Overview

As we dive into today’s article, you’ll first have a chance to focus on the Vow crypto price. We’ll look at the VOW token’s price action ever since it started to trade hands on Uniswap. Using technical analysis (TA), we will determine the most important support and resistance levels. Plus, we’ll use other basic indicators and tools to try and speculate on the potential direction of the Vow token price.

“Should I buy $VOW?” is a question numerous traders ask now that the project is experiencing on-chain traction. So, we’ll explain how to access Vow’s on-chain, real-time data to determine if it’s a good buy or not. After all, this data is the most important aspect of getting your timing right when trading. Remember, on-chain activity always precedes price action!

Of course, we’ll also include the basics and explore what the Vow crypto project is all about to ensure that even those who are just discovering this project are all caught up to speed. This is where we’ll explore the project, $VOW’s utility, and more. Essentially, we’ll perform a basic fundamental analysis (FA).

Last but not least, we’ll also tell you how to move beyond any particular cryptocurrency and start spotting the best altcoin opportunities at any given moment. After all, that’s what Moralis Money is all about!

Vow Crypto ($VOW) Price Analysis

The $VOW price activity dates back to early June 2022. This was when the token started trading on Uniswap. The asset’s initial trading price was $0.4369. However, within the first week, the Vow token price went as high as $0.9222 and as low as $0.3092. Moreover, the token closed its first week below the listing price – the close was at $0.3619.

The following four weeks were quite exciting for traders. After all, the token’s value increased by 5x, setting its all-time high (ATH) on July 7, 2022, at $2.2322. However, that level didn’t hold for long, as the price withdrawal started on the same day, wicking as low as $1.0662.

As it tends to often be the case, that wick got filled over the next 43 days. In fact, the VOW token price went even lower, finding its local bottom on August 20, 2022, at $0.8802.

Following that low, $VOW doubled its value over the next 20 days but didn’t manage to maintain those heights. The price retraced and even started setting new lows. As such, it first formed more significant support at $0.7-ish but eventually bounced off of the $0.5-ish level.

Then, after reaching $0.9-ish levels, the token again turned to the downside, this time wicked as low as $0.068. The latter also marks the asset’s all-time low (ATL) and was set on April 10, 2023. Since then, $VOW has been ranging sideways between the $0.57-ish and $0.26-ish.

However, on June 30, 2023, the asset started showing some signs of strength. In the following 13 days, the VOW token price increased by nearly 400%. Next, the price pulled back and is currently above the $0.86-ish level.

The Vow Token Price Speculation

The above weekly $VOW chart indicates all the major levels of support (green) and resistance (red). Based on TA, these levels are the most probable levels of significance. So, if the $0.86-ish level manages to hold, the asset could start tackling the higher resistance.

On the other hand, if that level doesn’t hold, VOW will try to revisit support levels below it. However, a decent increase in the trading volume surrounding the latest rally indicates that the upward momentum might be here to stay.

In that case, the Vow token price could even reach its previous ATH if the overall crypto market conditions remain favorable. Further, if $VOW breaks that level, it will enter price discovery, where we can use the Fibonacci retracement tool to speculate on how high it could go. So, using that tool, its 4.236 extension points to $11.18-ish.

Should You Buy $VOW?

Keep in mind that the above price ($11.18) is highly speculative. So, even if VOW manages to reach that level in the upcoming bull market, that definitely won’t happen just overnight. After all, the Vow crypto project already has a rather significant market cap of more than $400 million.

Since we are not financial advisors, we can’t answer the above question for you. However, aside from the above price analysis and the Vow crypto FA below, we can further assist you by providing you with the right resources. And, when it comes to deciding whether an altcoin is a good buy or not at any given time, Moralis Money comes on top. This is where the Moralis Money token pages enter the scene!

These pages include all the links and information you need to conduct proper research for the token at hand, from the project’s official website and socials to the asset’s price chart and bubble chart. That said, when it comes to determining the best timing to buy or sell the token, real-time, on-chain metrics are the key. This is where Moralis Money has no parallel!

So, should I buy $VOW? Visit Moralis Money’s Vow ($VOW) token page; use that page to further DYOR for the asset and, in turn, build a stronger case for or against it. Then, use the token’s bubble map to determine whether its distribution is not too centralized. Of course, also look at the asset’s price to avoid buying the top.

Use the Moralis Money Vow ($VOW) Token Page

So, if you conclude that the token might be a solid investment or a profitable trade, use its real-time, on-chain metrics to determine if now is the right time to buy.

As a rule of thumb, use these two guidelines:

- If the token’s on-chain momentum is increasing, the price will follow to the upside.

- If the token’s on-chain momentum is decreasing, the price will follow to the downside.

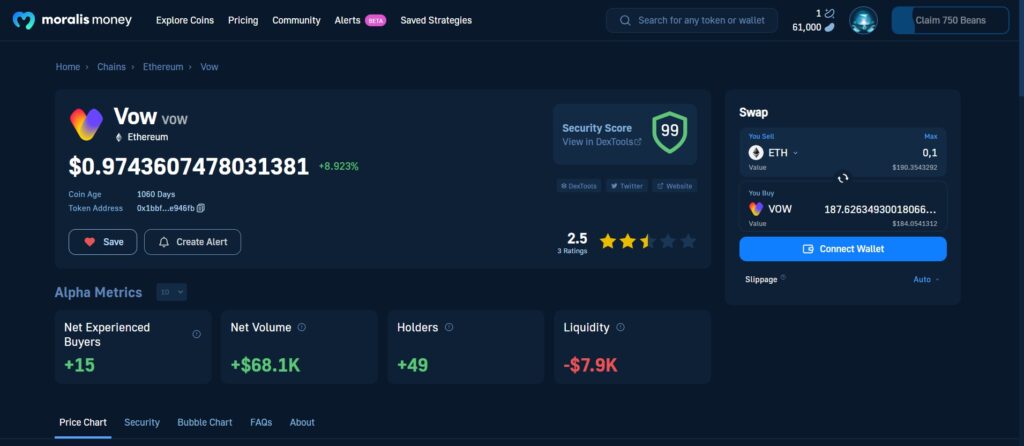

In the above image, you can see what the page for the Vow crypto asset looks like. You can access that page using the link provided in the previous section. Or you may also interact with the page via the widget below. So, make sure to explore all the sections of the page.

When you get to the on-chain metrics (alpha metrics), do not forget to explore different timeframes. By doing so, you’ll be able to determine the direction of the on-chain momentum.

Also, remember to look at the token’s score by other users. Plus, if you determine that token deserves your attention but that now’s not the best time to buy it, save it to your list and create alerts to be notified when the time will be right. By using these special types of crypto price alerts, you can save a ton of time!

Essentially, these alerts serve as your crypto breakout scanner.

As promised, here’s the interactive widget that you may use to access the Moralis Money Vow crypto page:

What is the Vow Crypto Project?

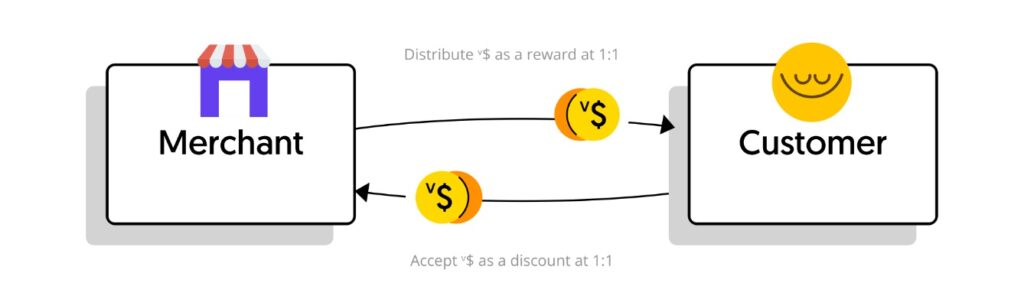

The Vow crypto project is all about creating stable cryptocurrencies (“Vcurrencies”) that can be directly exchanged by merchants and customers without any intermediary.

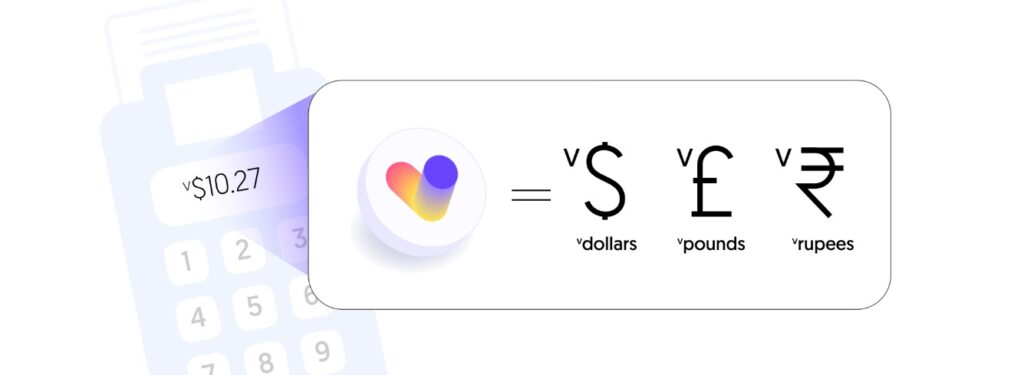

As presented in the project’s whitepaper, the idea is for merchants to commit (or “vow“) to accepting “Vcurrencies” as payments. These currencies are in one-to-one ratio with local currencies. So, if an item cost $10.27, users can pay the merchant that vowed to participate V$10.27 via their crypto wallets.

Unlike other stablecoins, the project claims that “Vcurrencies” always stay exactly the same as their corresponding local fiat currencies. Essentially, “Vcurrencies” get their values when merchant acceptors issue them as rewards and vow to accept them back as payments. So, these “V” currencies are decentralized and algorithmic in terms of minting, distribution, acceptance, and governance. There’s no central authority!

In addition, these currencies can also be freely sold to anyone at a mutually agreed price. So, they can be traded on P2P, P2B, and B2B levels.

Aside from buyers and merchant acceptors, there are also merchant validators (MVDs). MVDs are companies that operate existing cashback, rewards, or loyalty programs and have decided to join the Vow economy.

All in all, this project’s success depends greatly on its acceptance by merchants as well as by buyers. If folks across the globe find this system extremely practical and appealing, the merchants will be happy to jump in. However, for people to find this attractive, they typically want to see many merchants already accepting these types of currencies. So, the project’s marketing aims to onboard both simultaneously.

To ensure that “Vcurrencies” are properly backed and protected, the Vow crypto project uses two methods: VSR and WOV. Furthermore, variable stabilization rate (VSR) is a small amount of “Vcurrencies” that is burned on every spend.

The VOW Cryptocurrency

Vow is a free-floating cryptocurrency that plays a vital role in making the above-presented mechanism function properly. It is a crypto token on the Ethereum blockchain and follows the ERC-777 standard for fungible tokens. Essentially, you can think of $VOW as a settlement token.

VOW can be freely traded on decentralized and centralized exchanges (DEXs/CEXs), so its price can fluctuate greatly. As such, it is not appropriate for daily commercial use. Still, it serves an essential purpose – it protects all global “Vcurrencies” against defaulting or bankrupt merchant acceptors. It does so via its unique system of minting and destroying “Vcurrencies.”

Note: For more details on all aspects of the Vow crypto project and its $VOW coin, dive into the project’s 80-page whitepaper.

Altcoin Opportunities Beyond $VOW – Unlock Moralis Money’s Full Potential

So far, you’ve already learned about the power of Moralis Money’s token pages. They are powerful research tools and the key to getting your altcoin trading timing right. However, they are this tool’s secondary function.

Primarily, Moralis Money serves to spot the best altcoin opportunities across all the leading chains (Ethereum, BNB Chain, Polygon, etc.). By simply running preset filters or your unique combinations of search parameters (a.k.a. Moralis Money strategies), you get to find altcoins with potential before they pump!

So, use the two animations below to help you start benefiting from Moralis Money’s core purpose. With the power of Token Explorer, you’ll finally be able to spot tokens early and ride those massive rallies!

Here’s how you can start generating your dynamic list of altcoins with potential:

- Apply Moralis Money’s preset filters (the simplest, slightly less powerful way):

- Or, run your unique strategies (the ultimate way):

Anyone with internet access can start using Moralis Money for free. To access this tool’s full spectrum of features, you’ll also want to connect using a Web3 wallet (e.g., MetaMask).

Nonetheless, when it comes to spotting the best altcoin opportunities before it’s too late, you want to be able to access all the lower timeframes. That privilege is reserved for Moralis Money Pro users!

Exploring the Vow Crypto Project and the VOW Token – Summary

Throughout the above sections, you first had a chance to focus on the $VOW coin’s price action. As such, you saw where the token’s price is coming from, where it currently is, and where it may go. You learned about all the major support and resistance levels. Plus, we shared an optimistic price speculation.

Next, we explained why looking at the token’s real-time data is so important and how the Moralis Money token pages can help you cover that aspect. Then, we also covered the gist of the Vow crypto project and explained how $VOW fits the whole picture.

Last but not least, you learned how to use Moralis Money’s primary function to start finding the best altcoin opportunities. As such, make sure to put that knowledge into action today!