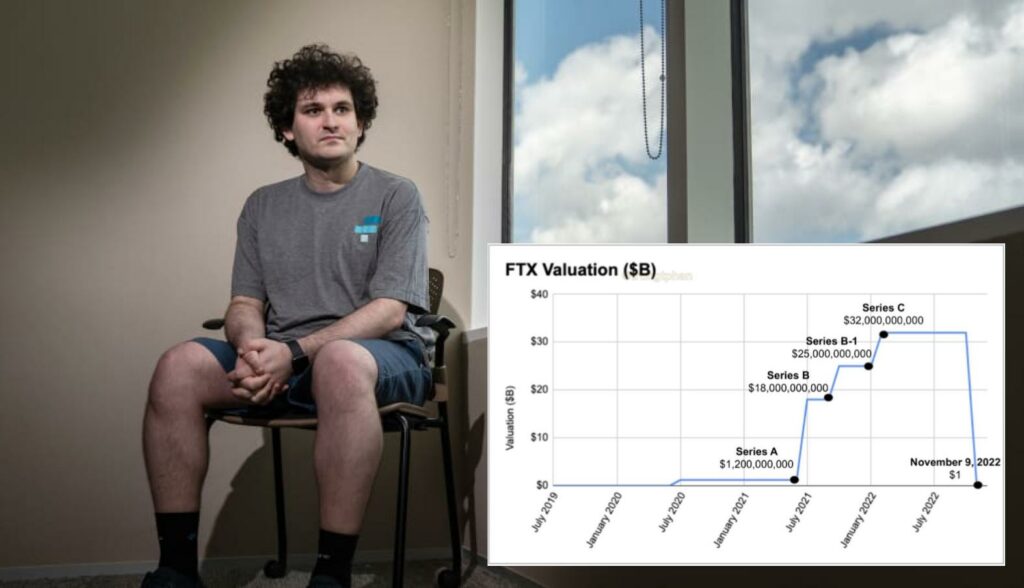

Until recently, FTX was one of the largest centralized cryptocurrency exchange platforms on the market, with millions of users across the globe. The FTX collapse caught the whole crypto industry off-guard. No one could predict that one of the top crypto exchanges could collapse in just a few days. FTX provided users with a broad range of services, from spot, and margin trading, all the way to crypto derivatives and futures contracts. The platform was considered one of the best choices for experienced crypto enthusiasts to engage in all trading activities. Also, FTX and its CEO, Sam Bankman-Fried, were heavily invested in numerous other crypto companies. In several cases, FTX came to the rescue of companies struggling with liquidity issues. It came as a massive surprise to many that now, FTX needs rescuing.

In this article, we'll explore what happened with FTX and find out all the details about the FTX collapse. Also, we'll see precisely how the FTX collapse started and how events unfolded chronologically.

The crypto market is onboarding millions of new users annually, rapidly entering most segments of society. To understand how cryptocurrencies work, you should check out the Crypto for Beginners course at Moralis Academy.

Start of the FTX Collapse: The CoinDesk Report

On November 2, CoinDesk published a report revealing confidential information about the balance sheet of Alameda Research, FTX's sister company. The report revealed that Alameda Research had more than 14 billion USD of funds. The main issue with the balance sheet is that more than three and a half billion USD of funds were FTX's native FTT tokens. Furthermore, another 300 million USD were locked FTT tokens, and two billion USD of FTT collateral.

These figures meant that a vast portion of Alameda Research's funds were tokens issued by a company to which it's connected. Both companies are associated with the same person, Sam Bankman-Fried. In short, the report showed that Alameda Research was using illiquid FTT tokens printed out of thin air by FTX. Alameda Research was sitting on vast amounts of tokens centrally controlled by FTX. The fact that Alameda Research relied on FTX's native token so heavily instead of other cryptocurrencies was alarming.

Web3 is all about decentralization, asset ownership, and interconnectivity. To learn more about Web3, you should check out our Web3 ebooks. If you're beginning your Web3 developer career, you can learn how to make a Web3 website easily with Moralis Academy.

Accusations of Alameda Research Trading With FTX User Funds

After the CoinDesk report, many industry experts expressed their suspicions that FTX wasn't liquid. Some even said that the funds used by Alameda Research might be user funds from the FTX exchange. Alameda Research held a considerable portion of the five billion USD total supply of FTT.

However, Alameda Research's CEO Caroline Elisson and FTX's Sam Bankman-Fried gave statements about the stability of both companies. They said that there weren't any liquidity issues. These statements didn't manage to stop the panic in the market. FTX users started withdrawing funds and selling FTT tokens on a mass scale. Also, the vast selling pressure and rapid drop in market demand led to the fast depreciation of FTT's value. FTT lost a considerable portion of its market capitalization in a few days. The FTT token quickly lost value, and FTX began heading toward collapse. In response to the situation with FTX, Binance announced plans to sell its FTT holdings.

Very soon, FTX stopped withdrawals, and users couldn't take their assets out of the platform's wallets anymore. The stoppage of withdrawals showed that FTX has liquidity issues, in contradiction with Sam Bankman-Fried's earlier statements. At this point, many crypto experts and media outlets expressed concerns. Additionally, some pointed out that the reason behind the suspension of withdrawals was that FTX didn't have the funds. Since FTX didn't have the assets to pay out its customers, the platform spent them or transferred them to another entity instead of holding user funds.

FTX's user policy clearly states that user funds remain in the platform's storage and that the platform can't use them for any other purpose except to store them safely.

Binance Announces Intent to Buy FTX but Then Backs Out

Just six days after the CoinDesk report, Sam Bankman-Fried admitted that there were substantial liquidity issues at FTX. The FTX CEO announced that Binance will buy FTX. The two exchange platforms signed a non-binding letter of intent stating that Binance might buy the platform and solve the liquidity crisis. The Binance acquisition news seemingly calmed the crypto market for 24 hours.

However, Binance officially backed out of the FTX deal a day later. The company announced that it was backing out of the deal after looking at FTX's books. The graveness of FTX's liquidity issues and accusations of mishandling user funds pushed Binance to scrap the deal. Once this news went public, the whole crypto market plunged into a panic. The price of Bitcoin and most other cryptocurrencies fell sharply. FTX's native token fell to as low as 2.4 USD on November 9. FTT's price fell more than 90% from its 25 USD value on November 2, when the FTX controversy started.

During the bear market, most cryptocurrencies lose vast parts of their market value, but that doesn't mean you should give up on crypto. Learn how to invest during a crypto bear market with Moralis Academy's practical guide.

Alameda Research Stops Activities

Sam Bankman-Fried took to Twitter on November 10 and announced that Alameda Research would be closing shop. As far as FTX customers are concerned, Bankman-Fried promised to repay "every penny" owed to FTX users. The FTX CEO admitted that the exchange was insolvent due to poor management of funds and apologized to users.

Missing User Funds

Concerning the accusations that Alameda Research used FTX customer funds, two sources from the company revealed to the media that this actually happened. The sources confirmed that the FTX CEO secretly transferred around 10 billion USD of FTX funds to Alameda Research. Also, between one and two billion USD worth of assets from this amount are unaccounted for and didn't appear on the company's balance sheet at a recent meeting.

In response to media inquiries about the 10 billion USD of assets, the FTX CEO said that the transfer didn't happen in secret. Sam Bankman-Fried stated that the transfer just had confusing internal labeling and didn't explain any further. As for the unaccounted user funds, the FTX CEO refused to give an answer.

Blockchain technology can seem overwhelming to beginners because there are many different networks and operational mechanisms. You can learn the essentials with the help of Moralis Academy's blockchain guides.

FTX Searches for Rescue Funds

Sam Bankman-Fried reached out to several leading crypto companies and large-scale investors to save the platform from total collapse. Bankman-Fried attempted to secure around nine and a half billion USD of rescue funds to keep the platform operational from companies like OKX, Tron, and Tether. However, this attempt was unsuccessful because investors refused to risk losing massive amounts of money by investing in the gravely compromised FTX exchange.

The crypto world uses numerous specific terms you won't encounter in any other industry. If you're new to crypto, check out the crypto terminology guide at Moralis Academy to learn all the key terms.

US and Bahamian Regulators Begin Investigating FTX

The US authorities began investigating FTX and Sam Bankman-Fried on November 9, while the Bahamian authorities launched their investigation on November 13. Since FTX is registered in the Bahamas, the Bahamian securities commission (SEC) exercised its authority and froze FTX assets. Furthermore, the Bahamian SEC also suspended FTX's registration and appointed a liquidation attorney to the case.

As far as the US investigation is concerned, the US SEC and the Commodity Futures Trading Commission are actively investigating allegations of disappeared funds. The investigation also covers the illegal use of FTX user funds by Alameda Research and the relations between companies tied to Sam Bankman-Fried.

Understanding blockchain technology and Bitcoin as the most prominent cryptocurrency is essential for all crypto newcomers. Get started with the Blockchain and Bitcoin 101 course at Moralis Academy.

FTX Files for Bankruptcy

November 11 is the pinnacle of the FTX collapse. The company filed for Chapter 11 bankruptcy according to US law. Sam Bankman-Fried filed bankruptcy for FTX, Alameda Research, and 130 other companies tied to the FTX network. Bankman-Fried also stepped down from his position as FTX CEO.

During the following period, we'll see what will happen with the customer funds and the legal investigations concerning the misuse of user funds. The new FTX CEO John Ray III will oversee the FTX bankruptcy and liquidation process. One of the goals of the process is to compensate affected users and creditors. However, this process can take a long time, as seen in other bankruptcy cases in the crypto industry.

At the time of the bankruptcy filing, FTX had approximately one billion USD of liquid assets and around nine billion USD worth of liabilities. Also, during the first days of the FTX bankruptcy, information surfaced about the possibility that there were approximately one million FTX creditors.

FTX Gets Hacked

Just a day after the FTX bankruptcy filing, the platform registered a massive outflow of 515 million USD worth of crypto assets. The platform claims that it suffered a hack after filing for bankruptcy and that it launched an investigation regarding the hack. It's important to note that the stolen funds were part of the leftover one billion US dollars of FTX liquid assets. Because of this, it will be even more challenging to reimburse FTX users and investors.

Some analysts suggest the hack may have been an inside job, but no evidence supports these claims.

User Reaction to the FTX Collapse

The FTX trading platform had millions of users and a market capitalization of around 30 billion USD. The company's value crumbled in a few days, and many users lost all the funds they kept on FTX. Crypto Twitter reacted angrily, with thousands of users commenting on Sam Bankman-Fried's Twitter posts regarding the situation. Users trusted the FTX user policy, which stated that all user funds remain in the company's wallets. It turned out that a large portion of the funds wasn't on the exchange; even worse, another company got hold of them.

The dominant user sentiment regarding the FTX collapse is disappointment in centralized exchanges. Recently, the DeFi sector and non-custodial crypto wallets reported a surge in the number of new users.

Web3 development is rapidly increasing in popularity. If you plan to start your Web3 project, check out the guide on how to build a Web3 app at Moralis.

The Industry's Reaction to the FTX Collapse

The industry reacted mainly by distancing it from FTX's behavior and emphasizing the importance of transparency on crypto exchanges. Some of the most prominent exchanges are promoting the idea of a Proof of Reserve mechanism to publicly keep track of the asset reserves in their custody. Binance's CEO Changpeng Zhao stated that a Proof of Reserve mechanism could return and grow user trust regarding centralized crypto exchange platforms.

FTX Collapse: What Happened? - Summary

The FTX collapse is another unfortunate, high-impact event on the crypto market, similar to the Terra network meltdown or the Celsius bankruptcy earlier this year. Events like these considerably impact investor trust in the broader crypto market. Such events are also opportunities for the industry to introduce changes that prevent things like these from happening again.

The FTX case highlighted the negative sides of non-transparent centralized crypto exchanges and why trading platforms mustn't do anything with user funds except store them for safekeeping. FTX behaved like a TradFi bank that takes user funds and reinvests them in risky market moves. This behavior is precisely what the crypto community is against and it remains to be seen how will it impact the broader crypto market.

JavaScript is a crucial Web2 programming language for mastering advanced Web3 programming languages such as Solidity. To jumpstart your Web3 developer career, check out the JavaScript Programming 101 course at Moralis Academy.