The short version of the story is that Olympus DAO is a decentralized reserve currency protocol that offers compounding interest through its treasury. DAO stands for decentralized autonomous organization, and the best part is the community calls the shots. In sum, Olympus DAO wants to be the financial reserve system for Web 3.0. So let’s see how the team plans on pulling this off.

Olympus DAO Explained – The Founders

It’s no secret that the global financial system is broken. Furthermore, the 2008 financial crisis primarily motivated Satoshi Nakamoto to create Bitcoin. The invention of cryptocurrency was the warning shot across the bow that international finance needed a change.

Authoritarian governments and supposedly democratic ones alike maintain strangleholds on centralized banks. Moreover, they help to drive irresponsible fiscal policies and regulations. It’s not surprising that their handling of the financial system has been an overall negative for everyday people worldwide.

That’s why the founder “Zeus” got the idea to build Olympus DAO. Zeus, along with a pseudo-anonymous team, is striving for a community-owned decentralized economy. It’s the best way to bring about transparency, stability, and financial inclusion.

The name “Olympus” comes from the mythological heavens ruled by deities depicted in the tales of Mount Olympus. Olympus DAO wants everyone with an internet connection to have the chance to own a decentralized reserve currency completely independent from state politics.

Now that you know more about the team and their reason for creating the protocol, let’s get Olympus DAO explained more thoroughly.

OHM – Not a Stablecoin

Stablecoins are an essential part of crypto. Further, their lack of volatility is like a rock in a stormy sea of other raging cryptocurrencies. Crypto users can take comfort transacting with stablecoins knowing their value will hold steady unless there’s some horrible Black Swan event that leaves no one unscathed.

However, if the stablecoin is pegged to the U.S. dollar, it will move with the dollar in both positive and negative directions. In other words, even though it’s stable, if the dollar depreciates, so will the stablecoin pegged to it.

So you can’t get Olympus DAO explained without first understanding that its native token is OHM. More importantly, OHM is not a stablecoin. Instead, the team designed it to become an algorithmic reserve currency with decentralized assets backing it.

If you’re still unsure about stablecoins, DAOs, and other topics, check out the Crypto For Beginners course at Moralis Academy. It’s the best place to start learning about cryptocurrencies.

More About OHM

The goal for Olympus DAO is to build a currency system where the DAO controls the OHM token’s behavior at a high level. The concept is similar to the gold standard. The OHM token provides free-floating value that its users can depend on due to the fractional treasury reserves from which OHM draws its value.

Hence OHM is a “backed” cryptocurrency, not a “pegged” one. It’s not pegged to the U.S. dollar. Instead, a basket of assets backs it. Furthermore, by focusing on supply rather than price, Olympus DAO believes OHM can hold its value even in the face of market volatility.

The way it works is the Olympus DAO treasury backs each OHM with at least one DAI. When OHM trades below one DAI, the treasury does a buyback and burns OHM until it pushes the price back to one DAI. However, there is no upper limit, so OHM is okay to trade above one DAI.

Think of it this way: If “== 1” represents “pegged,” then “>= 1” represents “backed.” So OHM’s floor price equals one DAI.

The Ukraine invasion has raised many questions. One of them is how the refugees can cope with their currency crashing and the Russians seizing everything, including their banks. News reports regularly show people fleeing their homeland, but they’re not talking enough about how cryptocurrencies are helping Ukrainians keep their savings intact. Learn more by reading our Ukraine & cryptocurrency article.

Olympus DAO’s Reserve Currency

OHM is the native currency, and a basket of assets backs it in the Olympus treasury. This secured treasury holds a line of intrinsic value that the token cannot drop below.

If you want to have Olympus DAO explained, you must know that the protocol wants OHM to be the decentralized reserve currency. Further, market participants want a reserve currency to be a stable form of value. For instance, the U.S. dollar’s stability depends on the federal reserve’s direction. On the other hand, autonomous market forces determine OHM’s stability. More importantly, tokens backed by a basket of decentralized assets will help preserve this stability.

A reserve currency should be tradeable with minimal price slippage and adequate liquidity to accommodate mega trades. OHM needs to be a tradeable everyday liquidity pair. Thus, the goal is to establish OHM as a reserve currency accepted across all present and future chains and to denominate all trading pairs.

We’ve been talking about DAOs in this article, but who creates them? If you want to know how to create a DAO? Please read our latest article on the topic.

Olympus DAO Core Innovations

The core team delivered two innovations right from the start:

1. pOHM

The team gets incentive rewards in pOHM to prioritize long-term growth. Olympus DAO cannot make private sales of OHM. If they pre-mined and sold OHM tokens, they would need to take an additional $1 per OHM sold to keep the token flush. Such actions would not be efficient.

So, by selling pOHM (a derivative OHM), the holder has the option to mint OHM by burning pOHM. For example, a trader could provide one DAI and one pOHM to mint one OHM. Thus, pOHM tokens are similar to options. One pOHM is worth the price of one OHM minus the intrinsic value. Hence it only makes sense for a trader to redeem the pOHM when OHM is above its intrinsic value.

Such actions keep incentives aligned. Also, pOHM is vested based on supply. Thus, as the collection of OHM grows, holders can redeem more pOHM. The team wants the pool to increase and for the price to go up.

2. Decentralization

The most critical element of Olympus DAO is the community, and these contributors exercise decentralized power. The move to decentralization started with the DAO managing the Olympus protocol. Hence, Olympus DAO’s organizational structure is not strictly hierarchical.

The Pillars of Olympus

Olympus bases its success on three pillars of support: Reserve, Liquidity, and Utility. More importantly, each Pillar supports the protocol with a dedicated team carrying out numerous initiatives.

1. Reserve Pillar

This Pillar establishes purchasing power. Therefore projects related to the Reserve Pillar will focus on maintaining OHM’s purchasing power.

2. Liquidity Pillar

To help foster universal acceptance in DeFi, the Liquidity Pillar will draw from campaigns to bootstrap OHM liquidity.

3. Utility Pillar

This Pillar encourages high usability. Utility refers to the funding of everyday tasks, and it will help drive the adoption of OHM in the Web 3.0 ecosystem.

These pillars will support making OHM a reserve currency that users can easily exchange for other goods and services.

Learn about DeFi at Moralis Academy! There is a wide range of courses from which to choose. But the Master DeFi in 2022 course is a great place to start.

Market Participation

To participate in Olympus DAO, users can engage in staking and bonding. Stakers can stake OHM to get more tokens. Likewise, those interested in bonding can exchange LP tokens for discounted OHM after a fixed vesting period.

DAOs are an essential part of the crypto ecosystem, but gaming is another exciting sector. If you’re interested in learning more, please read about the top gaming tokens on our Moralis blog.

Using Game Theory

To have Olympus DAO explained requires understanding some of the game theory dynamics at work. The simplest way to visualize the game theory model is to understand the three possible actions for players to undertake:

1. Stake

A player is most likely to stake if they foresee a price or supply expansion. Staking will push prices up. By incentivizing users to stake OHM, the token supply stays off-market. When the protocol mints new OHM tokens, the majority get distributed to the stakers. Thus, stakers gain by compounding their balances.

2. Sell

On the other hand, a player is most likely to sell if they predict a contraction in price or supply. Selling has the opposite effect of staking and will push the price down.

3. Bond

More players are likely to bond when they don’t anticipate any significant downward moves in price or supply. Bonders benefit from price consistency. They put capital upfront to receive a fixed return at a set future date. A bonder’s profit will depend on OHM’s price at the bond’s maturity. Thus, bonding is the process that grows treasury reserves.

The game strategies are cooperative. In other words, they create a positive-sum environment with any conflicting plays such as stake/sell and bond/sell resulting in neutral outcomes. The only negative-sum effect is a sell/sell scenario to disincentivize players.

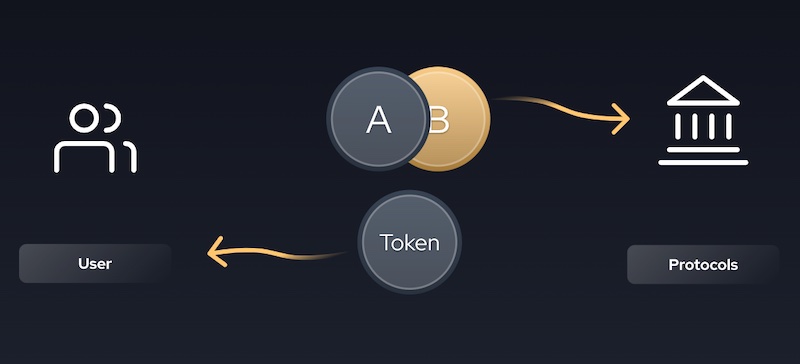

Protocol Owned Liquidity

Olympus DAO uses what’s called “protocol-owned liquidity” (POL). It has a protocol-managed treasury and, as mentioned, a bond mechanism and staking rewards to control supply expansion.

Bond sales generate profits for Olympus DAO, and the treasury takes these profits to mint OHM. Lastly, it distributes them to stakers. Regarding the protocol’s health, staking and bonding are beneficial while selling is detrimental. Furthermore, staking and selling cause a price move, but bonding does not.

Additionally, only the protocol can mint or burn OHM. This requirement guarantees that one DAI backs one OHM. So, the protocol will continually buy OHM when it falls below one and will continue until all sellers are exhausted if need be. Olympus DAO’s motto is “you can’t trust the FED, but you can trust the code.”

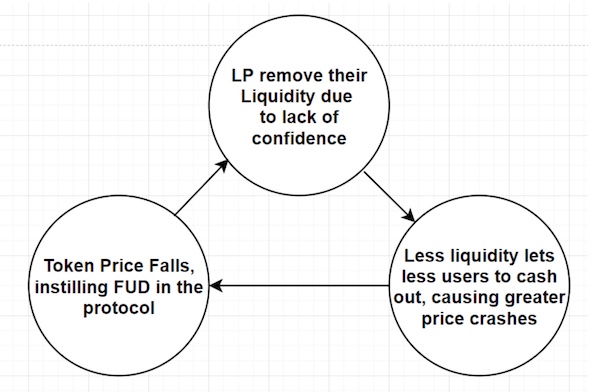

Liquidity Guarantees

To further get Olympus DAO explained, we must look at its liquidity guarantees. Thanks to its bond mechanism, Olympus DAO owns most of its liquidity. This feature means that the protocol does not have to incentivize liquidity by dishing out high rewards to mercenary yield farmers.

Olympus DAO guarantees enough liquidity to handle any sell or buy transaction. Because it is the most extensive liquidity provider, it keeps most of the liquidity provider fees as more income for its treasury. Thus POL can back the OHM token.

In traditional banking, the fractional reserve system works because depositors don’t come stampeding in all at once to withdraw their funds. Banking clients’ faith in the system rests on the shoulders of the FDIC with trust in their regulations. The OHM token is not FDIC insured, but its incentive structure protects stakers.

Olympus DAO Participation

The community governs Olympus DAO with members presiding on the forum and token holders snapshot voting. DAO members use governance tokens to vote on essential protocol topics like treasury functions and partnerships. Furthermore, the protocol is always looking for new contributors. So, to participate, users can join the Olympus Forum or the Discord channel.

Crypto prices are still slumping, but don’t worry. All you need to do is read our article on how to survive a bear market. There is loads of info there.

Olympus DAO Explained – Conclusion

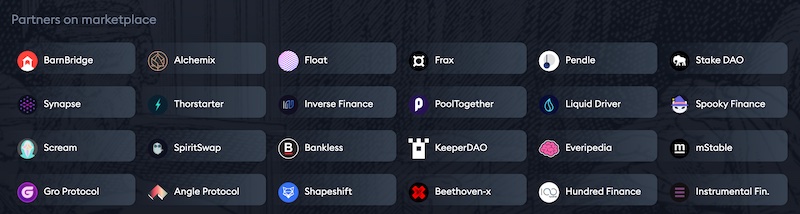

Olympus DAO is off to a good start in reaching its ambitious reserve currency goals. With a growing community in its first year in the DeFi space, it has onboarded more than 85,000 users, climbed from zero to 60 developers, has over 150 people building its protocol, and developed 50 partnerships.

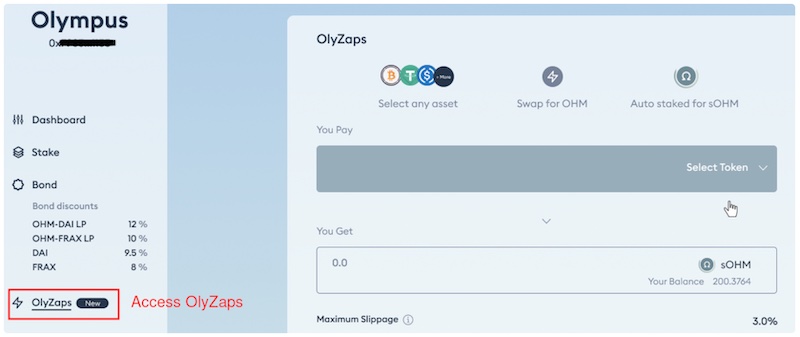

OlyZaps is the latest addition to the protocol that allows users to zap (exchange) cryptos into sOHM or a bond in a simple operation. This convenience is for users looking to take a position quickly. Learn more on the OlyZaps page.

Olympus DAO boasts a fun community embracing greater economic cooperation in Web 3.0. Further, it’s looking for like-minded individuals with aligned incentives who want to join its global network.

If this sounds like something you’re interested in, join the Olympus DAO Discord channel. If you want to get started on a career in crypto, join Moralis Academy. There you will find a complete list of blockchain classes anywhere. So, get started today!