This article will not only address the “how do NFT royalties work?” question. It will also examine how artists, musicians, and other content creators can finally benefit from their creations after the sale of an NFT (non-fungible token). If you need to learn more about NFTs before learning about their royalties, check out some of the NFT use cases on the Moralis blog.

How Do Royalties Work?

NFT royalties work similarly to traditional royalties. For example, a recording artist can have their contract stipulate that they get paid a royalty percentage of each album sold. Or they may get paid a royalty every time her song gets played on the radio. In both cases, the artist depends on the record company’s bookkeeping to accurately and honestly record each sale and her percentage.

So, with royalty payments, the recording artist gets paid for initially recording the song and future sales, likewise with NFT royalty payments. The artist makes money not only on the initial sale of their NFT but also on subsequent ones. Let’s examine this royalty feature further.

Do you find the blockchain confusing? Are you still asking, “what is crypto?“. If so, get the blockchain explained in our recent article. Or take the Crypto for Beginners course at Moralis Academy!

Some Royalties are Better Than No Royalties

In the music industry, the record company has always subjugated recording artists. If they are fortunate enough to get a royalty deal, the musician can only hope that the label honestly accounts for all of the album sales and radio airplay.

Likewise, art speculators and lucky buyers could flip their purchases for exorbitant profits if they picked the right undiscovered artist before they got famous. That’s how the system has worked until now.

The old system excludes artists from ever benefitting from subsequent sales. It must be painful for a starving artist to have sacrificed a painting for a hundred bucks to put food on the table only to see it go for millions of dollars in a Christie’s auction. NFTs have completely disrupted the old system. Artists can finally get their fair share of perpetual sales.

Investing in NFTs and crypto is a risky business! Thus, learn how to invest in crypto in our academy!

How Do NFT Royalties Work for the Artist?

In short, NFT royalties give the artist proceeds of the sale price each time their NFT resells on a marketplace. But, there are differences. So, how do NFT royalties work as opposed to traditional royalties?

First, NFT royalty payments get executed by smart contracts automatically. No third-party intermediary needs to be trusted to pay the royalty fee. When the artist creates an NFT, most marketplaces offer the choice to determine a royalty percentage during the minting process. Typically, it ranges up to 10%. But the creator can choose whatever rate they want.

Second, a smart contract is not a paper contract. It is executable code triggered by an event. In this context, it would be the buying or selling of an NFT. Furthermore, regarding royalties, the resale event on a particular NFT marketplace would trigger the transfer of a portion of the proceeds back to the artist automatically. There’s no need for the artist to haggle or keep a watchful eye over their agents, lawyers, or collectors who resell their creations. The smart contract automatically deducts the royalty fee right when the NFT resells because it’s hardcoded into the smart contract.

However, NFTs don’t automatically yield royalties unless the owner explicitly codes it into the smart contract terms. The process is not complex on marketplaces that offer the feature. It’s usually just checking a box and typing in the percentage amount. The smart contract takes care of the rest automatically.

How Do NFT Royalties Work to Maximize Earnings?

Traditionally, the payday for the artist ends after the initial sale. For example, the painter gets paid for his artwork. But the new owner could resell it for a profit as soon as it leaves the gallery. Likewise, subsequent buyers could continue to resell the artwork without the original artist ever seeing a penny of it.

This scenario can be problematic for artists who later became famous. The painter Jean-Michel Basquiat, for instance, was selling his paintings for hundreds of dollars to celebrities such as Madonna and Debbie Harry (of Blondie) in his early years. Later, his paintings would fetch millions of dollars.

Basquiat died young, but earning royalties off subsequent resells could be a massive bonus for artists who enjoy success during their lifetime. Particularly for those who grow in popularity. NFT royalties can accomplish this by charging fees on perpetual sales. So, whatever kind of NFT an artist creates, they can assign royalties to it and get paid recurring royalties from future sales.

Various Royalty Systems

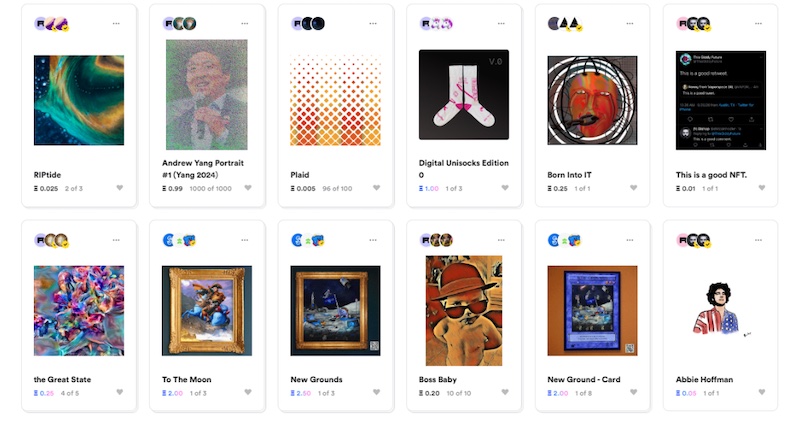

Royalty systems can vary depending on the NFT marketplace. Platforms such as Rarible offer the royalty option, but others don’t. Nonetheless, newer marketplaces will continue to innovate the royalty system with alternate ways to benefit content creators.

NFTs and decentralized finance (DeFi) are becoming more intertwined. If you want DeFi explained, check out one of our recent blog articles. Or, enroll at Moralis Academy and take the Master DeFi in 2022 course to boost your knowledge further.

NFT Marketplaces

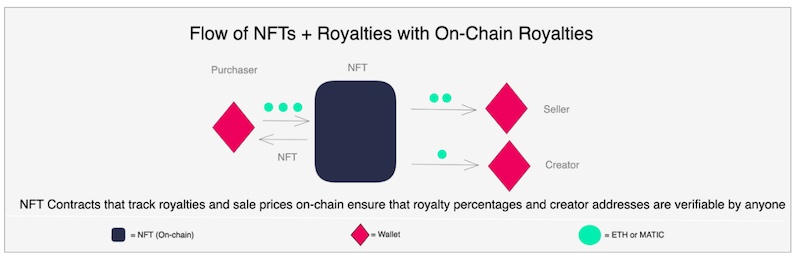

So, how do NFT royalties work at the marketplace level? The process is quite simple. A creator can allot a percentage of secondary sales as royalty when minting the NFT. After minting, the artist/creator will earn a portion of all future sales based on their fixed rate.

For example, let’s say you created an NFT on Rarible, a piece of digital art. Soon after, a buyer purchases your NFT art for 1 ETH. As such, you earned 1 ETH for the sale minus the marketplace fees.

NFT Royalties in Action

However, your earning potential in the above example is not over after the initial sale. You were savvy enough to code a 10% royalty into your NFT. So the smart contract sends you 10% of future sales.

Let’s say the artwork gets more popular, and the first buyer (#1) gets an offer from another buyer for 5 ETH. In this case, buyer #1 would profit 4 ETH in the transaction.

But because you added a 10% royalty as a condition for future sales, you’ll receive 0.5 ETH (5 ETH x 0.1 = 0.5). Not bad! You just earned 0.5 ETH for doing nothing. That’s passive income for you, and the buyer still profits 3.5 ETH from the resale.

Hopefully, your fame as an artist grows, and subsequent reselling efforts continue to capture more ETH. Since you coded royalties into your NFT, you stand to gain from every future sale. As long as your art keeps selling, you’re golden.

Who Benefits from NFT Royalties?

Musicians, content creators, and artists benefit from NFT royalties, but buyers also do. That’s because they won’t have to worry about counterfeits flooding the market and ruining the value. Even if fakes surface, NFTs make it easier to identify the original.

Thanks to blockchain technology and its unalterable ledger system, NFTs preserve the authenticity of the original artwork. The combination of blockchain technology and smart contracts identifies the original author.

Thus, the buyer can verify an NFT’s authenticity, and the creator benefits from automatic smart contract payments that remove the chance for intermediaries such as a record company or art gallery from hiding or withholding royalties. It’s a win-win for both parties.

Why Use NFT Royalties?

The benefits already mentioned are that NFT royalties are a quick and easy way for creators to continue earning beyond the initial sale. But another use case of NFT royalties is that the artist can retain the copyright while selling a percentage to others. Not all NFT marketplaces offer this feature, but it is likely to catch on.

Customizing NFT Royalties

So the artist writes the royalty into the smart contract. But just how customizable are they? Can an artist write in a 20-year end date? Or must it always last for the life of the artist? How about hardcoding a royalty that will continue perpetually to pay surviving heirs? The only limits to customization are the owner’s creativity and the particular technology of the blockchain in use.

The way to go is to create the most palatable construct that is friendly to the creator’s market. The idea of perpetual royalties may be attractive to some, while others prefer finite limits. Whether it lasts one year or continues endlessly, these dates will become more customizable as marketplaces adopt new features.

Such options will remain platform-dependent as the ecosystem evolves. We’re more likely to see that different types of NFTs will have additional terms attached, whether digital art or physical items such as paintings, antique automobiles, rare whiskey, or concert tickets linked to the NFT.

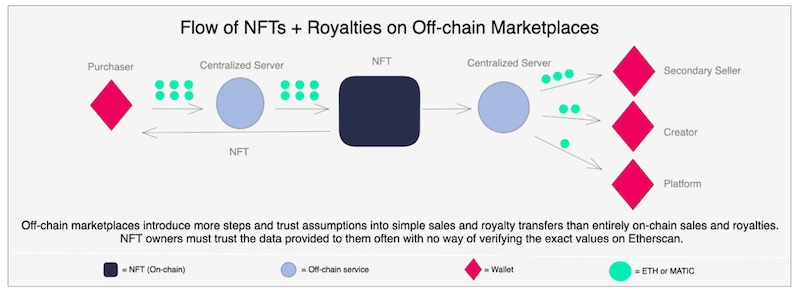

Selling NFTs Off-Chain

One question that arises is, how do NFT royalties work when a buyer resells the NFT outside of the original platform? It depends on the platform’s terms. Users need to beware of what they agree to on these NFT marketplaces. More importantly, if a buyer obtains an NFT with a royalty attached, they can nullify it by selling through an off-chain marketplace. This problem needs addressing.

As you’ve noticed, this article is about NFTs. If you’d like to read an article about the original cryptocurrency, read our “What is Bitcoin?” article!

NFT Royalties and the Law

Other potential areas of concern include intellectual property rights cases and tax consequences from royalties. So, how do NFT royalties work in a legal context? The answer is that the waters are still murky. Typically, governments consider NFT royalties as capital gains.

In other legal realms, NFT royalties will likely become estate assets, and, therefore, traditional instruments such as wills and trusts will administer any transfer of said assets.

Further, there isn’t a definite concept of perpetual royalty in US property law. Once a person buys an item, they own it. The exception would be in fine art. If a person buys a painting, they own 100% and can resell it for 100% of the profits. Similar to the way people flip real estate or automobiles. However, the user is not allowed to take a painting and start printing digital copies of the image for resale. The artist still retains the copyright to sell digital prints of the original work.

The underlying asset might be natively digital or purely physical. Therefore, the underlying asset made into an NFT may have a separate existence in legal terms with property rights while existing as a digital representation on a blockchain. Even with smart contracts executing on a blockchain, users are still obligated to actual real-world contracts in agreements amongst parties.

The lesson for NFT investors is they need to read the fine print listing the terms of service before buying. Likewise, a creator needs to understand the platform’s terms of service to understand what rights, banknotes, etc., they’re giving away.

NFT Royalties and Regulations

We’re seeing fungible tokens becoming more subject to regulation, which is also likely to happen to non-fungible tokens.

There are regulatory potentialities to consider in the future, such as securities law and anti-money laundering measures. Unlike fungible tokens, NFTs can be collectibles, and there is a long tradition of collectibles remaining safely outside the “security” space. In other words, collectibles are generally not considered securities such as stocks or bonds.

Another consideration is many regulations don’t apply to tokens but instead to the players in the ecosystem. A caveat to this scenario is the construct of the supporting platform. Is it considered to be a security in and of itself?

Regulators are looking at the movement of tokens, particularly those with a high dollar value. When traders use artwork as an underlying asset, these NFT tokens might raise the eyebrows of state officials looking for money launderers. One should consider state and federal laws and take an ecosystem approach when considering how regulations could affect NFT royalty earnings.

NFT Royalties Explained – Conclusion

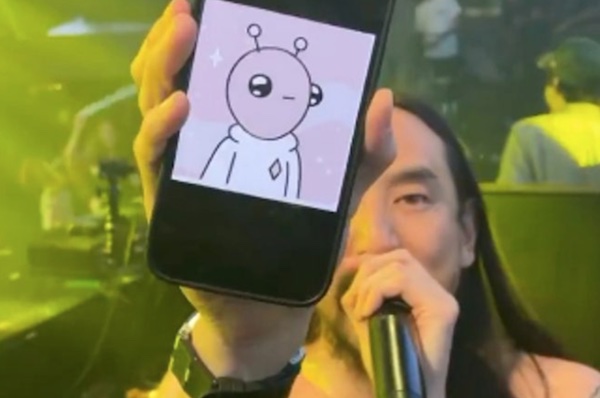

NFT royalties benefit famous artists such as Kings of Leon and Steve Aoki. They are seizing on this new technological feature. But everyday artists and creators can also profit from future sales of their work.

The antiquated practice of record companies, big businesses, and speculators having all the fun making millions off the work of starving artists is thankfully coming to a close.

How about you? Are you ready to start profiting off blockchain technology? The good news is you don’t have to be a talented NFT artist to do so. Check out the full course load at Moralis Academy and learn how to become a blockchain developer today!