Cryptocurrencies are growing bigger and bigger by the day, and it is more popular than ever before to trade in these virtual currencies. The most well-known cryptocurrency out there is Bitcoin. Bitcoin was the trigger that started the cryptocurrency trend, and it is common to associate crypto with Bitcoin. The increase in interest also results in new creative strategies such as, for example, hodling.

The value of Bitcoin is continually changing, but the increase in value since its inception is quite staggering. In the beginning, a single Bitcoin was worth next to nothing, and at one point in 2017, the value reached almost $20,000. Following this, the value of Bitcoin has continued to hover around levels previously inconceivable.

The value of a Bitcoin was approximately $11,714 in the past week, which means the value has almost halved since 2017. Since this, Bitcoin has taken a minor tumble towards levels below the $11,000 line. However, if we look at Bitcoin's price development since March, the numbers look promising. About halfway through March, the value of Bitcoin was around $4,944, and as mentioned before, the last week’s value was around $11,714. This is an increase in the value of about 137% in just five and a half months.

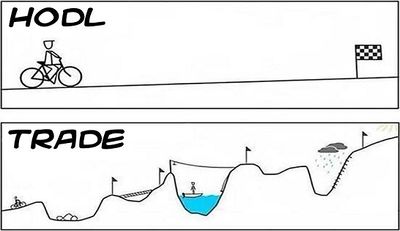

There is no doubt that Bitcoin's value has increased in the long run, but what is even more interesting is the volatility of this currency. We have seen several ups and downs for Bitcoin throughout the years, and they can be very drastic. This poses a significant problem for investors since it means that the risk is higher. Predicting when cryptocurrencies go up and when they go down is not always profitable in the long run since it is hard. People buying and selling at the wrong time is problematic since people lose money doing this.

The problem with the high volatility is the reason for the strategy the community is calling “hodling”. But what is hodling, and why is this strategy profitable?

The Origin of Hodling

Yes, you are reading the word "hodling" right, and it is not a spelling mistake, or at least not anymore. The word was coined when a frustrated Bitcoin trader made some arguably terrible trades and went on a rant about it on a crypto forum. The trader, by the name of GameKyuubi, wrote a post titled "I AM HODLING." This is a famous misspelling that is often said to be the the origin of the term hodling, and it was all a result of a drunk trader going on a rant on the internet.

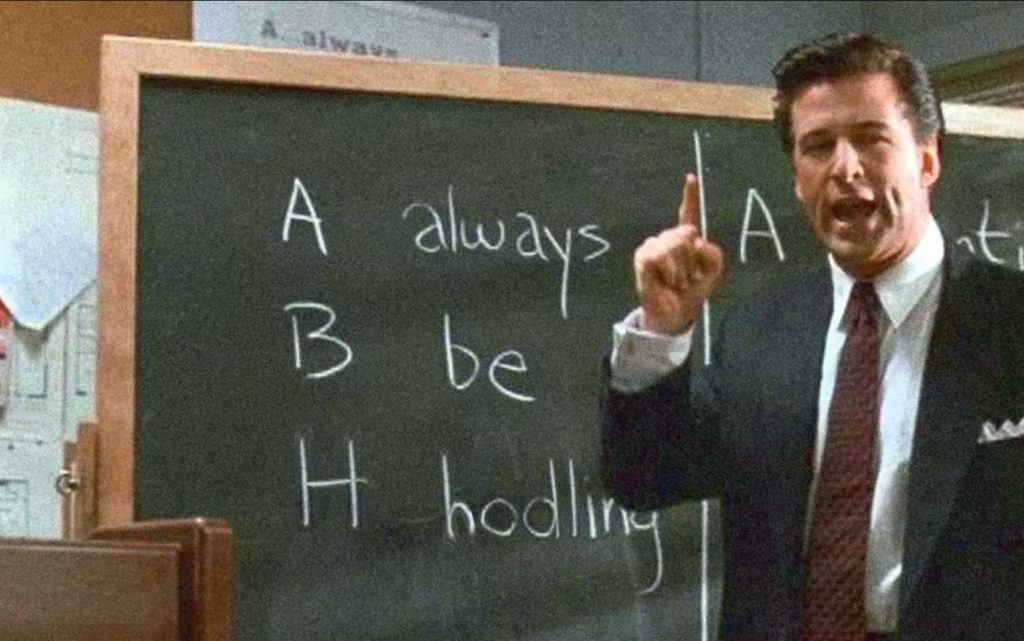

The idea behind the strategy is basically to hold Bitcoin. If you try to sell when the market is up and buy when it is down, it will end badly for you, or so did at least GameKyuubi reason. GameKyuubi realized that he/she did not have the necessary skills to day trade and therefore needed another strategy. GameKyuubi also explained that since Bitcoin is a zero-sum game, arguing that other traders can only take your money if you are selling.

Therefore, the phrase “hodling” is just a spelling mistake of the word "holding," which would refer to someone holding Bitcoin for a longer amount of time. But instead of saying that someone is "Holding Bitcoin," the community prefers to call it "hodling Bitcoin," all due to the drunken rant of a trader.

The Hodling Strategy

Soon after the post by GameKyuubi, the term hodl, or hodling, became popular. Furthermore, the strategy is based around holding Bitcoin or other cryptocurrencies for a longer period of time. Hodling does not look fondly on short term trading strategies. The reason behind this is the same as the reason why GameKyuubi decided to hodl Bitcoin instead of trying to sell it at the right time. This means that traders would most likely fail to time the market's ups and downs and lose money in the process. In day trading, timing is everything, and if the timing is off, the funds will be lost.

The strategy of hodling also goes well along with the fact that Bitcoin is extremely volatile. From May 2013 until the end of the same year, the value increased with around 788% and fell by more than 70% in 2014. This shows the extreme rollercoaster Bitcoin has been on, and in order to make money off the volatility, timing is critical.

Buying and selling when an asset is as volatile as Bitcoin is tough if you want to profit. And even if you can profit by trading, you likely miss out on money you would have gained by just hodling Bitcoin instead. Hodlers can escape the volatility, by simply hodling Bitcoin.

FOMO and FUD

By hodling, Bitcoin traders can escape two fundamental fears that can be damaging; FOMO and FUD. FOMO is the "Fear Of Missing Out," which means that people are afraid of missing out on an opportunity. Between the beginning and end of 2013, when Bitcoin surged and increased with around 788%, many people might have felt like they did not want to miss out on the opportunity. This is a clear example of when FOMO can come in to play, and people invest when the price is high. Imagine investing in 2013 to see your Bitcoins fall by 70% the following year.

FUD, on the other hand, stands for "Fear, Uncertainty, and Doubt." And unlike FOMO, FUD results in people selling their assets too early. So by just hodling on to the asset, this is an uncertainty that can be avoided.

Hardcore crypto-believers, also known as maximalists, hodl cryptocurrencies not only to avoid FOMO and FUD but since they believe that regular fiat currencies will be replaced by crypto. Because they think that cryptocurrencies will replace the current system, they deem fiat currencies unnecessary since they will lose all value. And this is why they do not sell their cryptocurrencies and hodle instead.

How to trade Bitcoin

If you are interested in buying Bitcoin and adopting the hodling strategy, one vital step is to acquire cryptocurrency in the first place. One thing that needs to be decided is how you would like to deal with Bitcoin. There are two different ways: firstly, buying the actual currency, and secondly, speculation on the value of a cryptocurrency. The latter is known as CFDs, which is a leveraged deposit. A leveraged product such as CFDs can magnify profits and losses, meaning there is a higher risk factor with a higher reward.

Wallet

The first thing to do is to set up a Bitcoin wallet. A wallet is used to store your Bitcoin until you are ready to make a trade. There are several different wallets out there, and they can have unique features, so it is up to you which one to choose. Some might focus more on security; meanwhile, others are more suited for trading since more platforms accept them.

Some of the wallets are directly connected to exchanges, which makes it easier to make trades. One of the platforms providing this kind of service is Coinbase. However, using a wallet that an exchange provides can have a drawback. If the site, for example, experiences problems, it means that you might not be able to access your assets. The other option is to set up a wallet that is not directly tied to an exchange.

Some examples of wallets are Exodus, Bitcoin Core, and Mycelium.

Exchanges

To buy cryptocurrencies such as Bitcoin a cryptocurrency exchange is the way to go. The exchange works as a line between the crypto and the fiat world. Crypto exchanges work in the same way as a stock exchange except that the assets traded are cryptocurrency instead of stocks and other financial instruments.

There are several different exchanges out there, some for trading fiat currency to cryptocurrency and some for crypto-to-crypto exchanges. The fiat to crypto exchanges helps to trade regular fiat currency for cryptocurrencies such as Bitcoin or Ether. Some of the most used ones are Kraken, Bitbuy, and Coinbase. These are designed to be beginner-friendly, and by using, for example, Bitbuy, you can easily trade your money for Bitcoin, Ripple, or Ether.

Once you have acquired cryptocurrency, you can also make deals on a crypto-to-crypto exchange. On these exchanges, it is possible to trade one cryptocurrency for another. So, for example, it is possible to trade Bitcoin for Ether and vise versa. An example of a crypto-to-crypto exchange is Binance. Most of the crypto-to-crypto exchanges are more designed towards users with more experience trading in crypto. This means that they are not as user friendly as the fiat-to-crypto exchanges.

Payment

Once you have set up a wallet and chosen an exchange that suits you, the next step is to choose a payment method. Most exchanges accept several different payment methods, but one thing to be wary about is scam sites. Try to pick one of the most trustworthy sites to avoid losing your money to a scammer.

Coinbase, for example, allows both credit and debit card payment, direct bank account transfers, and they also recently added PayPal as an option. Since all these methods work fine, it is up to you to pick a method that you are comfortable with.

Once all of this is set up, you can get right to buying your first Bitcoins or other cryptocurrencies. One important part to remember is the fact that one Bitcoin is quite expensive. However, the exchanges allow you to buy fragments of Bitcoin so that it is more affordable to everyone out there. It is not uncommon to buy just parts of a single Bitcoin, so do not worry.

If you are purchasing on an exchange like Coinbase, the Bitcoins you purchase will be directly transferred into your Coinbase wallet. As mentioned above, one option is to leave the assets in this wallet, but if the site were to experience maintenance problems, it would be hard to access the cryptocurrency. As an alternative, you can transfer the assets to an external wallet that you create off the site. However, when moving your assets from a wallet such as the one in the Coinbase system, they will take a small fee. But this fee is small and will barely put a budge in the assets you are transferring.

Start Hodling

Once the first asset is acquired, you will have to decide what you want to do with them. One strategy is to try to make a profit by day trading, but this can be hard when someone is new to the game. The volatile nature makes everyone prone to FOMO and FUD, which can make even experienced traders uneasy.

In contrast to day trading, hodling is an easier strategy. By basically holding on to assets during a longer period of time, you, as a trader, can neutralize the volatility of most cryptocurrencies. But if you decide to go for the hodling Bitcoin strategy, it is essential to stick with it. It can be easy to get cold feet and want to sell when the value of Bitcoin surges. Then it is vital to remind oneself that this is a long term strategy.

Looking over a span of five years, the hodling strategy for Bitcoin has been super useful. At the beginning of 2015, the price of one Bitcoin was just above $300. Just five years later, the value of Bitcoin has increased with about 3,600%. In the same amount of time, Dow Jones only saw an increase with about 60%. The development of Dow Jones pales in comparison to that of Bitcoin. However, Dow Jones is just an industrial average of several companies. But none-the-less, investing in Bitcoin five years ago would have resulted in a significantly higher payoff than an index fund tied to Dow Jones.

Hodling Conclusion

The numbers speak for themselves, showing that a hodling strategy for Bitcoin would have been profitable during the last five years. The history of Bitcoin is definitely not a guarantee that the trend will continue. However, it does not look like cryptocurrencies will become irrelevant; in fact, they will most likely continue to grow even more prominent, especially in the long term.

If you would like to learn more about hodling, Bitcoin and Blockchain, feel free to join the number one blockchain education platform Ivan on Tech Academy. The academy offers a selection of blockchain courses for both beginners and more experienced developers alike.