To begin with, we’ll start by exploring Pendle Finance. In doing so, we’ll give you an overview of the ecosystem, which is a critical part of determining the value of the PENDLE token. From there, we’ll explore the token and its on-chain metrics using Moralis Money. To top things off, we’ll dive deeper into Moralis Money and show you how to effortlessly find the next PENDLE token.

With the power of Moralis Money, you can quickly generate a dynamic list of altcoin gems in a couple of clicks. As a teaser, check out the GIF below, where we apply a single premade filter to find hot new low-market cap coins with increasing buy pressure:

What is Pendle Finance?

Pendle Finance is a permissionless decentralized finance (DeFi) protocol allowing users to execute various sophisticated yield-management strategies. The protocol facilitates tokenizing and trading future yield through an automated market maker (AMM) system. Launched on the Ethereum network – and other EVM-compatible chains – the Pendle Finance protocol provides a platform where users can maximize their profits, independent of current market conditions.

Pendle Finance deployed on the Ethereum mainnet in 2021 and went live as one of the first yield tokenization protocols on the network. Since then, it has quickly risen and become a fast-growing project in the DeFi space. Moreover, the framework supports other prominent DeFi platforms, including Aave and Compound.

The primary goal of Pendle Finance is to provide an ecosystem where crypto traders holding yield-bearing assets can boost profits and lock in potential gains upfront. Furthermore, the protocol aims to provide traders with immediate exposure to future yield streams without the need for underlying collateral. To achieve this, Pendle Finance features three critical components:

- Yield Tokenization: The Pendle Finance protocol wraps yield-generating assets into SY (standardized yield tokens). These are wrapped versions of the underlying assets compatible with the Pendle AMM. Then, they are divided into yield and principal components: YT (yield token) and PT (principal token).

- Pendle AMM: Both YT and PT can be traded through the Pendle Finance AMM.

- Vote-Escrowed PENDLE (vePENDLE): This is the staked version of the PENDLE token and is the protocol’s governance token.

How Does the Pendle Finance Protocol Work?

Owners of yield-generating assets can deposit their tokens into the Pendle Finance protocol. In doing so, the protocol wraps these assets into SY (standardized yield tokens), which follow a standard designed to facilitate interactions with assets’ yield-generating mechanisms. The SY comprises the YT (yield token) and PT (principle token) components. Consequently, anyone depositing yield-bearing tokens can mint both a YT and PT.

From there, holders can use the YT in a variety of ways. For example, they can deposit the YT into the Pendle Finance AMM to provide the protocol with liquidity. In return, they gain swap fees and other incentives.

Furthermore, the protocol allows owners to sell their YT for money upfront, enabling them to set interest rates and realize profits instantly. What’s more, users can buy yield tokens directly without having to own a yield-generating asset.

Through these yield tokens – that represent the owner’s right to claim yield – Pendle Finance facilities an effective yield market where traders can gain exposure to future yield. They can boost their yield exposure in bullish markets and hedge against yield risks during bearish conditions. However, note that the YT can only be swapped until its expiry, when it no longer has any value.

When a YT reaches so-called maturity, it ceases to generate yield. When this happens, the YT owner can redeem the principal token for the underlying assets or roll over to a new expiry. However, the YT owner must also hold the PT to carry out these actions.

What is the PENDLE Token?

The PENDLE token was minted on the 27th of April 2021, and it’s an ERC-20 token deployed on the Ethereum network. Since the beginning of 2023, the PENDLE token experienced an impressive 2,700% price rally during a six-month period. Consequently, now is a better time than ever to delve a bit deeper into the PENDLE token.

The PENDLE token is essential for the Pendle Finance protocol’s value-generating mechanism. What’s more, $PENDLE doubles as the governance token when it’s staked and locked into vePENDLE. This token is responsible for helping to further decentralize and stabilize the ecosystem.

The value of vePENDLE – and the provided governance right – depends on the amount of staked PENDLE and the duration of the lock-in period. Moreover, the token decays over time, going to zero at the end of the lock-in period. From there, users can unlock their staked PENDLE.

The Pendle Finance protocol claims a 3% fee from all yield acquired by YT. And this fee is distributed to vePENDLE holders. Furthermore, a percentage of yield from matured unredeemed PTs is also distributed to token holders.

Nevertheless, with an overview of the token, you might now ask yourself: will the PENDLE token continue its upwards trajectory?

Answering this question is easier said than done. However, we’ll point you in the right direction in the next section as we look closer at the PENDLE token’s on-chain analytics!

On-Chain Analysis – Exploring the PENDLE Token with Moralis Money

The PENDLE token plays an essential role in the Pendle Finance ecosystem. As such, this altcoin derives its value from the utility it provides. So, if the ecosystem grows, it might reflect positively on the token price. Consequently, one way of making PENDLE price predictions can be to follow the development of Pendle Finance closely.

However, another prominent way of trying to understand whether or not the PENDLE token will continue to grow is through on-chain analysis. With on-chain analysis, you can base your crypto predictions on irrefutable blockchain data in real-time. Unfortunately, acquiring this data can be challenging unless you leverage blockchain analytics tools like Moralis Money!

Moralis Money is the premier blockchain trading indicator. It leverages on-chain data in real-time to give you true market alpha. As such, with Moralis Money, it has never been easier to make accurate crypto price predictions.

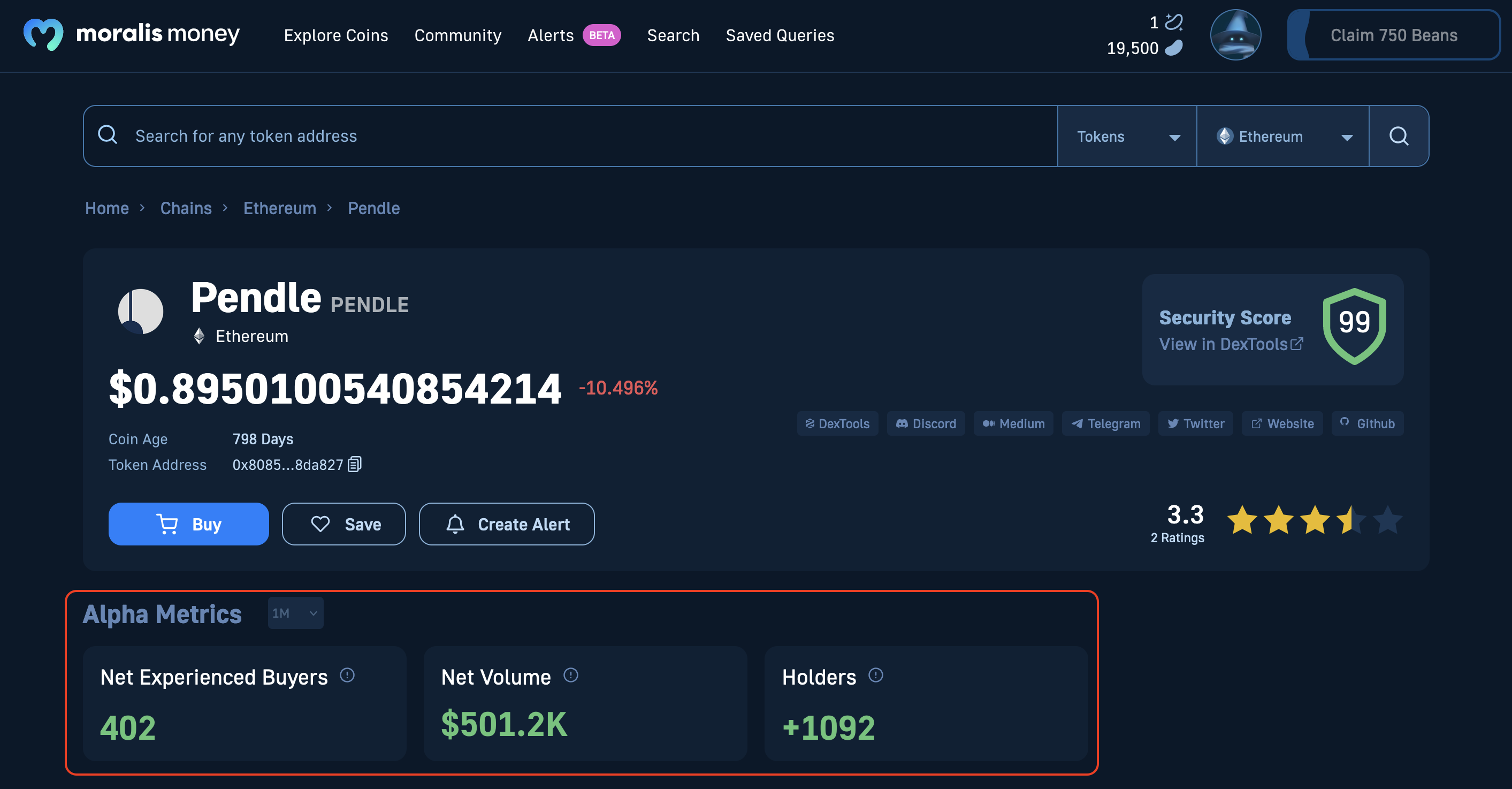

One of the central features of Moralis Money is the token pages. Each coin has its own dedicated token page displaying alpha metrics like price changes over time, the current number of holders, liquidity, etc. You can also find price charts, a bubble map, security info, and more on each page.

Here’s what it looks like for the PENDLE token:

In the interactive widget above, you can see the current price of the PENDLE token, and if you scroll down, you’ll also find a few alpha metrics. This includes changes in experienced net buyers, net volume, holders, etc., over time. With this information, you can easily determine the current market sentiment toward the token.

Studying this data in real-time is a much more reliable way of making price predictions than trusting static lists of token recommendations since PENDLE might be a good investment today but not as attractive tomorrow as sentiment changes.

Beyond Pendle Finance – How to Find the Next PENDLE Token Using Moralis Money

In addition to the token pages, you can also leverage Moralis Money to easily find the most undervalued crypto with the Token Explorer feature. To illustrate the accessibility and power of Moralis Money, we’ll show you how to find tokens with similar on-chain metrics to PENDLE.

As such, let’s start by looking closer at the PENDLE token’s on-chain data:

By studying this data, we can see that PENDLE – at the time of writing – has increased in both experienced net buyers and holders over the past month. What’s more, we also know that PENDLE has a current market cap of just above $80 million.

So, let’s take these three factors and create a unique search query in three straightforward steps:

- Step 1: Let’s start by adding the Market Cap filter to generate a list of coins that have a market cap greater than $50 million:

- Step 2: Next, let’s also add the Experienced Net Buyers and Holders metrics to filter for coins with growing buy pressure:

- Step 3: Add any other filters to make your query even more targeted and unique. For example, add the Coin Age metric if you’re looking for new coins. Or include the Liquidity filter if you want coins that have seen a positive influx of liquidity over a given time period.

That’s it; generating a dynamic list of potential altcoin gems is easy when working with Moralis Money. From here, check out each coin’s token page and continue doing your own research to determine whether the tokens will see price developments similar to that of PENDLE.

If you like what you have seen so far, join us as we explore Moralis Money further!

Moralis Money Overview – What is Moralis Money

Moralis Money is the industry’s #1 on-chain crypto screener. This tool leverages blockchain data in real-time, making it easy to find new crypto projects quickly. Moreover, Moralis Money supports multiple networks, including Ethereum, BNB Chain, Polygon, and others. Consequently, with Moralis Money, you can find the next 1000x crypto and 100x meme coin across several networks to maximize your altcoin gains!

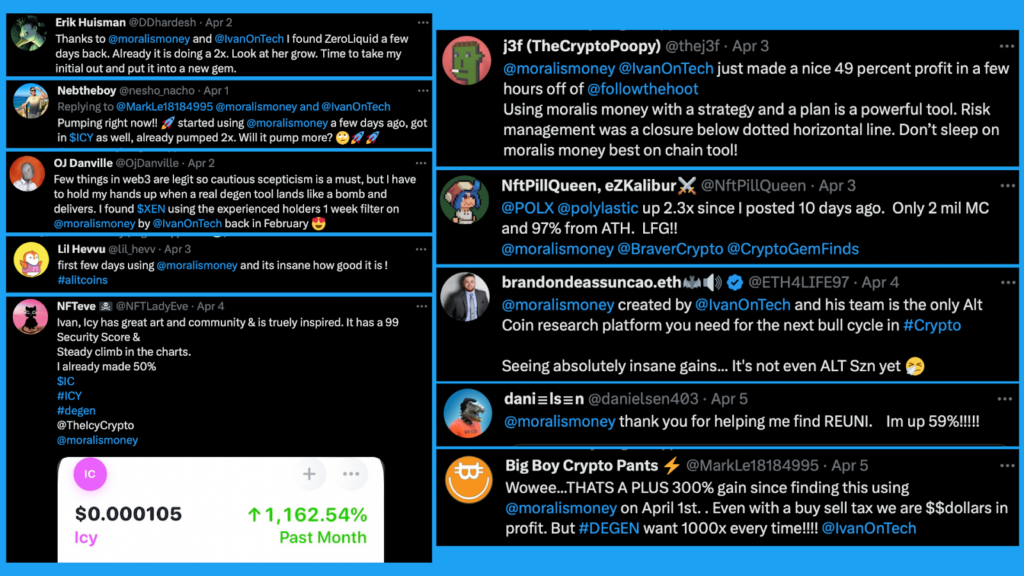

Just check out some happy Moralis Money users already making serious crypto gains:

So, how is this possible?

To answer this question, let’s explore some of the main benefits of Moralis Money!

Moralis Money Benefits

Moralis Money is equipped with three core features, all designed to help you make money in crypto:

- Token Explorer: Token Explorer features 15+ unique filters you can leverage to create search queries. In doing so, you can target specific tokens you’re after and find coins before everyone else. As such, you never have to FOMO into an opportunity again.

For instance, by adding the Coin Age and Experienced Buyers metrics, you can find freshly minted coins with growing buy pressure:

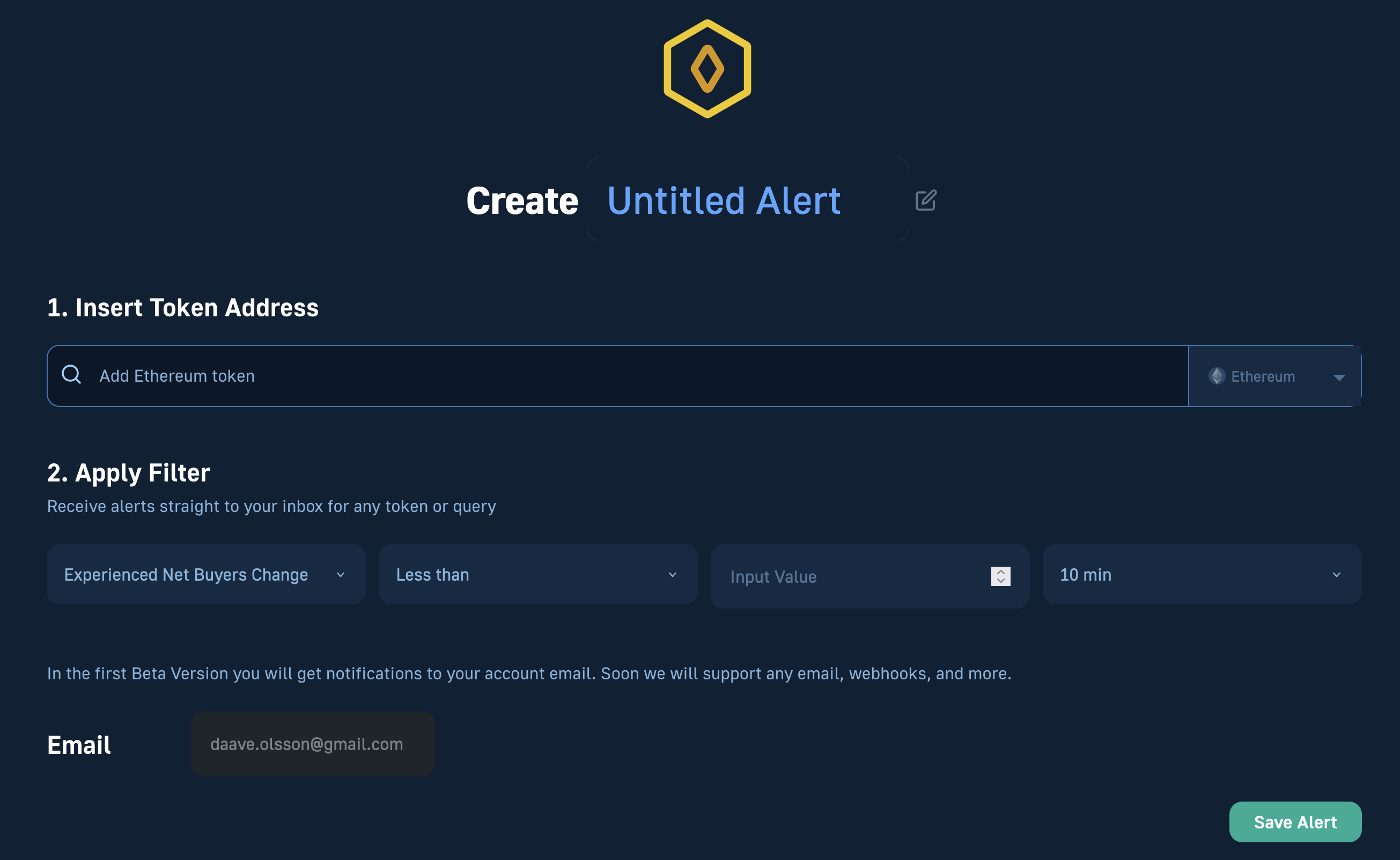

- Token Alerts: With Token Alerts, you can set up email notifications based on unique filters. By setting up an alert, you’ll get notified whenever something of interest happens on-chain. This means you can effectively trade and find new opportunities even when you aren’t in front of your screen.

Head on to the ”Alerts” tab, add a token contract, apply a filter, input your email, and start monitoring:

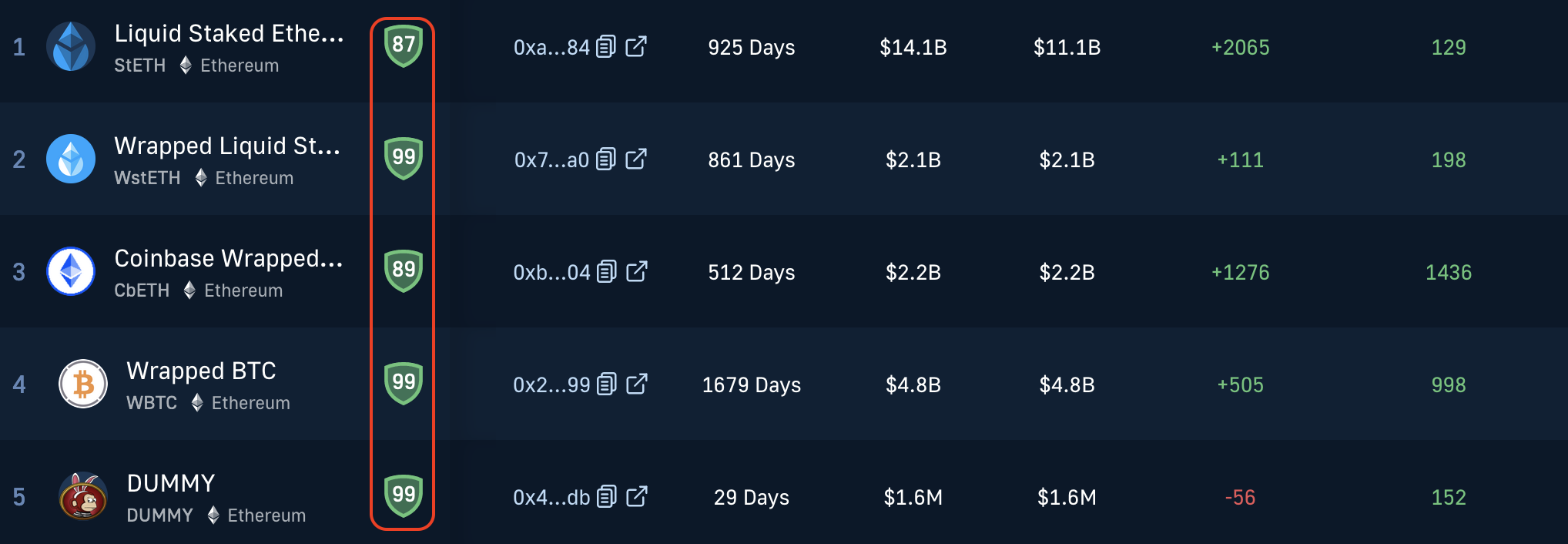

- Token Shield: The Token Shield feature provides a security evaluation for each coin. As such, thanks to Token Shield, you can effortlessly dodge scams like rug pulls. Simply look for the shield symbol attached to each coin to find its DEXT score:

So, by effectively leveraging Moralis Money and the features above, you can easily overcome trading challenges such as FOMO, time constraints, and scams!

Trade Like a Professional with the Moralis Money Pro Plan

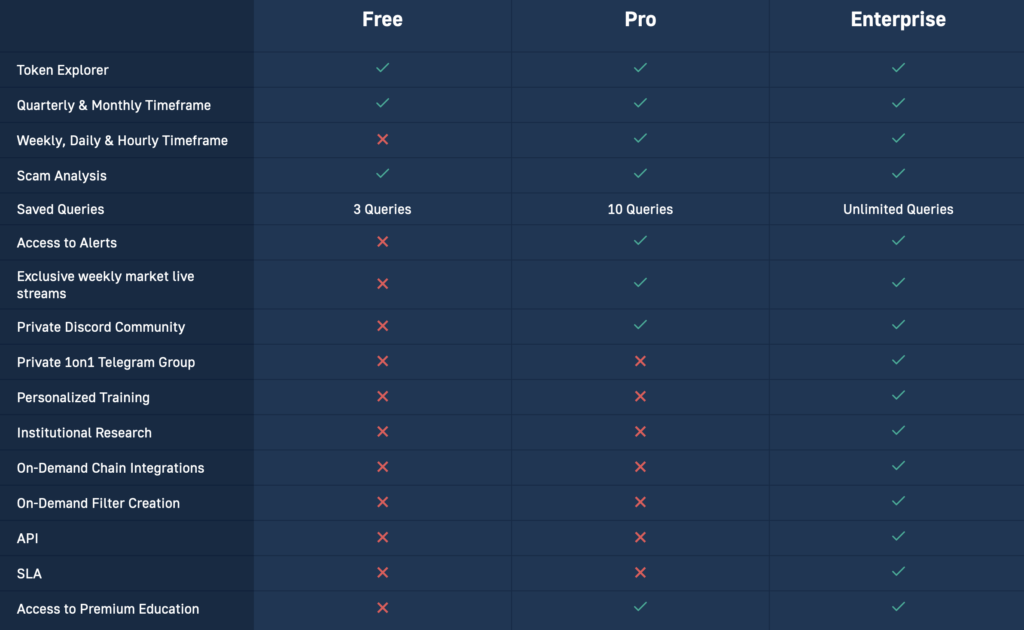

If you’d like to take your trading game to the next level and maximize your gains, consider subscribing to the Moralis Money Pro plan. As a Pro plan user, you get access to narrower timeframes for all search metrics, can save up to ten queries, set up five alerts, and much more:

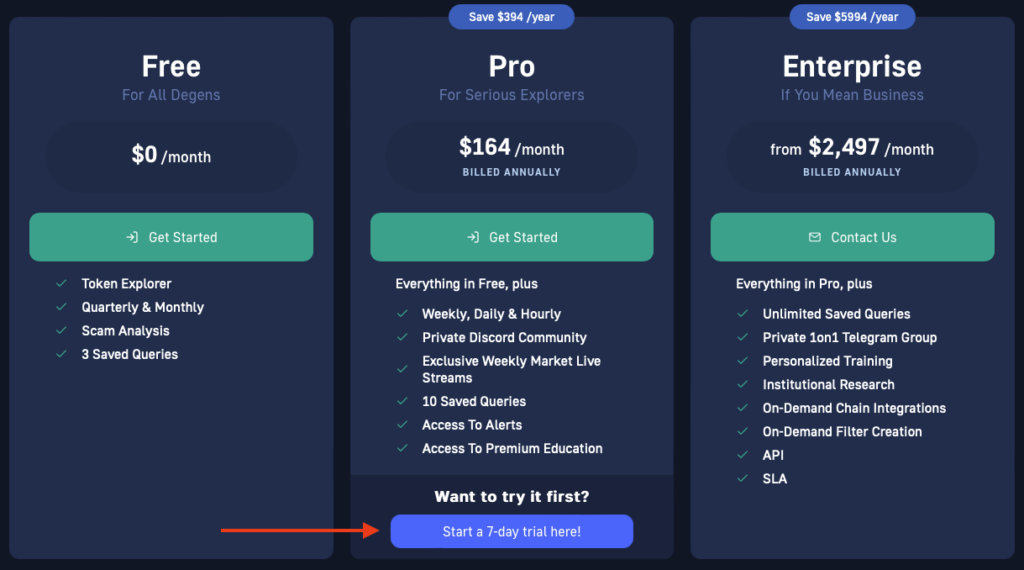

If this sounds exciting, sign up for our Moralis Money seven-day Pro plan trial and test it yourself. To do so, go to the pricing page and hit the ”Start a 7-day trial here!” button:

Also, if you’re eager to get going, you can try out Moralis Money for free using the interactive widget down below. Add one of the present filters or create a custom query from scratch by combining the metrics you’re interested in:

Summary – Exploring Pendle Finance and the PENDLE Token

Today’s article explored Pendle Finance, which is a DeFi protocol allowing users to implement and execute yield-management strategies. Through the protocol, users can tokenize and trade future yields via its AMM. What’s more, the protocol also features a native currency: the PENDLE token. The PENDLE token has experienced an impressive 2,700% price rally in just six months since the beginning of 2023.

In addition to exploring Pendle Finance, we also dove deeper into the PENDLE token’s on-chain metrics using Moralis Money – the crypto industry’s premier on-chain trading indicator! Also, remember that you can maximize the value of these features by signing up with the Moralis Money Pro plan!