In today’s article, we’ll kick things off by exploring the potential of high-volatility crypto. From there, we’ll dive into the intricacies of what causes volatility in cryptocurrency. Next, we’re going to show you how to find the most volatile crypto using the ultimate volatility indicator: Moralis Money. Lastly, we’ll show you how to check crypto volatility and explore the ins and outs of Moralis Money further!

If you’re eager to start finding high-volatility crypto, here’s a sneak peek of how easy it is with Moralis Money. All we have to do is launch Token Explorer and add the Coin Age, Market Cap, and Price Percent Change metrics to generate a list of potentially highly volatile crypto:

When Volatility Starts, Crypto Can 1000x!

Volatility is often seen as something negative as it’s usually associated with risk. However, the higher the risk, the greater the returns. As such, when volatility starts, crypto can easily 100x or even 1000x if you manage to find them in time!

- PEPE Token: Imagine finding the PEPE token back in April 2023. At the time, it was trading at only $0.00000002764. A couple of days later, it shot up in price to $0.000004354 – an incredible increase of almost 16,000%:

- Dogecoin: Back in 2020, Dogecoin was trading at just $0.0026. Six months later, the price of the token peaked at $0.74 – resulting in an impressive 28,200% price rally:

- MATIC: Imagine finding MATIC when it was trading at $0.003 in 2019. A few years later, the price spiked to $2.9 – an extraordinary increase of 96,000%:

Now, you might be thinking: finding these opportunities is easier said than done. However, it doesn’t have to be. We know as our team of experienced traders managed to capitalize on this high volatility by finding these lucrative opportunities before they broke out!

So, how did we do it?

We’ll show you exactly how, using the ultimate blockchain analytics tool: Moralis Money. But, to find high-volatility crypto with the same potential as the PEPE token, Dogecoin, and MATIC, we initially need to explore what causes volatility in crypto.

What Causes Volatility in Crypto?

There are numerous factors causing volatility in crypto, and we won’t be able to cover them all in this article. However, below, you’ll find five examples of key factors influencing the volatility of cryptocurrency assets:

- Supply and Demand: As with most assets, supply and demand are critical contributors to volatility within the crypto market. When people are looking to invest in assets like Bitcoin and Ethereum, their value increase as demand rises. And their value will decrease as supply increases.

- Speculation and Hype: Another critical factor contributing to high volatility in crypto is speculation and hype. When a new crypto launches, it can experience an initial spike of excitement as people hear about it for the first time. This causes people to buy and sell the new coin, which causes higher volatility.

- Market Conditions: Market conditions can also influence volatility. For instance, volatility is often lower during bullish conditions as the market and individual crypto steadily grow. However, during bearish market conditions, uncertainty is high, and volatility usually increases.

- Crypto Whales: The cryptocurrency market is full of so-called crypto whales. These are prominent actors holding vasts amount of a particular cryptocurrency. Since they hold a large portion of the total supply, their actions influence the price of assets, which can result in high volatility.

- Regulation and Laws: Crypto volatility is also influenced by laws and regulations as governments are looking to crack down on the industry. If regulation increases, it can affect the price of crypto significantly.

Metrics to Find Which Crypto is Most Volatile

Now, with a better understanding of what causes volatility in cryptocurrency, let’s explore three metrics to consider when trying to find high-volatility crypto:

- Market Cap: A cryptocurrency’s market cap provides an idea of how big an asset is and how much investments are backing it. Generally speaking, larger market-cap coins are more established, have more liquidity, and are less volatile than low market-cap cryptocurrencies. As such, if you’re looking for highly volatile crypto, you might want to go for low market-cap coins.

- Trading Volume: When trading volume is high, there’s a greater degree of agreement between buyers and sellers. During these conditions, prices usually shift less drastically, meaning that volatility is low. However, when trading volume is low, there’s often uncertainty among market participants, which causes higher volatility.

- Price Fluctuations: Lastly, the final metric is price fluctuations. This one is relatively straightforward, as volatility refers to the shifts in price over time. So, if you’re looking for high-volatility coins, then you’ll want to look for coins experiencing drastic price fluctuations.

However, even though you know what metrics to look for to find volatile crypto, it’s easier said than done. Without proper tools and systems in place, people generally struggle to find the right crypto matching the factors above. This is why professional crypto traders leverage volatility indicator tools to find high-volatility assets!

Why Use a Crypto Volatility Indicator?

When trying to find high-volatile crypto, 99% of traders generally struggle with one of the following challenges:

- FOMO: The fear of missing out (FOMO) is a big struggle for many traders. FOMO makes people trade emotionally and based on hype. In doing so, they often buy tokens at the top, only to see them fall shortly after.

- Time Constraints: Crypto never sleeps, and new opportunities come and go in the blink of an eye. In this fast-paced market, it’s generally a full-time job to keep track of all emerging opportunities, and most people can’t dedicate 100% of their time to crypto.

- Cryptocurrency Scams: The many opportunities to make serious gains have, unfortunately, attracted cryptocurrency scammers. As such, traders need to continuously be wary of rug pulls and exit scams.

So, how can you overcome these challenges and find the most promising high-volatility crypto?

The answer to the above question is to leverage a crypto volatility indicator like Moralis Money!

How to Find High-Volatility Crypto – Step-By-Step Guide

Moralis Money is the industry’s premier volatility indicator. It leverages blockchain data in real time, giving you true market alpha. As such, when working with Moralis Money, it has never been easier to find high volatility crypto before sites like CoinGecko, the masses, and cryptocurrency whales!

So, how does it work?

Well, Moralis Money is equipped with three core features helping you overcome the challenges from the previous section. And to help you avoid FOMO, you can leverage Moralis Money’s Token Explorer to find high-volatility crypto in a heartbeat!

Token Explorer lets you pick and choose between 15+ unique search parameters to target specific coins you’re after. In doing so, it’s possible to create unique search strategies based on the factors from the ”Metrics to Find Which Crypto is Most Volatile” section.

As such, let’s create a query to find new low market-cap coins with low trading volume and high price fluctuations:

- Step 1: Let’s start by adding the Coin Age and Security Score metrics to find new secure coins:

- Step 2: From there, let’s narrow our search further by adding the Market Cap metric to find tokens with relatively low market cap:

- Step 3: Lastly, add the Price Percent Change and Net Volume metrics to filter for coins with high price fluctuations over the past week with low net volume:

That’s it; when working with Moralis Money, you can generate a list of high-volatility crypto in just a few clicks!

From here, you can continue doing your own research regarding each coin by simply clicking on them. This will take you to their token pages, where you’ll find helpful info. For instance, you’ll get alpha metrics, security information, price charts, and much more:

The following section will show you how to use this info to check crypto volatility further!

How to Check Volatility

If you’d like to check the volatility of a crypto asset, a great place to start is technical analysis (TA). With TA, you can look at multiple technical indicators to determine the volatility of a cryptocurrency. And thanks to the price charts integrated into Moralis Money, you can easily do so with a couple of clicks!

In TA, there are multiple indicators you can look at to determine the volatility of crypto. We can’t cover them all; however, here are three prominent examples:

- Bollinger Bands

- Standard Deviation

- Average True Range (ATR)

Let’s use the Bollinger Bands indicator as an example to give you an idea of how this might work. Bollinger Bands is one of the most well-known indicators to spot volatility. When there’s high volatility, the bands widen. And when there’s less volatility, they contract.

So, how do you check volatility with Moralis Money?

Well, it’s simple! Go to the asset’s token page, scroll down to the price chart, click on ”Indicators,” search for Bollinger Bands, and apply them:

What’s more, you can follow exactly the same procedure to apply any other technical indicators to conduct a more in-depth analysis of the asset’s volatility!

Nevertheless, now that you know how to find high-volatility crypto using Moralis Money, let’s explore some additional benefits that make this tool the ultimate crypto volatility indicator!

What Makes Moralis Money the Best Crypto Trading Tool?

Moralis Money and the Token Explorer feature make it easy to find high-volatility crypto. However, this is just the tip of the iceberg, and there’s a lot more to the platform. As such, let’s explore five additional reasons why Moralis Money is the ultimate crypto volatility indicator:

- Token Alerts: The Token Alerts feature allows you to set up email notifications to monitor individual tokens and the market for emerging opportunities. As such, it’s the ultimate tool allowing you to overcome the time constraint challenge since you can find new coins even when you aren’t actively trading. If you’d like to learn more, check out our article on crypto price alerts.

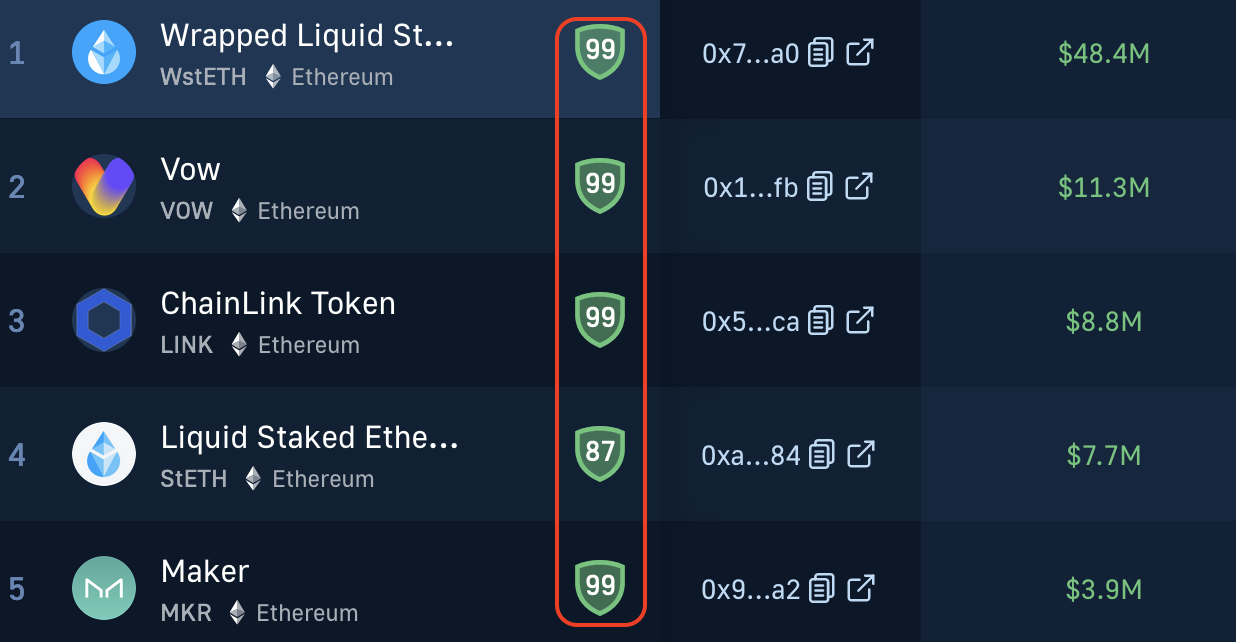

- Token Shield: Token Shield provides a comprehensive security evaluation for each coin. As such, with this feature, you can seamlessly dodge cryptocurrency scams. For a quick evaluation, simply look for the shield symbol attached to each coin to find their DEXT scores:

- Crypto Swap: Moralis Money additionally features an amazing crypto swapping feature. It leverages the 1inch DEX aggregator, making it one of the cheapest crypto swap platforms available. Here’s a quick demo of how it works:

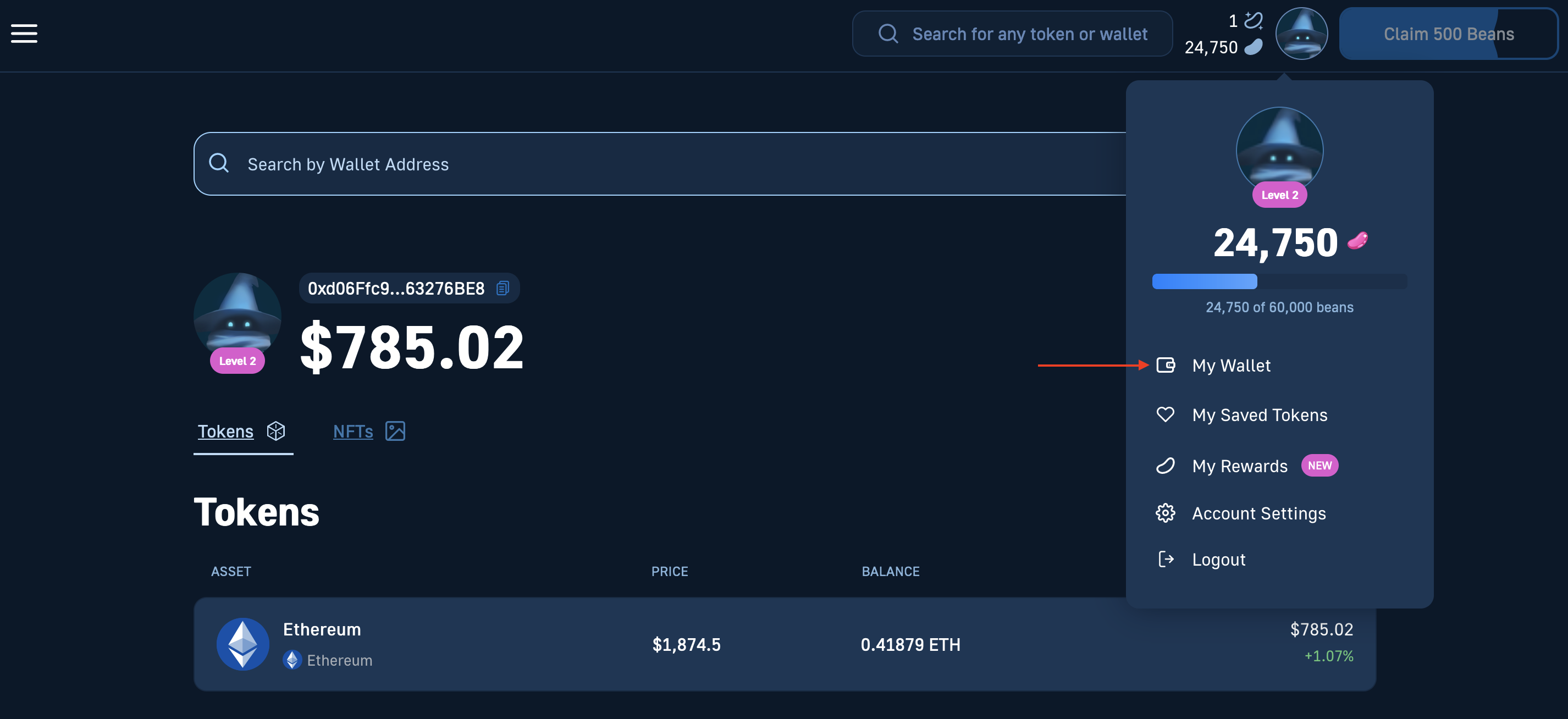

- Portfolio Manager: You can also leverage Moralis Money’s crypto portfolio manager feature to keep track of your assets:

- Cross-Chain Compatibility: Moralis Money supports multiple networks, including Ethereum, BNB Smart Chain, Polygon, etc.

The ability to find and buy up-and-coming crypto across multiple networks makes Moralis Money the ultimate one-stop shop for traders. So, if you haven’t already, try it out for free by visiting Moralis Money!

Pro vs. Free Crypto Trading Tool

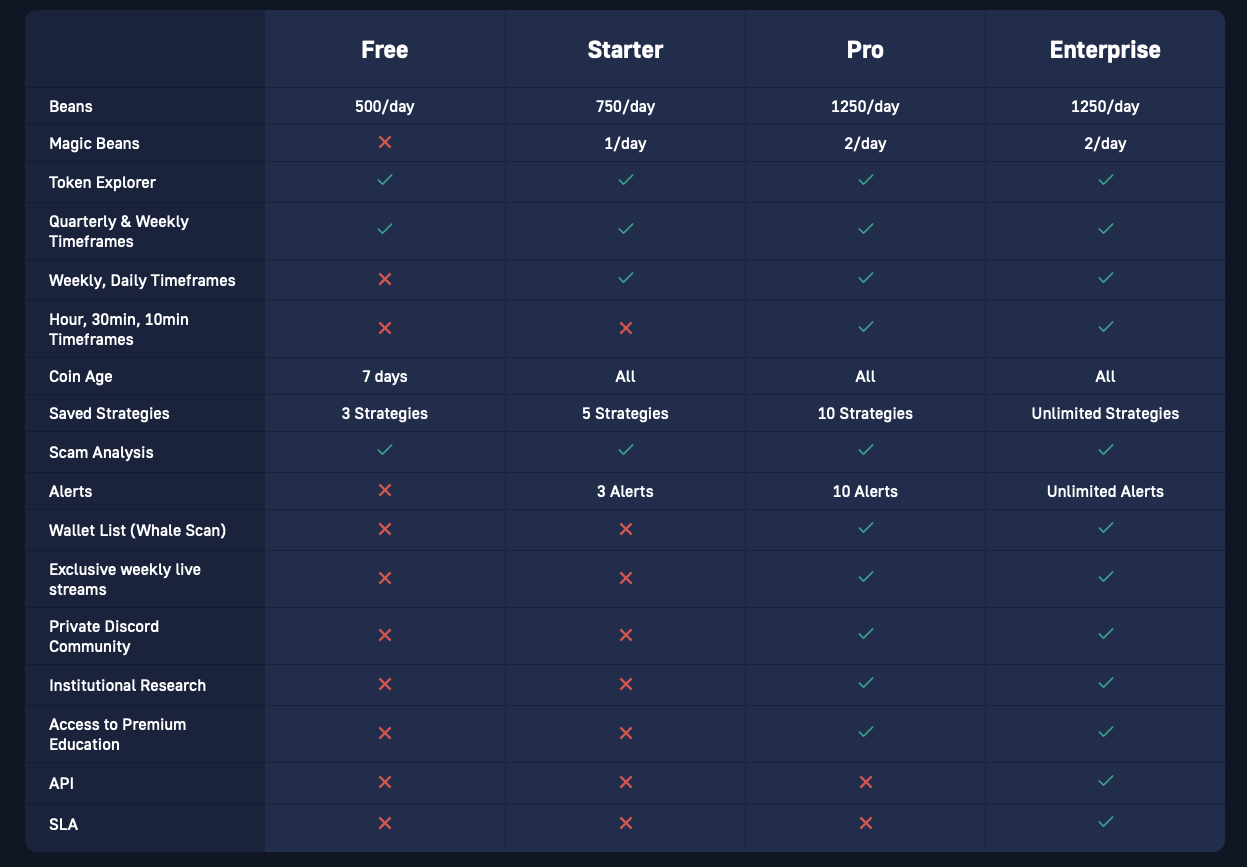

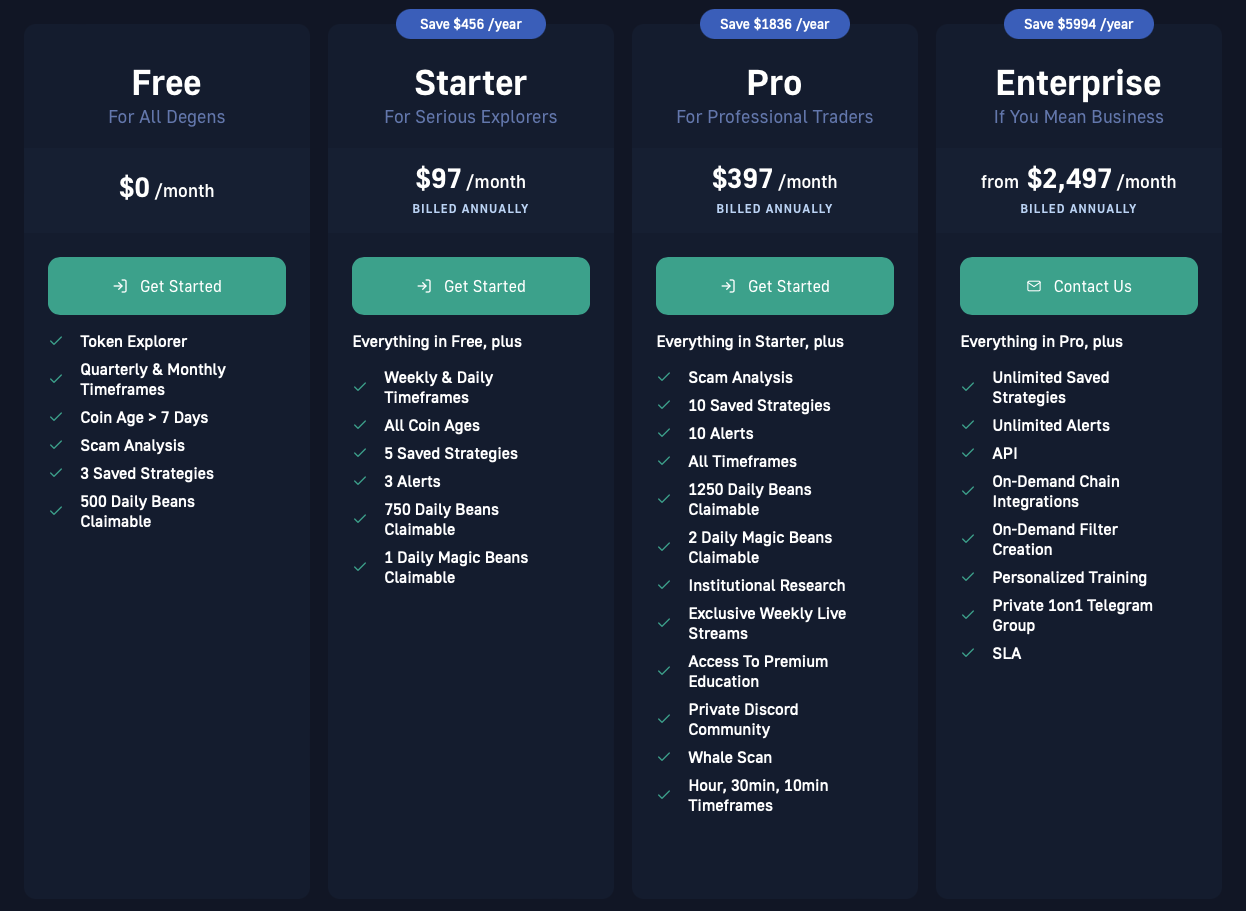

You can leverage Moralis Money entirely for free, and it’s a great start. However, if you’d like to start trading like a professional, you should definitely consider subscribing to the Moralis Money Pro plan!

As a Pro plan user, you get a bunch of benefits, and you’ll find three prominent examples below:

- Narrower Timeframes: As a Moralis Money Pro plan user, you get narrower timeframes for all search metrics. This means you can query on-chain data on a daily, hourly, and even ten-minute basis.

- Private Discord: You also get access to a private Discord server where you can become part of a more extensive community of like-minded traders.

- Premium Education: All Pro plan users additionally get access to premium education that can help you maximize your crypto gains.

In addition to these benefits, you also get the option to save up to ten strategies, ten alerts, and much more:

So, if you’d like to maximize your crypto gains, subscribe to the Moralis Money Pro plan immediately!

Summary: How to Find High-Volatility Crypto

In today’s article, we showed you how to find high-volatility crypto using Moralis Money – the ultimate crypto volatility indicator – in three steps:

- Step 1: Launch Token Explorer and add the Coin Age metric.

- Step 2: Combine Coin Age with the Market Cap filter.

- Step 3: Lastly, add Price Percent and Net Volume to find coins with high price fluctuations and low net volume.

Also, remember that you can supercharge the power of Moralis Money by subscribing to the Pro plan. With the Moralis Money Pro plan, you get a bunch of benefits, including narrower timeframes for all search parameters, access to a private Discord, access to premium education, and much more:

What’s more, if you’d like to try it out yourself, you can now take the Token Explorer feature for a test spin down below. Add a premade strategy, or create one from scratch by combining the metrics of your choice: