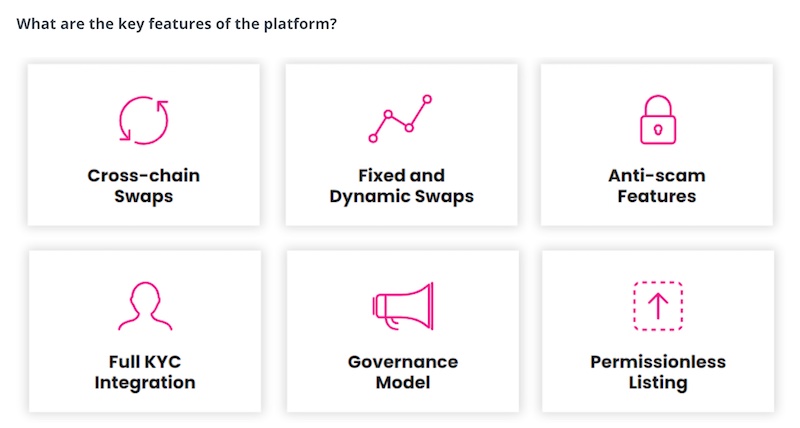

Polkastarter offers inexpensive transactions, ultra-fast and secure swaps, a friendly UX, and capabilities to move assets between blockchains. Further, this platform provides a launchpad for cross-chain token pools and auctions that are simple to use. These features benefit startups and blockchain projects in their early stages that are looking to raise capital and distribute tokens.

This article will explore some features that are available now and others launching soon. It will also examine the role that POLS (Polkastarter’s utility token) plays in its ecosystem.

What is crypto? If you’re confused, please follow the link to learn more. Better yet, go to Moralis Academy and take the Crypto for Beginners course!

What is Polkastarter? The Beginning

The founders of Polkastarter wanted to impact the industry by enabling projects to raise capital in a decentralized fashion. It needed the right combination of speed, scalability, governance, and interoperability.

With various options in play during the exploration phase, the CEO of Polkastarter, Daniel Stockhaus, became interested in Gavin Wood’s “Substrate” presentation at the 2018 Web3 Summit. Wood’s Polkadot project enabled the founders to create custom blockchains with a simple framework. Moreover, Polkadot’s mission, vision, and values are aligned with Polkastarter’s.

How Projects Can Launch on Polkastarter?

Projects wanting to launch on Polkastarter first get vetted by the team’s analysts and industry-leading experts. Next, Polkastarter helps approved projects raise funds by setting up a swap pool for its token based on a fixed purchase rate.

The platform’s “fixed swap pools” are advantageous for token sale investors in several ways. The primary advantage over traditional fundraising models such as initial coin offerings (ICOs) is that fixed swap pools keep the token price “fixed” throughout the sale until the initial supply is purchased. Hence the name.

Thus, projects can raise and exchange capital quickly and inexpensively, and users can participate in a secure environment knowing initial token prices won’t wildly fluctuate. We’ll examine these pools more closely below.

What is Polkastarter and What Problems Does it Solve?

Polkastarter went live in December 2020. Since then, it’s grown in popularity as a platform for initial DEX offerings (IDOs). With the explosion of “DeFi summer” in 2020, decentralized exchanges (DEXs) became more popular. Likewise, IDOs became an inexpensive, decentralized alternative to ICOs and initial exchange offerings (IEOs).

These three are all investment models. However, the project’s website launches an ICO while the crypto exchange vets and launches an IEO. An IDO, on the other hand, takes place with a third-party platform vetting the exchange with the token sale occurring in a decentralized fashion.

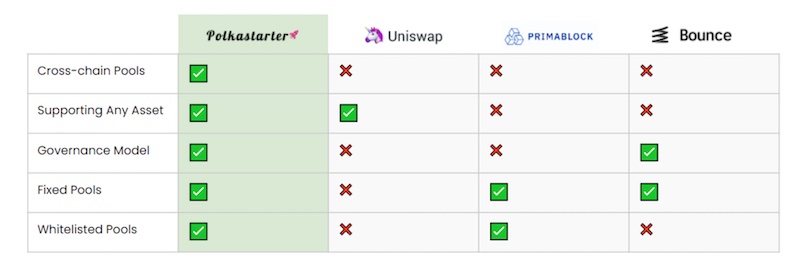

While IDOs cut some initial expenses for token listings, the convenience comes with another cost – sharp traders figured out how to front-run listings following liquidity bursts. For example, investors could jump in front of the herd and buy an entire pool on Uniswap, causing the asset’s price to skyrocket. This aggressive action caused others to “ape in” as they tried to corner the market on entire pools of new token listings.

The mad rush that followed was driven by those trying to snatch the lowest prices before others could get in. The result was a torrent of volatility with unfortunate scenarios that crushed many traders.

Overcoming the Downside of IDOs

In an IDO, projects need to provide liquidity on both sides of the asset. The “base currency” and the “quote currency” (typically ETH). So, a pair could consist of something like POLS/ETH. With the currency pair in place, the token trades against automated market makers (AMMs) like the one that powers Uniswap. The price then adjusts based on supply and demand forces.

Are you confused by crypto and the blockchain? Don’t be! Check out our “Blockchain Explained” article to get a solid foundation on how blockchain and crypto work.

How Liquidity Pools Work in AMMs

Liquidity pools benefit projects that need immediate liquidity for their token by offering users liquidity at varying price points. Notably, token values are difficult to determine before it passes through an extended price discovery phase. At this point, its value is anyone’s guess.

Thus, a new liquidity pair wedded to the protocol’s token can suffer volatile price swings, especially for lightweight pools holding less than $100k. Whales can muscle these around, shifting the liquidity pool’s balance ratio each time they swap a token within it. Swaps trigger the smart contract’s controlling rate to automatically preserve the 50/50 ratio for cryptocurrency pairs in the liquidity pool.

So, every time a user swaps with the liquidity pool, it changes the rate. Moreover, when a project tries a token launch via AMM liquidity pools, the price can quickly moon if numerous investors buy. That’s because liquidity pools must maintain the ratio amidst buying pressure.

What is a Fixed Swap Pool?

You’re probably wondering, “what is Polkastarter doing to overcome the above issues?”. First off, a “fixed swap pool” sets a fixed price for swaps. Projects combining this feature with the IDO model will know the precise amounts of capital raised and their sold tokens.

Further, they can trust that their community is holding tokens bought at a fair price. Conversely, investors can know their funds directly contribute to the project’s development.

The IDO model with fixed swap pools also lets projects set additional parameters on their fundraising. Such controls include limiting the number of investors in the pool and setting maximum investment levels per user. Developers can accomplish this by coding hard or soft caps into the smart contract, thus, keeping the funding rounds as equitable and transparent as possible.

More on Polkastarter and Fixed Swap Pools

So, what is Polkastarter? A simple answer is that Polkastarter is a DEX that allows projects to list their tokens at a fixed price that will hold fast. This fixed-price feature minimizes volatility during a token’s launch time. It also brings greater transparency regarding the amount of capital raised and tokens sold. Otherwise, high volatility makes this data challenging to calculate.

Polkastarter’s “superpower” is enabling projects to launch liquidity pools that execute orders at a fixed price – rather than relying solely on the AMM model. In sum, fixed swap pools provide the following solutions to these problems:

1. Lack of Control Mechanisms

Projects lacking control mechanisms can result in liquidity rug pulls and unfair token distribution.

2. Token Dumps

Control mechanisms can also protect against private investors dumping their tokens and crashing the price.

So, what is Polkastarter doing to combat token dumps and rug pulls? Keep reading to find out.

Benefits of Fixed Swap Pools

Fixed swap pools offer benefits to projects and investors alike. First, transparency regarding the number of tokens sold and how much capital the project raised is vital for investors. With fixed exchange rates, investors know how much they’re paying and how much they are getting.

Second, savvy investors can make better decisions in a fixed-price environment instead of one with high volatility. In such a state, interested investors have the chance to buy tokens at a reasonable pace and price without having to “ape in” with reckless abandon.

Third, a wider distribution of token holders is advantageous for startups. More significant variations amongst token holders (demographically and geographically) provide a more favorable outlook for centralized exchanges (CEXs). They consider the number and location of token holders as a critical factor regarding whether they should list a project’s token.

Lastly, fixed swap pools serve one of Polkastarter’s goals – to ensure that funds go to the project. That’s why Polkastarter started working with fixed swap pools in the first place – to provide a more equitable token distribution mechanism while remaining decentralized.

Polkastarter’s Use Cases

So, what are the use cases of Polkastarter? After all, there is more than one. An important one is that startups can raise needed capital on Polkastarter’s decentralized and interoperable infrastructure. However, Polkastarter’s technology is helpful for cases other than fundraising. These include password-protected, closed OTC deals with sales discounts for whitelisted addresses.

Polkastarter and Polkadot

There are multiple reasons why Polkastarter prefers Polkadot. With Ethereum’s escalating network fees and slower platform performance, end-users feel frustrated. They want inexpensive transactions, uber-quick swaps, and a more friendly UX.

Big brand name blockchains such as Bitcoin and Ethereum can only process between seven to 30 transactions per second (TPS) depending on network congestion. On the other hand, Polkadot solves these speed and scalability issues in a couple of ways.

1. Horizontal scalability with parachains.

2. Vertical scalability with its consensus mechanism enabling parallel processing of blocks.

Perhaps you’re wondering, “what is Bitcoin?“. If so, learn about it on Moralis Academy’s blog. More importantly, check out the Blockchain & Bitcoin Fundamentals course at Moralis Academy for a deeper dive.

Why Polkastarter Chose Polkadot

We’ve mentioned Polkadot quite a bit during our “what is Polkastarter?” discussion. Thus, you’re probably wondering why the Polkastarter team prefers the Polkadot blockchain? It’s because Polkadot simplifies the process of blockchain building within its ecosystem. It also serves as a positive force for standardizing and democratizing all its chains. Along with a shared vision for the future, the team decided on Polkadot.

The potential to exchange assets across blockchains is also coming to the forefront. DeFi’s future isn’t likely to be confined to only one blockchain, and interoperability is becoming a “must-have” in the ecosystem. Buying, selling, and transferring assets across blockchains should be mandatory, not merely a “nice-to-have” feature.

Speaking of decentralized finance, if you want DeFi explained, make sure to check out our recent blog article.

Polkadot provides interoperability from a programming perspective by enabling cross-chain compatibility and cross-chain transfers via bridges, while Polkastarter features fixed swap pools and cross-chain swaps. Thanks to Polkastarter’s ecosystem, users can get higher throughput for quicker, less expensive transactions while staying connected to the Ethereum blockchain (and others) for liquidity purposes.

Most importantly, Polkadot’s features help Polkastarter complete its mission of building an interoperable, cross-chain DEX.

The POLS Token

Token utility on Polkastarter is multifaceted. Moreover, POLS is Polkastarter’s native utility token. It plays various roles in its ecosystem, such as governance and staking, which are vital to maintaining long-term token holders and community members. POLS token holders can vote on which projects get featured, the types of auctions, product features, and token utility.

Staking POLS for Pool Rewards

Typically, users who stake cryptocurrencies commit to locking up their tokens for a time. The trade-off is the “stakers” get staking rewards for providing utility to the network, and staking the POLS token works the same way.

Users providing liquidity on Polkastarter are eligible to stake POLS tokens to earn a cut of the day’s token pool fees. When a user creates a token pool on Polkastarter, the pool creator pays a fixed fee on the total amount raised. A percentage of this fee goes to the stakers of POLS.

For example, let’s say a pool creator raises 100 ETH on his token sale with a fixed fee of 1%. That means one ETH gets deducted from the sale (100 x 1% = 1). So a percentage of the one ETH collected in fees will go to POLS stakers. That is how POLS stakers earn rewards from token pools of various cryptocurrencies.

Moreover, staking rewards get distributed in predetermined cycles. So, a user holding 5% of the total amount of POLS staked during a cycle receives 5% of the staking rewards for that period. For example, if Polkastarter generated 100 ETH in total for the staking rewards pool, that user will get 5% of it or five ETH.

Staking POLS for Pool Access

If community members want to access token pools, they must first stake POLS tokens. Moreover, the creators of token pools keep full autonomy over this process. Pool creators can limit pool access exclusively to POLS holders for a reduced fee on the swapped funds.

Projects can also limit access to the top liquidity and network contributors for high-demand pools, and features like password protection and whitelisting can help provide limitations in these situations. However, it’s always best to align the interests of the entire community, not just the whales. Thus, the POLS token is the coordinating mechanism for doing so.

Thus, Polkastarter’s fixed swap smart contract, combined with POLS token staking features and its migration to Polkadot, gives it a unique approach for token launches.

There are so many great crypto projects available. This makes it hard to decide which one to trade. Don’t worry; learn how to invest in crypto at Moralis Academy.

What is Polkastarter? – Conclusion

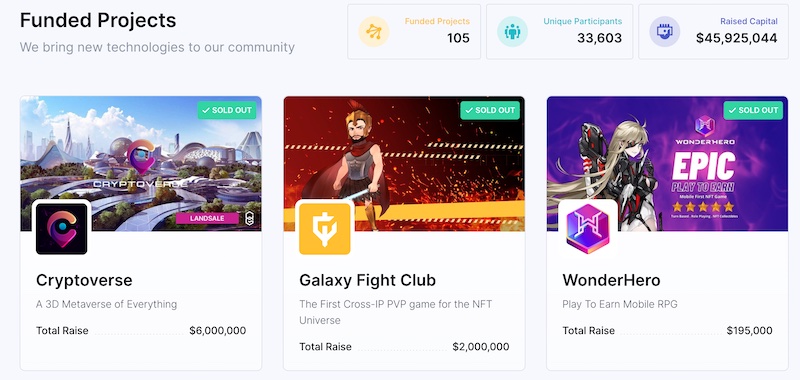

2022 ushered in a new crypto winter, and hopefully, it only turns out to be a mild cold front. But even with the market downturn, Polkastarter launched eight new projects and raised $7.5 million in three months. That figure brings their total capital raised to $46 million distributed across 105 projects.

Polkastarter’s future looks bright. Now is the time to make yours bright as well. Head over to Moralis Academy and learn how to become a blockchain developer today!