In today’s article, we’ll kick things off by exploring breakouts vs fakeouts. From there, we’ll dive into the #1 crypto breakout scanner: Moralis Money. In doing so, we’ll show you how to find breakouts using this industry-leading breakout screener. From there, we’ll also show you how to use Moralis Money to set up alerts so you can receive crypto breakout signals in real time, even when you aren’t actively trading.

So, without further ado, let’s dive into breakouts and fakeouts!

Breakouts vs Fakeouts – Avoid FOMO During a Potential Breakout

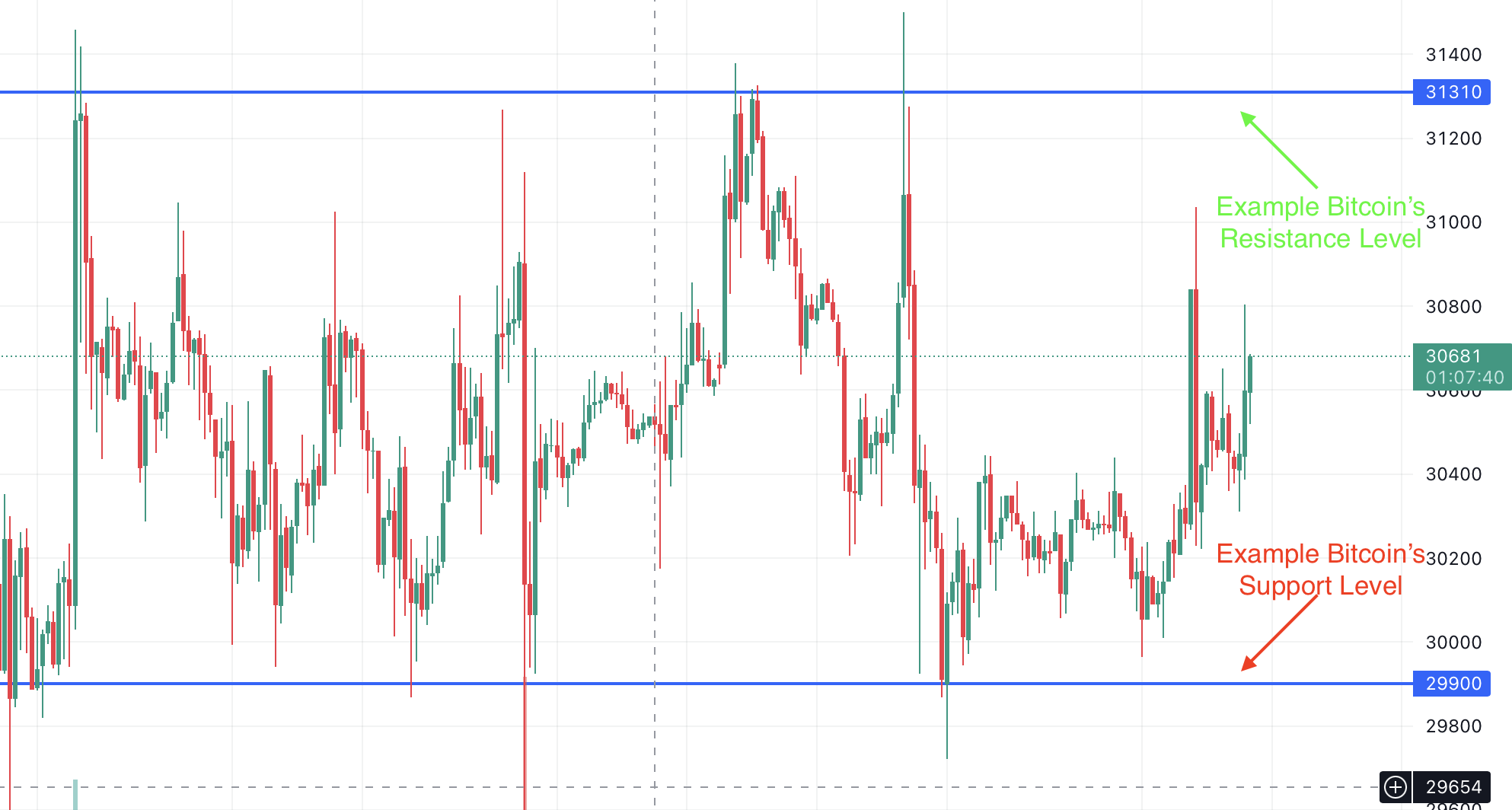

In technical analysis (TA) – a prominent altcoin trading strategy – breakouts refer to the price of an asset moving below the support or above the resistance levels. A negative breakout occurs when sellers push the price below the support level. And a positive breakout occurs when buyers succeed in pushing the price beyond the resistance level. Breakouts can indicate that an asset’s price will continue to trend in the direction of the breakout.

However, to make further sense of this, let’s briefly recap what support and resistance levels entail:

- Support Level: The price level or area on a trading chart under the current market price where buying interest is strong enough to overcome selling pressure.

- Resistance Level: The price level or area above the current market price where selling pressure is strong enough to overcome buying pressure.

Furthermore, breakouts tend to happen after periods of reduced volatility and often signal a trend reversal attempt by the market. Breakouts accompanied by high volume can be considered strong signals. As such, the higher the volume, the higher the chance that the price will continue in the direction of the breakout.

However, if an asset’s price temporarily breaks outside the support level or resistance area but quickly reverses, it may be considered a fakeout. Consequently, a fakeout is a setup that looks like a breakout but fails.

Often when a cryptocurrency is close to a breakout point – or even as it has broken a resistance level – many people FOMO into the asset as they don’t want to miss out on a massive price rally. This can be a significant mistake as not all breakouts are successful, and some instead result in fakeouts. Instead, it might be wiser to wait for confirmation, such as a candle closing outside or above the resistance level.

Avoid FOMO Using Moralis Money’s Token Explorer

Prematurely buying an asset can be devastating, so you should always wait for confirmation to ensure that the breakout won’t fail. However, this is easier said than done, which is why professional traders leverage blockchain analytics tools like Moralis Money.

Moralis Money is an industry-leading crypto scanner that can help you find the next crypto breakout. This tool leverages real-time, on-chain data, giving you true market alpha so you can find new crypto projects before everyone else. As a result, by using Moralis Money, you don’t have to FOMO into an opportunity ever again!

So, how does this work?

Well, one of the core features of Moralis Money is Token Explorer. With Token Explorer, you get the option to pick and choose between 15+ unique search queries to create your own search strategies. In doing so, you can easily target unique coins you’re after.

So, let’s take a close look at how you can find new breakouts using the #1 crypto breakout scanner!

How to Find Breakouts Using the #1 Crypto Breakout Scanner

In this section, we’ll show you how to leverage the #1 crypto breakout scanner to find new breakout crypto. Thanks to the accessibility of Moralis Money and the Token Explorer feature, you can now do so in three straightforward steps:

- Step 1: To begin with, launch Token Explorer and add the Price Percent filter. In doing so, you can filter for coins that have seen positive price movements over a given time period. In this case, we’ll query coins that have increased by 5% over the past two weeks:

- Step 2: In combination with positive price developments, we also know from the ”Breakouts vs Fakeouts – Avoid FOMO During a Potential Breakout” section that volume is an essential factor, as higher volume indicates increasing buy pressure. As such, let’s combine the Price Percent metric with the Net Volume filter:

- Step 3: Now that you have generated a comprehensive list of altcoins, you need to continue doing your own research. A great place to start is Moralis Money’s token pages. For instance, let’s take the AAVE token as an example.

By visiting the AAVE token page, you get a bunch of details regarding the token, including price developments over time, alpha metrics, security information, etc. You also get a trading chart for the token. With this chart, you can conduct your own TA by, for instance, checking out both the support and resistance levels to determine whether or not the token has the potential to breakout:

All in all, with Token Explorer, you can leverage unbiased on-chain data and blockchain analytics in real-time, which can give you an edge in the market and help you make solid investment decisions!

Receive Crypto Breakout Signals Using Moralis Money

In addition to Token Explorer, another neat feature of the #1 crypto breakout scanner is Token Alerts. With Token Alerts, you can effortlessly set up email notifications for both individual tokens and the entire market. In doing so, you’ll get real-time crypto breakout signals with a few clicks.

So, how does this work?

Option 1: How to Find New Crypto with Breakout Potential

Your first option is to set up alerts for your own strategies that you create using Token Explorer to monitor the market for emerging opportunities. Let’s use the filter we set up in the previous section to do so.

Start by saving the strategy:

From there, go to ”Saved Strategies,” locate the filter in question, click on the bell button, add the required information, and start monitoring:

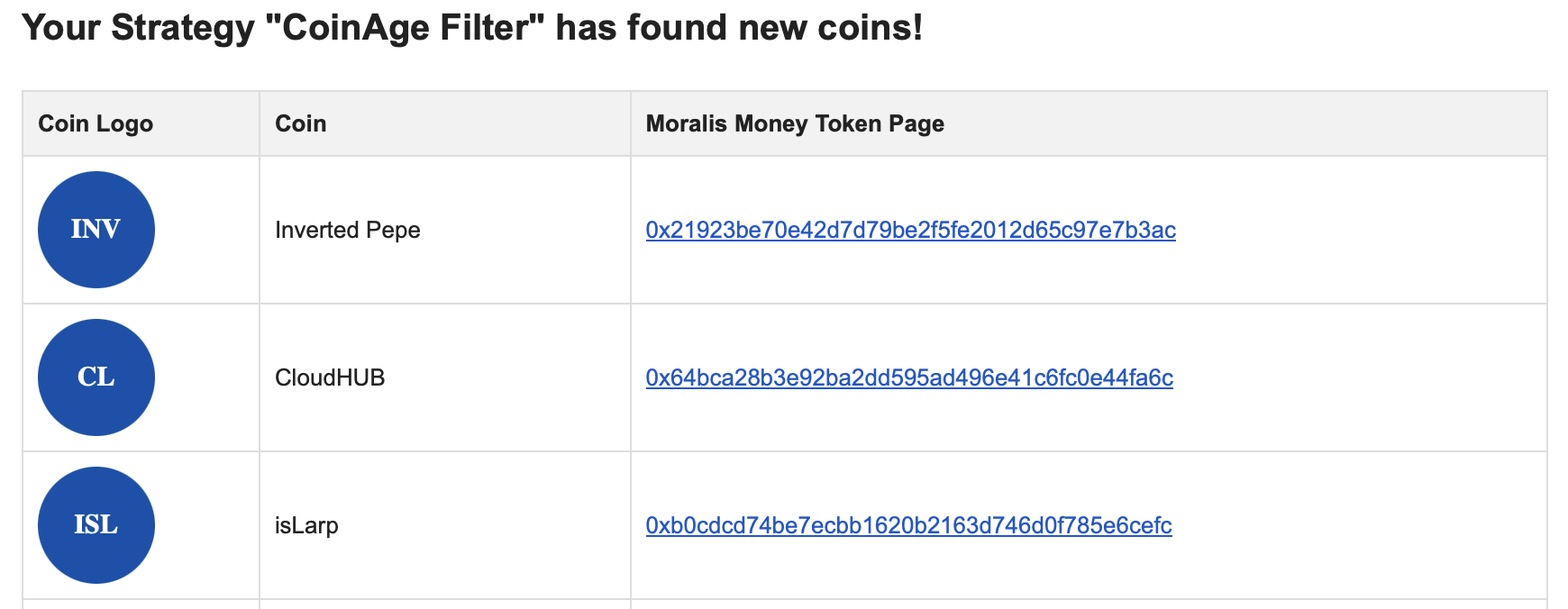

In return for setting up an alert, you’ll now receive continuous emails containing lists of altcoins that have recently come to match the filter. As such, this is the perfect tool if you want to receive crypto breakout signals to identify new promising opportunities. This is what the response might look like:

Option 2: Monitor Individual Tokens for Breakout Signals

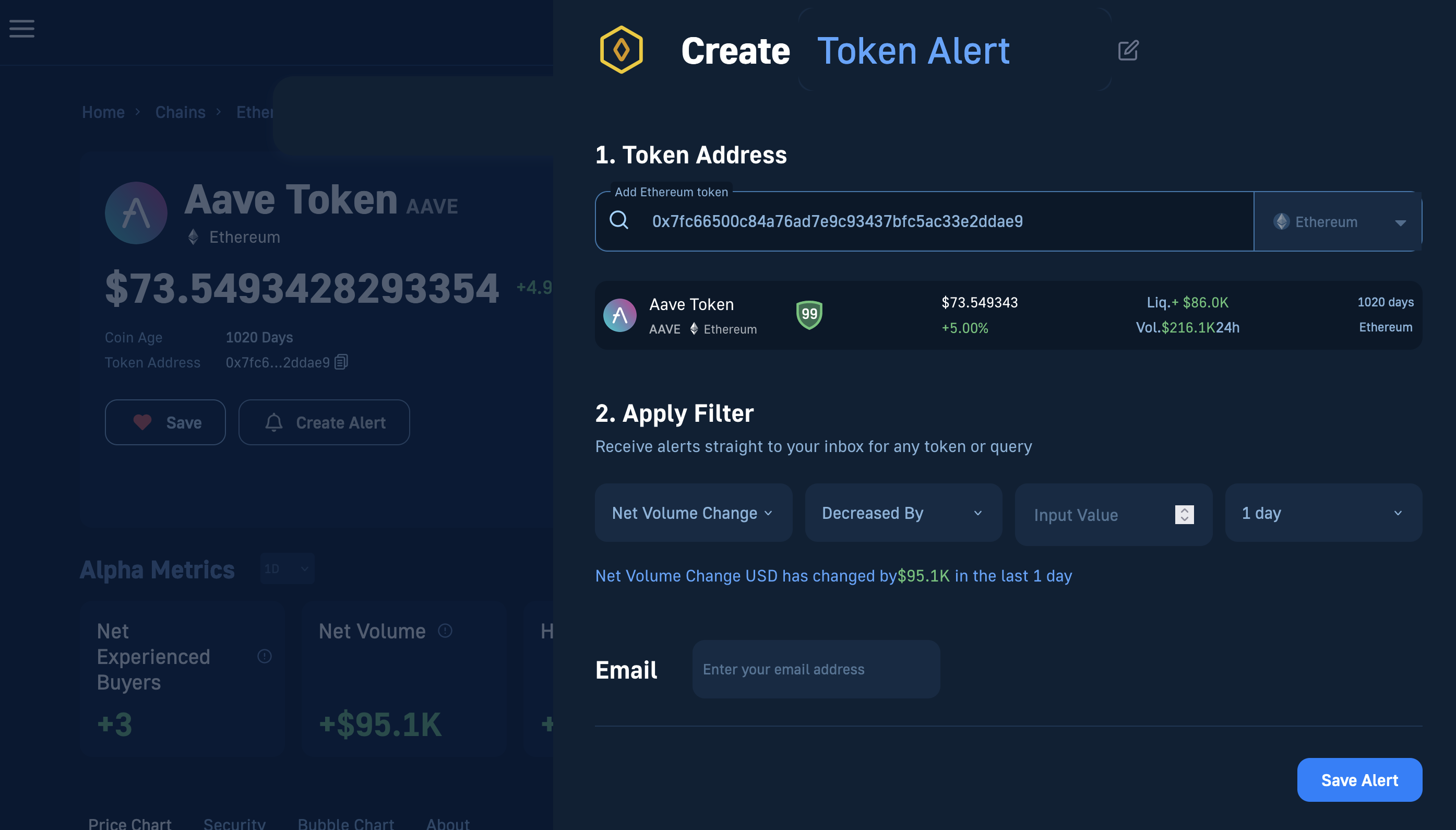

For the second option, you can set up an alert to monitor an individual token for breakout signals. To do so, go to the coin’s token page and hit the ”Create Alert” button:

Next, name your alert, apply a filter, input your email address, and hit ”Save Alert”:

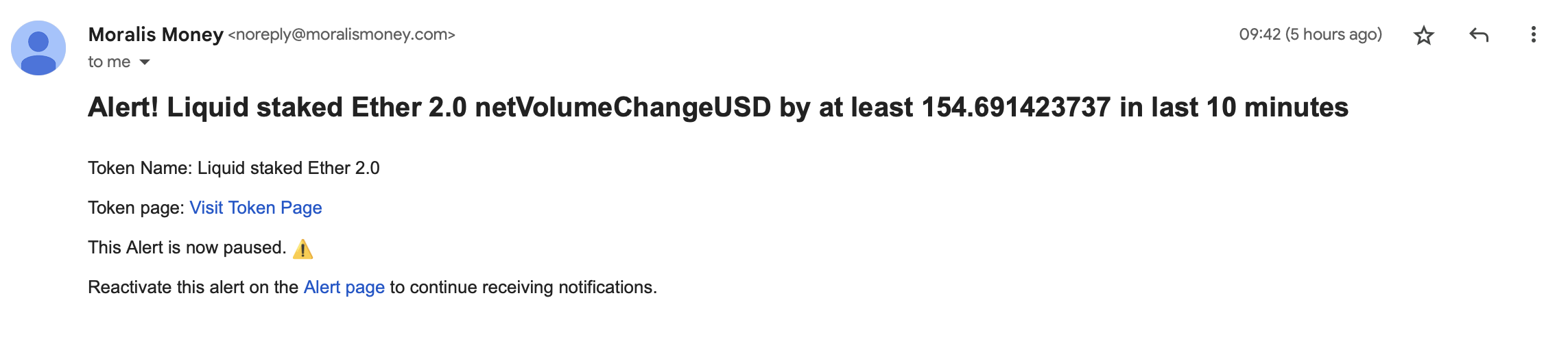

In doing so, you’ll now get notified when the token matches the filter. So, as an example, by adding the Net Volume Change filter, you’ll get notified whenever the buying pressure of a token increases, which can be a positive indicator that a token will experience a breakout. As an example, this is what the response can look like:

Which Crypto Signals are the Best?

When it comes to crypto signals, the best indicator is on-chain data. Whenever a transaction occurs on a blockchain network, it’s immediately recorded and saved to the digital ledger. As such, on-chain data is one of the quickest ways to get market updates.

Furthermore, blockchain data is immutable. Consequently, the data you get from querying a blockchain network is completely unbiased, making it perfect for rational investment decisions.

However, one challenge with on-chain data is that it can be hard to get a hold of, especially if you don’t have the proper tools and systems in place. Fortunately, this is where crypto monitoring tools like Moralis Money enters the equation.

Moralis Money leverages real-time blockchain data, presenting it to you in a readable and understandable format. As such, this is the easiest way to get crypto trading signals. Moralis Money provides a bunch of alpha metrics, including a token’s number of holders, changes in buyers, experienced buyers, liquidity, volume, etc., over time, and much more.

What’s more, thanks to the cross-chain capabilities of Moralis Money, you can use this tool to find the most undervalued crypto across multiple blockchain networks, including Ethereum, Arbitrum, Polygon, and many others.

This makes Moralis Money the ultimate source for on-chain token data and a great tool every trader should leverage to get real-time crypto signals!

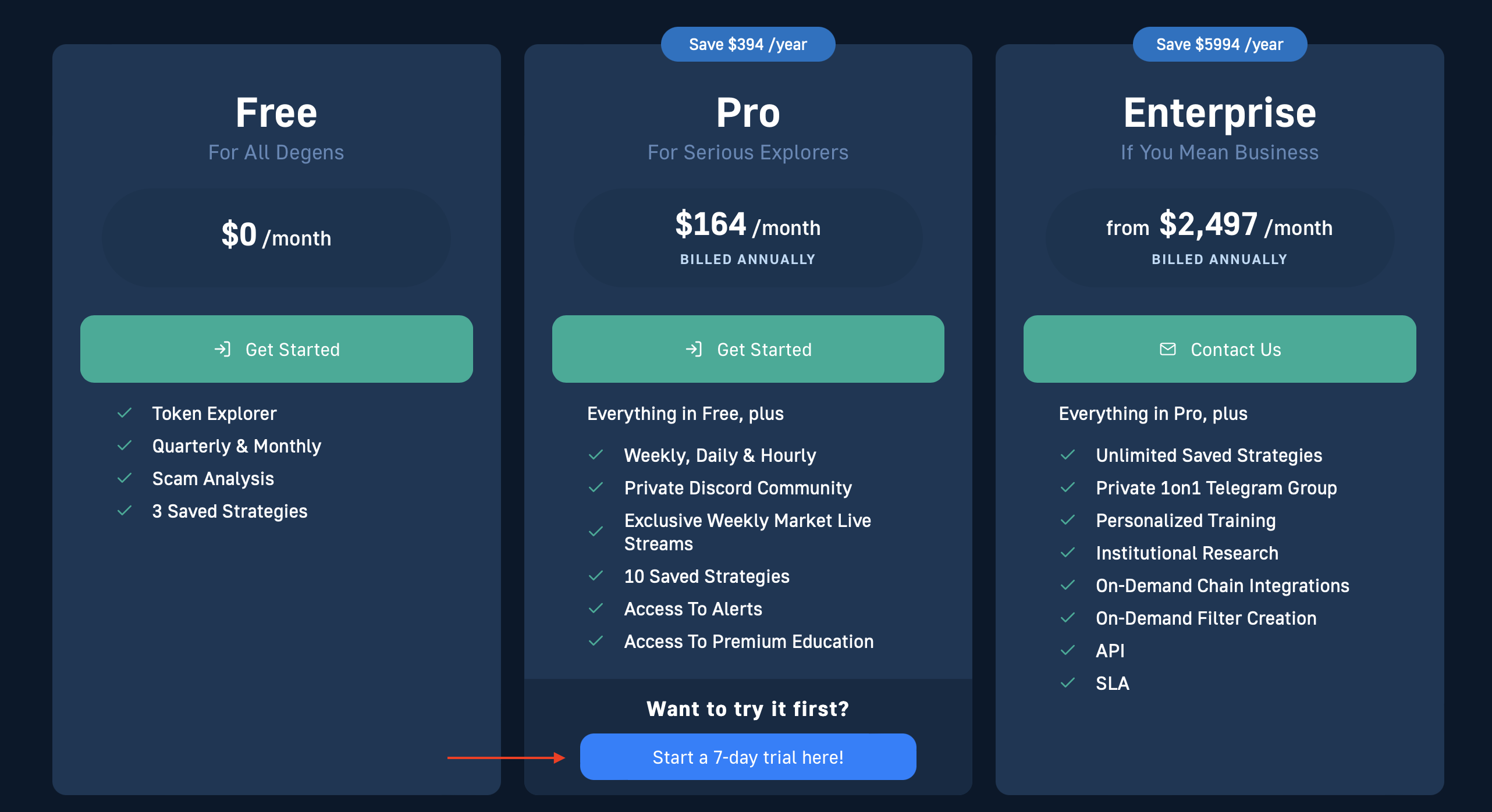

Also, did you know that it’s possible to boost the power of Moralis Money further by subscribing to the Moralis Money Pro plan? Want to know what it entails? Then join us in the next section as we explore the ins and outs of the Moralis Money Pro plan!

Start Trading Like a Professional with Moralis Money’s Pro Plan

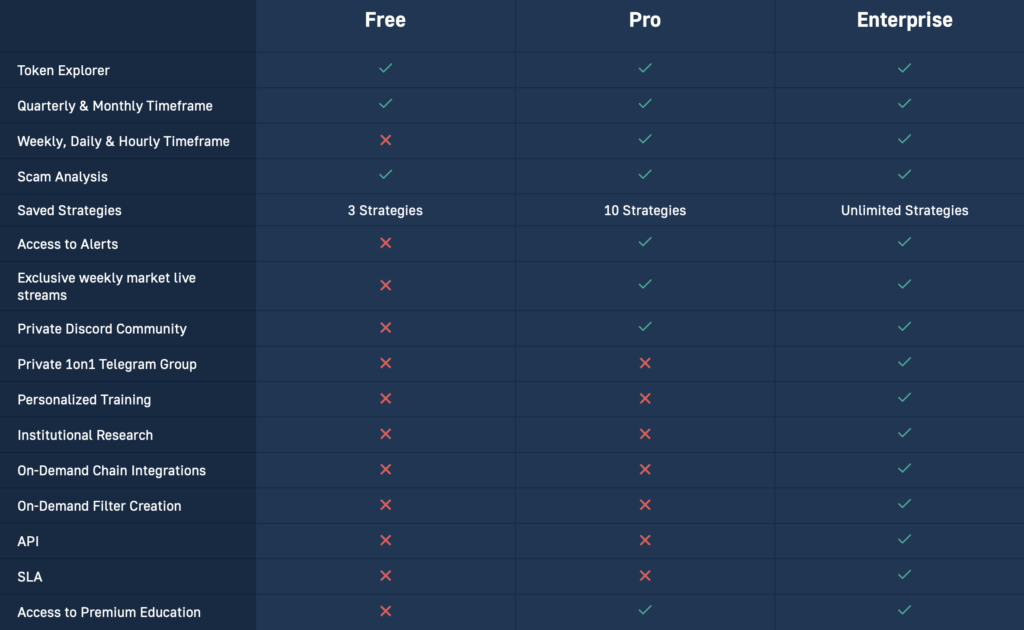

If you want to take your trading game to the next level, then you should definitely check out the Moralis Money Pro plan. With the Moralis Money Pro plan, you get a bunch of benefits, and you can find three prominent examples here:

- Narrower Timeframes: One of the most significant benefits of the Moralis Money Pro plan is narrower timeframes for all search parameters. This means you can query marked data on a daily, hourly, and even ten-minute basis to get true market alpha.

- Premium Education: With the Moralis Money Pro plan, you can also access premium education. This includes a monthly newsletter with the latest trading strategies and other crypto trading tips.

- Private Discord Server: You can also become part of a larger crypto community by joining the Moralis Money Discord server.

Along with the three examples above, you also get access to Token Alerts, can save up to ten search strategies, and much more:

If this sounds interesting, try out the Moralis Money Pro plan with our seven-day trial. Simply go to our pricing page and sign up:

You can also try the Token Explorer feature directly using the interactive widget below. Apply premade Moralis Money filters or create a strategy from scratch by combining the metrics of your choice:

Summary: How to Find Crypto Breakouts Using a Crypto Breakout Screener

Today’s article started with an explanation of breakouts and fakeouts. A breakout occurs when the price of an asset moves above its resistance level or below the support level. Furthermore, breakouts can indicate that an asset’s price will continue to move in the direction of the breakout.

However, if an asset moves beyond either the resistance or breakout levels and quickly reverts, it instead experiences a fakeout. As such, when an asset experiences a breakout, it can be wise to wait for confirmation to ensure it doesn’t fail.

Identifying breakout opportunities can be difficult, which is why professional traders use a crypto breakout screener. And the best scanner available is Moralis Money!

Moralis Money is an industry-leading crypto breakout screener. It leverages real-time, on-chain data to provide true market alpha. As such, when working with Moralis Money, it has never been easier to get crypto breakout signals and find tokens before they pump.

In today’s article, we covered two of Moralis Money’s key features:

- Token Explorer: With Token Explorer, you can easily find new and promising altcoins by combining 15+ unique search parameters. This is one of the features making Moralis Money the ultimate crypto breakout screener.

- Token Alerts: With Token Alerts, you can set up email notifications to get crypto breakout signals in real time, even when you aren’t actively trading.

Also, remember that you can supercharge the two features above with the Moralis Money Pro plan. By subscribing to this plan, you get narrower timeframes for all search queries, access to a private Discord server, and much more!