In the first part of today’s article, we will explain what the Lybra Finance project is all about. This is where you’ll learn the gist of the eUSD token and the LBR crypto coin. We’ll look at the mechanics and unique aspects of the project and its stablecoin. You’ll also be able to determine whether you should consider investing in eUSD or LBR.

To assist you even further, we’ll take a closer look at the price of the LBR token. As for the eUSD token, aside from some minor deviations, it is pegged at $1. Although it is pegged, it’s worth exploring this new stablecoin’s real-time, on-chain metrics before using your ETH as collateral. As such, we’ll share the Moralis Money eUSD and LBR pages.

However, stablecoins remain a highly risky business, so it might be better to focus on the ultimate high-risk, high-reward venture, which is what Moralis Money’s core features are all about!

What is Lybra Finance?

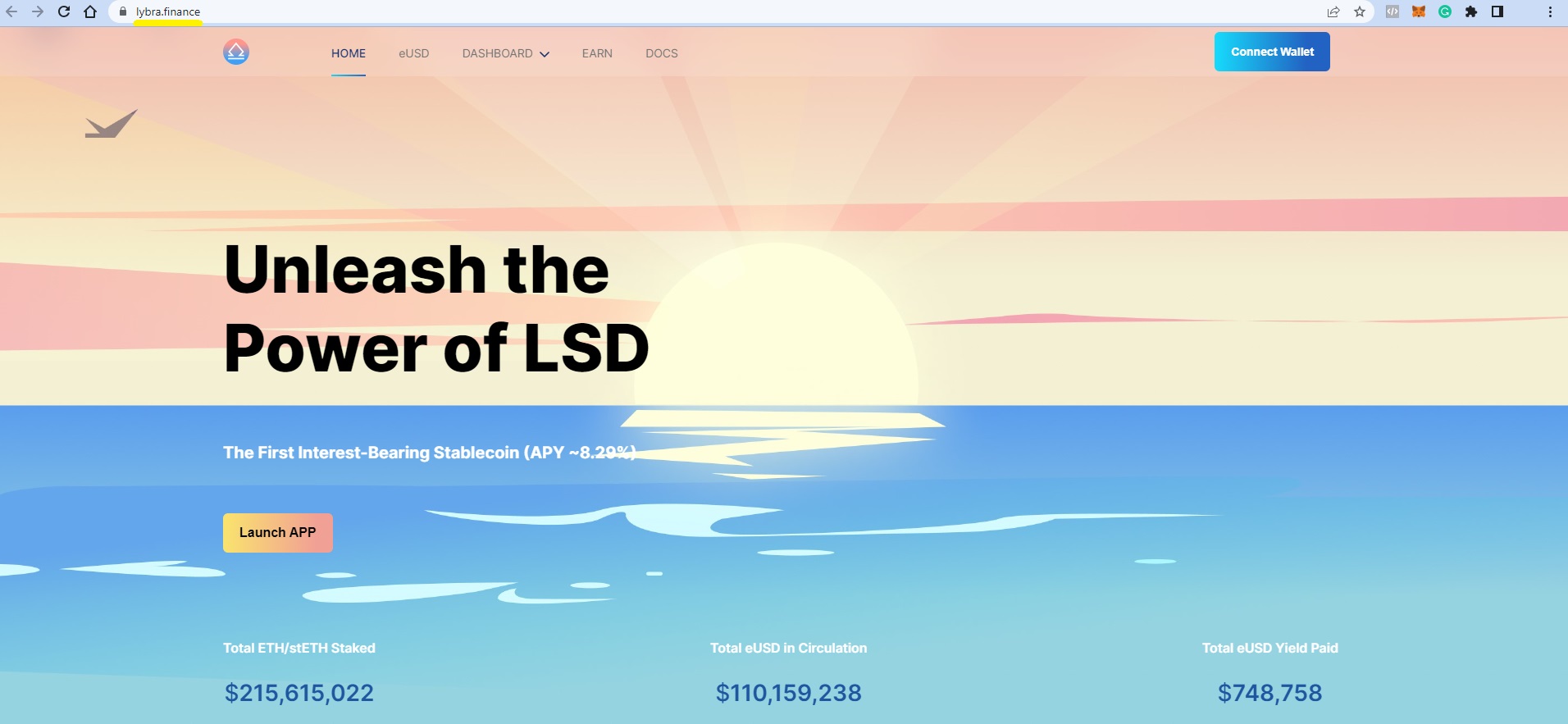

Lybra Finance is a new crypto project that strives to offer a truly decentralized, DAO-governed stablecoin. The project went live in May 2023 with two cryptocurrency assets, the eUSD token, and the LBR token. The former is the first interest-bearing stablecoin, and the latter is the Lybra DAO’s utility token.

The official Lybra Finance website breaks things down into as few steps as possible. So, here’s how the core team explains the process in the most simple manner:

- How Lybra works in three steps:

- Step 1: Deposit ETH/stETH as collateral.

- Step 2: Mint the eUSD token – mint/borrow eUSD against your ETH collateral.

- Step 3: Collect interest or spend eUSD in other DeFi protocols. By holding eUSD, Lybra Finance promises an APY of approximately 7.2%.

- Adding LBR into the picture bears the following four options to earn money via Lybra:

- Hold eUSD and receive yield.

- Mint eUSD and earn rewards in the LBR token.

- Hold and stake LBR and share protocol revenue.

- Collect LP rewards by providing eUSD/ETH liquidity.

So, by simply holding eUSD in your wallet, you can earn a yield (7.2% at the time of writing). According to the information on the project’s official website, Lybra automatically calculates interest for you.

How is the eUSD Token Pegged to 1 USD?

When dealing with stablecoins, asking yourself how the token is pegged to 1 USD is important. Lybra answers this question by explaining two scenarios: eUSD above $1 and eUSD below $1. Essentially, they explain that users regulate the price by minting new eUSD and selling it when it is above $1 and by buying eUSD at the discounted price if/when it falls below $1. Lybra promises that users can always redeem one eUSD for $1 worth of ETH/stETH.

So, just by these types of supply and demand counterbalance, the eUSD stablecoin is pegged to $1.

How Can the eUSD Token Be Earning Interest?

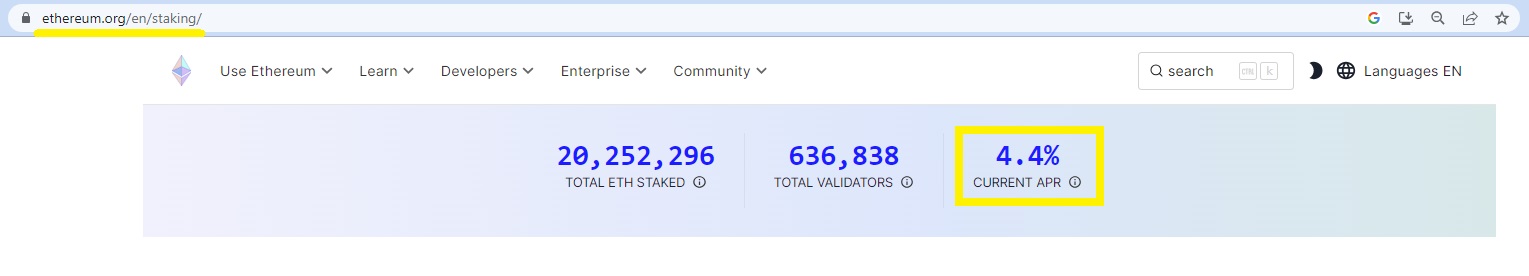

The interest earned from eUSD comes from the Lybra protocol’s interaction with stETH and liquidity staking derivative (LSD). So, the Lybra protocol converts every ETH deposited into stETH. The latter earn yield from staking on the Ethereum network, which is currently at 4.4%.

Why Use Lybra Finance?

Lybra themselves provides the three main reasons why to use them:

- Interest-Bearing Stablecoin – A user-friendly way to automatically earn interest on their stablecoin (eUSD).

- Leveraged Long on ETH – By depositing ETH as collateral and minting eUSD without borrowing fees or interest, users can use eUSD to buy more ETH. According to the Lybra team, this is an effective way to go on a “leveraged long” on ETH with zero cost.

- Decentralization and Stability – By only accepting ETH and stETH, Lybra ensures a higher level of decentralization and stability.

- Token Incentives – The LBR tokens are additional incentives for those who deposit ETH and mint eUSD. LBR can be an additional source of income.

If you are actually considering using Lybra Finance, make sure to visit their documentation. There, you can dive deeper into the mechanisms and the other ins and outs of the Lybra protocol. Furthermore, if you want to access the Lybra dashboard, just hit the “Launch APP” button on the homepage.

However, it’s worth pointing out that you can trade eUSD and LBR without using the Lybra dashboard. Simply access the most popular DEXs and find relevant trading pairs.

EUSD Token Price

Since this is a fairly new stablecoin, the price of eUSD still tends to fluctuate around the $1 mark. Most of the time, these fluctuations are in the range of one or two cents; however, you can see several spikes on the chart below. The highest eUSD has reached so far was $1.34 on June 17th, 2023. However, the spikes you can see in the chart are around $1.063. On the lower side, the eUSD token dipped to $0.96.

All in all, eUSD is a stablecoin. So, unless you plan on using the Lybra Finance functionality to mint eUSD, trading that crypto asset makes little sense.

LBR Price

The LBR token is a much more volatile cryptocurrency that can offer interesting trading opportunities. If you look at the LBR’s price chart below, you’ll instantly understand what we mean.

Just by looking at the minimum and maximum prices of the LBR token, you can see that it has already performed a 50x rally. After it started trading on Uniswap on May 2nd, 2023, at $0.4298, the token didn’t get much traction. Despite the low volume, the token managed to increase by more than 60% within the first day. However, it pulled back in the following days, reaching the token’s current all-time low (ATL) at $0.1080.

But the token didn’t stay that low for long as it found proper support at the $0.2-ish level. After a 50% increase, that support got retested and managed to hold. On May 12th, 2023, LBR went on a massive run from that level. This rally consisted of several legs. For instance, the 36-hour breather around the $0.44-$0.7 region was a nice entry area. Many Moralis Money Pro users spotted LBR’s increasing on-chain momentum and entered at this point. As such, they were able to ride the rest of the multi-100% increase. Though the total rally from the aforementioned support at $0.2-ish offered a 25x price increase.

However, only traders with high-quality, real-time insights were able to exit near the top for the largest possible gains. After all, LBR pulled back rather fast and hard. After an 88% retrace, the token bounced off the previous resistance at the $0.6-ish region. Next, it increased by 300% and is currently trading between the support at $1.16-ish and resistance at $1.8-ish. At the time of writing, LBR sits at $1.2933.

Consider Real-Time, On-Chain Data for LBR and the eUSD Token

If you want to invest in or trade eUSD or LBR after going through the above information, don’t be too hasty. After all, both fundamental analysis (FA) and technical analysis (TA) do not give you the ultimate edge. The latter comes in the form of reliable, real-time, on-chain data.

After all, on-chain activity always precedes price action. Things like how many token holders there are, the number of net buyers, and many other metrics provide invaluable insights. Insights like that are important, especially when you look at them on different timeframes and determine how they are evolving over time.

As a simple yet powerful guideline, use these rules:

- If the token is gaining on-chain momentum, the price will move to the upside.

- If the token is losing on-chain momentum, the price will move to the downside.

By looking at the real-time, on-chain data, you can get your timing right. As you may know, proper timing is the key to successful investing and trading.

Fortunately, you can use Moralis Money token pages to explore these kinds of insights in a user-friendly manner. You can do so by pasting any token’s address into the search field. However, when it comes to the eUSD token and LBR crypto coin, you can use the interactive widgets below.

Aside from real-time, on-chain data, these pages provide other details regarding the crypto assets in question. As such, they serve as perfect DYOR tools.

Here’s the Moralis Money page for eUSD:

Here’s the Moralis Money page for the LBR token:

If you already know which altcoins you want to explore, Moralis Money token pages are the tools for you. However, in most cases, traders don’t know the best altcoin opportunities at any given time. That’s where Moralis Money’s primary function enters the scene!

Going Beyond Lybra Finance with Moralis Money

Suppose your own research tells you that the 7.2% APY is worth putting your trust in Lybra Finance; great! However, the way we see things, stablecoins do not offer a great risk-to-reward ratio. As such, we prefer to focus on finding the best altcoin opportunities early.

Of course, this is by no means financial advice. However, if you get your timing right, there are no other financial opportunities like trading/investing in altcoins!

After all, the average altcoin tends to perform a 50x-70x price increase during bull markets. Hence, entering altcoins with strong on-chain momentum early and holding them throughout the bull run can be a great tactic. In fact, that’s the method we used to ride most of EGDL’s, MATIC’s, and many other alts’ rallies in the last bull market.

Back then, we didn’t have Moralis Money yet, so we spent a ton of time analyzing on-chain data. But now, thanks to this awesome on-chain tool, you can access the same insights with just a couple of simple clicks. As such, you can easily ride multiple waves all the way to the top.

In addition, you don’t need to wait for a year or so to catch 10x, 100x, or 1000x alt rallies. There are individual altcoins or entire classes of alts pumping hard at various stages of the crypto cycle. After all, just look at the 2023 memecoin season. The latter gave birth to many amazing opportunities, including ASAP, PAAL, MEMEVENGERS, BAD, PLANET, and many others.

However, to see what’s actually possible in the realm of altcoins, just look at PEPE’s run. This memecoin flew through the charts and printed a massive 100,000x increase in just 21 days!

Start Finding the Best Altcoin Opportunities with Moralis Money Today!

Tokens like PEPE are, of course, rare. However, 50x rallies are not all uncommon in the altcoin arena. As such, make sure to start using Moralis Money’s primary function and find the best altcoin opportunities early!

Use the following tips to get going with the ultimate on-chain tool without breaking a sweat:

- Experience the power of Token Explorer by selecting one of Moralis Money’s preset filters. They are the simplest and the fastest way to generate your first dynamic list of altcoins with potential:

- Go beyond the presets and start running unique queries. Fortunately, this is a simple task – just play around with different combinations of Token Explorer metrics, their values, and timeframes:

- Here are some useful suggestions regarding which Token Explorer metrics to use:

- Coin Age – Targeting newly minted altcoins.

- Market Cap – Targeting more seasoned alts or the ones with specific market caps.

- Buyers, Experienced Buyers, Experienced Net Buyers, ETC. – Filtering out tokens that are gaining/losing the on-chain moment.

- Security Score – Reducing the risk of entering scammy tokens.

- Save your winning queries and start running them on autopilot:

- Utilize Moralis Money token pages to research individual altcoins before “pulling the trigger”:

Visit Moralis Money’s homepage or use the interactive widget below to start putting the above tips into practice!

Full Guide to Lybra Finance – Should You Buy the eUSD Token? – Summary

If you went through the above sections, you had a chance to learn what Lybra Finance is all about. You now know that this crypto project utilizes the power of LDS to offer the first interest-bearing stablecoin. By depositing ETH or stETH, this platform allows users to mint the eUSD token and collect rewards in the form of LBR tokens. We also looked at eUSD and LBR’s price action.

Additionally, you also learned about the power of Moralis Money. First, we presented you with the Moralis Money token pages for eUSD and LBR. As such, you can use these awesome tools to explore real-time, on-chain data for these two tokens. Of course, you can use these types of pages for any other altcoin that lives on various chains (Ethereum, BNB Chain, Polygon, etc.).

If you wish to increase your chances of being among the first on the ball, make sure to opt for the Moralis Money Pro plan.

Also, don’t forget to collect Moralis Money Beans!