Anyone who has ever had a job will know that it can be extremely hard to scale your income. Working means you are earning an active income – and you have to trade your time and energy for compensation. Passive income, on the other hand, is when you have income streams that are essentially effortless. The advent of cryptocurrency and Bitcoin have led a growing amount of people to look into how to earn passive income with crypto. This article takes a look at the four main ways how to earn a passive income with Bitcoin in 2020.

Specifically, we’ll take a look at Bitcoin, how it can be used, and the differences between passive and active income. Following this, we’ll explore the various ways to make your money work for you – so you can earn a passive income with Bitcoin.

This article is part of our ongoing Passive Income series. Be sure to check out our coverage of how to earn a passive income with Ethereum, and how to earn a passive income with Cardano. The Ivan on Tech Academy is the world’s leading educational suite for blockchain education. We bring you the most up-to-date content all in one place.

If you’d like to learn more about cryptocurrency and blockchain, we highly recommend you take a look at Ivan on Tech Academy. The Academy is one of the premier cryptocurrency education platforms anywhere in the world, and features a wide range of blockchain courses to suit all skill levels – even those without any previous experience! What’s more, Ivan on Tech Academy features countless completely free blog posts. As such, if you’re wondering is it too late to get into Bitcoin, or if you want to find out how to get a job in crypto, we’ve got you covered! Enroll in the Ivan on Tech Academy today to start your new crypto journey!

What Is Bitcoin?

Unless you have been living under a rock, odds are you have heard of Bitcoin. However, what is Bitcoin exactly? Well, the short answer is that Bitcoin is a type of digital currency generally known as cryptocurrency. In a literal sense, Bitcoin is pieces of code transacted between a network of computers around the globe. As such, Bitcoins are not physical coins or currency – rather, it is a virtual currency.

This deflationary crypto asset is often referred to as “digital gold” or “gold 2.0”, for the similar properties Bitcoin shares with gold. Gold is durable over time and divisible into coins or bars. Bitcoin will function as long as there is an internet connection, and 1 BTC is divisible to 100 million Satoshis (named after Bitcoin’s anonymous creator, Satoshi Nakamoto). Both gold and Bitcoin are fungible, meaning the asset is of the same form, substance, and value regardless of condition or geographic location.

Crucially, both gold and Bitcoin hold deflationary properties, due to the scarcity of supply. Gold is of limited supply, although more gold mines are being discovered. As such, nobody really knows the actual max supply of gold. Conversely, Bitcoin has a hard cap of 21 million coins, which is all that can ever be mined. Furthermore, around 4 million coins have already been ‘lost’ through users losing or forgetting their private keys. Bitcoin has outperformed every other major asset in 2020 by far and is proving to be a store of wealth for many large publicly-traded companies. Consequently, more people than ever are looking into the different ways to make a passive income with Bitcoin, and are learning that trading Bitcoin isn’t the only option!

Active vs Passive Income

Most career choices that pop into peoples’ minds will rely on an active income. Whether you make an active income as a doctor, farmer, fireman, or binman; each income is “active” in the sense that workers exchange time for money. As the name suggests, this involves people actively moving or doing something in exchange for financial gain at the end of it. Time is precious and is the most valuable asset on your side for financial freedom if you know how to use it.

By comparison, most high net-worth individuals have several income streams, but understand that creating seven different active income streams is practically impossible. Instead, their way of increasing wealth and reducing working hours is through “passive income”. A passive income is the inverse of an active, meaning people can make money around the clock, without actively increasing their workload. There are hundreds of different ways to make a passive income, although today we focus on how to earn a passive income with Bitcoin.

Depending upon the form of passive income, it may take a few minutes, hours, days or even months to set up the structure. Fortunately, passive income with Bitcoin requires minimum effort, and creating an account for staking (explained below) just takes minutes. In the ~12 years of its existence, making a passive income with Bitcoin has never been easier than today.

In times of global financial uncertainty, it is vital to educate regarding how the financial infrastructure works. If you want to be one of the successful wealthy individuals, learning about how the stock market and the economy works, will help manage risk and probabilities. It is essential to understand how to earn a passive income with Bitcoin, in order to achieve financial independence through cryptocurrency.

How To Earn A Passive Income With Bitcoin

Trading

There are a variety of options one could use for trading to make a passive income with Bitcoin. Most people associate trading with day-trading, sitting at screens all day, and following the latest price movements. Whilst not entirely inaccurate, there are other ways to learn how to earn a passive income with Bitcoin through trading. For example, algorithmic trading bots.

Trading bots are computerized programmed bots that can run through an exchange and make transactions, without you being present. Algorithmic trading bots are a great way if you want to make a passive income with Bitcoin, as you can program the bot to your choice of parameters. You can decide price points to buy or sell or program for exceptions should there be a flash-crash or spike of price in the charts.

There are some legitimate services online that offer valid algorithmic trading bots for sale. However, sadly, they are heavily-outweighed by the number of scams on the market, offering fake bots to people that promise to make $500 into $350,000 in a week. It doesn’t quite work like that. Trading bots are programmed to the most probable outcome and sometimes, that trade doesn’t turn out that way. On these occasions, you may lose money. The challenge is to, on average, win more than you lose and you’ll be earning a passive income Bitcoin!

The best part about algorithmic trading? It’s available to anyone! Although the programming side may appear intimidating, we take an easy and straight-forward approach. Anyone, regardless of experience, can learn how to make their own trading bots with Ivan on Tech Academy. Enroll today and get 20% off with the code BLOG20. If you would like to try Algorithmic Trading but are unsure, there is also a 7-day money-back guarantee!

Staking

Several crypto wallets and exchanges offer in-app staking. This allows users to earn a passive income with crypto without having to do very much at all. Binance, for example, offers various rates for staking on the Binance app. Rates vary depending on the level of commitment the user wants to make. If you want to make a long-term savings account, you can lock up funds for a set period for higher returns. Also, If your coins are sat idly on an exchange, you might be able to earn a little interest without a lock-up period.

For example, Crypto.com offers various staking rewards depending upon the amount of time staked. For example, if you choose to stake BTC, you could earn up to 6.5% APY on a 3-month lock-up period, or 2% on a flexible basis if staking for under a month.

Another option that is similar to staking is a crypto interest-bearing account through a centralized custodian such as BlockFi. BlockFi, for example, pays up to 8.6% APY compounded for crypto assets. This is by far one of the simplest ways of learning how to earn a passive income with Bitcoin and other cryptocurrencies.

Wrapped Bitcoin

For many long-term Bitcoin hodlers, the world of DeFi can seem exclusive. This is because the majority of DeFi applications run on the Ethereum blockchain. However, one of the most interesting ways you can make a passive income with Bitcoin is by using wrapping services such as Wrapped Bitcoin (WBTC) or the Ren Virtual Machine (renVM).

Wrapped Bitcoin allows BTC to be deposited into a smart contract and used within the Ethereum-dominated DeFi ecosystem. This works by minting ERC-20 compliant tokens, which are pegged to the value of Bitcoin. Similarly, renVM converts Bitcoin into renBTC to be used in very much the same way.

DeFi applications make it easy to make a passive income with crypto. By effectively Bitcoin to the Ethereum blockchain, even Bitcoin maximalists can benefit from the wondrous world of decentralized finance. There are so many opportunities to be had in DeFi that it only makes sense that it is harnessed to understand how to earn a passive income with Bitcoin.

Wrapped Bitcoin in the DeFi ecosystem can be used for staking, lending, and borrowing, much like a normal ERC-20 token. What’s more, Wrapped Bitcoin can also be used for liquidity provision.

Providing liquidity to a liquidity pool can let users earn trading fees. This is perhaps one of the simplest ways to make a passive income with Bitcoin. Decentralized exchanges such as Uniswap are the perfect starting point for liquidity mining. Simply deposit your BTC into a protocol such as Wrapped Bitcoin or renVM, and it can be freely used in the Ethereum DeFi ecosystem.

If you’re interested in decentralized finance and want to learn more, check out our DeFi 101 course at the Academy. Ivan on Tech Academy has all the tools and resources to bring you up to speed in no time, regardless of your current level of knowledge or understanding.

HODLing

One of the most overlooked ways to make an indirect passive income with Bitcoin is simply to hold, or “hodl”, your Bitcoin assets. Although this can sound easy, few manage to follow the simple strategy of buying low, hold on, and wait. Over time, hodling has proven to be a profitable strategy for the vast majority of crypto investors.

Whether you start holding Bitcoin with a one-off purchase or through period investment (dollar-cost averaging), Bitcoin has increased in value substantially over the past years. Despite market volatility, Bitcoin is becoming recognized as a legitimate store of wealth by esteemed investors. What’s more, institutional investment is driving up the price of Bitcoin as publicly-traded companies invest in crypto, and buy up more Bitcoin than is being mined. With that said, however, be mindful that past performance is no guarantee of future success.

What Are Whales?

Bitcoin whales are the big Bitcoin investors, or the big “hodlers”. If you’ve heard the term ‘whale’ in the crypto community, these are predominantly the very early adopters of Bitcoin. These are the people who have sat tight and held their Bitcoins for the past decade, have seen more than a 10,000,000% return. Other ‘whales’ now include larger institutions putting their cash reserves into Bitcoin. One of these Bitcoin whales is Grayscale, which has been buying Bitcoin at a quicker rate than it is being mined each month, for their Grayscale Bitcoin Trust.

According to the DeepOnion community, there are different tiers of Bitcoin whales. These include the following:

- Humpback Whale: +5000 BTC

- Whale: 1000 – 5000 BTC

- Shark: 500 – 1000 BTC

- Dolphin: 100 – 500 BTC

- Fish: 50 – 100 BTC

- Octopus: 10 – 50 BTC

- Crab: 1 – 10 BTC

- Shrimp: <1 BTC

Price Prediction

Bitcoin will continue to rise in value the more it is adopted and the more in-demand it becomes. According to Investopedia, Bloomberg analysts predict the 2020 – 2021 bull run could end with Bitcoin potentially reaching a $1 trillion market cap (or around $50,000 per BTC).

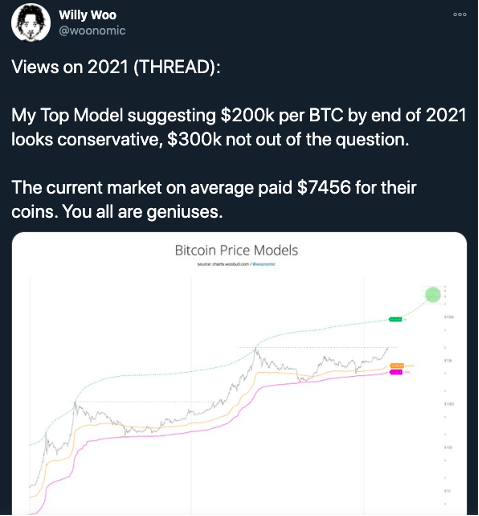

Willy Woo, an on-chain analyst and crypto Twitter influencer, recently tweeted: “a $200,000 BTC at the end of 2021 looks conservative, a $300,000 BTC is not out of the question”.

Hodling Bitcoin has historically proved profitable for more than 95% of investors. Providing you are keeping your private keys safe, and your coins on a secure cold hard storage device, hodling could be seen as the safest way to make a passive income with Bitcoin. With that said, however, this requires Bitcoin to keep increasing in value. If you do not necessarily want to merely hold Bitcoin, then the next passive income tip will likely be more to your liking:

Bitcoin Mining

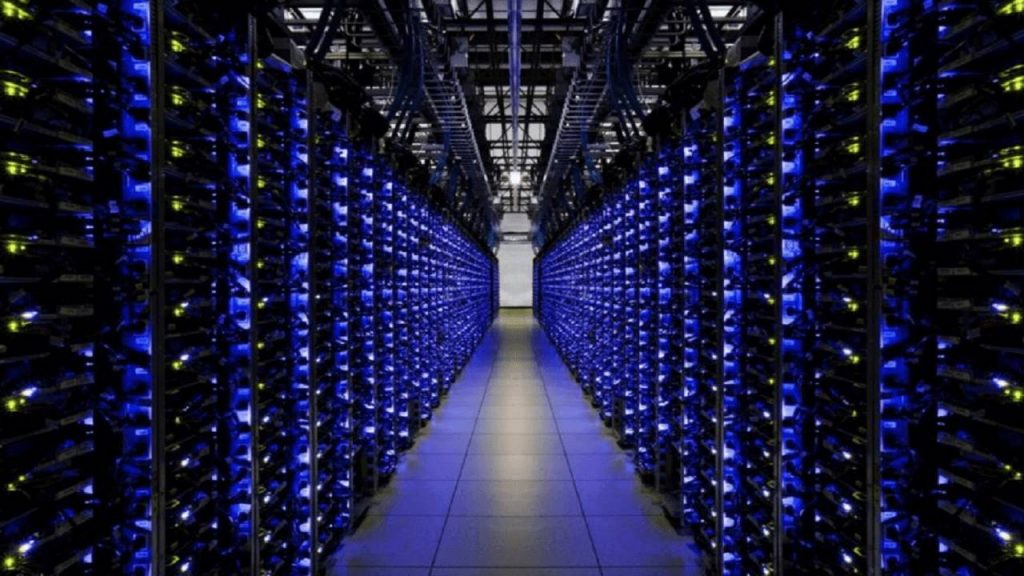

Historically, Bitcoin mining has been a profitable endeavor. However, as the Bitcoin ecosystem has grown, so too has the demand for high-performance mining rigs. Not too long ago, there was a time when you could mine Bitcoin using an entry-level computer. Now though, super-computers are required to process the immense computations required to validate Bitcoin transactions.

Realistically, it is difficult to make a reliable income by mining Bitcoin. Competition is huge, and unless you have access to cheap electricity, crypto mining is expensive. Furthermore, mining rigs quickly run the risk of quickly becoming outdated. This puts you at a serious disadvantage when competing with other miners using more advanced equipment than yours.

In short, unless you have a sizable amount of capital to invest in, and run a high-performance Bitcoin mining farm, it is likely not a profitable way to make a passive income with Bitcoin. Nevertheless, if you are one of the lucky few with access to cheap electricity and suitable mining equipment, Bitcoin mining can be a remarkably consistent passive income stream.

How To Make A Passive Income With Bitcoin in 2020 Summary

Now that you understand how to earn a passive income with Bitcoin, you can put your coins to work! Furthermore, you can broaden your horizons by entering the world of DeFi and using some of the amazing decentralized applications available. These four main ways to earn a passive income with Bitcoin, however, are just a start. The crypto industry is currently evolving, and the DeFi field in particular continues to provide new innovative ways to construct a passive income stream.

If you’d like to learn more about how to earn a passive income with DeFi, check out our DeFi-101 course on the Academy. Also, be sure to check out our piece on the Top DeFi Platforms 2020! As always, Ivan on Tech Academy is your one-stop-shop for the highest quality education available. We regularly update our courses, bringing you the most relevant and up-to-date educational material.