If you wish to jump straight into exploring the opportunities that the current crypto market has to offer, use the interactive widget above. Simply select one of the preset filters or apply your search criteria. Depending on your search criteria/filters, the results will show you if cryptos are gaining or losing on-chain momentum. The former is an indication that it might be time to get in on a specific coin, while the latter may signal that now’s the time to take a short position.

By using Moralis Money, you’ll be able to make gains regardless if the market is going up or down. After all, thanks to the Moralis Money Pro plan’s real-time, on-chain analytics, you can make gains both in a bull market as well as in a bear market!

In the following sections, we’ll explore all there is to know about this tool. At the end of this article, you’ll know how to easily make money in a bear market!

How to Make Money in a Cryptocurrency Bear Market

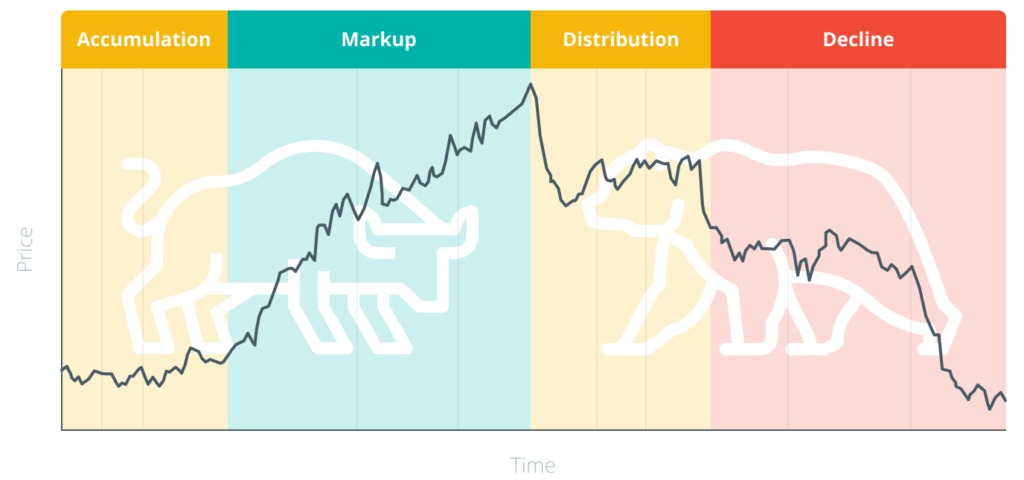

The above image speaks the truth that most casual traders do not consider. They typically enter the market when it’s already in the full swing of a bull run. Sure, you can make money in a bull run; however, to make life-changing gains, you must enter your bear market positions.

So, if you’d like to know how to make money in a bear market, the short answer is: to buy tokens that show great potential before they go on the run when bulls enter the market. Traders following that simple tactic were able to pocket some insane profits. How do we know that? Well, we did precisely that in the past two crypto cycles. Thanks to our team of on-chain experts, we detected EGLD and MATIC early. Now, you can access the same sort of on-chain data as they used via Moralis Money.

In case you don’t know what kind of gains altcoins offer, just look at the two charts below.

MultiverseX (EGLD) performed a massive 90x rally:

Polygon (MATIC) did even better. By entering this altcoin early (before the bull run), we were able to ride its 1000x-plus price appreciation:

The above two coins are just two of countless examples. While 1000x gains may not be that common (also not too uncommon), you can easily catch 50x-70x moves. After all, that is the price increase that the average altcoin tends to offer from the bear market lows to the bull market highs.

Individual Alts Can Have Impressive Rallies in a Bear Market

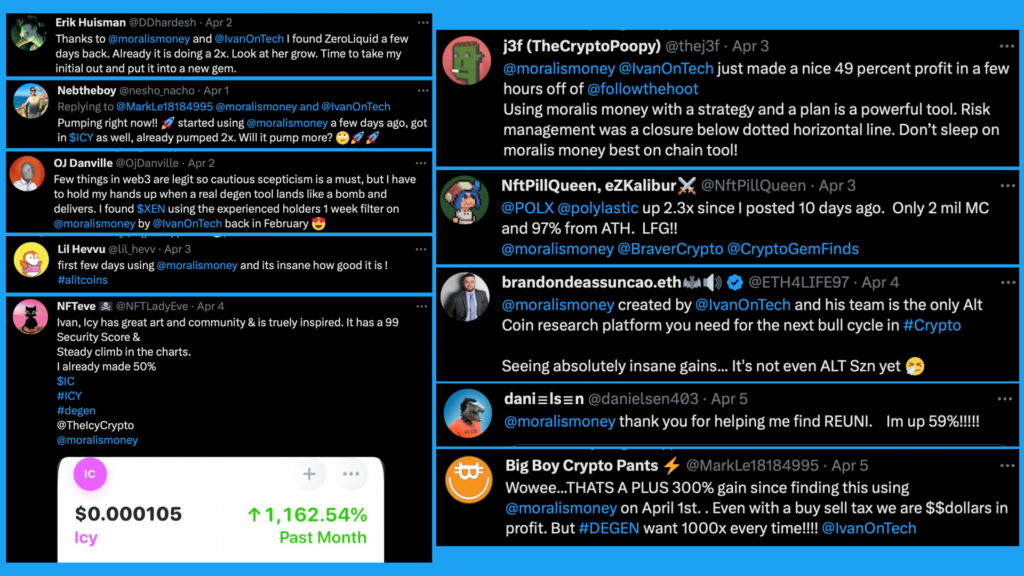

Even in a bear market, many tokens go parabolic. This brings us to the second way of how to make money in a bear market. By spotting altcoins that are gaining a lot of on-chain traction (which precedes price action), you can catch crypto before they go for local rallies. Moreover, there have already been a lot of those pumps lately.

In fact, many Moralis Money Pro plan users have been pocketing some incredible gains in the past weeks. Even though crypto, as a whole, has been trading more or less sideways since the final third of March 2023, traders using Moralis Money have been able to identify some spectacular opportunities.

After all, this period of what will turn out to be a reaccumulation or a redistribution phase also gave birth to the 2023 memecoin season. Thanks to Moralis Money’s on-chain insight, many Pro users spotted tokens like WOJAK, TURBO, and PEPE before they pumped hard.

Shorting the Market

Shorting the market is another popular way to make money in a bear market. After all, trading basics tell you not to trade against the trend. So, in the part of the bear market when prices are on a downhill ride, taking short positions can be extremely profitable.

However, to bet that the price of cryptos will go down, you need a “contract for difference” (CFD) trading account. This means you must use centralized exchanges (CEXs) instead of buying and selling tokens on decentralized exchanges (DEXs).

If you decide to explore this option, you need to understand the pulse of the crypto asset you want to short. Fortunately, on-chain data can help with that as well. So, instead of trying to spot tokens that are gaining on-chain momentum, you’d focus on the ones that are losing it.

Bear vs Bull Market

Unless you are coming into the crypto space with some experience from traditional markets, you might be confused by all this “bear” and “bull” talk. As such, make sure to have a look at the image below. The latter indicates the four typical stages of the market cycle.

When the market is on a consistent rise – printing higher highs and higher lows – it is in a “bull” phase. On the other hand, when the prices are going down – charting lower highs and lower lows – it is the “bear” season. Of course, this is not applicable to all time frames. In the crypto markets, weekly and monthly timeframes are the ones to determine whether we are dealing with a bull or bear market.

Looking at past cycles, it is usually quite easy to indicate the above-outlined phases. However, there can be one or even more additional accumulation phases (reaccumulation) and distribution phases (redistribution).

On the other hand, when it comes to determining the exact phase of the ongoing market, things are a lot trickier. This is why you can see a lot of contradictory theories flooding crypto Twitter. As such, you must learn how to create your own conviction. That’s also why reliable real-time, on-chain data is so helpful.

Nonetheless, make sure to check out our crypto trading for dummies guide to help you understand the crypto cycles and TA basics. If you’d like to learn more about the origins of the “bull” and “bear” terms, check out our article that teaches you how to spot bullish crypto trends.

Meet Moralis Money

Now that you know how to make money in a bear market in theory, it’s time you get acquainted with Moralis Money. After all, you’ve also learned that this powerful tool can help you determine what action to take. By finding tokens that are gaining or losing momentum, you can spot opportunities in both bull and bear markets.

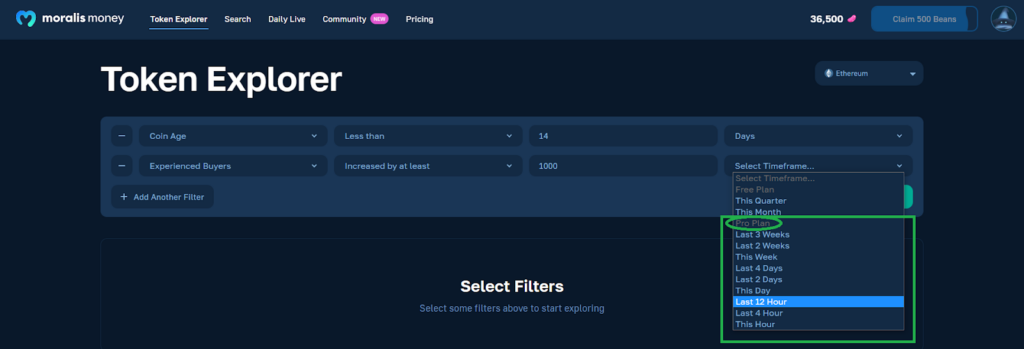

First, let’s point out that Moralis Money is a free tool for anyone with internet access. However, free Moralis Money plan users are limited to larger timeframes (monthly and quarterly). Therefore, if you are serious about your altcoin trades, you should opt for the Moralis Money Pro plan. The latter will grant you access to true real-time, on-chain analytics. Then, you’ll be able to respond properly to crypto market events as they happen. By trading with the latest on-chain market alpha in your corner, you’ll have the ultimate edge!

Whichever “how to make money in a bear market” above-presented tactic you choose, it is important to pick the right token. Moralis Money showing you holders, experienced buyers, market cap, and much more, is the perfect tool for guiding these decisions.

What Makes Moralis Money So Special?

The following list neatly sums up the major benefits of Moralis Money:

- Valuable insights into on-chain activity.

- No more confusing on-chain data charts; Moralis Money is nothing like other complicated on-chain tools that cause information overload.

- Quick and simple access to easy-to-understand actionable results.

- Generate a list of the most bullish crypto coins at any given time.

- Spot opportunities in all market conditions – focus on increasing or decreasing momentum.

- Overcome FOMO, avoid scams, and bridge the lack-of-time gap.

How to Make Money in a Bear Market? Use Token Explorer, Token Shield, and Token Alerts

Moralis Money has various functions and options; however, the gist of this powerful on-chain trading tool can be summed up with its three core features: Token Explorer, Token Shield, and Token Alerts. Let’s quickly look at each feature:

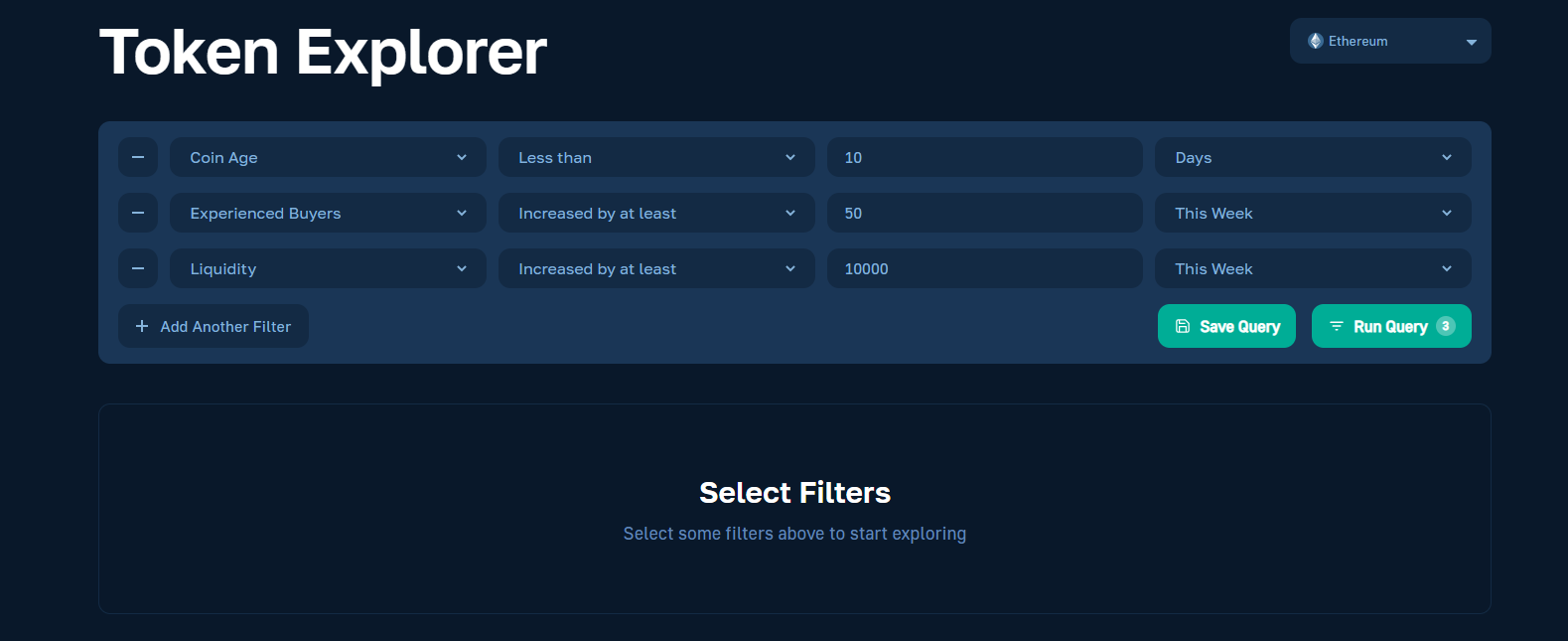

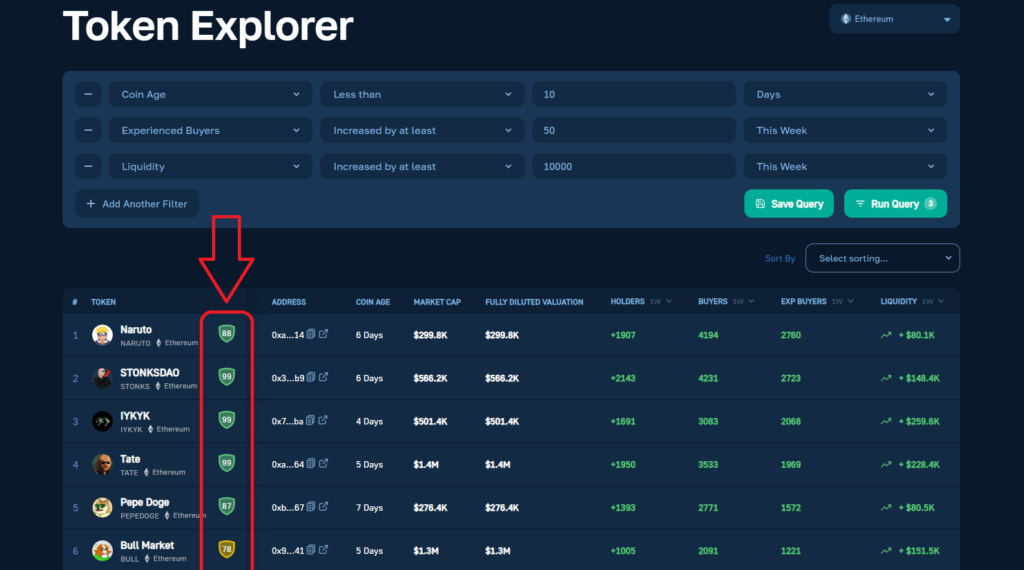

- Token Explorer allows you to run on-chain queries based on your unique combination of search parameters. As such, it allows you to spot altcoin opportunities in all market conditions. It returns a dynamic list of tokens gaining or losing on-chain momentum. That way, you can execute proper trades before it’s too late. By getting your timing right, you can finally say goodbye to FOMO.

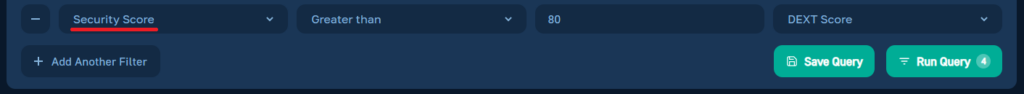

- Token Shield helps you avoid scams. This feature does its thing automatically – whenever you run a query, it performs security checks for the tokens that match your search criteria. You can see these scores next to each token on your dynamic list. The security scores are inside the color-coded shields, making Token Shield very intuitive. So, to stay as safe as possible, focus on tokens with green shields.

Another way to use the Token Shield feature is to apply the Security Score filter. By doing so, you can filter out tokens that do not match your risk tolerance.

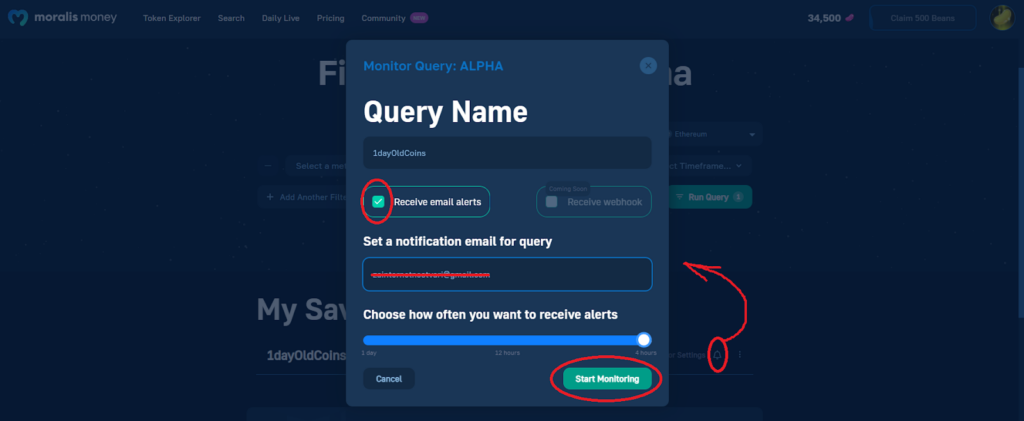

- Token Alerts enables you to set up email alerts for your saved queries. As such, you can run your favorite on-chain queries on autopilot and receive a notification directly in your inbox whenever there’s a new opportunity. The Token Alerts feature allows you to spot opportunities as they appear without investing additional time or going full-time crypto. With Token Alerts in your corner, you get to overcome time scarcity.

Start Spotting Altcoin Opportunities Today, No Matter the Market Conditions

One of many great things about Moralis Money is that you can use this tool in all market conditions. As such, make sure to use this section to help you get started with Moralis Money today. Then, you’ll be able to put the “how to make money in a bear market” theory into practice.

If you want to generate your first dynamic list of tokens that show some potential with a single click, just select one of the preset filters that await you on the Moralis Money homepage:

The preset filters can be a great starting point. However, since they are available to all Moralis Money users, they don’t allow you to spot unique opportunities. As such, your goal should be to get comfortable applying unique combinations of search criteria.

Fortunately, you can start finding your winning search criteria combo by applying the following three steps:

- Open Token Explorer.

- Apply the Coin Age filter if you wish to focus on newer coins. Or, use the Market Cap metric and target more seasoned altcoins.

- Add metrics like Holders, Buyers, Experienced Buyers, and Liquidity to spot which tokens are experiencing an increasing (or decreasing) on-chain momentum.

If you get the values right, you may find the best opportunities on your first run. However, it may take some tweaking to find the best Web3 coins to invest in or to short. So, make sure to try out various combinations of search metrics and different values.

Nonetheless, do not forget to DYOR for every token before taking your position in its market. Fortunately, you can start exploring every token with Moralis Money by simply clicking on the token’s name.

How to Make Money in a Crypto Bear Market – Full 2023 Guide – Summary

You now know how to make money in a bear market. We pointed out the three main methods: buying alts early, buying tokens before their local pumps, and shorting the markets. If you want to implement either of the aforementioned tactics, you need to get your timing right.

You also learned that you can detect altcoin opportunities by looking at real-time, on-chain data. This is where Moralis Money enters the scene. It is by far the best on-chain trading tool out there. By combining the power of on-chain insights and simplicity of use, Moralis Money enables you to time your trades (long-term and short-term ones) to a “T.,” especially if you opt for the Pro plan.

Where do you think we are currently at? Are we in a bear market or a bull market? Once you start applying the information obtained herein, you won’t really care what the label for the current market condition is. Instead, you will be able to focus on real-time, on-chain data to anticipate any increasing or decreasing momentum. This insight will enable you to adjust your trades accordingly.

Now go out there and make the most of this “how to make money in a bear market” guide!