You can start playing around with Moralis Money using the interactive widget below. Now, we strongly recommend learning more about how to use this free on-chain trading tool to spot bullish crypto coins before prices start going parabolic!

So, by diving into the following sections, you will learn how to make the most of out Moralis Money. Then, you’ll be ready to find the most bullish crypto anytime. Moreover, since the next bull run is slowly warming up, now’s the best time to learn how to identify the next crypto gems.

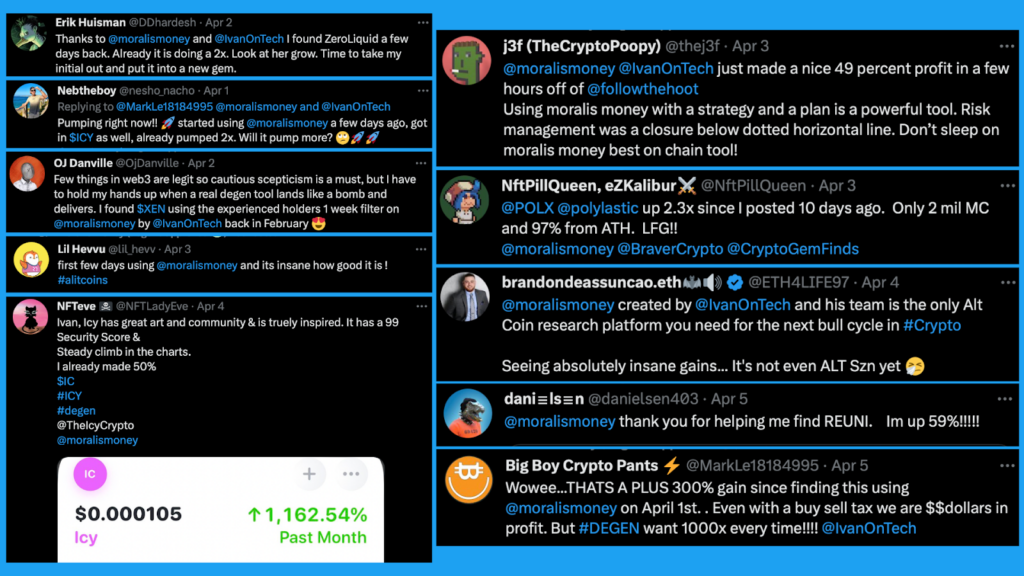

However, even though the bull run hasn’t officially started yet, many Moralis Money Pro users have already been pocketing massive gains. By detecting bullish crypto coins early, casual traders have positioned themselves properly and timely to ride the latest pumps of various assets. Those running Moralis Money queries in April even spotted the PEPE token in its early stage.

As you probably know, PEPE ignited the ongoing 2023 memecoin season. As such, Moralis Money Pro users have been able to get their share of initial pumps of many other new tokens, including the JEFF coin, the TURBO token, and the WOJAK token.

So, are you ready to join these traders in the know? It’s your time to find bullish crypto assets before they pump! Sign up for Moralis Money Pro today!

How to Spot Bullish Crypto Trends in 3 Steps Using Moralis Money

Let’s dive straight into a simple three-step process demonstrating how to find bullish crypto coins. However, if you wish to learn more about Moralis Money and the meaning of “bullish” and “bull run,” don’t forget to check out the rest of the article.

Now, in short, these are the steps to spot bullish crypto trends:

- Open Moralis Money Token Explorer

- Set Unique Filters

- This step includes sub-steps

- Run Your Search Query

So, without further ado, let’s get cracking!

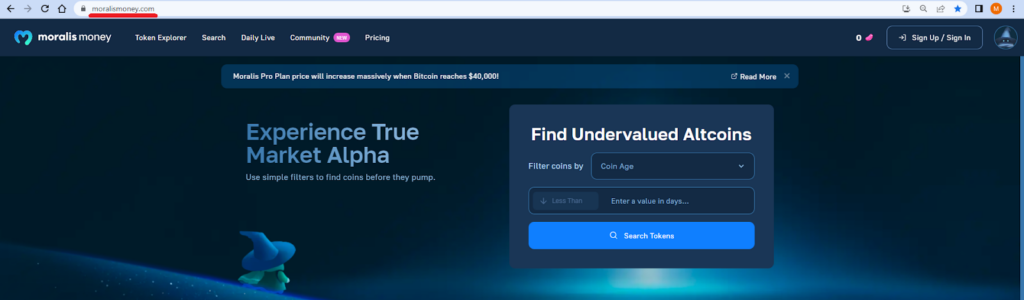

Step 1: Open Token Explorer

Token Explorer is Moralis Money’s core feature – it allows you to query on-chain data and find crypto tokens showing bullish signals.

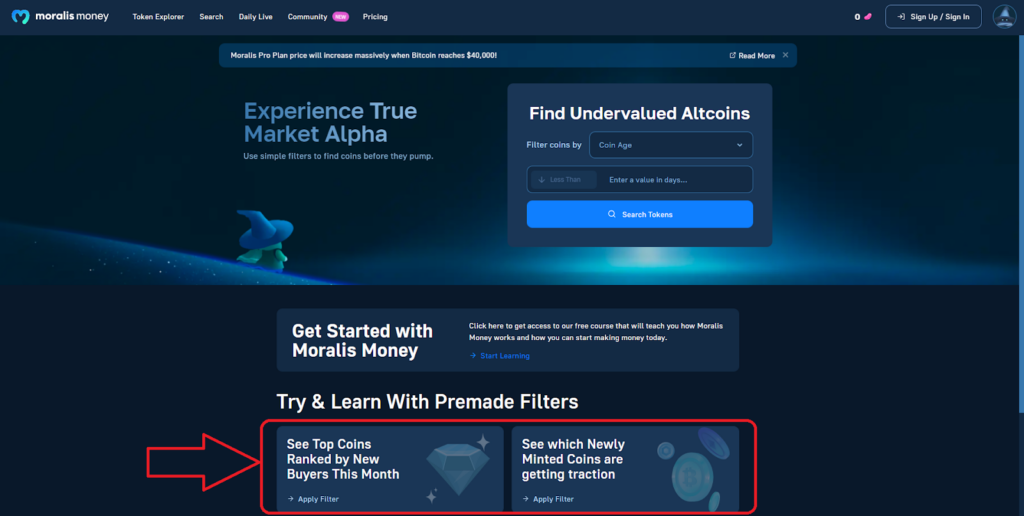

There are many ways you can access Token Explorer. For instance, you can use the interactive widget at the outset of this article. Or, you can visit the Moralis Money website and go with one of the options below:

- Select one of the preset filters:

- Or, on the homepage, run a single filter query:

Step 2: Set Unique Filters

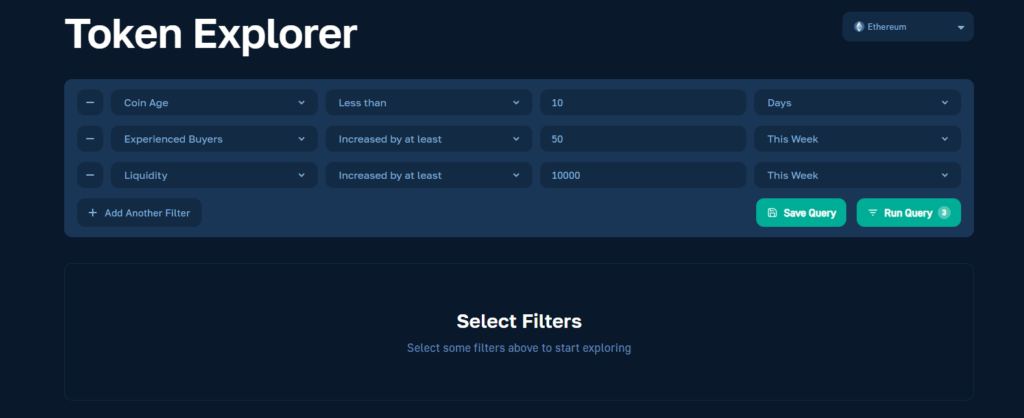

If you’d like to use your own unique search filters to find bullish crypto coins, then you can open up Token Explorer and then continue by setting your own filters:

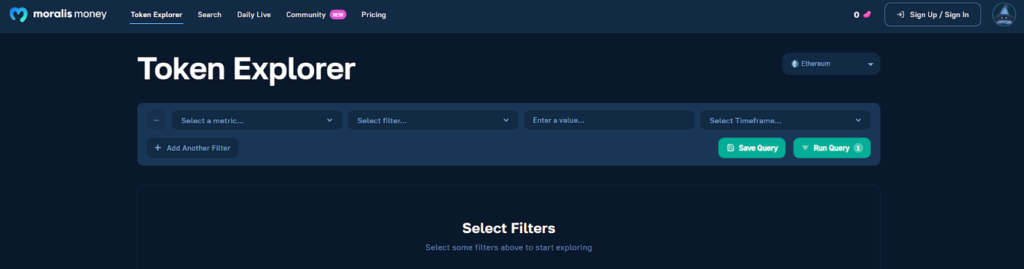

Then, you’ll land on the Token Explorer page:

Here, you can set one or more filters in place:

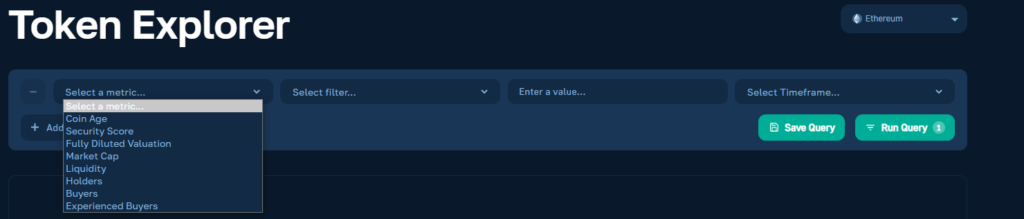

Moving forward, you’ll want to apply your unique combination of filters. The Moralis Money team is constantly adding new metrics that you can apply, but currently, you can choose among:

- Coin Age – Days since the token was created (minted).

- Security Score – The higher the number (up to 99), the less risky it is for the project to be a scam.

- Fully Diluted Valuation – The total value of all tokens in circulation plus the total value of all tokens held in the treasury.

- Market Cap – The total value of all tokens in circulation.

- Liquidity – The measure of the change in liquidity of the cryptocurrency’s exchange pairs.

- Holders – A change in the number of wallets that are holding the token.

- Buyers – The number of wallets that bought the token.

- Experienced Buyers – The number of wallets with a proven track record that bought the token.

Step 2.1: Focus on Newly Minted Coins or More Seasoned Altcoins

The Coin Age or the Market Cap filter is a great starting point.

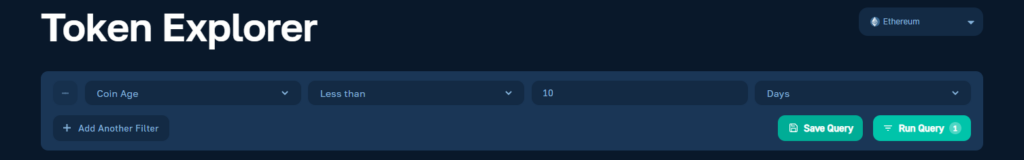

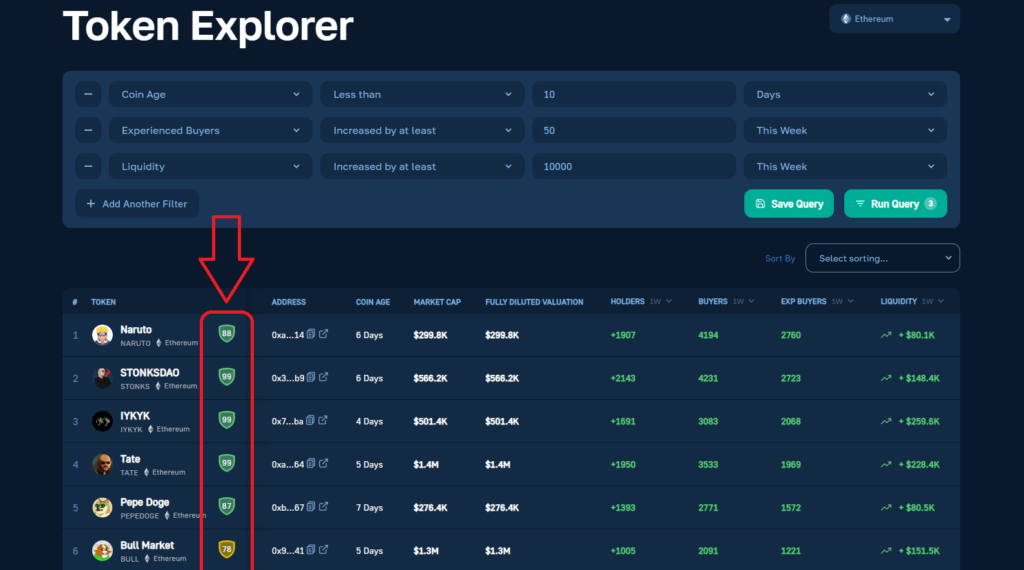

You’d use Coin Age if you wish to spot bullish crypto coins created recently. Here’s an example that would show you coins younger than ten days:

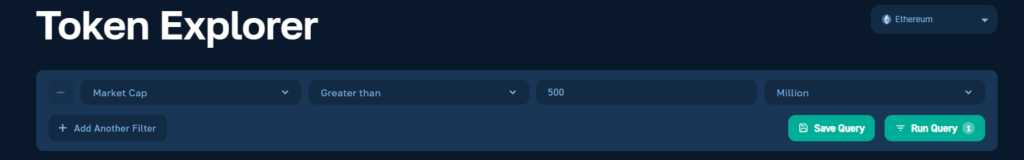

On the other hand, you’d apply the second one if your goal is to find bullish crypto among more season altcoins. Of course, to use the Market Cap metric for such a purpose, you need to go with the “Greater than” filter option and aim for coins with market caps of $100M+ or even higher. For instance, this is how you can target altcoins with market caps above $500M:

Step 2.2: Find Bullish Crypto Tokens by Looking at Their On-Chain Momentum

During your research, you wish to spot tokens gaining on-chain momentum.

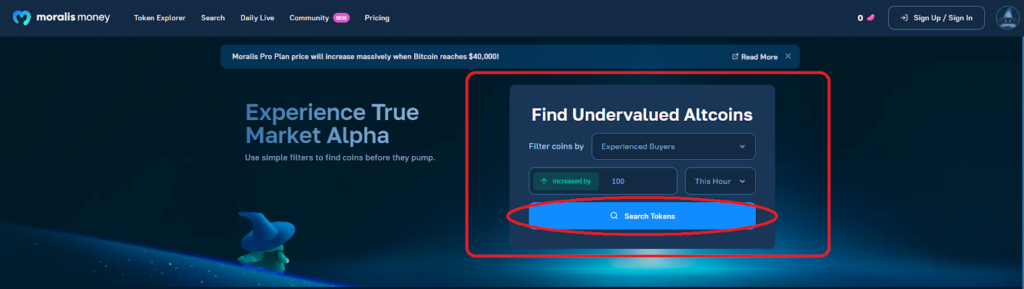

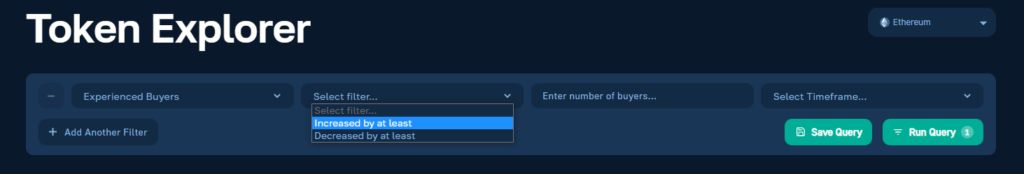

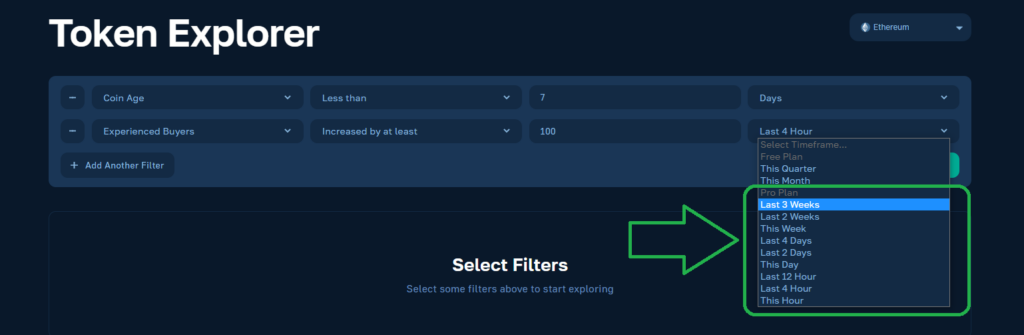

So, you want to use metrics like Liquidity, Holders, Buyers, and Experienced Buyers to particularly focus on the most bullish crypto tokens. Of course, in that case, you ought to select the “Increased by at least” filter option:

You can use just one of the above metrics or apply all sorts of combinations. After all, the goal is to find the combo that works for you.

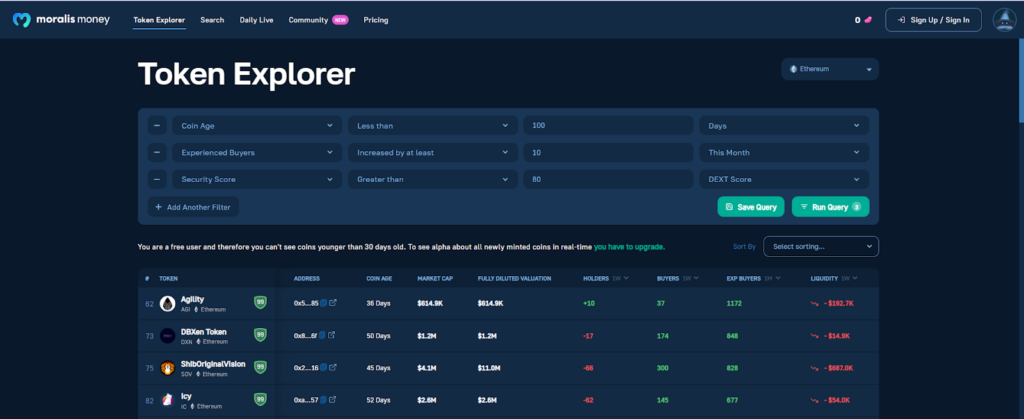

Step 3: Run Your Search Query

In the previous step, you learned how to apply different metrics to find the best combination that will help you find bullish crypto. So, you can wait until you set your combination of filters in place to run your query. Or, you can do so after adding each filter. Simply hit the “Run Query” button, and you’ll get a list of tokens that match your search parameters.

Of course, you might have to tweak your parameters and run your query several times to find the most bullish crypto tokens.

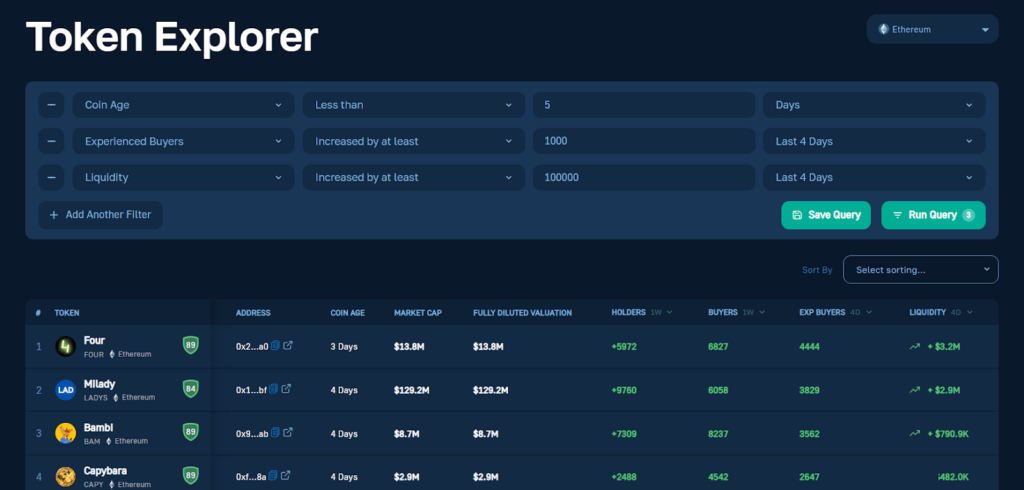

Here’s an example query that targets coins that are younger than five days, have 1000-plus new experienced buyers in the last four days, and have increased liquidity with $100,000 in the last four days:

Spot Bullish Crypto Tokens, DYOR, and Take Action

The above three steps are all you need to spot bullish crypto tokens. However, once you generate a dynamic list, you must DYOR for the crypto coins you believe deserve your attention. That way, you will easily find Web3 coins to invest in.

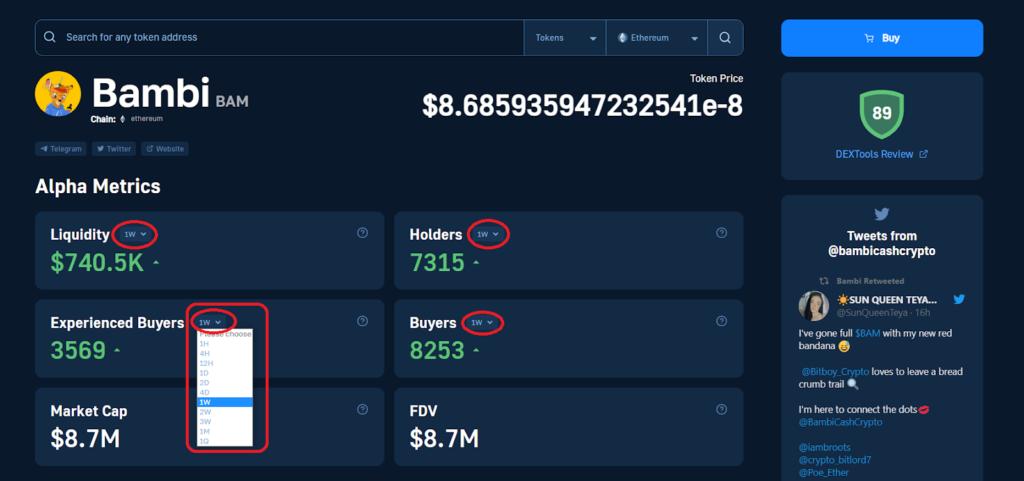

By clicking on any token’s name, you’ll land on that token’s page. There, you’ll see all the on-chain data, which you can explore on different timeframes to see how the token is performing over time.

The token pages also include links to tokens’ socials and websites, a sidebar displaying the latest tweets by the respective project, security stats, a price chart, a bubble map, and more.

All this information will help you determine whether or not the token at hand is the one you should buy. Of course, we encourage you to use other tools to support your conviction. If you determine the token is a good buy, hit the blue “Buy” button. The latter will take you to the 1inch aggregator that will find the best path for you to buy that token.

It’s worth pointing out that you can also use Moralis Money to make money when crypto goes down. In that case, you’d focus on tokens gaining negative momentum. So, instead of “Increased by at least,” you’d use “Decreased by at least.”

However, since the next bull run is slowly priming, now’s the best time to learn how to find bullish crypto coins. As such, start practicing the above three-step process today!

You can do that with a free Moralis Money plan. However, to spot the most bullish crypto assets before everyone else, make sure to lock in your Moralis Money Pro plan! With that plan, you’ll get access to great features, such as lower timeframes!

Bullish Crypto 101: What Makes a Crypto Asset “Bullish”?

Various aspects can make a crypto asset bullish. The most common ones include certain TA indicators, specific news and events, and strong fundamentals. However, it turns out that the most accurate and valuable indicator to spot bullish crypto assets come in the form of real-time, on-chain data.

Of course, you can combine the aforementioned aspects with on-chain data for additional confluence. Moreover, not looking at on-chain data would be quite foolish. After all, the real-time, on-chain data precede price action and can give you an unparalleled advantage when your goal is to find bullish crypto tokens before they pump.

The most typical on-chain indicators that make a crypto asset bullish include some of the following:

- Liquidity increase

- A noticeable increase in the number of token holders

- Number of buyers and experienced buyers increasing

Do not forget to consider various timeframes. After all, cryptocurrency can be bullish short-term and bearish long-term or vice versa. This is why you should always consider crypto cycles, general market conditions, news, fundamentals, TA, and other aspects.

What Does Bullish Mean in Crypto?

The term “bullish” is used when a particular cryptocurrency, an asset group, or the entire crypto market indicates that it may start or continue to increase in value. As such, we can have a “bullish” market, a “bullish” token, a person can be “bullish” about a coin, etc.

Essentially, it is an adjective that marks an optimistic belief that the prices of an asset will go up. The opposite of “bullish” is “bearish.”

According to Wall Street Journal, the two terms come from traditional markets, dating back to the 1850s. Furthermore, they might have been inspired by the blood sports of bull and bear-baiting that took place in medieval times.

What is a Bull Run?

A bull run is the most obvious part of the bull market, which typically generates the largest gains. However, the term “bull run” is often used interchangeably with “bull market,” meaning that the price goes up on the most significant timeframes.

Also, traders often say that a particular asset is “in a bull run” when the asset rallies on shorter timeframes, even if the market as a whole may not yet be in an obvious bull run.

The #1 Bullish Crypto Pattern Scanner – Moralis Money

Above, we’ve already demonstrated how to use Moralis Money to spot bullish crypto coins. So, at this point, you’re already aware of this tool’s power and simplicity. Yet, let us point out the core aspects that make Moralis Money the number one bullish crypto pattern scanner.

- It provides accurate on-chain activity, which precedes price action.

- Other on-chain tools are extremely complicated and cause information overload.

- Moralis Money returns easy-to-understand, actionable results.

- With this tool, you can generate a list of the most bullish crypto in seconds.

- Moralis Money’s core three features are designed to help casual traders overcome FOMO, avoid scams, and bridge the lack-of-time gap.

How Moralis Money’s 3 Core Features Overcome Trading Challenges

Here’s how Moralis Money’s core three features – Token Explorer, Token Shield, and Token Alerts – can help you say goodbye to FOMO, scams, and time scarcity:

- Token Explorer empowers you to run on-chain queries to find bullish crypto coins in a matter of seconds. You just need to apply a couple of filters and hit the “Run Query” button. By using this feature, you can spot great opportunities early so you don’t FOMO into tokens near the top.

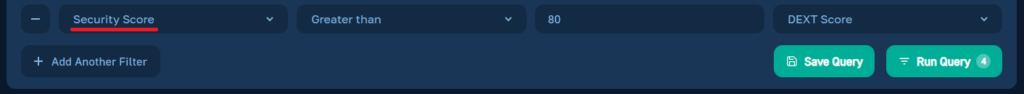

- Token Shield helps you avoid sketchy projects and scams. Unlike Token Explorer, the Token Shield feature does its thing automatically. Whenever you run a query, this feature performs a security check for the tokens that match your search criteria. As a result, Token Shield equips all the tokens on your dynamic list with security scores. The latter come in color-coded shields to make this as intuitive as possible.

You can consider security scores manually, or you can apply the Security Score metric to filter out tokens that do not match your risk tolerance.

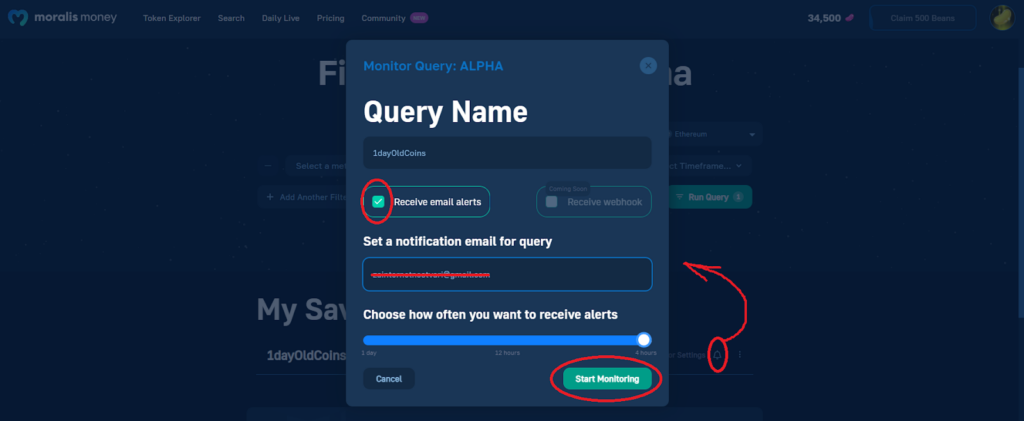

- Token Alerts allow you to scan for new opportunities without investing too much time. After saving your favorite queries, you get set up email notifications for those queries. That means you get to spot bullish crypto on autopilot. Whenever a new opportunity appears, you’ll receive an email notification with that token’s address. As such, your lack of time will no longer stand in your way of identifying the most bullish crypto assets.

Spot Bullish Crypto Trends in 3 Steps – Free Trading Indicator – Summary

In today’s article, you learned everything you need to know to maximize crypto opportunities. You now know how to use Moralis Money to find bullish crypto tokens before the herd.

A simple three-step process is all you need to generate a list of altcoins that deserve your attention. Then, you take that list and pick your winner by doing your own research, which you can start doing on the various Moralis Money token pages.

We also pointed out that the next bull run is slowly approaching, which means now’s a great time to master Moralis Money. By starting now, you’ll know exactly how to find bullish crypto coins before those insane rallies start. As a result, you’ll be able to ride those 1000x waves!

Nonetheless, do not forget to lock in the current Moralis Money Pro plan price before its next increase!