Novel technologies can bring a lot of questions and uncertainty for new users, particularly when it comes to financing and personal investments. If you’re one of the people who want to know for certain whether or not Bitcoin and cryptocurrency can be hacked before investing your hard-earn fiat currency into the futuristic digital money that is crypto, read on!

Another popular question asked by many is “will cryptocurrency last forever?” Historically, many fiat currencies have sooner or later gone to zero, so what is it that makes crypto so special and different from other currencies?

In this article, we will cover all of the above. To completely understand the answers to these questions, you need to get your head around what exactly cryptocurrency is, and how it works.

Cryptocurrency Basics

To get started with cryptocurrency you will need a digital wallet to store your funds. A wallet can be online (hot/soft wallet) or it can be a hardware device that stores your funds safely offline (cold/hard wallet).

A wallet has 4 functions:

- Store private keys (allows you to send/receive transactions)

- Create and sign transactions

- Broadcast transactions to nodes (computers on the blockchain network)

- Read the blockchain to confirm your available funds

Wallets do not store coins.

Cryptocurrencies are in fact pieces of code called UTXOs. This stands for Unspent Transaction Outputs.

To understand how UTXOs work, it’s best to explain the process of how a wallet constructs a transaction, for example, if your friend wants to send you some Bitcoin.

With every transaction, there is an input and an output. The input is the address where the BTC is coming from (your friend), the output is where the BTC is going to (you).

When you receive the transaction from your friend you can then use this output (BTC) in another transaction later down the line should you wish.

Alternatively, you may choose to hold (hodl) your Bitcoin, in which case these transaction outputs remain unspent.

Bitcoin and other cryptocurrencies are unspent transaction outputs from previous transactions on the blockchain. People do not own coins, they own UTXOs stored on a decentralized ledger.

Blockchain Technology Basics

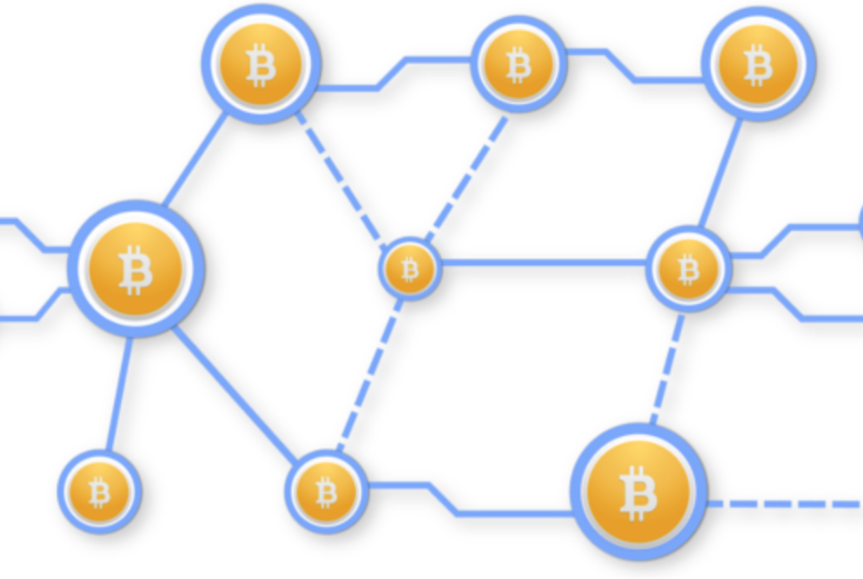

Blockchains are decentralized, distributed ledgers that have no one central point of authority or single-point-of-failure. They are powered by large computer networks across the globe, that must all agree on the validity of a transaction before confirmation of it being added to the blockchain.

A blockchain network verifies, tracks and stores all previous transactional data publicly for anyone to see. This provides a secure and transparent accounting solution, with information being immutable, meaning once confirmed, the data can not be erased or adjusted.

Information on the blockchain is cryptographically hashed with public and private keys. This means that your data information is unreadable without the private key, and you can control with whom you share your data.

PoW And Mining

PoW stands for proof of work, which means in summary, that the network of computers must put in significant computational power in order to validate transactions and mine new Bitcoin.

Transactions are verified mathematically by computers called nodes. These nodes must all reach consensus across the network that the transactions are valid i.e. there are sufficient funds to go to a valid address before a transaction is added to a block. Each node has access to the full copy of the blockchain.

Once a block of transactions is full it will then be appended to the blockchain, with infinite historical transactional data securely stored and accessible. Further transactions will then be placed into a new block and the process repeats.

Miners are the operators of supercomputers that mine fresh Bitcoin by solving immensely complex mathematical equations. Miners are financially incentivized to follow Bitcoin’s protocols and rules.

Miners must first spend energy on computers to mine to transactions and blocks. Only once the block is complete, validated, and appended to the blockchain, does the miner receive their reward.

Can Cryptocurrency Be Hacked?

Bitcoin itself has never been hacked due to the strength of the defense of the blockchain technology powering it. Historically, it is not cryptocurrencies that have been hacked (with one or two exceptions explained below) rather, the exchanges or wallets that have fallen victim to a security breach, resulting in cryptocurrencies being stolen/locked away in a smart contract with no command to release the funds.

Theoretically speaking, the Bitcoin blockchain could potentially be hacked – theoretically.

Bitcoin is reported to have nearly 100,000 nodes in its network.

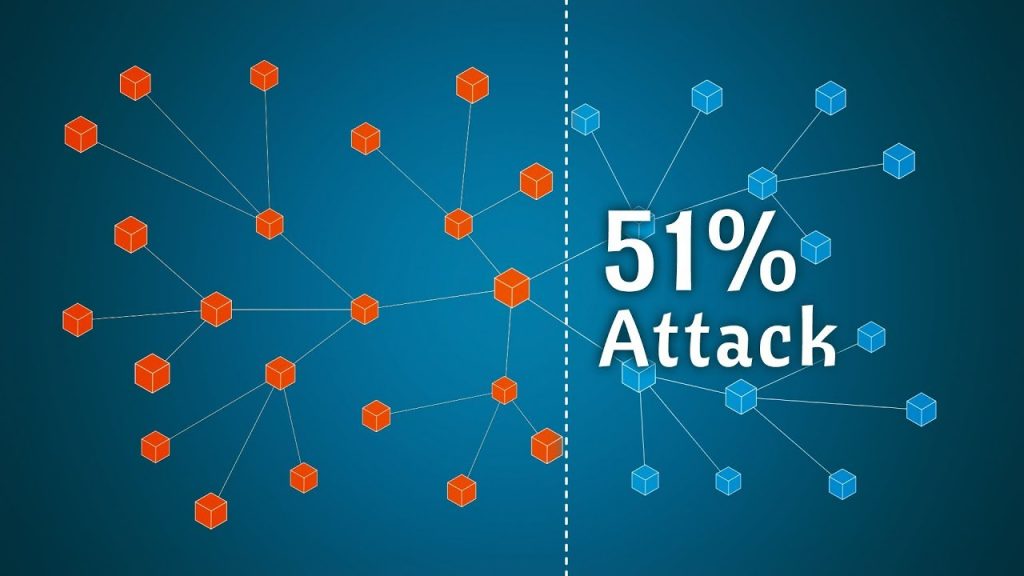

A hacker would need to take control of 51% of the hash rate in the network, which is approximately over 40,000 devices, all at the same time, to pose a threat and take majority control over the blockchain.

To do so would take longer than a human lifetime to achieve. Also, information on the blockchain is immutable, meaning it can not be erased or altered. If someone did manage to hack into the blockchain it would show a history of every action and transaction made.

51% Attacks

The cost of the process of hacking into the Bitcoin blockchain would be astronomical, it is far more profitable to follow the protocols as a miner. This is how the mining incentive is fool-proof. Miners’ rewards in Bitcoin and transaction fees will always be more profitable than a greedy attempt to manipulate the blockchain for their own personal gain.

Although there aren’t currently any supercomputers powerful enough to be a risk to the Bitcoin blockchain’s cryptography and immutability, this remains a questionable concern for some. Future technological advances are being considered by developers working on the blockchain as a community, to help grow and maintain the strength and security of Bitcoin.

Not every cryptocurrency on the market has a network as large as Bitcoin. (In fact, none even come close!)

Soon after Etherum was first released, the network suffered two 51% attacks within a week in 2016 which resulted in 800,000 ETC (approx $5.6million at the time) being double-spent.

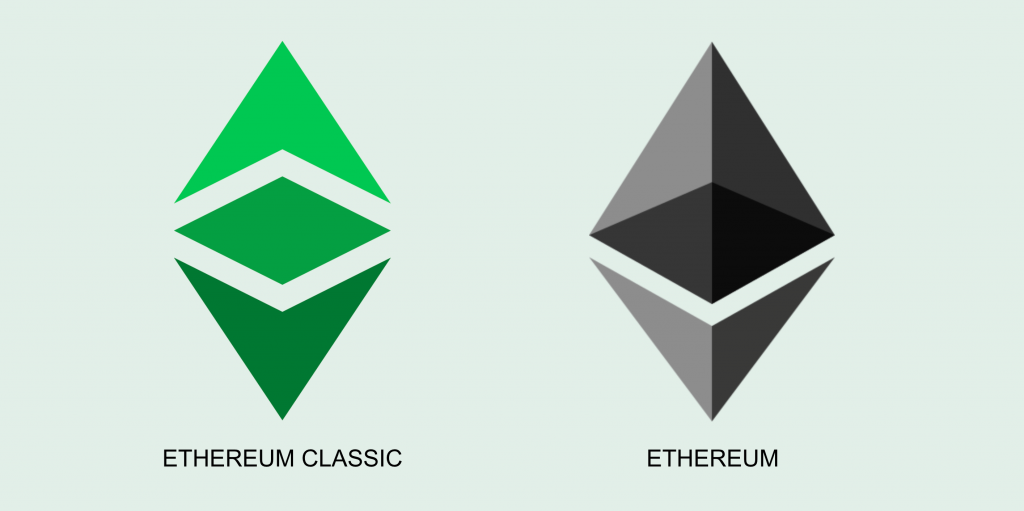

ETC vs ETH

The Ethereum Classic network community couldn’t reach a united decision as to how to resolve the issue; some believed that the blockchain should continue unaltered from the attack in line with the ethos behind blockchain, and implement updated protocols to try and prevent an attack from happening again.

Some believed that the history of the blockchain should be altered, so users who lost their ETC tokens would have them reinstated. New protocols were then implemented to prevent future attacks.

The Ethereum network split or forked on July 20th, 2016 when Ethereum Classic (ETC) continued the blockchain with the history of the attack, and a new, altered chain with no evidence of the attack, was branded Ethereum with a new ticker, ETH.

Etherum (ETH) is now the world’s second-largest cryptocurrency with a $43billion market cap, millions of users, and thousands of decentralized applications built on top of the protocol.

Ethereum Classic (ETC) however has suffered another round of 51% attacks in recent weeks. The main reason for Ethereum Classic being more vulnerable than ETH is due to the much smaller network of nodes, meaning it is more likely that a hacker could take over the majority of the network hash power.

The Bitcoin Cash (BCH) mining network fell prone to 51% attacks in May last year when 2 miners were in control of 43% of the Bitcoin Cash mining pool. These 2 miners were able to work together to prevent rogue miners from intercepting coins and transactions fees.

Proof of Work mining is being used less and less now as the introduction of Proof of Stake provides an added layer of security to the blockchain, making it astronomically harder for hackers to gain majority control of a network, but that’s an article for another day!

Fiat Currency History

Fiat currency is government-issued printed paper money that does not have intrinsic value, however, it is used by everyday people for everyday transactions and investments because they believe it has value because the government says so.

The definition of the currency is from the Latin word fiat, meaning “let it be done”.

Fiat currency was originally bank-issued receipts for gold in the late 17th century, however as the government has unlimited wants with only limited resources and gold, they started printing more receipts even though there was no gold to back its’ value.

In the 11th century, a bank in China began to issue paper money as opposed to the iron coins that were previously being used as currency, following a shortage of copper.

The Chinese referred to this as “flying money” – because of the way it could fly from one hand to another.

Initially, the paper money was exchangeable for gold, silver, or silk. Eventually, inflation began to take hold, as China started to fund the war with the Mongols, which it eventually lost. This set the precedent for all future fiat currencies.

Fast forward to 1971, when the world caught on that the United States of America had been printing more banknotes than there was gold available to back it, countries started asking for their gold back from the USA. Unable to keep up with these demands, President Nixon un-pegged the US Dollar from gold “temporarily”, though we have never gone back.

The US unpegged the dollar from the gold standard in the 1970s

A financial system of international fiat currencies, however, was pegged to the US Dollar and still is to this day. In 2020 so far, the US government has printed more money this year – than in the last 200 years combined.

The US Dollar has lost 92% of its purchasing power since 1913 as of 2019, who knows what this number will be for this year or next.

Will Cryptocurrency Last Forever?

Throughout history every currency that has ever come into circulation has been eventually devalued to 0, so will cryptocurrency last forever? If Bitcoin is being viewed as ‘digital gold’ for the similar properties that the crypto shares with the precious metal, some wonder, how long will Bitcoin exist?

As long as there is an internet connection – theoretically speaking yes, cryptocurrency could last forever. However, we don’t know what the internet may do or look like in 100, 500, or 1000 years from now!

Unless there is some unknown force of nature or science that could potentially wipe out internet servers, Bitcoin’s protocol was designed to be ever-lasting, decentralized and self-sustainable, valued by the faith of its users and investors.

Countries can outlaw cryptocurrencies by banning the use or purchase of crypto. However, this is incredibly difficult to enforce. Several nations have banned Bitcoin, however, people are using VPNs to access exchanges, and store their wealth either on or offline.

Ultimately, Bitcoin and other cryptocurrencies are code, so to try and remove them from circulation would include the removal of the internet… It’s very unlikely!

Bearing in mind that cryptocurrencies exist in a free market, and are valued on supply and demand of an asset, there’s a chance something could happen in the future in which people lose faith in a project or currency, and it could quite easily drop to zero.

Conclusion: Blockchain In Space

A lot of people believe crypto is a fad or a phase, or the latest trend that will die off at some point. However, cryptocurrencies and the use of blockchain technology is in quite the reverse of a dying movement.

We as a human race, have never had such an immutable, secure, and transparent asset as a store of wealth that we can truly own. The network itself becomes more difficult to hack as the number of Bitcoin users increases, and we are still in the early adoption phase.

Will cryptocurrency last forever? No one can say for sure, but thanks to the way the Bitcoin blockchain operates it would be incredibly difficult to get rid of – it’s currently not possible to delete the blockchain, and it seems a very unlikely option in the foreseeable future.

There are satellites in the sky that carry the blockchain data, so if the internet went down on a global scale, there would still be a blockchain node that carries all the information history, all it takes is for 1 node for the blockchain to survive.

Further to helping secure the Bitcoin network, satellite nodes are creating the potential for us to have a future with interplanetary cryptocurrencies – will Bitcoin be the first money on Mars?