. A higher TPS is crucial to the community. They need to feel at ease that they are using a technology that surpasses the visa standard (approximately 2000 TPS).

Ethereum’s next iteration (2.0) will use proof of stake with elements of sharding to improve the network’s performance thus seeing much higher transactions per second. This alone – makes it appealing for a wider range of use-cases; some of which were not as efficiently possible before in the blockchain space.

Come to think of it – De-Fi could do with ETH 2.0. For instance – ETH 2.0 will capitalize the “flash” in flash loans! Nevertheless, De-fi could not have come at a more appropriate time!

Solving Blockchain’s Scalability Issues

A great deal of effort and investment is continuously going into mitigating blockchain’s scalability issues.

One of the headline motivations for this directive is to level-up the user experience on blockchain networks to accommodate a diverse range of concurrent activity without compromising any of the blockchain elements.

When this is achieved – blockchain architects and companies will have a more comprehensive suite of blockchain tools to meet new and growing needs in the market. For a long time blockchain has been unfairly subjected to pessimistic scrutiny that undermine its value. Unfair in a sense that blockchain is brilliant, revolutionary and still young.

But then again, nothing exists in a vacuum totally free from pessimistic sentiments. Everything in existence has some criticism attached to it.

Even so – blockchain is resilient! It is here for good – and so is DLT. If you look at DLT you will see that many DLT based start-ups offer business-to-business solutions.

Distributed ledgers are well poised for companies because they address multiple-infrastructural issues plagued in industries. One of them is databases.

Given how disparate and complex organizations have grown – legacy databases have become victim to inefficiencies and security loopholes.

Such databases are prone to data leaks, redundancy, lack of integrity, and poor controllability.

Similarities Between Blockchain And DLT: How They Converge

Blockchain and decentralized economies grow in phases. Initial phases (of blockchain) were focused on decentralization, cryptocurrency, and ICOs. Just a quick side note here – distributed ledgers are not complete blockchains, and they do not have cryptocurrencies as you know them. I just thought I should throw that in.

Moving right along!

The next phase – we then saw companies coming on board to form new offerings using cryptocurrency but as utility-tokens to support their infrastructure (banking).

Perhaps, this was one of precursors that led to the De-Fi boom with new start-ups coming to life with swap-protocols and stablecoins.

But even so, the whole industry is still in this introductory phase characterized by intense research and development. But now we are seeing this phase where blockchain is converging more with DLT.

When you hear DLT, naturally you should think Hyperledger. Hyperledger is an open-source DL stack attributed with an array of protocols and resources built sophisticatedly well enough to make the digital activity more seamless and independent.

By that, I mean that users have finally reconciled with their control over the internet or any network- inclined day-to-day activity.

What Is Self-Sovereign Identity?

A notable aspect of Hyperledger is the number of big corporate companies involved in making DLT more than just aspirational.

Hyperledger is used for decentralized identity management by offering verifiable credentials. This has given rise to the self-sovereign identity (SSI) economy.

SSI is a user-authoritative and liberating identity management paradigm and workflow that sees to you controlling your digital identity and any other credential related to your identity without having to rely on intermediaries to verify specific credentials.

Credentials can be just about anything – your birthdate is a credential – your proof of residence is a credential.

SSI appeals to everyone – businesses and right down to individuals. For corporates – SSI offers decentralized identity and access management capabilities in a way that is truly seamless, liberating, and less intrusive.

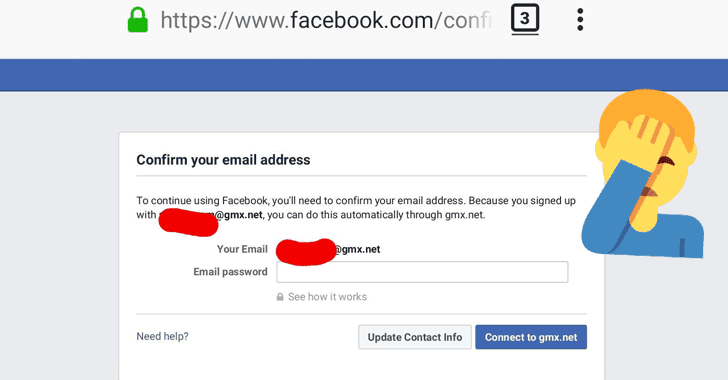

Data privacy and data protection is of paramount importance. So many data breaches occurring with email passwords being leaked – thus calling for regular password updates.

Though, over the years technologies have come about such as One-Time–Passwords (OTP) and 2- factor authentication (2-FA) with the main goal to reinforce security into our digital private lives.

It is a step in the right direction but even so – these solutions are not quite there yet. If anything – Metadium is amongst a select few of blockchain outfits who have customizable decentralize 2FA modules for use. That is a major leap forward!

Nevertheless, the implication being echoed here is that traditional “blockchain-less” or centralized solutions are not comprehensive enough. The user experience is hindered by so much friction and boilerplate all in the name of safety and data protection but much of your information is still vulnerably dispersed.

Real World Applications For Self-Sovereign Identity

Take a look at the many passwords you have and also take a look at all the redundant application- flows that forces you to repeatedly reveal sensitive information all the time.

For a more practical illustration – let’s shift our focus to Know Your Customer (KYC). KYC is a regulatory requirement for financial institutions to verify identities and respective places of residence during the inception stages when businesses form relationships with their customers. Without KYC, customers are not permitted to engage in the company’s core market-offering.

All financial institutions are subjected to the same obligatory protocol. It totally makes sense because if you are using the services of multiple financial institutions they would not be knowledgeable of the shared relationship they have with you and their industry competitors. This is where zero-knowledge proofs could come in (a topic for another beautiful day).

It can be more than one bank and/or several trading brokerage firms. This is the norm because traders generally have more than one broker for their retail-trading.

Now imagine having to go through the same KYC process more than 12 times! Laborious (I know) and risky. The more you give out sensitive information the more exposed you become.

So instead of going through that repetitive exercise – you could use DLT tech such as SSI to complete one KYC application then have your details verified once. Any other KYC to follow will be conducted using verified credentials and validators without needing to expose neither your bank statement nor your identity again and again. The proof of a successful KYC is verified and just cross-checked for the subsequent attempts. A new instance will have to be implemented and attested when the customer has to update some of their personal details – like a change of address.

This example is a DLT approach of which can also be accomplished using blockchain.

In Conclusion: More Use-Cases

In truth, we have just touched the tip of the iceberg – the use-cases are endless. Passwords are going to become a concept of the past as far as crypto wallets and web/mobile applications are concerned.

Mortgage application processes will be independently streamlined by the applicant.

Identity & Access Management (IAM) will be more decentralised and elegant.

Wallets will become smarter.

GDPR’s frameworks will be comprehensively fulfilled.

Therefore, it is imminent that DLT and Blockchain are converging into similar identities in terms of capabilities. They are no longer synonymous to adversarial linkages or comparisons as formerly thought.

In fact, they are complementary technologies that will enhance our digital lives and experiences for the better.