To kickstart this article, we’re going to dive straight into the main topic and explain blockchain analytics. From there, we’ll take a section to discuss the importance of leveraging on-chain data as a foundation for businesses and investment decisions. After that, we’ll explain how it works. To top things off, we’re going to explore five common blockchain analytics use cases:

- Blockchain analytics for traders

- Teams and businesses

- Detecting illegal activities

- Web3 development

- Supply chain solutions

So, without further ado, let’s dive straight into the intricacies of blockchain analytics!

What is Blockchain Analytics?

Before exploring the ins and outs of blockchain analytics, we must go back to basics. So, let’s initiate this guide by looking at what a blockchain is and how it works.

A blockchain is an immutable, distributed, and usually decentralized cryptographic ledger. Each blockchain is made up of blocks of data chained together in chronological order. Due to the decentralized and transparent nature of public blockchains, anyone can examine the transactions occurring in real-time to understand what’s happening on a network.

Being decentralized means no single entity controls or manages the system. Instead, an entire blockchain database is usually distributed among thousands of network participants from all over the world, and they optimize resource distribution, lower the risk of system failure, and reconcile data.

Now, with a brief understanding of blockchains and how they work, what is blockchain analytics?

Blockchain analytics is the process of identifying, collecting, interpreting, analyzing, and visualizing the publicly available information stored on a blockchain network. It involves using techniques and specialized software to extract this information to gain insight into user behavior, transactions, and other aspects of a blockchain network. Doing so helps traders, regulators, developers, law enforcement, and users understand historical and current events in real time.

This level of transparency and functionality in data analysis and management isn’t possible with conventional databases. This is mainly an effect of centralization and the fact that only a limited number of people can access the servers involved.

Consequently, blockchain networks and blockchain analytics offer numerous advantages compared to what’s possible in traditional centralized networks, especially in an ever-chaining world with unpredictable financial markets and tightening regulations.

Why Analyzing Blockchain Data is Important

Data is digital oil, and there is no secret that some of the largest conglomerates in the world harness vast quantities of data to guide their business decisions. Consequently, with such large amounts of data available through public blockchain networks, disregarding this resource would be a huge mistake. And by analyzing historical and current events, companies using blockchain analytics can gain insight into user behavior and overall trends to get an edge in the market.

Also, companies levering blockchain technology in any way in their business – regardless of industry – need a clear and complete view of everything happening in an ecosystem. This is essential for maintaining efficiency and compliance within the system.

Furthermore, this data is not exclusive to businesses; individual investors can also use this information. In doing so, they can base investment decisions on irrefutable real-time data to stay on top of the market and maximize their cryptocurrency gains.

Now, with an overview of blockchain analytics and why it’s important, let’s answer the question, how does blockchain analytics work?

How Does Blockchain Analytics Work?

In order to make the data stored on a blockchain network actionable, it needs to be extracted, analyzed, and processed into convenient formats. The raw blockchain data would need to be queried from nodes and decoded to ensure the accuracy of all transactions and events.

However, this is easier said than done, and if you’re somewhat familiar with the space, you know it’s a hassle to query a blockchain network. Fortunately, this is where blockchain analytics tools enter the equation.

Blockchain analytics tools handle the hassle of querying, indexing, and analyzing publicly available blockchain information. Moreover, these platforms usually also provide helpful visual representations of the data so it’s more easily understood.

There are many different blockchain analytics tools, and they often have their own unique niches. For instance, a tool like Moralis Money focuses on token data, making it the ultimate crypto scanner for traders. While Etherscan is more directed towards transactions, making it a valuable tool for Web3 developers.

Nevertheless, to understand how blockchain analytics can be used, let’s explore some different types and use cases in the next section.

Types and Use Cases of Blockchain Analytics

The types and use cases of blockchain analytics are endless, and in this guide, we’ll cover the following five:

- Blockchain analytics for traders

- Teams and businesses

- Detecting illegal activities

- Web3 development

- Supply chain solutions

So, with no further ado, let’s start with the first of our use cases: blockchain analytics for crypto traders!

1. Blockchain Analytics for Traders

All transactions occurring on a public network like Ethereum are recorded and stored on the blockchain. As such, by studying this data, you get market updates in real time, providing you with an advantage over other traders. For instance, with this info, you can identify freshly minted coins, see what tokens are being bought by other traders, identify growing trading trends, understand market sentiment, and much more.

However, you need a tool that effectively turns blockchain information into actionable token-related data, which is where Moralis Money enters the picture!

Moralis Money stands out as the premier alternative among the industry’s best crypto trading tools. It leverages real-time, on-chain token data to give true market alpha. As such, with this tool, you can find new crypto projects early to maximize the return on your investments.

Note: We’ll explore Moralis Money further in the ”The Ultimate Blockchain Analytics Tool for Traders – Moralis Money Explained” section below.

2. Teams and Businesses

Crypto teams and companies can leverage blockchain data for business intelligence, user/product analytics, and even to grow their ecosystem. This is possible as they can study the activity of current and potential users to get insight into their needs and habits.

What’s more, with on-chain analysis, both teams and businesses can also get a comprehensive overview of the crypto market as a whole. And by studying the available blockchain data, they can use the information regarding, for instance, growing market trends to make more accurate business decisions.

3. Detecting Illegal Activities

Law enforcement agencies were one of the early adopters of blockchain analytics. These organizations can use on-chain analytics to detect surges in illegal activities within the crypto space. Once detected, they can start investigating the matters and track down criminals on the blockchain.

There are blockchain analytics tools and companies like Chainalysis specializing in these matters. For example, Chainalysis can identify wallets likely linked to illegal activity. As soon as a wallet is flagged as illicit, the information is given to authorities for investigation.

4. Web3 Development

Another prominent example of blockchain analytics use cases is Web3 development. To make Web3 development easier, programmers can leverage blockchain analytics tools when building decentralized applications (dapps) and other platforms. With an on-chain analytics tool, they can look up transactions to ensure they worked as intended, examine smart contracts, and much more.

For instance, one such tool is Etherscan, a popular blockchain explorer for the Ethereum network. With this tool, developers can easily look up specific transactions, wallets, and smart contracts on both the Ethereum mainnet and testnets.

5. Supply Chain Solutions

Many organizations are currently experimenting with integrating blockchain technology into their supply chain practices. In doing so, they can replace manual record-keeping with automated smart contracts. In return, they lower the margin for human errors and unnecessary delays.

However, for this to work effectively, they also need to implement blockchain analytics to effectively track items within their supply network. And with blockchain analytics, companies can more easily conduct detailed inspections at any time and reduce the risk of potential problems in the future.

The Ultimate Blockchain Analytics Tool for Traders – Moralis Money Explained

When it comes to trading crypto, Moralis Money stands out as the premier blockchain analytics tool. Moralis Money leverages on-chain data in real-time, proving true market alpha. As such, by using this tool, you can effortlessly find the next 1000x crypto and 100x meme coin before everyone else to maximize your altcoin gains!

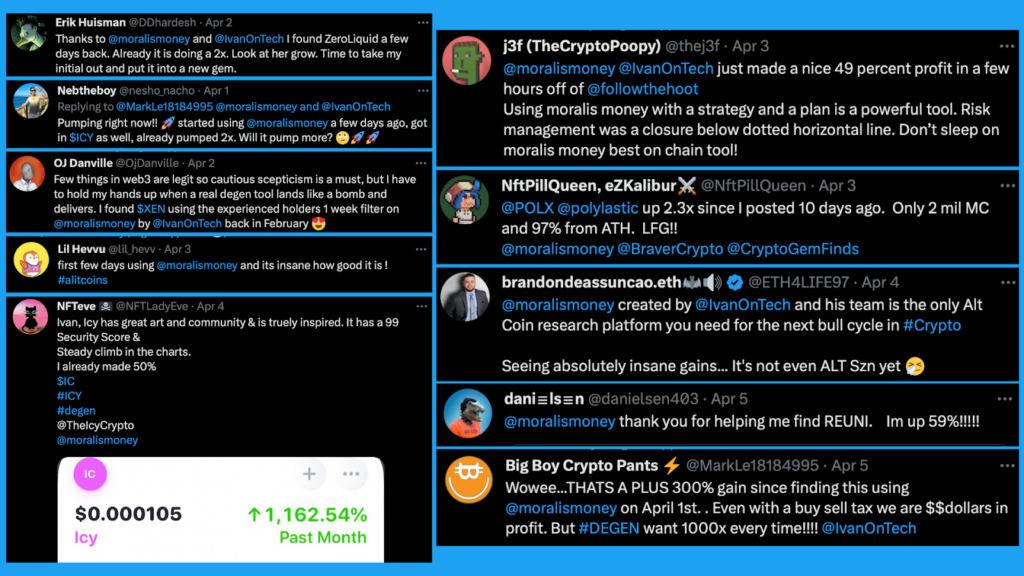

However, you don’t have to take our word for it; check out some Twitter testimonials of happy Moralis Money users already making significant gains:

So, how is this possible?

Well, Moralis Money has three core features:

- Token Explorer: With Token Explorer, you can pick and choose among 15+ filters to create unique search strategies. This means you can target precisely the tokens you’re after and find altcoin gems before everyone else.

- Token Alerts: Token Alerts lets you set up email notifications to monitor individual tokens and the market. As such, this feature makes Moralis Money one of the best crypto monitoring tools available.

- Token Shield: Token Shield provides a comprehensive security evaluation for all coins, allowing you to effectively dodge cryptocurrency scams.

If you’d like to learn more about using these features, check out our article on three essential crypto trading tips!

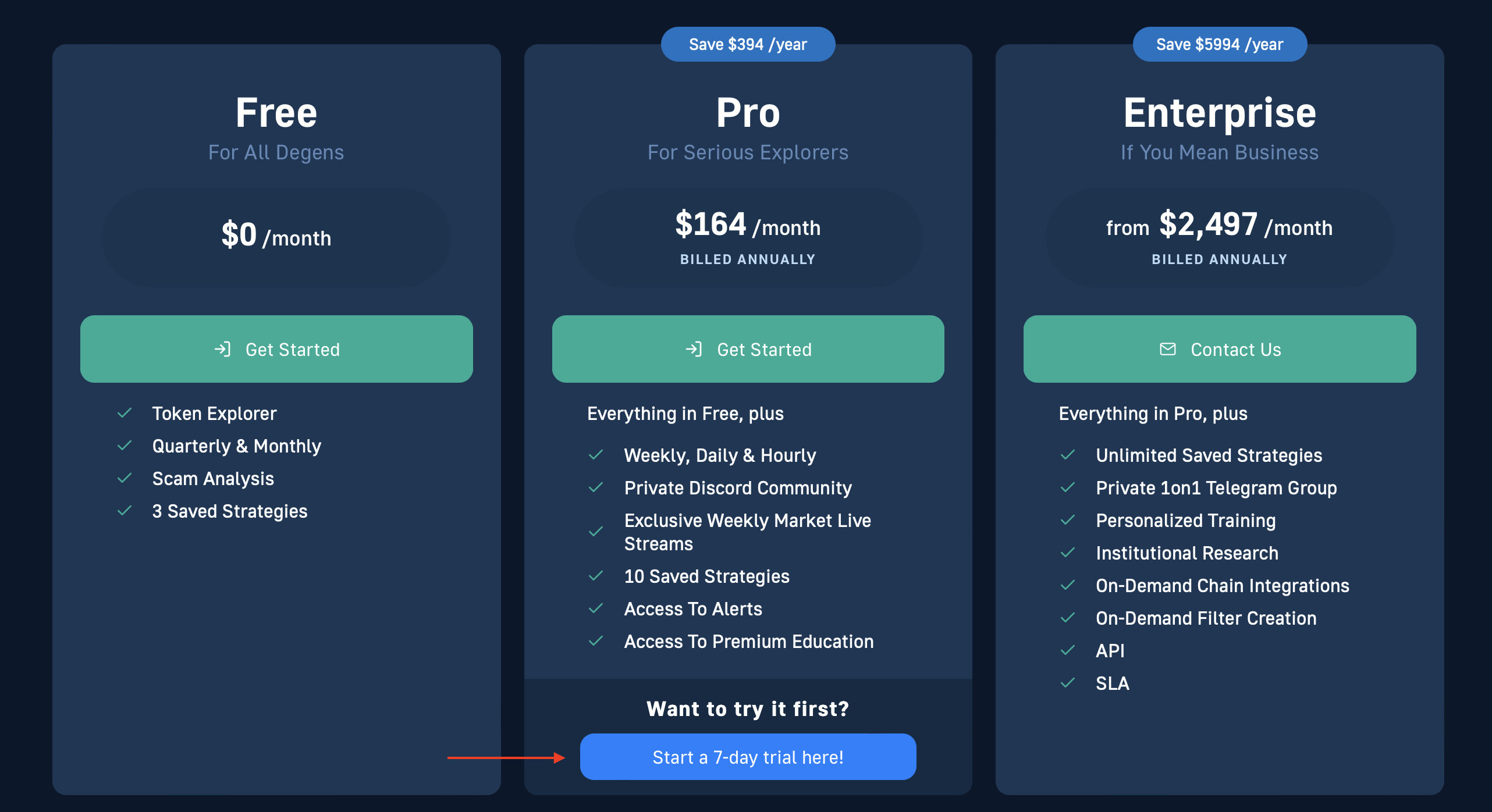

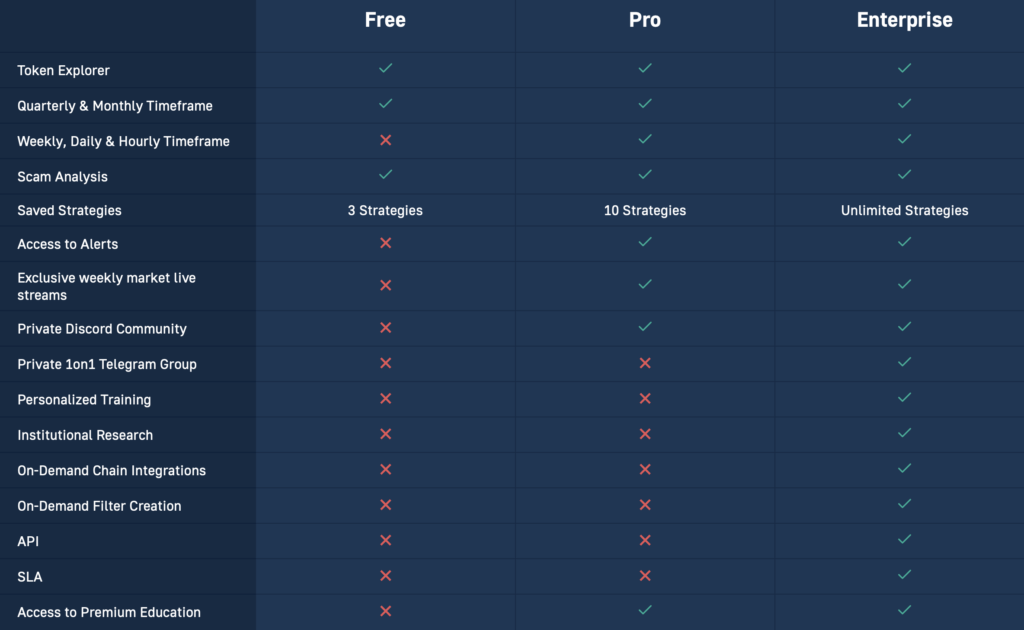

Also, did you know that you can supercharge these features with the Moralis Money Pro plan? Becoming a Pro user provides narrower timeframes for all metrics, access to a private Discord server, and much more:

If you’d like to try out Moralis Money, you can now use the interactive iframe widget below. Apply a premade filter or set up your own strategy by combining the filters of your choice:

Summary: What is Blockchain Analytics and How Does it Work?

In today’s article, we explored the ins and outs of blockchain analytics. In doing so, we learned that it’s the process of accessing, analyzing, and interpreting blockchain data. This information can be used in everything from investment and business decisions to Web3 development.

However, accessing, querying, and interpreting blockchain data is a hassle, which is where the demand for blockchain analytics tools comes from. Furthermore, there are many different tools for analyzing blockchain data, and they often have their own unique niches. For instance, Moralis Money focuses on proving token data in a readable and understandable format, making it the ultimate tool for crypto investors. In comparison, a tool like Chainalysis can be used by law enforcement agencies to detect illegal activities.

In addition to exploring blockchain analytics, we also covered five common use cases:

- Blockchain analytics for traders

- Teams and businesses

- Detecting illegal activities

- Web3 development

- Supply chain solutions

Lastly, as a bonus, we gave you a quick introduction to Moralis Money – the #1 blockchain analytics tool for crypto traders. In doing so, we covered the Token Explorer, Token Alerts, And Token Shield features. With these features, you can easily find tokens before they pump and boost your altcoin gains significantly.

Also, remember that you can supercharge the features above with the Moralis Money Pro plan. The pro plan provides loads of benefits, including narrower timeframes for all search parameters, premium education, access to a private Discord server, and much more.

If you wish to, you can now try Moralis Money by signing up for our seven-day Pro plan trial. All you have to do is visit our pricing page and hit the ”Start a 7-day trail here!” button: