The cryptocurrency industry, and consequently the decentralized finance space, have evolved beyond what many initially thought possible. What’s more, a growing number of hedge fund managers, institutional investors, and governments have given the green flag for crypto to thrive. With that said, many are yet to realize cryptocurrency and DeFi’s full potential. Although Bitcoin is hitting the headlines, understanding how to make a passive income with DeFi is often seen as a complex, high-risk endeavor. Read on for an easily understood breakdown of how to make a passive income with decentralized finance!

In this article, we look at some of the most important considerations for deciding how to make a passive income with DeFi. Also, we’ll explore some of the various methods of generating passive income streams and the projects facilitating the DeFi revolution. As such, we touch on some of the most popular DeFi projects, such as UniSwap, Compound, Balancer and much more.

This article comes as another in our ongoing Passive Income series. If you’ve missed our previous entries, see there articles on how to make a passive income with Ethereum, passive income with Cardano, and learn about passive income in crypto. If you want to learn more about the cryptocurrency and blockchain field, we strongly recommend you to check out Ivan on Tech Academy. The Academy is one of the leading blockchain education platforms anywhere in the world, and features countless world-class blockchain and cryptocurrency courses. See which ones suit you!

What Is Decentralized Finance?

To begin with, let’s answer the basic question of “what is decentralized finance”. Decentralized finance (DeFi) is the term used to categorize a broad range of financial applications that utilize cryptocurrency and blockchain technology. DeFi is posed to disrupt traditional financial intermediaries by removing middle-men from financial transactions.

In many ways, human intermediaries, or gatekeepers, have been a burden on financial transactions for many years. While the traditional financial system is fractured and highly inefficient. DeFi allows for value transfer across several complex financial instruments. Crucially, this occurs even with the absence of centralized entities such as legacy banks, and consequently without the control of a single organization or party. This gives users of DeFi greater levels of control and financial freedom. Before the buzzword “DeFi” came about, “Open Finance” was an umbrella term used to describe many of the features within DeFi.

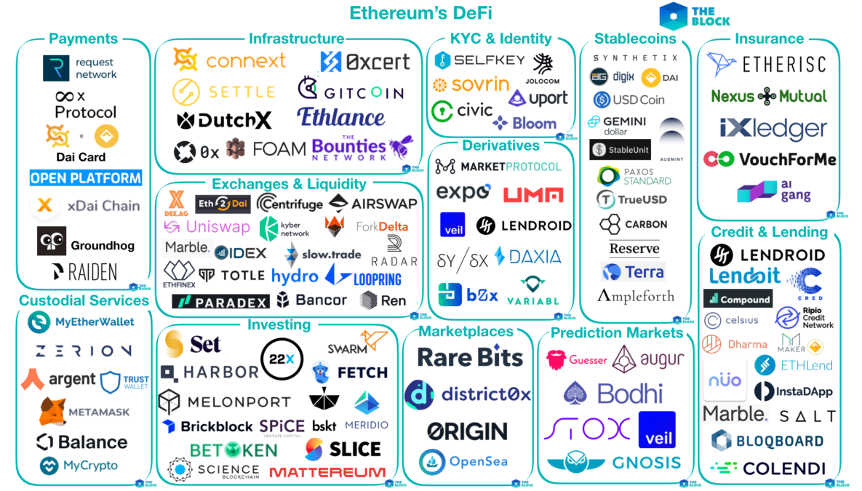

Some of the most common applications in DeFi include lending, decentralized exchanges (DEXs), staking, derivatives, crowdfunding, and insurance. All of these services are made available in DeFi without the need for third-party intermediaries. Instead, DeFi applications are highly automated, and largely rely on smart contracts. You can interact directly with smart contracts to execute trades, token swaps, and much more.

Decentralized Finance on Ethereum

The majority of DeFi applications are built on the Ethereum blockchain, the second-largest cryptocurrency platform. Despite this, however, several other blockchains are emerging that could compete with the DeFi offerings made available by Ethereum. In particular, Cardano, EOS, and Polkadot are platforms that are pushing DeFi both outside of Ethereum, and in a way creating interoperability with Ethereum.

However, there are many good reasons that the majority of DeFi has been built on Ethereum. Ethereum has created a platform that is based around programmable money. As opposed to Bitcoin, which is oftentimes referred to as “digital gold”, Ethereum is the technological solution to the unease felt in traditional financial markets. As the global financial infrastructure is in a state of flux, DeFi is reshaping the global economic landscape by bringing permissionless, borderless, open finance to the masses.

The appeal of DeFi is further compounded by the effects of the COVID-19 coronavirus pandemic. On a worldwide scale, interest rates are flirting with negative returns. Furthermore, unprecedented stimulus packages are devaluing the underlying fundamentals of almost every major fiat currency. DeFi offers a lifeline to those that may have previously been excluded from basic financial services, by offering the same financial tools that are available to everyone.

Why is DeFi So Popular?

Globally, DeFi has created tools for financial freedom. DeFi can be a useful tool for preserving wealth and avoiding harsh capital controls. Furthermore, DeFi platforms allow for fast and cost-efficient remittances outside of the traditional financial system, without KYC.

This is particularly useful for those without access to basic financial services, whether due to a lack of formal documentation, legal status, or because such services are not available locally. DeFi does not discriminate. DeFi promotes financial inclusion by providing access to financial instruments regardless of wealth, status, religion, or geography.

Another factor that makes DeFi so popular is the proliferation of stablecoins. Stablecoins provide a stable price-pegged asset on the blockchain that can be freely traded with other cryptocurrencies. One of the issues with stablecoins is that they are not always reliable. Some stablecoins use algorithms to keep the price as close as possible to $1. However, these valuations can fluctuate, and on occasion, can deviate drastically from their peg.

Stablecoins

Though this is infrequent, it can cause major problems for liquidity providers and yield farmers counting on that stablecoin remaining stable. Thanks to DeFi however, there are now a plethora of different stablecoins available. This means that many DeFi protocols can diversify by creating baskets of several different stablecoins to reduce the risk of such an event. Furthermore, stablecoins are providing the framework for various fintech and traditional banking firms to move into the crypto space.

DeFi also lowers the barrier of entry to participate in derivatives markets and synthetics. By using DeFi platforms like Synthetix, users can gain exposure to all kinds of markets without the need for a broker or other type of intermediary. Want to learn more about DeFi? Join +30,000 students already enrolled in Ivan on Tech Academy, and get 20% off with “BLOG20”.

DeFi For Everyone

Also, DeFi allows users to participate with much smaller investments than are required by many traditional services. As an example of how to earn a passive income with DeFi, an investor could gain access to the price of gold or stocks via the blockchain, without the need for a vault or a brokerage account.

DeFi has attracted the attention of many traditional traders. High yield and volatility are lacking in traditional markets. However, DeFi provides risk to suit every appetite. Trading altcoins is one of the highest-risk investment opportunities available in most markets. However, with correct risk management, trading altcoins can also be one of the most profitable forms of trading. Unsurprisingly, this is attracting attention from traders of all backgrounds. Perhaps one of the most captivating features of DeFi is wrapping services such as renBTC or Wrapped Bitcoin (WBTC).

These services allow Bitcoin hodlers to lock up their assets on an Ethereum protocol and mint ERC-20 tokens that are pegged to the price of Bitcoin. This has brought a wave of new users into the DeFi space. Wrapping services changed the minds of many Bitcoin maximalists about the value proposition of Ethereum. Also, wrapping services have added huge value to the DeFi space by putting idle BTC to work.

Prediction markets have become widely popular in the crypto space thanks to DeFi. The blockchain has created new markets that wouldn’t have otherwise been possible, introducing the concept of prediction markets to a new audience. With DeFi, you can bet on elections, sports, the weather, just about anything!

Although there are many exciting use cases for DeFi, many involve a high level of risk. One of the safest ways to understand the many benefits of this ever-evolving ecosystem is by learning how to earn a passive income with DeFi.

How To Earn A Passive Income With DeFi

UniSwap

One of the easiest ways to learn how to earn a passive income with DeFi is by becoming a Liquidity Provider (LP). Uniswap is a decentralized exchange whereby users can swap ERC-20 tokens directly from a web3 wallet to almost any other ERC-20 token. The key difference between DEXs such as Uniswap and centralized exchanges (CEXs) such as Coinbase and Binance, is that the tokens are made available by liquidity providers.

When making trades on CEXs, fees are paid to the exchange. However, with DEXs such as Uniswap, fees are paid to liquidity providers (LPs). LPs simply deposit an equal USD amount of two tokens, known as a pair, to a liquidity pool. Whenever these tokens are bought and sold, LPs earn a share of the fees generated by the token swaps.

For anyone hodling idle assets, wondering how to put them to work, providing liquidity to a platform like Uniswap is one of the simplest ways of understanding how to earn a passive income with DeFi.

Maker

Maker is one referred to as one of the founding fathers of DeFi. Considered by many to be the first building block on top of Ethereum, Maker was one of the major catalysts for the surge in DeFi adoption. MakerDAO is a decentralized autonomous organization that governs the Maker platform with the MKR token. Token holders can vote on updates to the protocol and events with the two Maker tokens generated, MKR and DAI.

Both the governance token MKR and the stablecoin DAI are ERC-20 tokens. DAI is one of the most popular stablecoins used by those who understand how to make a passive income with DeFi. Unlike stablecoins such as USDT or USDC, which rely on a centralized banking service backing the value of the coin, Maker approaches its stablecoin in a decentralized manner. The MKR token is burned in relation to any fluctuations in the DAI price, with holders incentivized to maintain the DAI token pegged to a $1 price.

The Maker platform offers borrowing and lending services, using smart contracts called Collateralized Debt Positions (CDP). Users can send their ETH to the Maker CDP smart contracts, to receive over-collateralized loans for up to 66% of the collateral value locked. DAI is the most-used decentralized stablecoin across the DeFi ecosystem. Using the Maker platform, you will soon learn how to earn a passive income with DeFi, using the DAI stablecoin in other DeFi applications.

Compound

Compound Finance is a decentralized, algorithmically-operated protocol for the lending and borrowing of cryptocurrencies. The Compound app comprises a sleek user interface and a visualization of the best interest rates for lending and borrowing.

Compound allows its users to borrow against their crypto collateral, or provide liquidity to the protocol. The interest rates for lending and borrowing are based on supply and demand. Compound has no lock-up period, meaning you are free to add or remove liquidity to pools frictionlessly.

As the name suggests, the idea is to earn interest that can be compounded by providing liquidity. Furthermore, users of the protocol earn the COMP governance token. The COMP token kickstarted the summer of DeFi. As the price of COMP increased dramatically, users began to realize the full potential of DeFi. Compound was catalytic in the birth of yield farming, whereby savvy liquidity providers jump from platform to platform in search of the highest yields possible.

Compound has already been audited and formally verified. Since May 2020, Compound has adopted community governance. Holders of the COMP token and their delegates debate, propose, and vote on all changes to Compound.

Aave

Previously known as ETHlend in the launch of November 2017, the peer-to-peer lending platform rebranded to Aave in January 2020. (Fun Fact: Aave is Finnish for Ghost). Aave is one of the most popular DeFi platforms for its ease of use and sleek interface. Additionally, Aave accepts a wide variety of assets and cryptocurrencies as collateral to use for loans. A bonus for users is being able to withdraw collateral at any time, with no mandatory lock-up period.

The protocol operates a bug bounty program – whereby developers are rewarded for finding any bugs or flaws within Aave’s infrastructure. On top of this, Aave has been through extensive auditing of their smart contracts. These security precautions and policies have radiated confidence to users, and in particular, the introduction of flash loans.

Flash loans are uncollateralized loans, that conduct all borrowing, lending, and repayment, all within the same transaction. For those new to the crypto industry, flash loans could be a very risky way to discover how to earn a passive income with DeFi. Do your own research, and make sure you understand the premise of a protocol before using it.

Balancer

The Balancer protocol was released in March 2020 on the Ethereum blockchain. Balancer is an automated market maker (AMM) that generates fees for liquidity providers. As a second layer platform built on top of Uniswap, Balancer allows AMMs to combine several assets into a single liquidity pool, even if they are unevenly weighted.

AMMs facilitate market-making without the need for intermediaries. Instead, algorithms determine the rules of any trades executed on the platform.

Balancer can be viewed as a type of self-balancing crypto ETF. Users can create and manage their own crypto index fund, or provide liquidity to an existing pool. These pools are self-balancing. This means that tokens can be freely exchanged without being removed from any given pool.

One of the key features of Balancer is its Constant Mean Market Maker (CMMM). This allows up to eight different tokens to enter a liquidity pool and be swapped or removed frictionlessly.

Yearn.Finance

Yearn Finance was developed single-handedly by Andre Cronje. The Yearn.finance protocol is a yield aggregator and DeFi ecosystem that maximizes yields for users of the platform. By using other DeFi protocols such as Curve, Aave, and Compound, Yearn.finance optimizes token lending and gives users the highest annual percentage yield (APY) available depending on their risk tolerance. This is done by locating the best returns for token lending across several platforms. All of this happens under the hood, saving a great deal of time and energy for users seeking optimal returns.

Among the various lending and farming opportunities proposed by Yearn.finance is the yPool on Curve finance. User deposits into the yPool are converted into “yield optimized tokens” (yTokens) including yUSDC, yUSDT, and yDAI. This function enables users to earn lending fees from Yearn but also trading fees from Curve. This is because liquidity is routed to various sectors of the DeFi space through yEarn.

Subsequently, Yearn has provided some of the most impressive rates of 2020. The platform is responsible for some of the largest gains made by yield farmers and is deemed by many to be one of the most innovative DeFi applications on the market. Yearn is also considered to be the most decentralized platform in DeFi.

Furthermore, thanks to its limited total supply of 30,000 YFI tokens, demand for the platform’s native token is substantial. In fact, the YFI token reached a staggering $43,000 during September and has shown remarkable strength since. At the time of writing, YFI is trading at $28,465 and has recovered considerably from its early November dump.

How To Earn A Passive Income With DeFi Summary

Decentralized finance is a great way to earn extra income, however, there are things to be wary of. Yield Farming protocols are sometimes referred to as ‘weird DeFi platforms’. Perhaps surprisingly, food meme coins like Yam, Pasta, and Sushi can sometimes offer substantial gains. More often than not, however, they are a one-way ticket to Rekt City. Protocols such as these require so much attention to price movement, that you could view this as more of an active, rather than passive income. Also, these projects are often short-lived and benefit only those who can get in early, before the inevitable post-launch dump.

If you’re interested in reading about more platforms where you can discover how to earn a passive income with DeFi, make sure to check out our article on the Top DeFi Platforms 2020. Ivan on Tech Academy is filled to the brim with educational material regarding all things crypto. First and foremost, the Academy features dozens of blockchain courses – but it also has a wealth of completely free material in the Ivan on Tech Academy blog. For example, are you wondering is it too late to get into Bitcoin, or do you simply want to know how to get a job in crypto? For this and much more, enroll in Ivan on Tech Academy to keep up to date with the cryptocurrency industry!