The Statera ecosystem has gained recent success and adoption as the interest in the Statera (STA) token has risen steadily over the past few months. Statera makes it easy to invest in an array of digital assets through the use of one simple token. But how does Statera achieve this? Moreover, Statera is working toward becoming the world’s first decentralized deflationary currency, with the potential of bringing sound money policy to any financial asset! So, how is this possible?

In this article, we’re going to explore the utility and diverse range of and qualities the Statera token holds. Also, we’ll cover the different tokens, pools, and portfolio funds available to invest in with Statera tokens, plus the overall pros and cons of using the platform.

If you’re just entering the world of crypto for the first time, it’s important to gain a firm understanding of how to safely buy, sell and store your crypto. The Crypto Basics course at Ivan on Tech Academy is designed to guide you through those crucial first steps of your crypto journey to ensure you’re equipped with all the knowledge needed to get started. Also, to learn the basics about how blockchain works on a technical level, be sure to check out the Blockchain & Bitcoin 101 course at Ivan on Tech Academy!

What is Statera?

Statera is a decentralized community-powered deflationary cryptocurrency, offering an innovative way to introduce sound money policies to any asset. Moreover, the Statera token (STA) is an Indexed Deflationary Token (IDT) powered by smart contracts.

Statera is positioning itself to be the world’s first immutable deflationary currency. As per the guidelines provided by The Federal Reserve Bank of St. Louis, displayed in the Statera whitepaper, currency is defined as having the following six properties; Durability, portability, divisibility, uniformity (or fungibility), limited supply, and acceptability. Statera automatically ticks five out of six of these boxes being a blockchain-based cryptocurrency with a capped supply. The acceptability of Statera is crucial for it to become a recognized medium of exchange.

Statera is creating a network effect building utility and trust, through a unique and immutable value proposition. This is achieved through increasing returns from liquidity pools, which we will go into greater detail on.

Statera (STA) Token

The Statera token (STA) is the deflationary star of the Statera ecosystem. The longer users hold the STA token, the lower the supply of STA token becomes. A decreasing supply drives up price pressure on the token. Furthermore, as part of Statera’s core algorithm, 1% of every STA token transaction is burned, thus reducing supply further.

The deflationary aspect of the Statera token allows holders to make the most of the positive price action of the Statera ecosystem, whilst simultaneously decreasing volatility. Statera offers one token with price exposure to multiple assets and liquidity pools. Also, Statera rewards long-term hodlers for their loyalty, which is a great way to earn a passive income with crypto!

Statera uses a positive cycle-effect of increasing new users whilst decreasing STA token supply, as the token price increases. Each trade creates a crypto arbitrage opportunity, which attracts more traders. Traders increase liquidity which in turn attracts further traders. With each trade, the token supply is reduced. Consequently, the increase in demand and decrease in token supply could theoretically drive up the Statera token price.

Additionally, Statera has plans for pairing the token with stocks, cryptocurrencies, or any other financial instrument or digital asset. In turn, this can bring a sound monetary policy into almost any asset (with future plans for oracle partnerships). Moreover, it could create a deflationary play on current stock prices. As an example taken from the Statera whitepaper, it could be possible to basket an STA token package with Apple stock. That basket would see the supply of the STA/AAPL stock decrease with the 1% burn rate on each transaction, having a deflationary effect on Apple stock price.

The Statera Ecosystem

The Statera ecosystem consists of several liquidity pools that are automatically rebalanced using the Statera smart contract portfolio manager. To achieve this, the Statera ecosystem incorporates smart-exchange routing and constant arbitrage opportunities to maintain the weighting of Statera's portfolio consistently. Arbitrage is the process of making profits on fluctuations in prices of assets across different markets.

As an asset within the portfolio increases in value relative to other tokens within the portfolio, the portfolio manager will automatically sell the token that is in profit. Profits can then be rebalanced across different funds. This is achieved using arbitrage. By providing liquidity to external markets using STA tokens, anybody can take advantage of such opportunities.

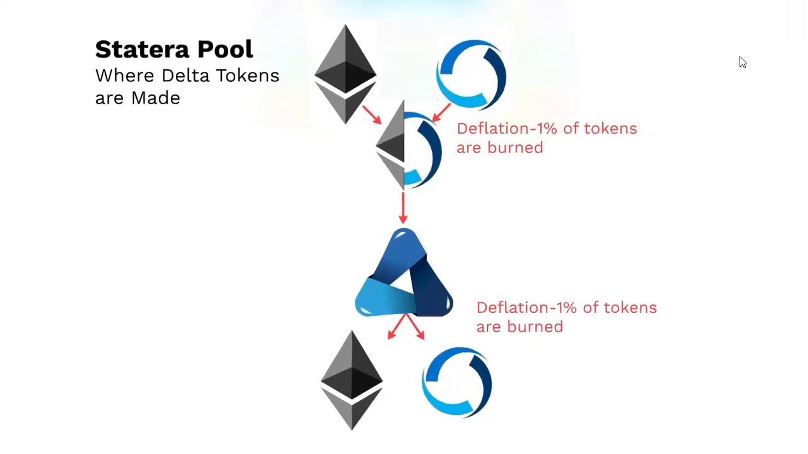

The Statera ecosystem consists of the STA token, the Uniswap Pool tokens (consisting of STA Delta tokens and STA Delta Liquidity tokens), and the Balancer Pool (including the Phoenix Fund). With Statera’s unique burning algorithm, any buy or sell transaction made within the Uniswap STA pool or Delta pool, or the Balancer Pool results in 1% of the transaction value in STA being burned.

STA Delta Token

The Statera Delta ERC-20 tokens are comprised of 50% STA and 50% ETH and are Uniswap Liquidity Pool Tokens. Delta tokens allow Statera to connect deflationary aspects to any platform, including platforms that don’t currently support deflationary tokens. This allows Statera to interact with any liquidity pools and protocols. Also, holders of the Delta token in Uniswap pools will accrue transaction fees, with Statera offering 38%-500% APY depending upon daily volume. Moreover, Delta tokens can be used to add to the Phoenix Fund (explained further below).

STA Delta Liquidity Tokens

The Delta Liquidity Token is similar to the Delta token, however, it is more heavily weighted towards ETH. Delta Liquidity Tokens consist of 75% ETH and 25% STA and, like Delta, will also accrue transaction fees from Uniswap pools. On the other hand, Delta Liquidity Tokens are not tradable at this time. In the future, however, as the community is decentralized, this could be a possibility.

Balancer Pool

The Balancer Pool is a deflationary secure index fund created by Statera consisting of three pools:

- Delta Token Pool

- Delta Liquidity Token Pool

- Phoenix Fund

Statera’s Balancer Pool consists of five tokens:

These assets were chosen for their fundamental roles within the blockchain ecosystem. Through a process known as ‘wrapping’, STA is combined 50/50 with ETH to create DELTA. The 50% STA within the Delta token is constantly rebalancing its price against the other four assets in the pool. This is so that deflation can occur safely on Uniswap, ensuring no deflation takes place within the Balancer Pool.

In turn, this deflation process increases the need for arbitrage in the Balancer Pool. When arbitrage opportunities are taken advantage of, transactions occur within a DELTA or STA based pool. As a result,1% of the transaction value of STA tokens is burned. As more transactions occur, more tokens will be burned, reducing supply, and theoretically encouraging positive price action. Moreover, the supply adjustment of the STA token amount within the Balancer Pool (50% of the DELTA token) will need to rebalance. As the price re-adjusts, this creates another need for a rebalance within the pools of the index fund, thus creating further arbitrage opportunities. This is referred to as a “synergistic loop” whereby the effect adds positive price pressure continuously.

The unique protocol also creates another synergistic loop through liquidity provision and transaction fees. The increase in usage of any STA-based pool creates opportunities for arbitrage, alongside increasing liquidity. The increase in liquidity and transactions increases the volume of fees, and in turn, increases profitability. This attracts more liquidity, attracting more arbitrage opportunities, therefore increasing fees, and profitability.

Statera Portfolio Options

Using just a single token, STA holders gain access to many different funds. These funds vary depending on the amount of risk a user wishes to take on. Generally, the higher the risk, the higher the upside potential, and the higher chance of getting rekt. In addition to funding Uniswap pools and the Balancer Pool, Statera now also offers various other portfolio options.

Phoenix Fund

The Phoenix Fund is the most diverse asset portfolio offered by Statera and is a substantial index fund within the Balancer Pool. Also, the Phoenix Fund is available for liquidity provision as a separate fund. This portfolio is weighted: 40% Delta , 30% wETH, 10% wBTC, 10% SNX, and 10% LINK. Although, when you break down the underlying components of Delta, the pool is actually weighted 50% wETH, 20% STA, 10% wBTC, 10% SNX, and 10% LINK. The Phoenix Fund has a heavier bet on Ethereum, as it’s the second-largest blockchain, hosting more than 90% of decentralized finance (DeFi) applications.

STANOS Fund

Similar to the Phoenix Fund, the STANOS Fund is also constructed with the same blue-chip crypto assets. However, they are weighted slightly differently. This portfolio is distributed as with 50% wSTA, 12.5% wETH, 12.5% wBTC, 12.5% SNX, and 12.5% LINK.

The portfolio was branded ‘STANOS’ by Statera’s committed community following its rise in popularity. The STANOS Fund sees a heavier percentage of STA than the Phoenix Fund and a more evenly distributed weight between the other four assets. The minting of wSTA process involves wrapping 1 STA to create 0.99 wSTA to take into account deflation. The wrapped version of the Statera token can be added to other pools or traded as a stand-alone asset.

High-Risk Fund

For those with a stronger risk tolerance, often developed through experience, the High-Risk Fund features some of the hottest DeFi projects around! The portfolio includes more speculative and volatile assets, however is counterbalanced with the stability of other cornerstone assets of the blockchain ecosystem.

The High-Risk Fund portfolio is weighted 50% wSTA, 11.88% wETH, 11.88% YFI, 11.88% UNI, 11.88% AAVE, and 2.5% FRY.

Low-Risk Fund

On the other hand, those who wish to invest in less speculative and more stable assets can choose to opt for the Low-Risk Fund offered by Statera. Weighted with 50% stablecoins - digital assets usually price-pegged to an asset or currency such as the US dollar - this provides a far less volatile ride for investors. The Low-Risk Fund portfolio comprises 22.5% USDC, 22.5% DAI, 50% wSTA and 5% ETH. Created for those who are more risk-averse, the main risk in the fund comes from STA.

The way we perceive currency has changed drastically over the centuries. The Bitcoin Standard course at Ivan on Tech Academy is the perfect way to understand the history of money. This course is designed to show you the evolution of money, where it started, and where it’s heading!

Advantages and Risks of Statera

It’s often a wise idea to make note of the pros and cons of a new and exciting platform. For the majority of the time, the positives naturally outweigh the negatives for successful projects. However, not being mindful of the potential pitfalls of successful projects can lead to some economic frustration.

Advantages

Keeping on top of a crypto investment portfolio can be a full-time job. Many people are attracted to the idea of earning a passive income with crypto on the side of their regular job. However, they soon realize that this can take up a great deal of time. To simplify this, indexes created by Statera include some of the key DeFi and cryptocurrency essentials, some speculative assets, plus centralized and decentralized stablecoins reducing volatility. Statera caters to those risk-averse to those hungry for risk. Also, the ‘one token one name’ approach simplifies investing in several assets at once.

Statera is completely decentralized, so there is no fear of the project being controlled by a single party or entity. The developers of Statera hold 4% of the token supply, which cannot be adjusted as per the protocol code. Furthermore, the protocol code has been audited by Hacken to ensure this can remain true. As a byproduct of the deflationary mechanism, Statera rewards loyal holders of the token over time through increased positive price pressure. Also, STA holders can earn significantly higher returns through funding one of the liquidity pools.

Risks

Despite the advantages of the Statera platform, there are a few risks to bear in mind. Being the first mover working towards a completely decentralized deflationary currency can come with opportunities and drawbacks. Statera has outlined its commitment to users remaining “nimble and responsive” to the needs of the market. Also, as the platform is fully decentralized, a further risk could be a non-active community which could hinder efforts to ensure the project remains on track. This too is a risk Statera has directly addressed in their whitepaper (see “The Future” section).

As Statera is indexed to the cryptocurrency market, a long continuous bear market could be a risk for the platform. This being said, Statera lived through the previous bear market, outliving many of its competitors. Another consideration could be platform failure, whereby a bug or fault in the code causes Statera to cease operating. However, to combat this potential risk, all Statera’s smart contract code is audited through Hacken.io.

Statera Ecosystem & STA Token Summary

Statera is a deflationary token driving the Statera ecosystem of decentralized finance (DeFi) index funds, with a wide portfolio of assets catering to a diverse range of risk appetites. The STA token is the principal digital asset and the lynchpin of the Statera ecosystem. Thanks to its deflationary mechanism, 1% of assets transferred on Statera are burned which reduces volatility whilst simultaneously increases positive price pressure. Additionally, all smart contract codes are publicly audited, creating trust and transparency for users.

Future integrations with oracles mean the Statera token can potentially be pegged to any financial or real-world asset, bringing sound money policy to almost any asset. The Statera platform has many exciting plans for the future, including Custom Smart Pools, fiat on-ramps and off-ramps, and official establishment as a currency. Also, Statera has plans for building a second-layer platform to further improve the ease of using all of Statera’s products in one place.

There has never been a better time to learn a new skill in an emerging industry. The demand for blockchain developers is extremely high, and understanding blockchain gives you an unfair advantage in the job market. To learn how to become a blockchain developer, take a look at the Bitcoin Programming 101 and Ethereum Smart Contract Programming 101 courses at Ivan on Tech Academy. Then if you want to take your programming game to the next level, check out our Javascript and C++ courses to become a certified blockchain professional! Ivan on Tech Academy is the premier online blockchain academy. With all the resources you need in one place, and courses curated by our team of industry-leading experts, why not find your perfect career in crypto today with Ivan on Tech Academy? Also, follow us on Twitter @Academy_IOT to let us know your thoughts about Statera!